MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 102,189.19 | -3.01% | 57.43% | 2,03 T |

| ETH | 3,206.61 | -3.07% | 10.95% | 386,19 B |

| XRP | 3.122 | -1.40% | 5.10% | 179,74 B |

| SOLANA | 247.63 | -3.49% | 3.42% | 120,55 B |

| DOGE | 0.3526 | -3.93% | 1.48% | 52,08 B |

| CARDANO | 0.9675 | -3.14% | 0.97% | 34,03 B |

| TRX | 0.2465 | -1.97% | 0.60% | 21,25 B |

| LINK | 24.40 | -6.17% | 0.44% | 15,60 B |

| AVAX | 35.42 | -4.05% | 0.41% | 14,60 B |

| SHIB | 0.00001996 | -2.93% | 0.33% | 11,77 B |

| DOT | 6.307 | -4.57% | 0.28% | 9,72 B |

*Prepared on 1.23.2025 at 07:00 (UTC)

WHAT’S LEFT BEHIND

Harry Jung to Lead CFTC’s Crypto and DeFi Efforts

Caroline D. Pham, Acting Chair of the US CFTC, announced that Harry Jung will serve as chief counsel in the leadership of its crypto and DeFi work. This appointment aims to increase the CFTC’s supervisory power over digital assets.

US Court of Appeals Overturns Tornado Cash Sanctions Decision

The US Court of Appeals for the Fifth Circuit overturned the previous ruling on the Tornado Cash sanctions and sent the case back to the court for a retrial. This decision could set an important precedent for DeFi platforms.

Kansas Plans to Invest Pension Funds in Bitcoin ETFs

Kansas Senator Bowser has introduced Bill 34, which proposes to invest up to 10% of public employees’ pension funds in Bitcoin ETFs. The bill aims to encourage the use of crypto assets in pension funds.

Coinbase CEO Ready for Operating Permit in Turkey

Brian Armstrong stated that they will start working as soon as they receive permission to operate in Turkey. Armstrong emphasized that Turkey is an important target for the growing crypto market.

“Decentralization” Reaction to Vitalik Buterin

After Vitalik Buterin announced that he is the sole decision maker at the Ethereum Foundation, he received criticism of decentralization on social media. “The Ethereum network is decentralized, but the foundation has a different structure,” Buterin responded to these criticisms.

DEX Trading Volume at Record High on Base Chain

Base Chain hit a historic record yesterday with $2.9 billion in decentralized exchange (DEX) trading volume. At the same time, ETH-USD trading volume rose to $1.3 billion.

Bitwise and CoinShares Step Up for Dogecoin ETF

Bitwise and CoinShares filed their Dogecoin ($DOGE) focused ETF applications in Delaware. However, the applications have not yet been approved by the SEC.

Etherealize Receives Investment from Ethereum Foundation and Vitalik Buterin

Etherealize is a new startup that aims to make Ethereum number one in the financial world. The company has received investment from the Ethereum Foundation and Vitalik Buterin, but the amount of investment was not disclosed.

430 Bitcoin Wallet Discovery Linked to Ross Ulbricht

Coinbase Director Conor Grogan uncovered wallets worth $47 million and 430 Bitcoins believed to be linked to Ross Ulbricht. These wallets have been dormant for 13 years.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| 13:30 | US Initial Jobless Claims | 221K | 217K |

| 16:00 | President Trump |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

The steps taken by US President Trump after his inauguration continue to be on the agenda of global markets. While the positive mood brought by the new President’s investment decision on artificial intelligence has started to give way to a neutral risk appetite, news from the world’s second largest economy stands out on the Asia-Pacific front this morning. In order to support the stock market, China announced a series of new measures to encourage the country’s local investment funds and insurance companies to increase their equity investments. Nevertheless, we are reading some stabilization in global risk appetite after the recent rises in stock markets and the first key macro indicator of the week (Initial Jobless Claims) and the President’s speech from the US today may be decisive as to whether this will continue or not.

On the digital assets side, investors continue to wait after the President’s inauguration speech, which did not mention the crypto world. Trump, who made evaluations on many important issues, may bring some movement to the market if he says something about digital assets other than his own coin, revealing his vision for the US. In this parallel, it will be useful to closely monitor the President’s speech today and try to find clues to understand his priorities. We think that the recent pullbacks in major crypto assets may start to limit and may gain ground for some upside depending on the news flow. However, this seems to require fresh information input, and if this does not happen, the horizontal and pressurized course may continue in the short term.

From the short term to the big picture…

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our predictions. Afterwards, the appointments made by the president-elect and the increasing regulatory expectations for the crypto ecosystem in the US and the emergence of BTC as a reserve continued to take place in our equation as positive variables. Although Trump, who took over the presidency with the inauguration ceremony on January 20, did not say anything for the digital world, we maintain our expectations on the subject in the coming days. On the other hand, although it is expected to continue at a slower pace, the expectations that the FED will continue its interest rate cut cycle (for now) and the volume in ETFs based on crypto assets indicating an increase in institutional investor interest support our upward forecast for the big picture for now. In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional pauses or pullbacks in digital assets. However, at this point, it is worth emphasizing again that we think that the fundamental dynamics continue to support the rise.

TECHNICAL ANALYSIS

BTC/USDT

Bitcoin Spot ETFs saw net inflows totaling 6,719 BTC (about $701 million). The bulk of this inflow came from BlackRock’s iShares Bitcoin ETF, which saw inflows of 6,208 BTC (about $648 million). iShares Bitcoin ETF’s total reserves now stand at 569,343 BTC (about $59.4 billion).

When we look at the technical outlook, we see that the price has pinned the price to the 101,500 level in response to the sell signal formed in the previous analysis. The price, which then recovered rapidly, is currently pushing the resistance level of 102,800. When we look at the technical oscillators, we observe that although it maintains the sell signal, it is again in harmony with the momentum indicator. In the continuation of the rise, hourly closes above 102,800 will be monitored and the next resistance level of 105,000 can be targeted again. In the continuation of the decline, 101,400 is important for holding at six-digit levels. With the breakdown to the downside, long positions clustered above the 95,000 level on the liquidation heat chart can be targeted.

Today, eyes are on US unemployment claims and we can say that the market expectation is 221K.

Supports: 102,800 – 105,000 – 102,800

Resistances 105,000 – 106,800 – 108,250

ETH/USDT

Yesterday evening, Ethereum (ETH) continued its downtrend after falling below the $3,292 level, retreated to $3,185 and is currently trading around $3,200. When the Cumulative Volume Delta (CVD) data is analyzed, it is seen that the selling pressure is taking place simultaneously on both spot and futures.

In terms of technical indicators, the Relative Strength Index (RSI) indicator continues to decline in line with the price action. In contrast, the Chaikin Money Flow (CMF) indicator is trending upwards independently of price action, creating an imbalance in the market. When the Ichimoku indicator is analyzed, ETH lost tenkan-sen and kijun-sen supports, followed by kumo cloud support. If the kumo cloud cannot be regained, the negative trend is likely to continue.

As a result, ETH, which entered a downtrend as expected with the loss of the $3,292 level, risks retreating to the $3,131 level unless it regains the sand cloud. However, in case the kumo cloud lower resistance at $3,223 is breached, it is possible that the price could rise back up to $3,292.

Supports 3,131 – 2,992 – 2,890

Resistances 3,292 – 3,382 – 3,452

XRP/USDT

Yesterday evening, CME added the XRP and SOL futures page to its website as a subdomain. The page states that XRP and SOL futures will be active on February 10, subject to regulatory approval. With this news, XRP, which surpassed the 3.20 resistance and rose to 3.28 levels, accompanied the retreat in the crypto market in this region and retreated to 3.11 levels again.

Looking at technical indicators, Relative Strength Index (RSI) and momentum accompany the price decline, while Chaikin Money Flow (CMF) continues its upward movement. Looking at the Ichimoku indicator, the fact that the tenkan level is not converging to the kijun level and the price is supported by the cloud and kijun levels indicates that a negative outlook has not yet started and the price may recover from here.

In summary, unless the 3.10 support is broken, the price recovery seems likely, but closures below this level may bring pullbacks to 2.98 levels.

Supports 3.1053 – 2.9851 – 2.7268

Resistances 3.1991 – 3.3854 – 3.5039

SOL/USDT

Developer Cantelopepeel left the Solana and Fire Dancer projects after two years of work. The developer founded Unto Labs with the goal of a new L1 chain with a consensus and architecture built from the ground up. Onchainde reveals that Solana’s daily transaction fees reached an all-time high of nearly $50 million per day. This figure corresponds to an annual rate of approximately $19.4 billion. On the other hand, Solana stablecoin market capitalization surpassed $9 billion, up 53% in 7 days.

The asset started to fall again after short rises. SOL, which tested the 275.00 resistance level, failed to break it and broke it to the downside, failing to find support from the base of the uptrend that has been rising since January 13. The asset continues to be above the 50 EMA (Blue Line) 200 EMA (Black Line) on the 4-hour timeframe. At the same time, the asset is above the 50 EMA and the 200 EMA. These could mean a bullish continuation in the medium term. When we examine the Chaikin Money Flow (CMF)20 indicator, it accelerated from neutral to positive territory. However, the Relative Strength Index (RSI)14 indicator moved from positive to neutral. However, the symmetrical triangle formation is noticeable. Today, Trump’s speech may cause fluctuations. The 291.00 level stands out as a very strong resistance point in the rises driven by both the macroeconomic data to come and the news in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements for the opposite reasons or due to profit sales, the 209.93 support level can be triggered. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 247.53 – 237.53 – 222.61

Resistances 259.13 – 275.00 – 291.00

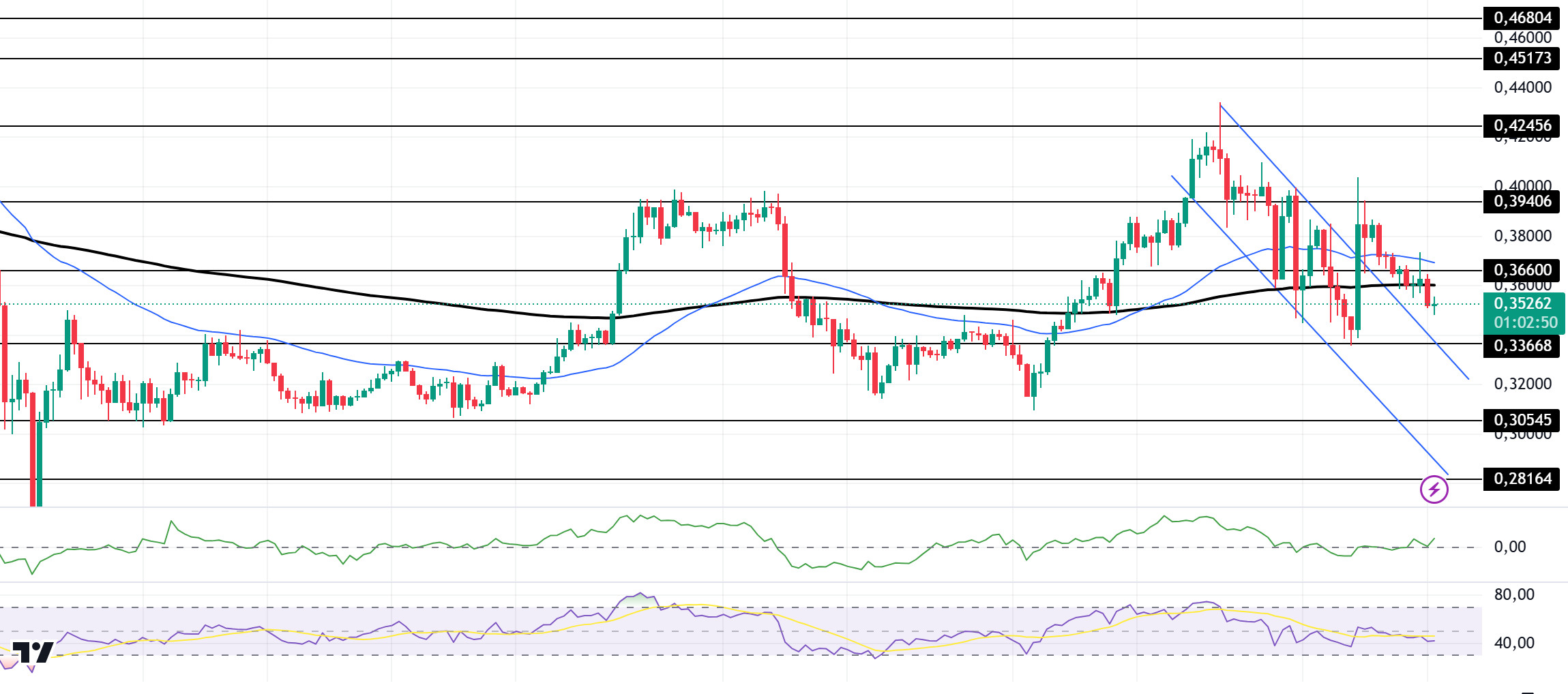

DOGE/USDT

After Tuesday’s rally, Dogecoin slumped after Elon Musk’s DOGE agency website removed iconic meme images. Bitwise registered the Dogecoin ETF in Delaware. However, this is only a trust registration, not an endorsement. On Onchain, Dogecoin whale trades rose to 588 in 24 hours, indicating increased network activity despite the continued price decline.

Doge had broken the downtrend that had been going on since January 18 after the sudden rise. However, it is likely to test the upper line of the downtrend by retreating from here. On the 4-hour timeframe, the asset broke below the 50 EMA (Blue Line) and the 200 EMA (Black Line). The 50 EMA continues to hover above the 200 EMA. However, the 50 EMA has turned down. This could lead to a bullish reversal. When we examine the Chaikin Money Flow (CMF)20 indicator, it moved from the neutral zone to the positive zone and money inflows seem to have increased. However, Relative Strength Index (RSI)14 is in negative territory. On the other hand, Trump’s speech today may cause fluctuations. The 0.42456 level stands out as a very strong resistance point in the rises due to political reasons, macroeconomic data and innovations in the DOGE coin. In case of possible pullbacks due to political, macroeconomic reasons or negativities in the ecosystem, the 0.33668 level, which is the base level of the trend, is an important support. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.33668 – 0.30545 – 0.28164

Resistances 0.36600 – 0.39406 – 0.42456

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.