Definition and Importance of Chainlink Reserve

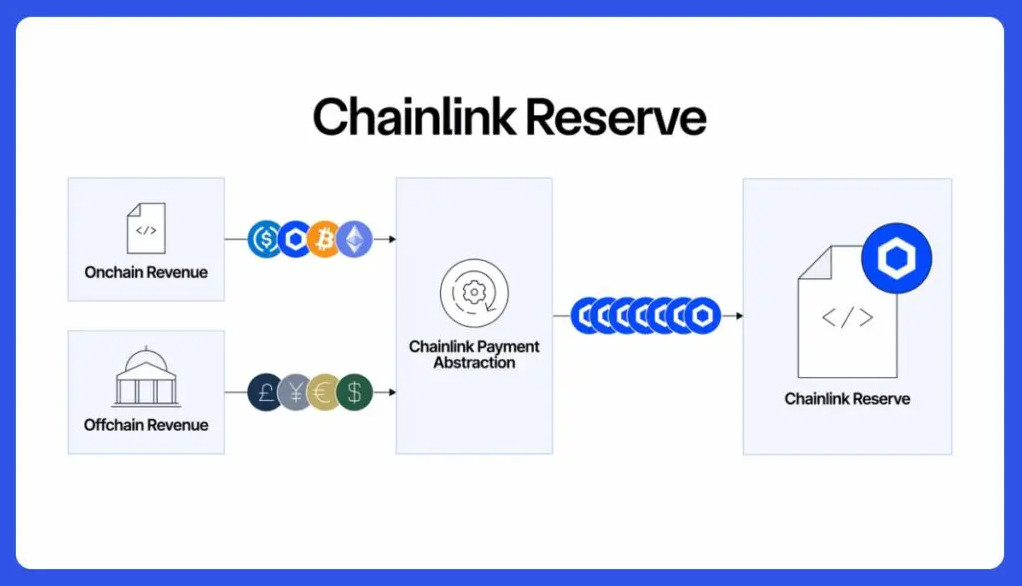

There has been a notable new development on the Chainlink front recently: Chainlink Reserve. The basic idea is quite simple but has a significant impact. The network has started automatically converting payments from institutions and fees collected from services used on-chain into LINK and accumulating them in a reserve pool.

Source: Chain. Link

To better understand how these revenue models are formed and to anticipate LINK’s potential, it’s worth taking a brief look at this:

Corporate Revenues

Chainlink integrates with major institutions such as Mastercard, Swift, and JPMorgan. These institutions use the network’s oracle services, CCIP (Cross-Chain Interoperability Protocol) infrastructure, or data streams.

- Payments are received from these institutions for these services.

- Payments are not always made in LINK; sometimes they are made in USDC, sometimes in ETH, or sometimes in the gas token of the relevant blockchain.

- These revenues are automatically converted to LINK on DEXs like Uniswap through the Payment Abstraction mechanism and transferred to the reserve pool.

On-Chain Service Revenues

Chainlink offers many products in the DeFi and Web3 ecosystem:

- VRF (random number service) → Randomness service for games and NFT mints.

- Automation → Automatic triggering of smart contracts.

- Data Streams → Price feeds for protocols like GMX.

- CCIP → Asset transfers and messaging.

When these services are used, on-chain payments are made. For example, if a DeFi protocol uses Chainlink VRF, it pays a certain service fee. These payments are also automatically converted to LINK and collected in the reserve.

The critical point here is that the Chainlink team does not plan to withdraw the LINK accumulated in this reserve for many years. So, while creating regular demand for LINK in the market on one hand, the pressure on the supply side is reduced because it is not sold on the market on the other. This dual effect actually becomes the most important factor strengthening LINK’s economic model.

Operating Mechanism and Current Status

If we ask, “How does this system work?”

- Let’s say an organization uses Chainlink services. Payments can be made in ETH, USDC, or gas tokens.

- Thanks to Chainlink’s Payment Abstraction mechanism, these payments are automatically converted into LINK on decentralized exchanges like Uniswap.

- The converted LINK is then transferred to an official reserve contract on Ethereum. This contract is transparent and visible to everyone; it can be tracked in real-time either through Etherscan or the reserve.chain.link dashboard.

Source: Chain. Link

As of today, the table looks like this:

- Initially, there were approximately 65,500 LINK (approximately $1 million) in the pool.

- On August 14, an additional 44,000 LINK were added, bringing the total to 109,000 LINK.

- Currently, over 109,000 LINK is held in the contract, meaning we are talking about a reserve worth approximately $2.5–2.7 million.

In short, the reserve has grown significantly in just a few weeks, and if this pace continues, we could see much larger accumulations in the medium term.

Market Impact and Role in the Ecosystem

Since the announcement, the LINK price has experienced an aggressive rise of over 60% relative to the overall market situation, reaching nearly $28. This is a small but clear indication of how the market perceives this new model.

There are three critical points here:

- Consistent demand generation → Since every revenue stream is converted into LINK, there is a constant buying pressure.

- Supply restriction → LINK tokens collected in the reserve will not return to the market for years. This reduces selling pressure.

- Increased institutional trust → This system operates completely transparently and automatically. Consequently, it creates an image of an “accountable token economy” for major players.

Looking at the community side, this initiative was generally interpreted in forums and social media as “Chainlink is buying back LINK itself.” This is because, ultimately, tokens are being withdrawn from the market and held in reserve. People particularly find the phrase “no withdrawals for many years” significant. This also comes to the fore as a positive pressure factor on the price.

Disclaimer

This article is for educational and informational purposes only. It does not constitute investment advice. Cryptocurrency investments carry risks, and market conditions can change rapidly. Always conduct your own research or consult a licensed advisor before making financial decisions.