Introduction

World Liberty Financial (WLF) is a decentralized finance (DeFi) initiative founded in 2024, backed by Donald Trump and his family. Members of the Trump family are actively involved in the leadership of the project. WLF aims to simplify and democratize cryptocurrency trading by providing users with an innovative and secure platform. This report explores the structure, team, objectives, and crypto investment strategies of World Liberty Financial.

What is World Liberty?

World Liberty is a platform that aims to provide a variety of financial services to individual and corporate clients. Its services include digital asset trading, portfolio management and blockchain-based solutions. The company’s main goal is to provide users with a fast, secure and efficient trading experience by becoming a trusted player in the cryptocurrency market. It also aims to develop innovative solutions by integrating blockchain technology into the financial world. World Liberty acts with an innovation-oriented approach in different sectors and aims to be a pioneering platform that combines technology and finance.

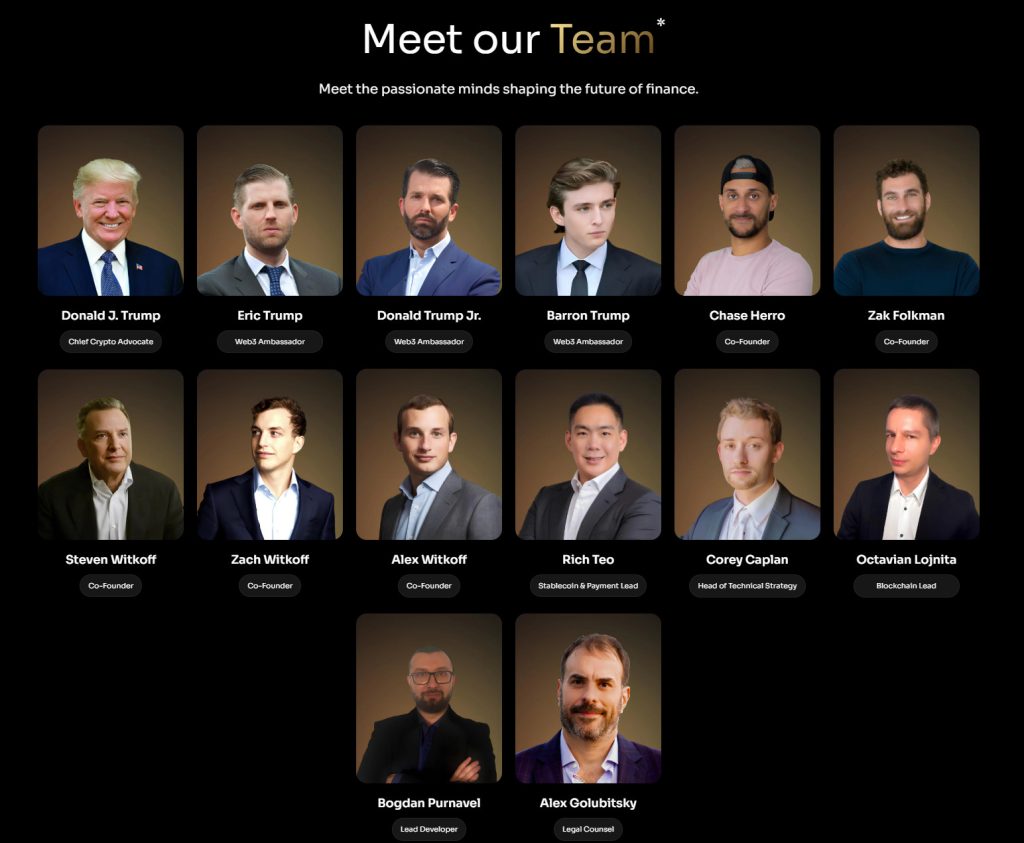

Project Team and Tasks

The company’s management team consists of experts in finance and technology

- Donald J. Trump – Chief Crypto Advocate – Leader advocating the adoption of cryptocurrencies and blockchain technology.

- Eric Trump – Web3 Ambassador – Ambassador promoting Web3 technologies and blockchain projects.

- Donald Trump Jr. – Web3 Ambassador – Team member supporting Web3 solutions and projects.

- Barron Trump – Web3 Ambassador – Young ambassador raising awareness of next generation technologies.

- Chase Herro – Co-Founder – One of the founders of the company and strategic vision provider.

- Zak Folkman – Co-Founder – Another founder who played an important role in the company’s development.

- Steven Witkoff – Co-Founder – Another founder specialized in financial and business processes.

- Zach Witkoff – Co-Founder – Leader in the company’s business development and innovative projects.

- Alex Witkoff – Stablecoin & Payment Lead – Stable cryptocurrency and payment systems development lead.

- Rich Teo – Stablecoin & Payment Lead – Leading crypto payment infrastructure and stablecoin projects.

- Corey Caplan – Head of Technical Strategy – Responsible for technical strategy and innovative solutions.

- Octavian Lojnita – Blockchain Lead – Integration and management leader of blockchain technologies.

- Bogdan Purnavel – Lead Developer – Provides software development and technical infrastructure leadership.

- Alex Golubitsky – Legal Counsel – Head of legal processes and compliance.

With their diverse expertise, this team has come together to create innovative solutions in the world of finance.

World Liberty Crypto Investments

WLFI Token and Usage

World Liberty has its own cryptocurrency, the WLFI Token. A total of 5.35 billion tokens were sold in the pre-sale of this token in 2024, generating close to $80 million in revenue. The WLFI Token is designed to enable users to participate in DeFi projects and provide an integrated payment method into the platform ecosystem. These funds were used to strengthen the company’s reserves, invest in new blockchain projects, and as an investment vehicle in other crypto assets.

Token Investment Table

According to Spot on Chain platform data, World Liberty has invested in the projects listed in the table.

| Token | Total Purchases | Average Purchase Price ($) | Total Sales | Average Selling Price ($) | Realized Loss/Profit ($) | Unrealized Loss/Profit ($) |

|---|---|---|---|---|---|---|

| ETH | 12.761K | 3,628 | 11.919K | 3,226 | -4.795M | -341.658K |

| WETH | 1.252K | 4,054 | — | — | — | -1.040M |

| LMWR | 3.935K | 0.314 | — | — | — | -304.34 |

| APE | 1.00 | 0.739 | — | — | — | 0.33 |

| MAGA | 4.747K | 0.0001506 | — | — | — | -0.32 |

| ACH | 4.404K | 0.0196 | — | — | — | 10.82 |

| Token | Total Purchases | Average Purchase Price ($) | Total Sales | Average Selling Price ($) | Realized Loss/Profit ($) | Unrealized Loss/Profit ($) |

|---|---|---|---|---|---|---|

| CBBTC | 102.90 | 97,181 | 102.90 | 103,511 | +651.289K | — |

| SAFE | 12.35 | 1.533 | — | — | — | -7.23 |

| AAVE | 6.137K | 326.10 | — | — | — | -201.934K |

| LINK | 78.387K | 25.536 | — | — | — | -412.980K |

| UNI | 23.18 | 16.694 | — | — | — | -80.22 |

| WOJ | 1.337K | 0.00147 | — | — | — | -0.92 |

Important Developments

While World Liberty utilized the proceeds from the pre-sales of WLFI tokens in different projects, there were transactions that resulted in large losses and profits. The most important of these are as follows:

- Largest Realized Loss: WBTC(-$502.063K)

- Largest Realized Profit: CBBTC(+$651.289K)

- Largest Unrealized Losses: WBTC(-$274.167K), ENA(-$136.093K), ONDO(-$92.264K)

General Evaluation

World Liberty has been pursuing an active strategy of diversifying its crypto asset portfolio and focusing on blockchain projects. The company’s losses on projects such as WBTC, ENA and ONDO demonstrate the effects of market volatility. However, the positive returns from tokens such as CBB also demonstrate that their strategy has been successful in certain areas.

The success of the platform depends on improving security mechanisms and user experience in the long term. This report is intended to summarize the current state of the company and point to future strategies.