MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 105,340.00 | 3.27% | 57.55% | 2,09 T |

| ETH | 3,309.06 | 2.17% | 10.99% | 398,74 B |

| XRP | 3.166 | 3.81% | 5.03% | 182,37 B |

| SOLANA | 256.55 | 8.32% | 3.44% | 124,80 B |

| DOGE | 0.3671 | 7.74% | 1.49% | 54,21 B |

| CARDANO | 0.9989 | 2.52% | 0.97% | 35,13 B |

| TRX | 0.2514 | 5.56% | 0.60% | 21,66 B |

| LINK | 25.99 | 7.91% | 0.46% | 16,60 B |

| AVAX | 36.91 | 5.14% | 0.42% | 15,21 B |

| SHIB | 0.00002056 | 3.54% | 0.33% | 12,14 B |

| DOT | 6.610 | 5.69% | 0.28% | 10,19 B |

*Prepared on 1.22.2025 at 07:00 (UTC)

WHAT’S LEFT BEHIND

US SEC Launches Crypto Task Force

US SEC Acting Chairman Mark Uyeda has created a task force “committed to developing a comprehensive regulatory framework for crypto assets”. The task force will be led by Commissioner Hester Peirce.

Trump’s TRUMP Token Comment

Speaking about the TRUMP token, Donald Trump said, “I don’t know much about it, I just know I launched it. I heard it was very successful.”

Trump Pardons Silk Road Founder Ross Ulbricht

US President Donald Trump has signed a pardon for Ross Ulbricht, founder of the dark web platform Silk Road.

500 Billion Dollar Investment in Artificial Intelligence

Trump announced that OpenAI, SoftBank and Oracle are planning a $500 billion investment in an artificial intelligence initiative called “Stargate”. An executive order will be issued for this initiative.

Eric Trump Calls for Investment

“Now is the time to invest in the US, especially in crypto assets and technology,” Eric Trump said, noting that the US will experience a major economic transformation in the coming period.

Dogecoin Logo Update

The US Government’s Department of Productivity (DOGE) has replaced its website logo with an illustration of a dog other than the Dogecoin dog.

Circle Acquires Hashnote

Circle acquired Hashnote for $1.3 billion to enter the asset tokenization market. This step aims to strengthen Circle’s USDC stablecoin.

Trump and Doge ETF Applications from REX

REX filed for Bitcoin ($BTC), Ethereum ($ETH), Ripple ($XRP), Solana ($SOL), Trump ($TRUMP), Bonk ($BONK) and Dogecoin ($DOGE) ETFs.

KULR and Genius Group Bitcoin Investments

KULR: Increased his Bitcoin investments to 510 BTC, accumulating a total of $50 million. His average cost per Bitcoin was $101,695.

Genius Group: increased its Bitcoin reserves to 420 BTC. The average cost was $95,912, while the total reserve value reached $40 million.

Trump Family’s WLFI Project

The Trump family-owned crypto project World Liberty Financial (WLFI) staked 5,252 ETH ($17.43 million) in Lido, converting it into stETH.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Previous |

|---|---|---|

| DavosWeb3 | Event Begins | |

| Space (ID) | Giveaway |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

The first actions and statements of the new US President are closely monitored in global markets. Announcing the establishment of an artificial intelligence initiative led by Softbank, OpenAI and Oracle, Trump stated that China may be subject to a 10% tax increase, which will start as soon as February 1st. While Asian stock markets generally rose with the impact of the artificial intelligence news, Chinese indices diverged negatively due to the its own news flow. European stock markets are also expected to start the new day on the back of tariffs and “trade war” concerns.

Digital assets are trying to recover from the fact that Trump did not make any statements about the crypto world during his inauguration ceremony. The largest cryptocurrency, which spent yesterday recovering losses, is relatively flat and slightly retreated this morning. In the middle of the week, when the economic calendar is quiet, Trump’s moves will continue to be in the focus of the markets. We think that price changes based on news flow will continue in digital assets and the upward trend continues to dominate.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our predictions. Afterwards, the appointments made by the president-elect and the increasing regulatory expectations for the crypto ecosystem in the US and the emergence of BTC as a reserve continued to take place in our equation as positive variables. Although Trump, who took over the presidency with the inauguration ceremony on January 20, did not say anything for the digital world, we maintain our expectations on the subject in the coming days. On the other hand, although it is expected to continue at a slower pace, the expectations that the FED will continue its interest rate cut cycle (for now) and the volume in ETFs based on crypto assets indicating an increase in institutional investor interest, support our upward forecast for the big picture for now. In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional pauses or pullbacks in digital assets. However, at this point, it is worth emphasizing again that we think that the fundamental dynamics continue to support the rise.

TECHNICAL ANALYSIS

BTC/USDT

The markets’ attention continues to focus on Donald Trump. Speculation that Trump would make crypto a national priority and create Bitcoin reserves before his inauguration had created great anticipation among investors. However, these expectations have so far not materialized and the cryptocurrency sector has been ignored in Trump’s initial decisions. This led to disappointment among crypto investors. On the other hand, institutional companies such as MicroStrategy, Kulr and Genius Group continue to increase their crypto investments in line with expectations.

When we look at the technical outlook, it is seen that the volatility in BTC, which came from 101,700 to 107,300, is quite high. The price, which retreated with the selling pressure it faced at these levels, is currently trading at 105,350. Although technical oscillators are in a weak buy signal, we see that the momentum indicator is weakening in the negative zone. We observe that BTC pricing is under the influence of Trump and exhibits indecisive price behavior. If the decline continues, the 105,000 level appears as critical support, while the persistence above this level can be perceived as positive. In the continuation of the rise, we can say that the price will push the new ATH level.

Supports: : 105,000 – 102,800 – 101,400

Resistances 106,800 – 108,250 – 109,700

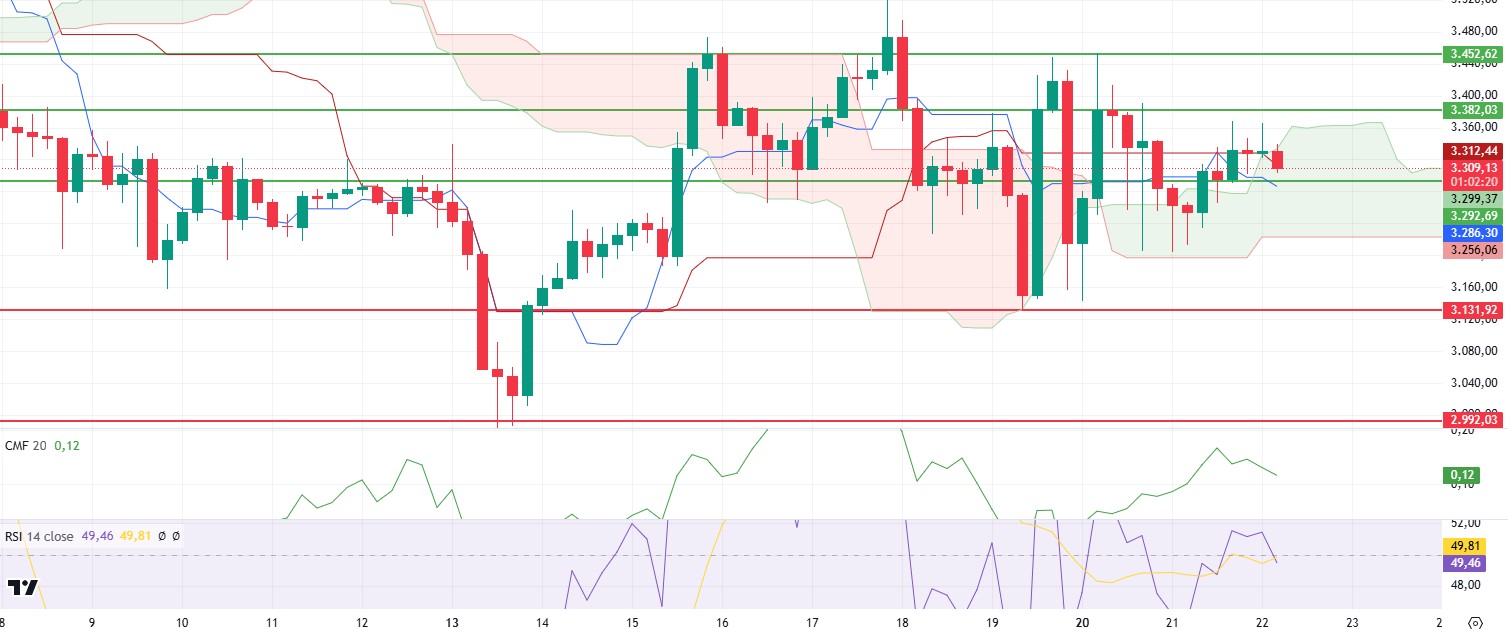

ETH/USDT

ETH rose above the kumo cloud to as high as 3,360 yesterday evening. However, the price retreated slightly as a result of the selling pressure it encountered in this region. ETH’s recent lack of volume has caused a squeeze on the price, and a narrowing triangle pattern can be seen on the chart. While such patterns usually indicate an unstable market, it is predicted that there may be sharp movements depending on the direction of the breakouts. Therefore, it is critical to focus on breakout levels and develop a trading strategy accordingly.

When we look at the technical analysis indicators, there are some signs of weakness on the market. Chaikin Money Flow (CMF), which has maintained an upward trend for a long time, started to retreat, indicating that buyers are losing strength. This indicates that the bullish momentum in the market is waning. At the same time, the retracement on the Relative Strength Index (RSI) adds to the negative outlook and supports that the price is less likely to gain upside momentum. Looking at the Ichimoku indicator, the rejection of the tankan level from the kijun level and the return of the price back to the boundaries of the kumo cloud suggests that the market is in an indecisive state. This structure suggests that the price may struggle to find direction in the short term and horizontal movements may continue. The boundaries of the kumo cloud are especially important in terms of support and resistance zones.

To evaluate price movements through support and resistance levels, if the 3,292 level is broken, the downward movement can be expected to continue during the day. This break may cause the price to head to lower levels as selling pressure increases. On the other hand, an upside break of the 3,382 level signals that buyers are gaining strength and the price may exhibit sharp rises. This breakout could be an important signal determining the direction of the market and is likely to push the price towards new highs, especially if supported by an increase in volume. In conclusion, the current technical outlook for ETH reveals that the market is uncertain and it is important to position according to the breakouts. Careful monitoring of support and resistance levels is critical to minimize risks in the face of volatile movements.

Supports 3,292 – 3,131 – 2,992

Resistances 3,382 – 3,452 – 3,565

XRP/USDT

XRP, which managed to rise to 3.19 support and even slightly above, as expected yesterday evening, has experienced a slight retracement in the morning hours, rejecting this region. After this price action, it seems that XRP is in the consolidation phase and technical indicators also support this situation.

Relative Strength Index (RSI) and momentum indicators are relatively flat, which may indicate that the price is trying to gather strength. At the same time, Chaikin Money Flow (CMF), despite a slight pullback, remains in the positive area, indicating that buyers are maintaining their strength in the market. The fact that the price is currently in the consolidation phase increases the likelihood of horizontal movements or slight pullbacks during the day. A bullish break of the 3.19 level on volume could allow XRP to continue its upward movement. A breakout of this level would indicate a stronger buyer bias in the market. On the other hand, the 2.98 level is critical as the main support in downward movements. In case this level is broken, deep declines seem likely and may lead the price to test lower levels.

As a result, XRP’s current technical outlook highlights the importance of support and resistance levels, while revealing that price movements, especially above the 3.19 level, should be closely monitored.

Supports 2.9851 – 2.7268 – 2.5500

Resistances 3.1991 – 3.3854 – 3.5039

SOL/USDT

While there was no announcement of a Bitcoin Strategic Reserve in the Trump speech, a leading centralized crypto exchange in the US sent almost a quarter of a billion dollars worth of SOL tokens from an unknown wallet. Pump.fun deposited 116,055 SOLs to a centralized exchange while the law violations case was ongoing. As for Onchainde, Solana’s total value locked (TVL) exceeded $10 billion, its highest level since the FTX crash.

Testing the 50 EMA (Blue Line) as support, the asset rallied from there and also broke the base of the uptrend since January 13 to the upside and re-entered the uptrend again. On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). This could mean that the uptrend will continue in the medium term. At the same time, the asset is above the 50 EMA and 200 EMA. When we examine the Chaikin Money Flow (CMF)20 indicator, it is in positive territory and inflows have started to decrease. This may cause a further pullback. However, the Relative Strength Index (RSI)14 indicator moved from negative to positive territory. The 291.00 level appears to be a very strong resistance point in the rises driven by both the upcoming macroeconomic data and the news in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements for the opposite reasons or due to profit sales, the 209.93 support level can be triggered. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 247.53 – 237.53 – 222.61

Resistances 259.13 – 275.00 – 291.00

DOGE/USDT

US Debt Clock introduced the DOGE clock to calculate the savings generated by DOGE. On the other hand, Dogecoin’s network activity is heating up and whale transactions have been increasing recently. The number of transactions exceeding $1 million on the Dogecoin network has increased, reaching 588 transactions in the last 24 hours. On the other hand, Santiment shared that whales bought 590 million DOGE in the last 24 hours.

After yesterday’s spike, Doge broke the downtrend that had been in place since January 18. However, it has retreated from there and is testing the top line of the downtrend as well as the 50 EMA (Blue Line) at the time of writing. On the 4-hour timeframe, the asset is stuck between the 50 EMA (Blue Line) and the 200 EMA (Black Line). The 50 EMA continues to hover above the 200 EMA. This could be the beginning of a medium-term uptrend. When we analyze the Chaikin Money Flow (CMF)20 indicator, it is seen that money inflows increased by moving from the positive zone to the neutral zone. However, Relative Strength Index (RSI)14 is in the neutral zone. The 0.42456 level appears as a very strong resistance point in the rises due to political reasons, macroeconomic data and innovations in the DOGE coin. In case of possible pullbacks due to political, macroeconomic reasons or negativities in the ecosystem, the 0.33668 level, which is the base level of the trend, is an important support. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.36600 – 0.33668 – 0.30545

Resistances 0.39406 – 0.42456 – 0.45173

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.