MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 101,487.30 | -4.49% | 57.72% | 2,01 T |

| ETH | 3,225.98 | -4.93% | 11.15% | 388,39 B |

| XRP | 3.028 | -4.02% | 5.00% | 174,18 B |

| SOLANA | 235.07 | -7.69% | 3.28% | 114,07 B |

| DOGE | 0.3394 | -9.52% | 1.44% | 50,11 B |

| CARDANO | 0.9735 | -7.20% | 0.98% | 34,17 B |

| TRX | 0.2380 | -0.01% | 0.59% | 20,48 B |

| LINK | 24.04 | -7.16% | 0.44% | 15,30 B |

| AVAX | 35.00 | -7.20% | 0.41% | 14,36 B |

| SHIB | 0.00001986 | -6.39% | 0.33% | 11,66 B |

| DOT | 6.251 | -5.39% | 0.28% | 9,61 B |

*Prepared on 1.21.2025 at 07:00 (UTC)

WHAT’S LEFT BEHIND

US President Donald Trump Makes Remarks at Inauguration Ceremony

Following his inauguration, US President Trump announced a national emergency on the southern border, the repatriation of criminal aliens and the repeal of the electric vehicle law. He also announced that tariffs would be reinstated and the Panama Canal would be brought under US control.

5 Altcoins Purchased by World Liberty Financial

Trump family-backed World Liberty Financial made crypto purchases totaling $23.5 million. ETH, LINK, ENA, AAVE and TRX were purchased for $4.7 million each.

Musk Announces Ross Ulbricht’s Release

Elon Musk announced that Silk Road founder Ross Ulbricht will be released with a pardon from US President Trump.

Cryptocurrency Searches at the Top on Google

According to Google search data, the search volume for “how to buy cryptocurrency” reached its highest level in the last 5 years.

DOGE Faces Three Different Lawsuits

The Musk-led Department of Government Efficiency (DOGE) has faced three lawsuits for violating the Federal Advisory Committee Act.

Ethereum Foundation Pledges 50,000 ETH for DeFi

The Ethereum Foundation announced the transfer of 50,000 ETH to a new wallet address to support decentralized finance (DeFi) projects.

Arthur Hayes: “Trump Will Not Create a Bitcoin Reserve”

Arthur Hayes said Trump’s plans to create a Bitcoin reserve are unlikely and criticized the purchase of Bitcoin with debt.

Rumble Makes First Bitcoin Purchase

After announcing its $20 million Bitcoin strategy, video-sharing platform Rumble has completed its first BTC purchase and announced plans for more purchases in the future.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Previous |

|---|---|---|

| Fasttoken (FTN) | 20MM Token Unlock | |

| SwissBorg (BORG) | Reveal Event |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

The highly anticipated inauguration of the crypto-friendly new US President Donald Trump took place yesterday. For now, we can say that the fact that he did not say anything for the digital world was taken as an opportunity to realize profits. In addition, it seems that the President’s first actions will be to impose additional taxes on Mexico and Canada from the beginning of February. The fact that there is no tariff talk about China for now, even though he has referred to it, has created a basis for the rise of Asia-Pacific indices. European stock markets are expected to start the new day with a decline due to the tariff threat. The US, which was closed yesterday due to a holiday, is expected to have a horizontal-positive opening.

There is no significant news flow in the economic calendar. The markets will mostly focus on the reverberations after Trump’s inauguration. In addition, the President’s steps in his first days in office will be closely monitored. In digital assets, we expect a volatile trading period where news flows will be more effective. We maintain the following expectation for the long-term outlook.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our predictions. Afterwards, the appointments made by the president-elect and the increasing regulatory expectations for the crypto ecosystem in the US and the emergence of BTC as a reserve continued to take place in our equation as positive variables. Although Trump, who took over the presidency with the inauguration ceremony on January 20, did not say anything for the digital world, we maintain our expectations on the subject in the coming days. On the other hand, although it is expected to continue at a slower pace, the expectations that the FED will continue its interest rate cut cycle (for now) and the volume in ETFs based on crypto assets indicating an increase in institutional investor interest support our upward forecast for the big picture for now. In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional pauses or pullbacks in digital assets. However, at this point, it is worth emphasizing again that we think that the fundamental dynamics continue to support the rise.

TECHNICAL ANALYSIS

BTC/USDT

Donald Trump’s inauguration ceremony, which the markets were eagerly awaiting, took place. Trump, who focused on security, technology, tariffs and immigration in his speech, did not make any statements about Bitcoin and cryptocurrencies, which he frequently brought up during the election process. This created uncertainty in the markets. Bitcoin, which exceeded the all-time high (ATH) of 109 thousand dollars before the ceremony, experienced a sharp retreat after the ceremony.

When we look at the technical outlook, it lost the support levels of 105,000 and 102,800 respectively from 109,700 levels with the selling pressure. Currently trading at 101,800 above the 101,400-support level, BTC’s momentum indicator continues to weaken while technical oscillators maintain the sell signal. Looking at the BTC weekly liquidation chart, the accumulation of long trades between the 95,000 and 100,000 levels is noteworthy. Closes below the support level of 101,400 may deepen the selling pressure and liquidation zones may be targeted. With the correction of the decline, we will follow the price to exceed the resistance level of 102,800.

Supports 101,400 – 100,000 – 99,100

Resistances 102,800 – 105,000 – 106,800

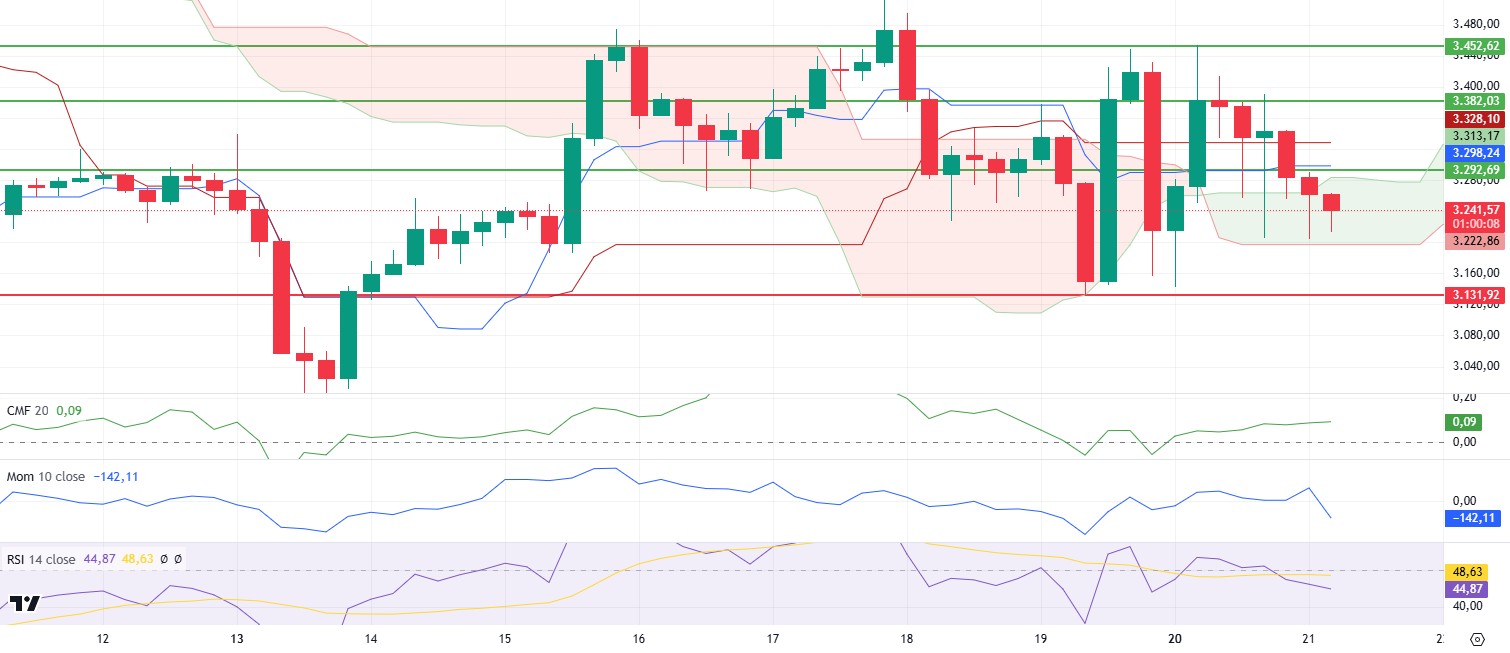

ETH/USDT

Yesterday evening, Donald Trump’s failure to mention Bitcoin and cryptocurrencies during his inauguration ceremony led to increased volatility in the crypto market, which also affected ETH. ETH continued its downtrend, losing an important support level of 3,292 in the process. Around the same time, Trump’s World Liberty Financial used the Lido Finance platform to stake the ETH it had purchased. In addition, the Ethereum Foundation also took a notable step towards the DeFi sector, allocating 50,000 ETH to participate in DeFi products, starting with AAVE.

From a technical perspective, it is evident that the momentum in ETH price has weakened. However, the positive divergence in the Relative Strength Index (RSI) indicator stands out as an important signal that the price has the potential to rebound to the upside. In addition to this positive signal, the Chaikin Money Flow (CMF) indicator remains in positive territory, indicating that the buy side of the market is still strong and the price has not gone into a completely uncontrolled decline.

Key levels are of great importance for ETH. In particular, maintaining the 3,196 level will increase the chances of the price retesting the 3,292 level in the short term. However, in case of a loss of the 3,196 level, the price can be expected to retrace down to the next critical support at 3,131. A break below this level could trigger a deeper downtrend and lead the price to retreat to lower levels. To summarize, ETH has the potential to rebound in the short term, but it should be noted that increased volatility and fundamental factors in the market could put pressure on the price

Supports 3,131 – 2,992 – 2,890

Resistances 3,292 – 3,382 – 3,452

XRP/USDT

XRP, which continued its upward movement by exceeding the 3.19 support level yesterday, faced selling pressure after Donald Trump did not mention Bitcoin and cryptocurrencies in his inauguration ceremony and fell back to the 2.98 support level. This pullback created a significant weakness on the price action and increased the negative signals in technical indicators.

Momentum has entered a downtrend, clearly indicating that the market is losing upside momentum. In addition, the Chaikin Money Flow (CMF) indicator made a double top and turned down, indicating that the selling pressure in the market may increase. The Relative Strength Index (RSI) indicator is also trending downwards, supporting the negative outlook and weakening the market’s recovery prospects.

However, the current price level of XRP should be carefully monitored as it lies in critical support zones. The fact that the price is close to the kumo cloud on the Ichimoku indicator increases the possibility of a rebound from this level. If XRP can hold its support at 2.98, a technical rebound towards 3.19 could take place. However, if the 2.98 level is lost, a deep downtrend may be triggered by the current technical weaknesses. In summary, XRP price action is at a critical juncture. Whether the support levels are maintained or not will be the key factor that will determine the direction of the price. It is important for traders to act cautiously, paying attention to the 2.98 support level and the overall market outlook.

Supports 2.9851 – 2.7268 – 2.5500

Resistances 3.1991 – 3.3854 – 3.5039

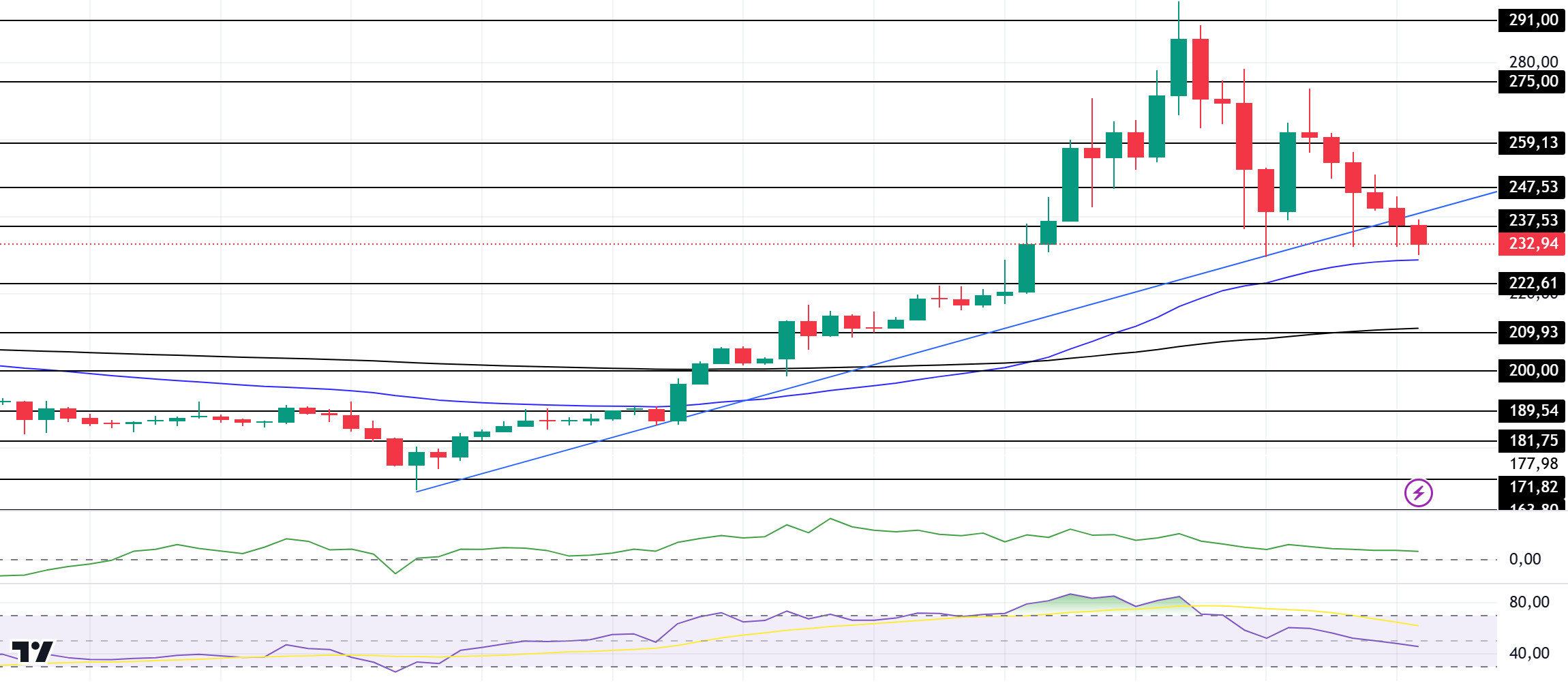

SOL/USDT

Cuba-linked meme coins in Solana allegedly gained $158 million in value in 24 hours. The Cuban Foreign Ministry’s X account appears to have deactivated the account on Monday after the rug pull allegations surfaced. Solana’s total transaction fees once again reached $50 million. Jito performed strongly, with Jito verifiers earning a record $25.2 million in daily revenue.

SOL, which has been moving downward for two days after the huge rises over the weekend, has broken the uptrend that has been going on since January 13th. On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). This could mean that the uptrend will continue in the medium term. At the same time, the asset is above the 50 EMA and 200 EMA. However, at the time of writing, the asset is testing the 50 EMA as support. When we examine the Chaikin Money Flow (CMF)20 indicator, it is in positive territory and inflows have started to decline. This may cause a further pullback. However, the Relative Strength Index (RSI)14 indicator switched from positive to negative territory. The 291.00 level appears to be a very strong resistance point in the rises driven by both the upcoming macroeconomic data and the news in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements for the opposite reasons or due to profit sales, the 209.93 support level can be triggered. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 222.61 – 209.93 – 200.00

Resistances 237.53 – 247.53 – 259.13

DOGE/USDT

Vivek Ramaswamy said on X that he is leaving the Department of Government Productivity and is “confident that Elon and his team will succeed in streamlining the government.” On the other hand, Whale Alert data indicated that 29.86 million units of DOGE were purchased from a centralized exchange, worth about $78.57 million. This happened just before Donald Trump’s inauguration, reinforcing expectations of a pro-crypto environment under Trump’s leadership. In addition, Elon Musk’s role in Trump’s administration has further excited DOGE supporters.

Doge has continued to decline since January 18th. On the 4-hour timeframe, the asset started to be below the 50 EMA (Blue Line) and the 200 EMA (Black Line). At the same time, the price is testing the strong resistance at 0.33668 as support at the time of writing. The 50 EMA also continues to hover above the 200 EMA. This could be the beginning of a medium-term uptrend. When we examine the Chaikin Money Flow (CMF)20 indicator, it has crossed into negative territory and money outflows are increasing. However, Relative Strength Index (RSI)14 is in negative territory again. The 0.42456 level stands out as a very strong resistance point in the rises due to political reasons, macroeconomic data and innovations in the DOGE coin. In case of possible pullbacks due to political, macroeconomic reasons or negativity in the ecosystem, the 0.33668 level, which is the base level of the trend, is an important support. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.33668 – 0.30545 – 0.28164

Resistances 0.36600 – 0.39406 – 0.42456

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.