Introduction

Customs duties and tariffs are a tax imposed by the government on imported goods and services and paid by the businesses that bring them into the country. Designed to protect domestic industries, tariffs often increase costs for consumers by making foreign products more expensive and potentially reducing demand. Tariff rates vary from country to country and by product type. Agricultural products are generally subject to higher taxes. While tariff rates are generally low in developed countries, they can be higher in developing countries.

Some countries impose high tariffs on certain products to protect local industries. For example, India imposes high tariffs on agricultural products.

US President Donald Trump announced that he will impose a 25% tariff on imports from Canada and Mexico from February 1, 2025

As of 09.02.2025, China’s decision to impose tariffs of up to 15% on US goods was published. After the news, cryptocurrencies fell by 5% across the board.

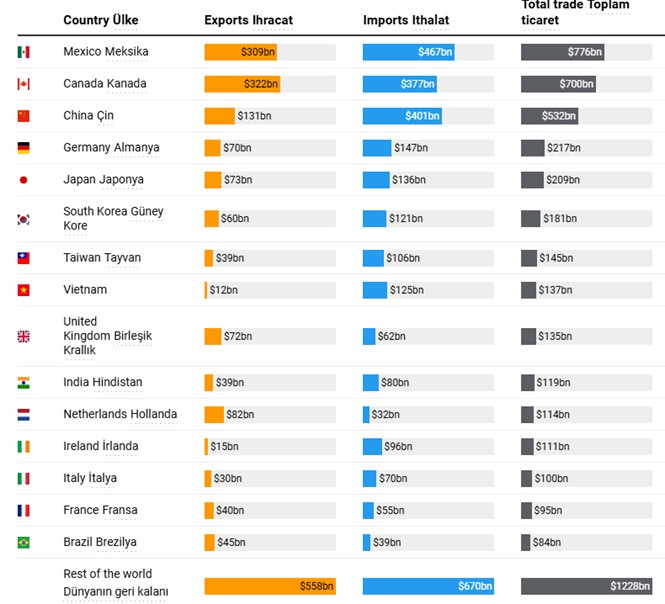

Imports from China will be subject to an additional 10% tariff. A lower tariff of 10% will be applied to energy imports from Canada. This means that US importers will now have to pay an extra dollar to the federal government, increasing their costs. Chinese goods were subject to previous tariffs between 2017 and 2021, starting with Trump’s first term. Mexico, Canada and China, the United States’ largest trading partners, account for more than 40% of total goods traded and are worth more than $2 trillion.

Customs Tariffs

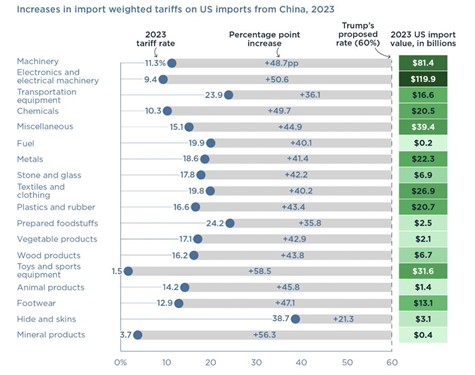

China is the dominant supplier of toys and sporting goods to the United States, provides 40% of US footwear imports and is the source of a quarter of US electronics and textiles. Tariffs of up to 60 percent on China could have a major impact on international goods markets.

Looking at tariffs across countries

- USA: Average tariff rate: 1.6% (5.3% on agricultural products, 1.4% on industrial products). The US imposes low tariffs on imports from many countries due to free trade agreements.

- European Union (EU): Average customs duty rate: 1.5% (10.8% for agricultural products, 1.0% for industrial products). There are no customs duties between EU member states.

- Japan: Average tariff rate: 2.5% (18.7% on agricultural products, 1.1% on industrial products).

Developing Countries:

- India: Average tariff rate: 6.3% (32.8% on agricultural products, 4.9% on industrial products). India imposes high duties on some products to protect local producers.

- Brazil: Average tariff rate: 8.0% (10.0% for agricultural products, 7.8% for industrial products).

- China: Average tariff rate: 3.5% (9.9% for agricultural products, 2.8% for industrial products). China keeps tariffs relatively low as it is an export-oriented economy.

- Russia: Average tariff rate: 4.8% (10.8% for agricultural products, 4.3% for industrial products).

Russia imposes high taxes on some strategic products.

Before these tariffs

18% if coming directly from European Union countries,

If they came from other countries, a 20% tax was charged.

Details of Tariffs on Canada and Mexico:

- Imports from Canada and Mexico will be subject to a 25% tariff.

- An additional 10% tariff was imposed on some imports from China.

- Trump stated that these tariffs were imposed due to illegal immigration, drug trafficking (fentanyl crisis) and trade imbalances.

- He argued that these measures would protect American jobs and force Canada and Mexico to take tougher steps on border security.

- Stock and cryptocurrency markets fell after the announcement.

- The governments of Canada and Mexico imposed retaliatory tariffs on US goods. Canada responded by imposing a 25% tariff on $30 billion worth of American imports.

- There were suggestions that escalating trade wars could increase consumer prices and damage North American supply chains.

- The US Chamber of Commerce and business representatives have criticized the tariffs for creating economic instability

Steel and Aluminium Tariffs (2018)

During Donald Trump’s presidency, tariffs have been imposed on Canada and Mexico, particularly in the context of trade policies. These tariffs focused primarily on steel and aluminium products and were implemented as part of Trump’s “America First” policy. In March 2018, the Trump administration decided to impose tariffs of 25% on steel and 10% on aluminium products on national security grounds. These tariffs covered several countries, including Canada and Mexico. Canada and Mexico were among the largest suppliers of steel and aluminium to the US. Canada and Mexico retaliated against these tariffs. For example, Canada imposed additional tariffs on various products imported from the US (steel, aluminium, agricultural products, etc.).

USMCA (New North American Free Trade Agreement) Process

The Trump administration worked on a new agreement with Canada and Mexico to replace NAFTA (North American Free Trade Agreement). This agreement is called the USMCA (US-Mexico-Canada Agreement).

Steel and aluminium tariffs were a major point of contention during the USMCA negotiations. Canada and Mexico demanded the elimination of tariffs.

In May 2019, the Trump administration lifted steel and aluminium tariffs on Canada and Mexico. This step helped the USMCA move forward.

Impacts of Tariffs

The steel and aluminium tariffs have had a negative impact on the Canadian and Mexican economies. Canada’s steel industry has been particularly hard hit.

In the US, while the tariffs protected steel and aluminium producers, they caused cost increases in sectors such as automotive and construction that use these products

Impact on Stock Exchanges and Introduction of Tax Tariffs.

- When Trump imposed tariffs in 2018, the NASDAQ index fell by 10%. And there was an extremely volatile market for months.

The tariffs imposed have increased the costs of trade, which has reduced investors’ confidence in future profit margins. The outbreak of a trade war between the US and other countries reduced investors’ risk appetite. The chart shows the lows and volume changes between January 25, 2018 and June 21, 2018, indicating both selling pressure and buying opportunities.

Three categories of imports from China now face average tariff rates below 10 percent.” Toys and sporting goods, minerals and electronic and electrical machinery’. Of these sectors, the United States relies most heavily on China for toys and sporting goods. While toys appear to be products for which substitute vendors are readily available, China maintains its dominant position in toy production for a variety of reasons, including its elusive capacity to produce materials that meet U.S. product safety standards. Toys and sporting goods are currently taxed very lightly, and the new tariffs will be felt directly by American households. Trump’s tariffs have led to tensions in international trade relations. With the signing of the USMCA, trade relations with Canada and Mexico have normalized to some extent.

Canada is a major exporter of crude oil, with 97% of its crude oil exports going to the US in 2023, while Mexico exports a large amount of products such as auto parts as well as fruits and vegetables. China is a major exporter of electrical equipment and electronics, including chips, laptops and smartphones.

There seems to be a temporary pause in tariffs on Mexico and Canada. However, Trump has signaled additional tariffs against the EU and others, with tariffs against China taking effect on February 4

In response, countries will likely adopt a range of strategies, from direct retaliation to protecting trade relations between the US, China and other partners. Globally, we can expect inflationary effects and significant disruptions to supply chains.

Conclusion

These reciprocal tariffs affect trade relations and economic balances between the US, Canada and Mexico. Such trade wars can harm all parties in the long run. The tariffs have gone down in history as an example of Trump’s protectionist trade policies. This process marked an important turning point in US trade policies and affected global trade dynamics. During Trump’s presidential campaign, he promised to impose tariffs on the US’s largest trading partners in retaliation against undocumented migrants and the flow of drugs, especially fentanyl.

Trump also emphasized the use of tariffs as a tool to support domestic production and encourage foreign businesses to set up factories on US soil.

Tariffs are also used to generate revenue for a country through extra income from taxes on imported goods used for public spending. The US administration hopes that the latest tariff war will encourage companies to build more factories and businesses in the US