Introduction

Toncoin, a highly scalable L1 blockchain operating on The Open Network, has become one of the leading projects since the end of 2023 thanks to its connection with the Telegram ecosystem. On the Telegram side, on-chain transfers began in 2022 with a wallet bot, the integration of the non-custodial wallet called TON Space, announced in September 2023, and its integration into the application, followed by reaching over 100 million users by the end of 2024, have led to the emergence of a concrete and scalable user base for Toncoin throughout 2025, alongside the widespread adoption of the native wallet.

This structure was complemented by the entry of TON Strategy, a digital asset treasury company formerly known as Verb Technology, which now focuses on accumulating Toncoin and trades on Nasdaq under the ticker symbol TONX. According to the company’s third-quarter 2025 report, it purchased 217.5 million TON, earned 336,000 TON in staking rewards, reaching approximately 217.8 million TON by the end of the period, with the fair value of its digital assets amounting to around $588 million. The approval of a $250 million share buyback program during the same period was an important sign that the Toncoin story is being taken seriously on the corporate side as well.

Toncoin and The Open Network: Purpose and Design

Source: docs.ton.org

Toncoin is the native asset of The Open Network TON, a Layer 1 blockchain. The network operates with Proof of Stake consensus, uses a multi-chain and shardable architecture for high scalability, and defines its goal as building an infrastructure capable of supporting billions of users from the outset. The primary objective is to make fast and low-cost transfers, micropayments, and on-chain services part of everyday use, especially for a broad audience relying on the Telegram user base ( ).

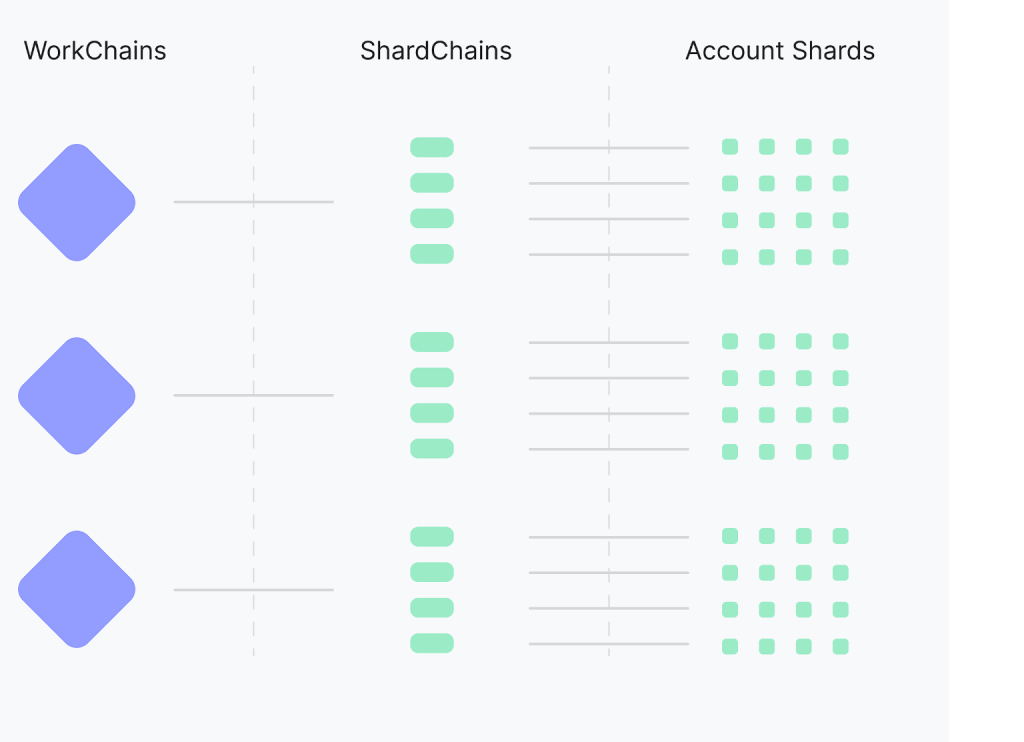

To support this goal, the network uses the workchain, shardchain, and account shard hierarchy shown in the diagram. The workchain layer represents main chains that can be customized according to different use cases, with each workchain divided into shardchain segments that carry the transaction load in parallel. The account shard layer is the smallest data unit, hosting specific address ranges and their associated smart contracts. This multi-layered structure enables the addition of new shards in response to increasing demand, aiming for horizontal network scaling, parallel transaction processing, and relatively low confirmation times even during peak periods.

The main modules that form the ecosystem are TON DNS, TON Storage, TON Proxy, TON Payments, and TON Space, a self-custody wallet solution embedded within Telegram. TON DNS converts on-chain addresses into readable domain names, TON Storage functions as a decentralized file storage layer, and TON Proxy adds an additional layer of privacy and routing to network traffic. TON Payments and Toncoin provide the payment and gas infrastructure for all these services. Toncoin is the primary currency used for transaction fees, staking collateral, storage and service payments, and governance processes.

On the tokenomics side, approximately 5 billion TON were minted at the project’s inception, of which only 1.45% was allocated to the team and test users, with the remaining large portion released through the Initial Proof of Work (IPoW) process. Today, the total supply has risen to approximately 5.14 billion TON, which corresponds to an annual inflation rate of approximately 0.6%, and newly issued tokens are distributed to validators through block rewards. The network also attempts to offset part of the inflation by burning a portion of the transaction fees. The overall design aims to provide users with as frictionless a Telegram experience as possible while positioning Toncoin as both a payment layer and a security layer in the background.

From Telegram to the community chain: The regulation story and price impact

The relationship between Telegram and TON gained practical significance in 2022 when Toncoin and other assets could be transferred within chats via a wallet. In September 2023, the integration of the TON Space non-custodial wallet into the Telegram interface enabled users to hold, send, and access DeFi from within the app without leaving it. The wallet’s update in March 2025 with trading and yield features, along with the announcement that it had reached over 100 million users, solidified the scale of the integration.

This integration affects the Toncoin price in two ways. First, the potential increase in Toncoin usage within Telegram for mini-apps, games, payment solutions, and advertising carries the potential to grow on-chain volume and transaction fees in the medium term. Second, the investigations and regulatory pressure that Telegram occasionally faces can also affect risk perception due to its close relationship with the Ton ecosystem. Telegram’s transition to profitability in 2024 and its commencement of generating significant revenue from the mini-app ecosystem built on TON will, on the one hand, increase the economic importance of this partnership, while on the other hand, make regulatory issues more critical in terms of investor sentiment.

Corporate demand TON Strategy and the new balance on the supply side

TON Strategy is a treasury company established with the business model of holding and staking Toncoin. As of the third quarter of 2025, it has purchased 217.5 million TON, earned 336,000 TON in staking rewards, and held approximately 217.8 million TON at the end of the period. The fair value of the company’s Toncoin positions is around $588 million, and the balance sheet also shows over $50 million in cash and restricted cash.

This picture shows that Toncoin has become the focus not only of retail investors but also of publicly traded institutional players. The $250 million share buyback program can be read as a strong signal of the company’s confidence in its own balance sheet and Toncoin strategy. At the same time, this program is indirectly linked to Toncoin’s supply dynamics. In the long term, a large accumulation of TON in the same hands carries the risk of price fluctuations becoming more sensitive to the decisions of certain players. Therefore, TON Strategy is both a long-term buyer that could support the price and a concentration factor that needs to be monitored closely.

Market cycle response and medium-term outlook

Market data shows that the Toncoin price has a high correlation with Bitcoin and the broader crypto market, and that price movements often exhibit a high beta character. During upward phases, especially when risk appetite increases and Telegram-related news flow is positive, Toncoin reacts upward with higher volatility compared to Bitcoin. The expansion of Telegram wallet integration, the growth of TON-based applications, and news from actors such as TON Strategy play a triggering role in reinforcing these movements.

Conversely, during periods of deteriorating global risk appetite, sharp sell-offs in the crypto market, and Telegram being in the spotlight due to regulation, Toncoin generally reacts downward above the market average. Both the risk reduction tendency of institutional treasuries and the sensitive perception of the Telegram ecosystem can increase selling pressure. This structure positions Toncoin in the medium term not so much as a defensive asset, but rather as a strong story but distinctly cyclical L1. In an upward scenario, Telegram’s internal user growth, real use cases within the Ton ecosystem, and institutional demand support upward potential, while in a downward scenario, the regulatory process, concentration in token distribution, and general market sentiment emerge as weak links.

Conclusion

In summary, Toncoin is a growth-oriented blockchain project that aims to combine a high-throughput L1 infrastructure with the Telegram ecosystem. The technical architecture, traffic provided by Telegram on the user side, and the presence of players such as TON Strategy on the corporate front determine both the project’s upside potential and the cyclical risk it carries.

Integration steps and corporate moves happening in the background directly impact the Toncoin price. The deepening of the wallet and mini-app ecosystem on the Telegram side are elements that strengthen the building blocks for Ton. Conversely, regulatory pressure on Telegram and the concentration of Toncoin supply in certain hands are key topics in the medium-term risk framework. Therefore, Toncoin should be evaluated as a growth position sensitive to crypto market cycles and Telegram-focused news flow.