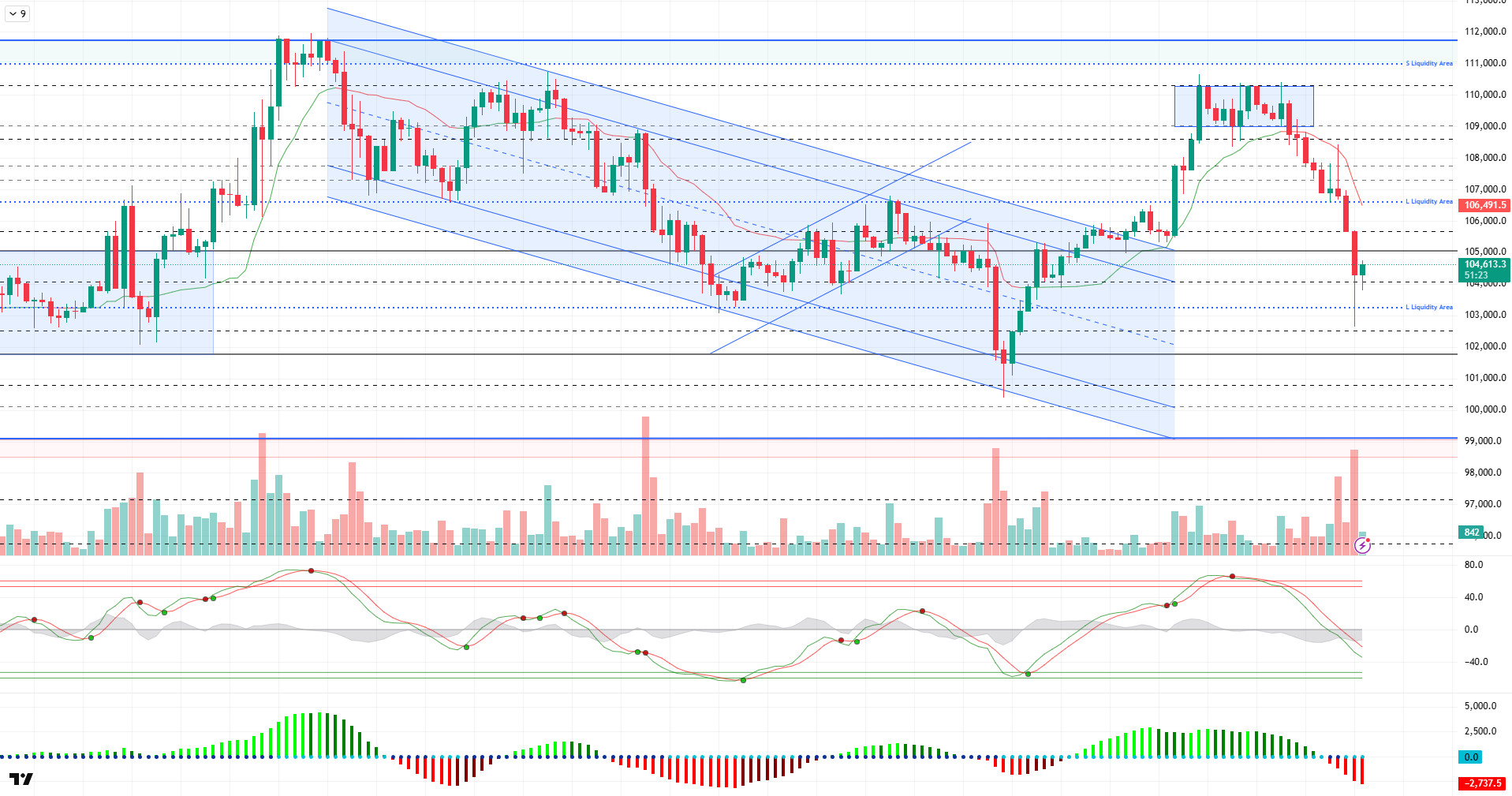

Technical Analysis

BTC/USDT

As tensions rise again in the Middle East, an Israeli airstrike on Iran has alarmed global markets. While explosions occurred in strategic areas in Tehran, the Israeli Defense Minister declared a state of emergency across the country in retaliation. US President Trump said he had been briefed before the attack and was considering the possibility of Iran returning to the negotiating table. The course of today’s attacks and whether the retaliations will continue will be followed and the fragile structure of the market against Gold will be questioned once again.

When we look at the technical outlook after the latest developments, it was observed that BTC showed signs of recovery after testing the 106,600 level yesterday and in this direction, it gave an important upward signal by pinning above the 108,000 level. However, after this rise, the price was subjected to a sharp selling pressure due to the negative developments we mentioned above while trying to consolidate in the 106,000 – 107,000 band. With this pressure, BTC fell as low as 102,600. At the time of writing, the price has recovered to 104,500 after this decline and is trading with high volatility.

On the technical indicators side, the Wave Trend oscillator continues to signal a sell signal, while momentum indicators are hovering in negative territory. The Kaufman moving average is at 106.100, continuing to confirm the downtrend above the price.

With this sharp decline, there was a serious movement on the liquidation side. It is seen that the liquidations in the last 24 hours reached 1.12 billion dollars and the buy positions were almost completely closed. Looking at the liquidity map, it is noteworthy that while large downward liquidations have been completed with the current decline, the next liquidity area is concentrated at the ATH levels of sell-side positions.

Overall, both technical and liquidity data followed by fundamental developments helped deepen the decline in BTC. However, despite such a strong news flow compared to previous years, the fact that the price has only dropped by about $ 2,000 for the moment shows that the BTC price structure is still strong. In this context, the 105,000 level will be followed as the first resistance point with recovery movements during the day. If this level is passed, the price can be expected to head towards the 106,000 – 107,000 band again. On the other hand, if the negative news flow continues, the 103,300 level will stand out as a critical support with increasing volatility and will be decisive in terms of holding at six-digit price levels.

Supports 103,300 – 102,400 – 101,800

Resistances 105,850 – 106,600 – 107,300

ETH/USDT

The renewed flare-up in the conflict between Israel and Iran last night led to a sharp decline in global risk appetite, which was naturally reflected in a sharp sell-off in global markets. The impact of these developments also spilled over to crypto assets, with ETH, in particular, losing value rapidly in high-volatility trading, falling as low as below the $2,500 level.

When technical and on-chain data are analyzed in detail, it is seen that the decline is not only driven by market sentiment but also by structural selling pressure. Especially in the Cumulative Volume Delta (CVD) data, it is clearly observed that heavy sell orders from both spot and futures markets increased the pressure on the price. This collective selling behavior suggests that in the short term, most investors are risk averse and liquidating their positions rapidly.

Moreover, the funding rate, which had been in positive territory for a long time, turned negative, indicating a significant increase in short positions. This suggests that bearish sentiment is gaining weight in the broader market and the number of sell positions on leveraged trades has increased significantly.

The Chaikin Money Flow (CMF) indicator is also showing a clear weakening. The indicator has moved sharply into negative territory, confirming the rapid outflow of liquidity from the market and a significant slowdown in capital inflows. A return of CMF to positive territory could be considered as one of the prerequisites for a possible recovery.

The Ichimoku indicator also supports the current weakness. The price is currently trying to hold on to the lower band of the cloud, but the tenkan level has dipped below the kijun level, indicating that the short-term momentum is weakening and the trend is turning down. If the price slips below the kumo cloud, the risk of a pullback to the support area defined as the “demand zone” on the chart remains on the table.

On the other hand, although most of the technical indicators are generating negative signals, the fact that the price is still within the Ichimoku cloud suggests that the potential for a recovery has not completely disappeared despite the current decline. However, if the cloud is lost, it is highly likely that the sales will deepen further and cause a decline towards the determined demand zone. This region may continue to be monitored as a possible support zone as it is one of the levels that have received a strong reaction in the past.

Top of Form

Below the Form

Supports 2,329 – 2,130 – 2,029

Resistances 2,533 – 2,736 – 2,857

XRP/USDT

XRP was adversely affected by the heightened perception of geopolitical risk as the news flow about the conflicts between Israel and Iran intensified yesterday evening and fell sharply to the $2.08 level in line with the selling wave seen in the market in general. This level represents a technically critical area as it has worked as a strong support in past price movements. If the price sags below this support level, there may be a scenario where downward pressure may increase and the decline may deepen. For this reason, the $2.08 level is a point that should be carefully monitored as both a technical and psychological threshold in the short term.

Technical indicators continue to provide weak signals in support of the current price structure. On the Ichimoku indicator, the price has moved below the kumo cloud, indicating that the market structure has turned negative and the upside momentum has been lost. In addition, with the tenkan level falling below the kijun level, a classic sell signal has been formed and this structure is still valid. This signal suggests that selling pressure may continue in the short term, while possible recoveries may remain limited.

The Chaikin Money Flow (CMF) indicator also supports this weak outlook. The fact that the indicator shifted to negative territory and continued its downward trend suggests that liquidity outflows continue in the market and sellers are still the dominant side. This suggests that bullish attempts, especially without volume, may be met with selling and the market is still struggling to find a clear buyer. On the other hand, the fact that the Relative Strength Index (RSI) indicator has fallen back to the oversold zone suggests a potential for a short-term reaction, although the RSI at this level alone cannot be considered as a strong turn signal.

As of the general outlook, the price’s persistence at the level of $2.08 stands out as the first condition for a possible recovery movement in the short term. However, breaking this support may pave the way for the market to test lower support levels and accelerate the downward trend. Therefore, price behavior in this region should be closely monitored; especially whether an upward movement supported by increased volume occurs will be decisive for a possible change in direction.

Supports 2.0841 – 2.0402- 1.6309

Resistances 2.2154 – 2.3928 – 2.4765

SOL/USDT

Publicly traded DeFi Development Corp. has signed an agreement for a $5 billion equity credit line. The firm will use the proceeds from the issuance and sale of its common shares to acquire SOL.

SOL price kept pace with the cryptocurrency market, declining by nearly 9%. The asset continued its retreat, breaking the strong support at $150.67 with a strong candle to the downside. A double bottom formation has been formed. This could be a bullish harbinger. It is currently testing the $144.35 level, which is a strong support. If the retreat continues, the $133.74 level should be followed.

On the 4-hour chart, the 50 EMA continued to be below the 200 EMA. This suggests that the bearish trend may continue in the medium term. At the same time, the fact that the price is below both moving averages suggests that the market is currently bearish in the short term. However, the large gap between the price and the 50 EMA may be a sign of a rebound. Chaikin Money Flow (CMF-20) has crossed into negative territory; in addition, the decline in daily inflows may take CMF deeper into negative territory. Relative Strength Index (RSI-14) started to be in the oversold zone. This could lead to a rebound. The $150.67 level stands out as a strong resistance point in the event of a rally on the back of macroeconomic data or positive news on the Solana ecosystem. If this level is broken upwards, the rise can be expected to continue. If there are pullbacks due to contrary developments or profit realizations, the $138.73 level may be retested. In case of a decline to these support levels, the increase in buying momentum may offer a potential bullish opportunity.

Supports 144.35 – 138.73 – 133.74

Resistances 150.67 – 163.80 – 171.82

DOGE/USDT

SEC begins review of Bitwise Dogecoin ETF application.

The DOGE price kept pace with the cryptocurrency market, falling by about 11%. The asset, which continues its retreat by breaking the strong resistance level of $0.17766 downwards, may test the strong support level of $0.16686 if the retreat continues. On the other hand, the double bottom formation may start an uptrend.

On the 4-hour chart, the 50 EMA (Blue Line) continues to be below the 200 EMA (Black Line). This shows us that the asset is bearish in the medium term. The fact that the price is below two moving averages signals that the asset is bearish in the short term. At the same time, the fact that the price is away from the moving averages may cause a rebound. The Chaikin Money Flow (CMF-20) indicator crossed into negative territory. In addition, negative money inflows may move CMF deeper into the negative zone. Relative Strength Index (RSI-14), on the other hand, remained in the negative territory and is in the oversold zone. This may cause the price to rebound. The $0.18566 level stands out as a strong resistance zone in case of a rally on the back of political developments, macroeconomic data or positive news flow in the DOGE ecosystem. In the opposite case or possible negative news flow, the $0.16686 level may be triggered. In case of a decline to these levels, the increase in momentum may start a new bullish wave.

Supports 0.16686 – 0.15680 – 0.14952

Resistances 0.17766 – 0.18566 – 0.19909

Legal Notice

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.