Bitcoin is known as an asset that differs from traditional financial markets with its decentralized structure and digital asset feature. On the other hand, the Russell 2000 index is a stock market index representing small and medium-sized companies in the US. Recently, similarities have been observed in the price movements of Bitcoin and the Russell 2000 index, and the correlation between them has increased. This points to the increasing interaction between traditional financial markets and cryptocurrency markets, which have different dynamics.

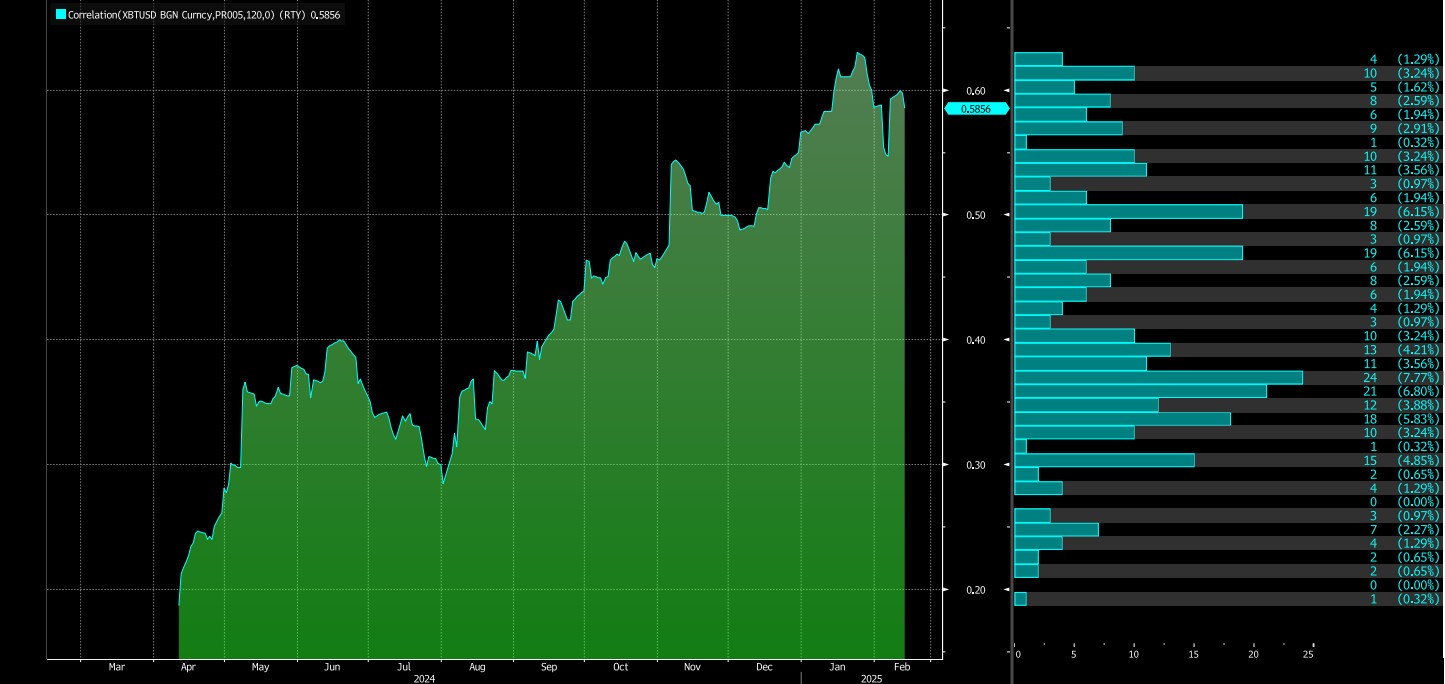

Source: Bloomberg

As shown in the chart, the correlation between Bitcoin and the Russell 2000 index has been increasing since August 2024. Currently, a positive correlation persists at the 0.5856 level.

So, what are the main factors behind this correlation? In general terms, these factors can be analyzed in three points:

- Macroeconomic Factors and Risk Perception

- The Role of Institutional Investors

- Technological Developments and Market Dynamics

- Macroeconomic Factors and Risk Perception

One of the main reasons for the correlation between Bitcoin and the Russell 2000 index is that macroeconomic factors have similar effects on both risk-sensitive asset classes. In particular, inflation, interest rates and global economic uncertainties directly affect the performance of both Bitcoin and small-caps.

- Inflation and Monetary Policies: As central banks adopt tight monetary policies to fight inflation, investor interest shifts from risky asset classes such as Bitcoin to less risky fixed income assets, while companies in the Russell 2000 index increase their financing costs. This may cause both asset classes to lose value.

- Risk Perception: Bitcoin and the Russell 2000 index are generally considered high-risk assets by investors. During periods of heightened macroeconomic uncertainty, investors tend to be risk averse and move away from these assets, causing both to lose value.

- The Role of Institutional Investors

The adoption of Bitcoin by institutional investors has strengthened the links between cryptocurrency markets and traditional financial markets. Institutional investors are investing in both Bitcoin and small-cap companies for portfolio diversification. This makes the performance of both asset classes more interconnected.

- Portfolio Management (Diversification) Strategies: When diversifying their portfolios for risk management purposes, investors may invest in both Bitcoin and companies in the Russell 2000 index. This causes the price movements of both asset classes to become more interconnected.

- Liquidity and Market Depth: Bitcoin’s increased liquidity and market depth make it easier for institutional investors to buy and sell the asset. This increases Bitcoin’s correlation with traditional financial markets.

- Technological Developments and Market Dynamics

Technological developments affect the performance of both Bitcoin and the companies in the Russell 2000 index. In particular, the fact that technology-oriented companies have a significant weight in the Russell 2000 index increases the correlation of this index with Bitcoin.

- Blockchain Technology: Blockchain technology, which underpins Bitcoin, is used in many industries, from financial services to supply chain management. With companies in the Russell 2000 index investing in this technology, the performance of both asset classes is becoming more interconnected.

- Market Dynamics (High Volatility): Bitcoin and companies in the Russell 2000 index generally have high volatility. This leads traders to develop similar strategies for both asset classes, which increases correlation.

Will This Correlation Between Bitcoin and the Russell 2000 Index Continue?

Whether the high correlation between Bitcoin and the Russell 2000 index will persist may depend on macroeconomic conditions and market dynamics. In particular, factors such as inflation, interest rates and global economic growth will continue to influence the performance of both Bitcoin and the Russell 2000 index. This could lead to continued correlation between these two assets.

General Evaluation

The high correlation between Bitcoin and the Russell 2000 index is due to many factors such as macroeconomic factors, the role of institutional investors and technological developments. In this respect, the increase in the correlation between Bitcoin and the Russell 2000 index can be explained by macroeconomic factors, the influence of institutional investors and market dynamics. While inflation, interest rates and economic uncertainties affect the value of both assets, investors’ perception of risk supports this parallelism. The fact that institutional investors invest in both Bitcoin and small-cap companies brings price movements closer together, while Bitcoin’s increasing liquidity strengthens its interaction with traditional financial markets. In addition, the weight of technology-oriented companies in the Russell 2000 index and the high volatility of both assets also reinforce this relationship.

This correlation is expected to continue in the future, but it should be noted that it may vary depending on market conditions. Therefore, the high correlation between Bitcoin and the Russell 2000 index presents both opportunities and risks for investors. The fact that these two asset classes move in a similar way can reduce the impact of portfolio diversification. In this regard, investors should review their portfolios taking this correlation into account and prioritize risk management.

Disclaimer

This article is for informational purposes only and does not constitute financial or investment advice. The NFT market is rapidly evolving, and potential participants should conduct thorough research and consult with a qualified professional before engaging in any transactions involving NFTs.

Click for more education articles