MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 102,655.82 | 2.14% | 58.06% | 2,03 T |

| ETH | 3,179.57 | 2.36% | 10.94% | 383,22 B |

| XRP | 3.158 | 9.47% | 5.20% | 182,05 B |

| SOLANA | 236.97 | 2.05% | 3.29% | 115,30 B |

| DOGE | 0.3320 | 3.38% | 1.40% | 49,09 B |

| CARDANO | 0.9583 | 5.36% | 0.96% | 33,73 B |

| TRX | 0.2457 | 1.79% | 0.60% | 21,17 B |

| LINK | 23.81 | 2.34% | 0.43% | 15,21 B |

| AVAX | 33.81 | 0.98% | 0.40% | 13,92 B |

| SHIB | 0.00001885 | 3.56% | 0.32% | 11,12 B |

| DOT | 5.886 | 2.12% | 0.26% | 9,09 B |

*Prepared on 1.28.2025 at 14:00 (UTC)

WHAT’S LEFT BEHIND

Trading Volume of Hong Kong Virtual Asset ETFs Reaches HK$18.5 Million

Hong Kong exchange data showed that the total trading volume of virtual asset ETFs today was approximately HK$18,526,710.

Arizona Senate moves forward with Bitcoin Reserve Bill

The Arizona Senate is planning to make a significant change with the Bitcoin reserve bill, which would allow public funds and pensions to invest in Bitcoin. This could be a turning point in cryptocurrency adoption.

Metaplanet Aims to Increase Bitcoin Holdings to 10,000 by the End of 2025

Japanese investment firm Metaplanet plans to increase its Bitcoin holdings by raising a fund of $745.5 million. The company aims to increase its current 1,761 BTC holdings to 10,000 BTC by the end of 2025.

dYdX 2024 Annual Report: Trading Volume Reached $270 Billion

According to dYdX’s 2024 Ecosystem Report, the platform’s annual trading volume reached $270 billion and cumulative trading volume reached $1.46 trillion. DYDX holders increased 290%, total Mega Vault deposits reached $79 million, and the community distributed $63 million in trading rewards.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| 15:00 | US CB Consumer Confidence (Jan) | 105.7 | 104.7 |

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations

MARKET COMPASS

After the DeepSeek shock, global markets are struggling to recover. European stock markets are positive and Nasdaq futures, seen as the US technology index, point to a bullish start to the new day. Digital assets, on the other hand, seem to have taken a break from the recovery trend following the recent declines. After today’s macro indicators, markets are waiting for the results of the Federal Open Market Committee (FOMC) meeting, which will be completed tomorrow. For the short term, we think that the recovery trend may continue, albeit weakly.

From the short term to the big picture.

The victory of former President Trump on November 5, one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our predictions. In the aftermath, the appointments made by the president-elect and the increasing regulatory expectations for the crypto ecosystem in the US and the emergence of BTC as a reserve continued to be in our equation as positive variables. Then, 4 days after taking over the White House, the new President signed the decree of the Cryptocurrency Work Unit, which was among his election promises, and we think that the outputs it will produce in the coming days will continue to reflect positively on digital assets.

On the other hand, although it is expected to continue at a slower pace, the expectations that the FED will continue its interest rate cut cycle (for now) and the fact that the volume in ETFs based on crypto assets indicates an increase in institutional investor interest support our upward forecast for the big picture for now. In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional pauses or pullbacks in digital assets. However, at this point, it is worth emphasizing again that we think that the fundamental dynamics continue to be bullish.

TECHNICAL ANALYSIS

BTC/USD

Bitcoin continues to rebound weakly amid macroeconomic factors, Nvidia news and a general sell-off in tech stocks. In the options market, the heavy trading of put options with a strike price of USD 96,000-98,000 indicates that the downtrend may continue ahead of the FED interest rate decision. Moreover, the accumulation of long positions at levels where put options are dominant in the futures market is noteworthy.

Looking at the technical outlook, we observe that the price tested above the resistance level of 103,000 and did not last. In BTC, which is currently trading at 102,600, technical oscillators continue to maintain the weakening buy signal, while the momentum indicator continues to gain some more strength. In the continuation of the rise, closures above the 103,000 level will be followed and the 105,000 level is targeted. In the event of a decline, we will follow the 101,400-support level, and the breakdown may be tested below six-digit levels again.

Supports: 101,400 – 99,100 – 98,000

Resistances 103,000 – 105,000 – 107,000

ETH/USDT

ETH was slightly lower during the day on low trading volume. While selling pressure, especially from the kijun line, dragged price action without volume, technical indicators offer important clues about the overall market situation.

The Chaikin Money Flow (CMF) indicator has gained momentum to the upside, signaling that buyers are starting to regain strength in the market. However, CMF is still in negative territory, suggesting that capital inflows have not yet reached sufficient levels. The Relative Strength Index (RSI), on the other hand, has recovered after breaking out of oversold territory, but is signaling a slight pullback, accompanying the slight decline in price. Nevertheless, the overall trend suggests that the RSI maintains its positive outlook.

In order for the price to re-enter the uptrend, the 3,224 level, where the intermediate resistance point and the kijun level are located, must be exceeded. If it holds above this level, the next target will be 3,292. If this area is crossed, the 3,329 level, the intersection of the kumo cloud and the trend line, is an important resistance area. A break above these levels could trigger a stronger rally. Otherwise, a break below the kijun level could increase the risk of a downside move. In such a scenario, the first support point could be the 3,131 level. If this support is broken, a deeper retracement to 2,992 levels may occur.

Supports 3,131 – 2,992 – 2,890

Resistances 3,292 – 3,350 – 3,452

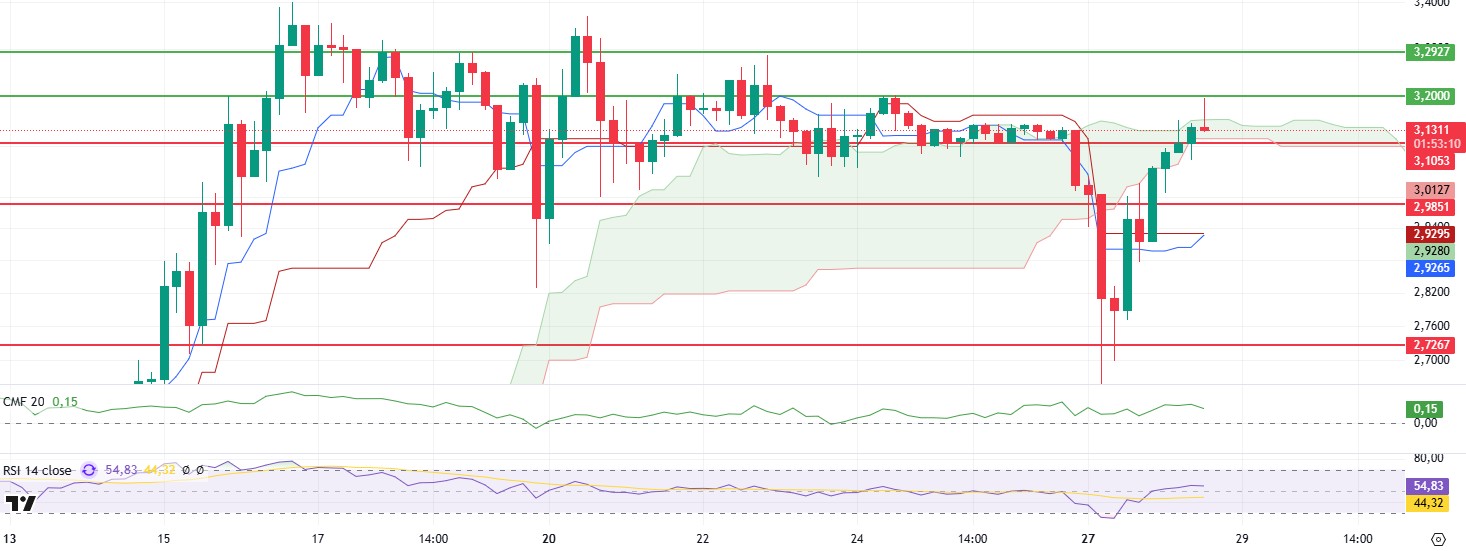

XRP/USDT

XRP managed to break through the sand cloud resistance during the day, rising as high as 3.20. However, strong selling pressure from this area pulled the price back to the limits of the sand cloud. This move is a sign of market indecision.

The Chaikin Money Flow (CMF) indicator continues to retreat, reflecting the weakness in capital flows. On the other hand, the upward trend in the Relative Strength Index (RSI) and momentum indicators suggest that buyers are still active in the market and the potential for a price rebound remains.

From a technical point of view, a retest of the 3.20 level seems likely in case of a close above the Kumo cloud in the evening hours. If this level can be strongly breached, the next target for the price will be the 3.29 level. A break of this resistance zone could further accelerate the upside movement and take XRP to a new uptrend. In the downside scenario, the 3.10 level stands out as the most critical support point to watch carefully. Pricing below this level could disrupt XRP’s positive outlook and result in a deeper pullback. In such a case, if the price remains under the kumo cloud again, it may increase selling pressure.

Supports 3.1053 – 2.9851 – 2.7267

Resistances 3.2000 – 3.2927- 3.3854

SOL/USDT

SOL continues to maintain the downtrend that started on January 19, pricing in the near-resistance zone of the downtrend. The asset turned bullish after taking support from the 200 EMA. On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). This could mean that the uptrend will continue in the medium term. At the same time, the asset is located between the 50 EMA and the 200 EMA and tested the 50 EMA as resistance but failed to break it and retreated slightly. When we examine the Chaikin Money Flow (CMF)20 indicator, it has approached the neutral zone from the negative zone. However, the Relative Strength Index (RSI)14 indicator has risen from the oversold zone to the neutral zone levels. This can be seen as an opportunity for selling. The 259.13 level stands out as a very strong resistance point in the rises driven by both the upcoming macroeconomic data and the news in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements for the opposite reasons or due to profit sales, the 209.93 support level can be triggered. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 237.53 – 222.61 – 209.93

Resistances 247.43 – 259.13 – 275.00

DOGE/USDT

Elon Musk invited Dogecoin founder Shibetoshi Nakamoto to join DOGE (Department of Government Efficiency), creating optimism among the bullish dynamics reflected by the DOGE price.

DOGE has remained sideways since our morning analysis. Having broken the December 20 uptrend with a strong downside candle, at the time of writing, the asset is testing the base level of the uptrend as resistance. On the 4-hour timeframe, the 50 EMA (Blue Line) has started to be below the 200 EMA (Black Line). This could mean that the decline could deepen in the medium term. At the same time, the price is below the 50 EMA (Blue Line) and the 200 EMA (Black Line). When we examine the Chaikin Money Flow (CMF)20 indicator, it is in the negative zone, close to the neutral zone, but money inflows and outflows are in balance. However, the Relative Strength Index (RSI)14 is in the negative zone near the neutral level. At the same time, the RSI indicator is testing the resistance of the downtrend. The 0.39406 level appears to be a very strong resistance point in the rises due to political reasons, macroeconomic data and innovations in the DOGE coin. In case of possible pullbacks due to political, macroeconomic reasons or negativities in the ecosystem, the 0.28164 level, which is the base level of the trend, is an important support. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.30545 – 0.28164 – 0.25025

Resistances 0.33668 – 0.36600 – 0.39406

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.