Introduction

Decentralized artificial intelligence projects Fetch.ai (FET) and Ocean Protocol (OCEAN) had decided to join forces under the name Artificial Superintelligence Alliance (ASI) in 2024 with ambitious goals. However, this ambitious alliance unexpectedly became the scene of a dispute. Tensions between the two projects over token management turned into one of the most talked-about crises in the crypto world, with mutual accusations and legal threats. In recent weeks, the parties have taken significant steps toward reconciliation, and the future of the FET token, which has lost approximately 93% of its value, has become a matter of curiosity. In this report, we will cover all the details of the Fetch.ai–Ocean Protocol dispute, the resolution process, and the possibility of the FET token recovering after its sharp decline.

The Background of the ASI Alliance: Merger and Dissolution

Source: blog.oceanprotocol.com

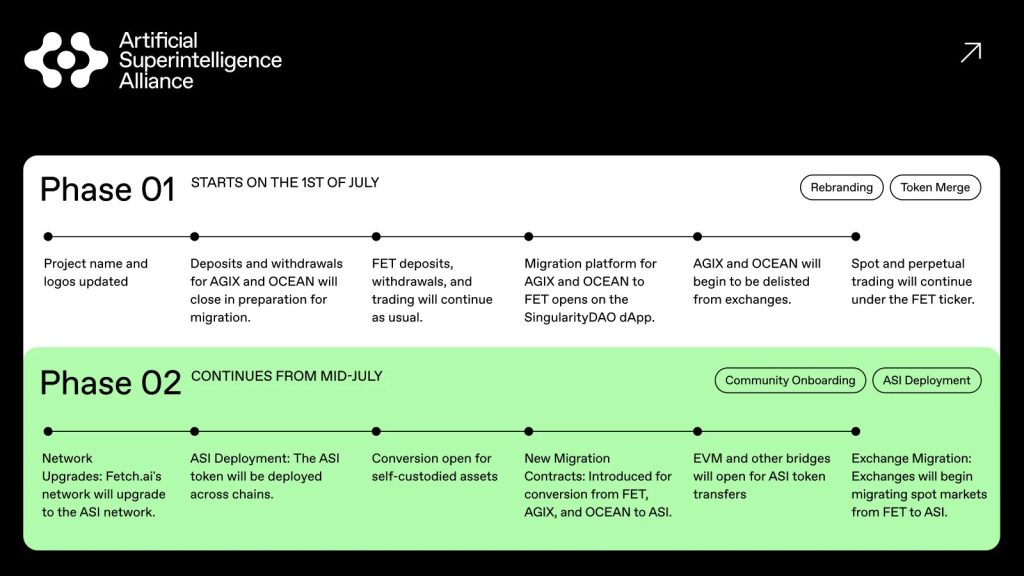

Fetch.ai, SingularityNET (AGIX), and Ocean Protocol shared a roadmap to merge the three ecosystems under a single artificial intelligence token. In the first phase, AGIX and OCEAN were converted to FET at specified rates, temporarily consolidating value on FET. The ultimate goal was to transition to a common “ASI” token ( ). The process progressed unevenly in the early stages due to technical details, differing operational decisions by exchanges, and uncertainties. For example, a major exchange announced it would not support this comprehensive token transition, citing the large total volume of the transition. This news flow and uncertainty paved the way for double-digit declines in FET-AGIX-OCEAN prices in the early stages.

The Emergence of the Token Dispute: Accusations and Tension

Source: x.com/bubblemaps

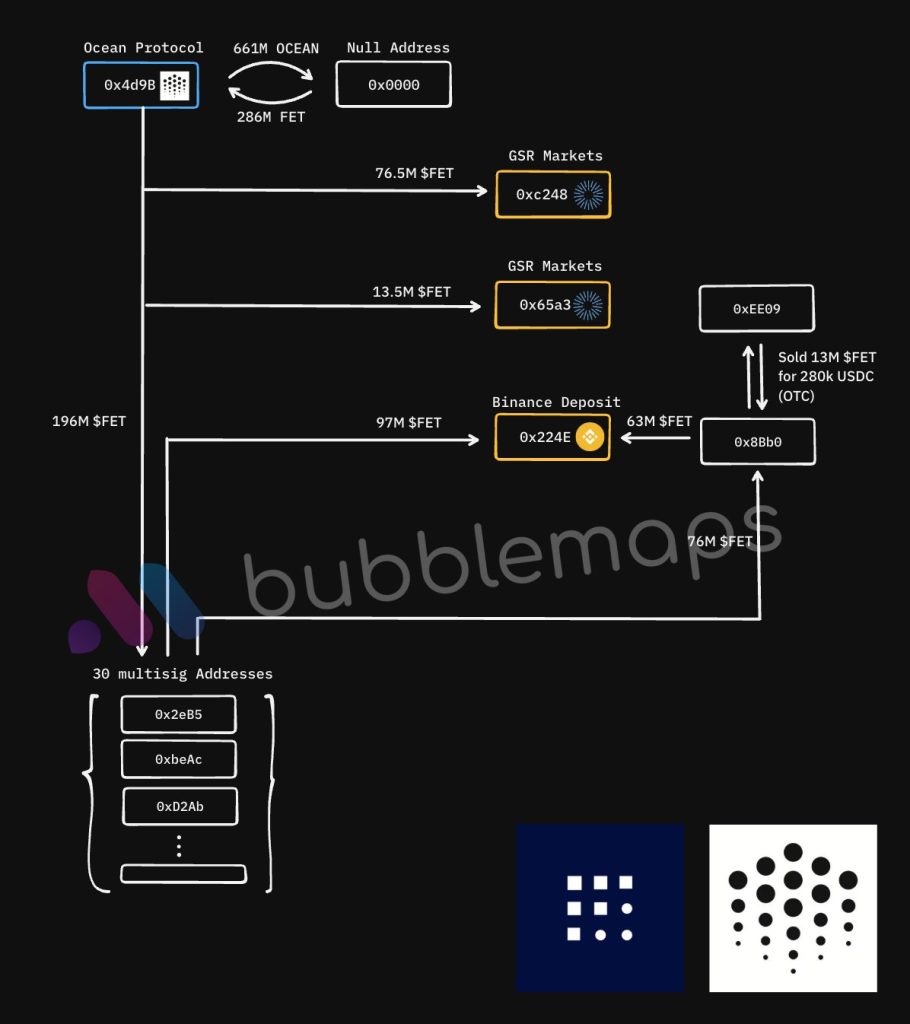

In October 2025, the Ocean Protocol Foundation announced its departure from the ASI Alliance. Following the announcement of the split, short-term pressure was seen on the tokens of the alliance components. The Fetch.ai side claimed that approximately 661 million OCEAN was converted to FET from a multi-signed wallet linked to Ocean, which equates to approximately 286 million FET. Additionally, Fetch.ai CEO Humayun Sheikh alleged that Ocean had unauthorizedly minted approximately 719 million new OCEAN in 2023 and that conversions from this pool to FET had taken place in July 2025.

According to on-chain tracking, a significant portion of the FETs in question moved quickly: approximately 160 million FETs were directed to exchanges (particularly large exchange deposit addresses), while a total of approximately 90 million FETs were directed to addresses associated with GSR Markets. Bubblemaps visuals also indicate that approximately 13 million FET were sold over-the-counter (OTC) for approximately 280,000 USDC, and approximately 196 million FET were distributed to 30 different multisig addresses. These flows reinforced allegations that Ocean’s FET holdings were rapidly liquidated ( ) and created selling pressure in the market. Ocean, however, denied all allegations, arguing that the transactions were carried out within the framework of treasury policies and that the main reason for the sharp decline in FET was general market conditions and large FET sales by alliance partners; it emphasized that the splits and conversions were not directly related to the price collapse.

Legal Process and Search for Solutions

Source: x.com

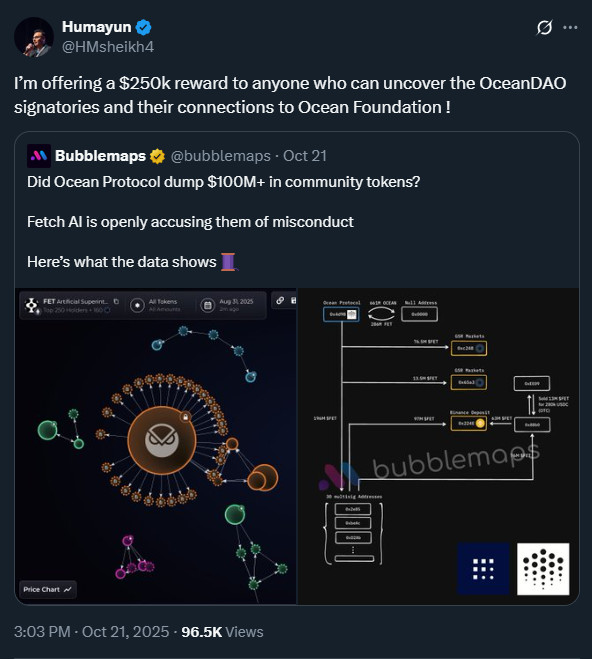

Following the split, the dispute moved to a legal front. Ocean announced that the dispute had been referred to arbitration in accordance with the ASI merger agreement and emphasized transparency. The Fetch.ai side announced a $250,000 reward to shed light on multisig signatories and foundation ties associated with Ocean, encouraging community-driven evidence gathering; it also put the option of a class action lawsuit in multiple jurisdictions on the table.

Risk mitigation measures were also seen in the market infrastructure. Binance announced that it would suspend OCEAN deposits on the ERC-20 network starting October 20, 2025, and warned that deposits sent after this date may not be credited. This step was interpreted as a precautionary move in the context of the controversial token minting and circulation risk.

Following the tense period, a critical compromise proposal emerged from the Fetch.ai side around October 23–24: Fetch.ai would waive all legal claims in exchange for Ocean returning the controversial 286 million FET to the Fetch community. Ocean responded positively in principle, stating that the return process could begin once a formal written offer was received. To facilitate the process, GeoStaking, a validator on the Fetch network, acted as a mediator and announced that the parties were close to reaching an agreement centered on the return. Thus, a friendly resolution emerged instead of a long and grueling court marathon.

FET Token Price Plunge: Reasons and Current Status

In March 2024, when the ASI narrative peaked, FET had risen to approximately $3.22. In the second half of 2025, however, amid uncertainties, allegations of separation and on-chain flows, FET fell to around $0.26, dropping approximately 93% from its peak. Additional selling pressure over the last three months weakened market depth and triggered panic selling.

OCEAN also experienced volatility after the split, with brief recoveries during periods of heightened reconciliation expectations.

As of early November 2025, FET entered a period of equilibrium in the $0.25–0.40 range, indicating that the pace of the downtrend has slowed, but significant losses remain on the table. Technically, looking at the weekly chart, we see that FET is currently trading around the $0.40 level. Trading near the upper band of the downtrend channel that began in March 2024, FET could move towards the formation target of $3 in the event of a breakout from this channel, seeking a new peak.

Future Expectations: Can FET Recover?

With the crisis largely beginning to resolve, eyes have turned to the future of FET. According to experts, the return of 286 million FET and the resolution of all disputes with Ocean Protocol will significantly reduce the selling pressure on FET. This is because once these tokens are returned and removed from circulation or transferred to the community treasury in a controlled manner, the market will no longer carry the risk of bulk sales originating from Ocean. Humayun Sheikh also described the token return agreement as a move that will protect the Fetch community from further uncertainty and establish trust. Therefore, it is expected that investor confidence will be partially restored in the short term and the FET price will stabilize. Indeed, while news of the resolution of the dispute has had a positive impact on OCEAN, it would not be surprising to see a similar relief rally in FET.

On the other hand, it may take time for FET to fully recover and return to its previous high levels. Uncertainties in the alliance process and a loss of over 90% in value have shaken confidence in the project. To restore this confidence, it will be critical for the Fetch.ai team to stick to its principle of transparency and continue with its roadmap. Experts indicate that increasing community communication, providing guarantees that similar problems will not recur , and demonstrating concrete successes for the project could attract investor interest again. The future of the ASI alliance will also be decisive for FET; with Ocean Protocol’s departure, it is unclear how Fetch.ai and SingularityNET will continue this shared vision. If Fetch.ai, together with SingularityNET, can successfully advance the ASI vision with revisions, demand for FET could increase again in the long term. Otherwise, a further loosening of the alliance structure could limit FET’s use cases and adoption potential.

Finally, the state of the broader crypto market will influence FET’s chances of recovery. While the AI-themed coin rally in 2024 propelled FET to new heights, the bear market in 2025 had the opposite effect. If there is a revival in the market and a new wave of interest in AI projects as we approach 2026, FET could also benefit from this momentum. However, if the market remains stagnant, resolving the dispute alone may not be enough to restore FET to its former glory. In summary, for FET to recover, both internal dynamics (trust, transparency, project development) and external conditions (market trends, investor appetite) will need to be positive. Nevertheless, the end of the Fetch.ai–Ocean dispute, which was a major element of uncertainty, is seen as an important step in the right direction for FET investors.

Conclusion

The dispute between Fetch.ai and Ocean Protocol was a striking example of how fragile decentralized partnerships in the crypto world can be. The hopeful alliance that began with the ASI alliance turned into a major conflict due to a lack of transparency and trust issues. After months of accusations, token transfers, and price volatility, the parties’ agreement to return 286 million FET tokens marked a turning point in resolving the crisis. With this settlement, both Fetch.ai and Ocean Protocol avoided a grueling legal battle and gained the opportunity to focus on the development of their projects.

Compensating for FET’s sharp decline in value will certainly not be easy. However, the looming threat of a massive sell-off within the Fetch.ai community is now subsiding. The steps the project takes in the coming period will be decisive in rebuilding trust. If the Fetch.ai team can present a clear vision to investors, establish successful partnerships, and deliver on its promises in the field of artificial intelligence, FET could recover its losses over time. On the other hand, the lessons to be learned from this process are not limited to these projects. It is clear that projects forming similar alliances in the crypto ecosystem need to reach more solid agreements on token economics and governance. The legacy left behind by the Fetch.ai–Ocean dispute serves as a warning for future partnerships: without transparency, fair distribution, and trust, even the brightest alliance visions can shatter against reality.