Percolator and the Competition It Could Bring to the Perp Dex Ecosystem

What is Percolator?

Anatoly Yakovenko, co-founder and CEO of Solana, introduced “Percolator,” a new decentralized perpetual exchange protocol designed to operate natively on the Solana blockchain. Yakovenko’s move appears to be an effort to create a new infrastructure layer that could attract liquidity providers and high-frequency traders seeking alternatives to centralized exchanges.

According to documents, Percolator aims to offer CEX-level execution speeds with multi-part order books and enable different trading pairs or markets to operate simultaneously without competing for the same computational resources. The platform aims to offer self-custody and a high-speed solution for continuous futures trading, allowing crypto traders to speculate on price movements without expiration date constraints.

How Does Percolator Work?

Percolator offers an innovative architecture that differs from existing perpetual DEXs. The protocol uses “slab matching engines,” which divide the exchange’s order book into multiple independent engines running simultaneously.

These mini engines, called “slabs,” manage separate order books for different tokens. This design allows liquidity providers to compete while protecting isolated risks. If an error or malicious activity occurs in one slab, users who have never interacted with that slab are unaffected.

The system is powered by two main components:

The Router program manages user collateral and portfolio margins and coordinates trading between different slabs. It tracks positions and ensures that trades are executed instantly.

The slab program consists of independent continuous engines operated by liquidity providers. Each slab independently manages its own matching and clearing.

According to Yakovenko’s documentation, this architecture guarantees atomic routing and portfolio netting while giving each liquidity provider the freedom to innovate within their own slab. The system is designed to match or exceed the capital efficiency of traditional single order book exchanges.

Can Percolator Revitalize the Solana Network?

Solana has lost ground in the meme coin market, one of its strongest areas in recent times. Retail interest, once Solana’s strongest area of user activity, has sharply declined from the overall meme coin sector following the major cryptocurrency sell-off in October. Over $28 billion in meme token value was wiped out in mid-October. The total market value of meme tokens fell from $72 billion to $48 billion, and monthly gains achieved largely through Solana and BNB Chain trading activity were erased. This decline has forced Solana to seek new growth drivers. Activity on Solana launchpads also slowed, with weekly trading volumes falling from $1.5 billion in July to approximately $600 million by the end of September. In this context, Percolator represents a potential shift, entering the competitive continuous trading space in an effort to reestablish Solana’s technological superiority in the decentralized finance space. Additionally, Solana is improving its new network performance. The blockchain recently achieved its longest continuous operation since its 2020 launch, running uninterrupted for 623 days and demonstrating the network’s technical maturity. This enhanced stability could help Solana regain the trust of developers and traders as it seeks to reestablish its presence in the DeFi ecosystem, and Percolator could benefit from this.

The Battle for Perp Dex Dominance

Perpetual futures exchanges have become one of the fastest-growing areas in decentralized trading. These platforms offer users the opportunity to speculate on crypto prices without an expiration date, with on-chain payments and 24/7 market access.

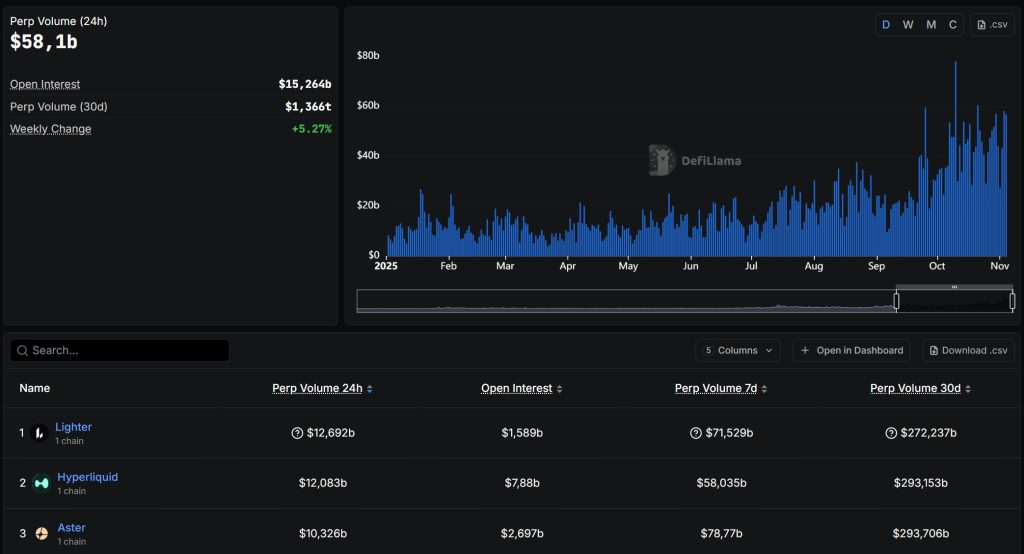

The sector’s total 30-day trading volume recently surpassed $1.15 trillion, indicating a rapid shift from centralized exchanges to decentralized derivatives platforms. Currently, Hyperliquid and Aster dominate this space. Hyperliquid, operating on its own Layer 1 blockchain, has the deepest liquidity with $7.59 billion in open interest and a 30-day trading volume of $309 billion. The exchange has become a benchmark for speed and transaction quality, managing a daily trading volume of $17 billion at its peak this year. Its token, HYPE, has a market capitalization of approximately $10.2 billion, supported by annual revenues exceeding $1.19 billion.

Meanwhile, Aster has emerged as a strong competitor. Built on the BNB Smart Chain with the support of Binance co-founder Changpeng “CZ” Zhao, the exchange has managed to attract new users thanks to its multi-chain support and aggressive incentives. Aster recently generated $2.97 billion in annual revenue. This figure is more than double Hyperliquid’s and recorded a 30-day continuous volume of $145 billion. Earlier this month, it briefly surpassed Hyperliquid in daily trading volume. Both platforms are currently leading the way in decentralized derivatives trading, but Percolator’s design could introduce a new variable.

By leveraging Solana’s low-cost, high-performance infrastructure, the goal is to combine Hyperliquid’s efficiency with Aster’s modular flexibility, while delivering it entirely on-chain within the native Solana environment. Yakovenko’s decision to release the design as open-source code demonstrates a commitment to transparency and community collaboration. The documents include risk controls such as comprehensive escrow and atomic routing, designed to prevent over-leveraging across multiple liquidity providers within a single transaction. This move also occurs amid shifting user flows across blockchains. A report published by VanEck in July stated that as traders seek simpler and faster alternatives for continuous markets, Hyperliquid is “poaching high-value users from Solana.”

Percolator’s advantage is that it is specific to Solana, a blockchain capable of processing up to 65,000 transactions per second. This raw throughput could enable faster transactions and lower fees compared to competitors operating on their own proprietary blockchains or other networks.

If Percolator succeeds, it could help reverse this trend and bring advanced traders back to the Solana ecosystem. Still, competition is fierce. Aster and Hyperliquid maintain strong positions with large liquidity pools and institutional participation. Currently, the Solana Foundation has not disclosed whether Percolator will receive official ecosystem support or emerge as a community-driven protocol. If successful, Percolator will join the expanding repertoire of native financial primitives developed on the Solana blockchain, which already includes decentralized options, lending protocols, and tokenized asset platforms.

Source: DefiLlama

What Stage Is the Project In?

Percolator’s documentation has been published on GitHub and is described as “ready for implementation.” The documentation introduces two main components: the Router and the Slab program.

The Router manages collateral, portfolio margins, and cross-slab routing, while the Slab program functions as a matching engine controlled by liquidity providers (LPs). Each slab operates independently, enabling what Yakovenko calls “fully independent matching and settlement.” This design ensures that issues originating from a specific slab do not affect users who have not interacted with it. This design allows each LP to keep their slab completely independent and innovative, while the Router provides atomic routing, portfolio netting, and comprehensive security capabilities.

The project’s GitHub repository already shows completed data structures for order books and memory pools, even though the development of liquidation systems is still ongoing. However, the official launch date has not yet been announced.

Data shows that the volume of Solana-based perp DEX has fallen by 24.19% on a weekly basis, with the current monthly total volume standing at approximately $63.24 billion. This reflects the market’s steadily losing momentum. Yakovenko argues that this approach will prevent congestion during periods of high trading volume, a known issue for many existing DEXs. In his technical summary, Yakovenko writes, “The design keeps each LP’s slab completely independent and renewable.” “Total capital efficiency matches that of a monolithic DEX, which typically has better execution quality through selective routing.”

Although the codebase is still under development and several processes, such as account verification and funding rate updates, are not yet complete, many fundamental data structures are already in place. The project’s GitHub files indicate that the system is close to stress testing, which could potentially be an important step for Solana in the DeFi sector.

Development Status and AI Assistance:

The project’s core infrastructure is already complete. GitHub documentation shows that the core data structures, including the Router, Slabs, memory pools, and order book systems, are finished. However, critical components such as the liquidation engine are still on the development roadmap.

Interestingly, Yakovenko revealed that he used Claude AI to generate and test code. On social media, he explained that he was “just playing around with Claude to see how well he could build the protocol,” encouraging others to “steal this idea.” This transparent, open-source approach differs from many crypto projects that keep their development process secret. At least two external developers have submitted pull requests to contribute to Percolator, demonstrating the community’s early interest in the project.

There is no official launch schedule for Percolator. While its “ready for implementation” status and completed core infrastructure indicate that development is at an advanced stage, critical components such as liquidation mechanisms still need to be worked on.

The project’s open-source nature means other developers can build competing applications or contribute improvements. Yakovenko’s explicit encouragement to “steal the idea” suggests he is more interested in demonstrating that Solana can support competitive continuous trading than in maintaining exclusive control over Percolator. Considering the development pace and current pull requests from external contributors, the testnet launch could occur within a few weeks to a few months, but this remains speculation without official confirmation.

Conclusion

Yakovenko’s Percolator is a calculated move to reclaim Solana’s position in the rapidly growing perpetual derivatives market. The timing makes strategic sense, given that perpetual DEXs are projected to grow by 530% by 2025 and show no signs of slowing down. It remains unclear whether Percolator can compete with Hyperliquid’s first-mover advantage and Aster’s Binance backing, but Solana’s technical capabilities give it a chance in this rapidly evolving space. Currently, Percolator’s code is under review on GitHub, and developers involved with the repository note that the project is in an “intensive testing phase.” This suggests that if the liquidation and governance components are finalized, the launch could happen soon. If fully realized, Percolator could become one of Solana’s most important DeFi projects. The protocol will demonstrate the ability to manage sophisticated, exchange-level workloads entirely on-chain without compromising Solana’s decentralization.

The project could also help Solana regain its transaction volume and users who have migrated to competing platforms. Even securing a modest market share while perpetual DEXs currently handle over $1 trillion in monthly transaction volume would create significant activity for the Solana ecosystem.

Disclaimer

The information and analysis provided in this report are for informational purposes only and do not constitute investment advice. Market data and opinions are based on publicly available information and are subject to change without notice. Darkex does not guarantee the accuracy, completeness, or reliability of the information provided. Cryptocurrency investments carry significant risks, and readers should conduct their own due diligence before making financial decisions.