Technical Analysis

BTC/USDT

In the US, President Trump’s statement that he may announce his choice for Fed Chair in January and his continued harsh criticism of Powell have reignited debates about monetary policy independence. In Asia, China’s launch of the “Justice Mission-2025” exercises around Taiwan following the US arms sale to Taiwan has significantly heightened military tensions in the region. On the European front, both the increase in attacks on the ground and the deadlock in negotiations on territorial and security guarantees along the Russia-Ukraine line are weakening expectations for a short-term resolution to the conflict.

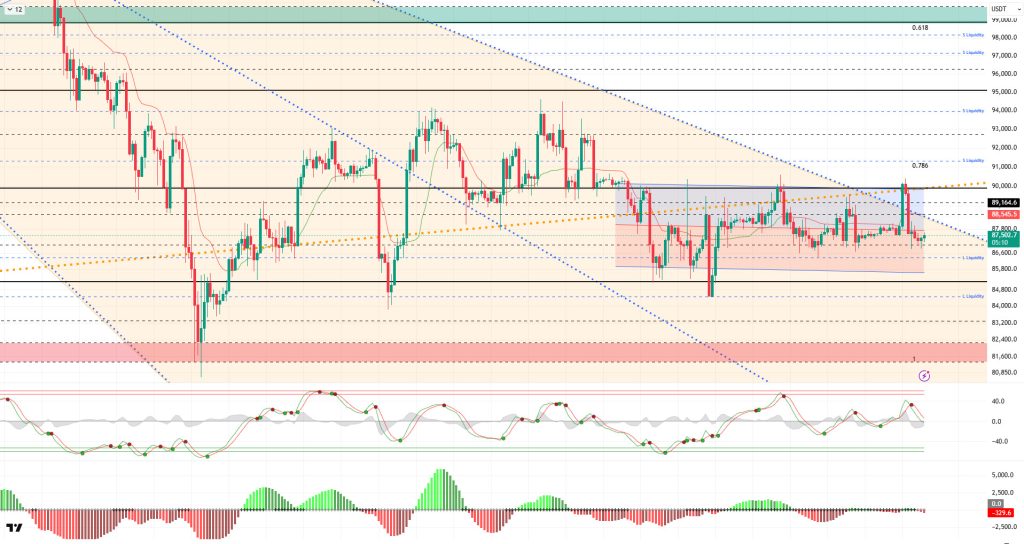

From a technical perspective, BTC gave back all of its gains from the weekend with another candle. The price, which briefly fell outside the orange band, failed to hold there and was unable to break through the 90,000 level on its sixth attempt. The price, which fell below the middle line of the descending trend channel, is recording a rebound at the 87,500 level at the time of writing. As we mentioned earlier, BTC, which is trying to close 2025 in the red, is heading into the last day of the year with a 6.44% decline.

Technical indicators show that the Wave Trend (WT) oscillator has crossed into a sell signal just below the overbought zone, while the histogram on the Squeeze Momentum (SM) indicator briefly crossed into positive territory before losing momentum again. The Kaufman Moving Average (KAMA) has now crossed above the price level at $88.545.

Looking at liquidation data, short-term buy levels are being liquidated at around 88,000, while the next sell level is maintaining accumulation at 86,000.In contrast, while short-term sell levels are being liquidated at the 90,000 level, the 91,000 level stands out as a liquidity zone in a broader time frame.

In summary, while President Trump continued his criticism of the Fed chairman, political tensions in Asia gave way to military exercises. On the Russia-Ukraine front, the parties have not reached an agreement in negotiations. When liquidity data is examined, it is seen that areas with concentrated short-term transactions are being targeted, while long-term selling levels have not yet been tested. After this stage, the 88,500 level stands out as a short-term resistance area for the price to regain momentum.Closes and pricing above this level could enable the 90,000 reference area to be tested once again with renewed momentum. If selling pressure deepens, 87,000 will emerge as a short-term support area, while 86,000 will be monitored as another liquidity area.

Supports: 86,300 – 85,000 – 84,000

Resistances: 88,500 – 89,000 – 90,000

ETH/USDT

The ETH price has stabilized since yesterday evening. Following purchases at the $2,910 level, the price reacted upward, rising above the $2,950 level. This movement indicates that sellers have lost appetite after the previous pullback and buyers are back at the table. Although the upward move was limited, the price clearly moving away from support produced a reassuring signal in the short term.

On the liquidity side, the intraday flow recovery is noteworthy. Chaikin Money Flow (CMF) has moved back into positive territory, signaling that money is flowing back into the market. Following the previous weakness, this reversal indicates that buyers have not completely withdrawn and that their intention to support the price continues. Although liquidity is not yet at a level to generate strong momentum, it can be said that it has significantly reduced downward pressure.

Momentum has reached a more balanced point. The Relative Strength Index (RSI) is showing a horizontal structure around the 50 level. The RSI holding in this region indicates that neither buyers nor sellers have a clear advantage, but also that the previous decline has paused for now. The absence of excessive pressure on the momentum side allows the price to linger at current levels.

The Ichimoku indicator structure remains intact. While the price continues to stay within the Kumo cloud, the Tenkan level being above the Kijun level stands out as a positive technical detail. This positioning indicates that the upward structure has not been completely broken and that the short-term trend is still intact. Staying within the Kumo cloud suggests that a little more time is needed for the direction to become clearer.

In the overall view, the range between $2,926 and $2,910 is being monitored as a critical defense zone in the short term. As long as there is no sustained movement below this area, it seems possible for the price to attempt upward movements. On the upside, the $3,019 level is an important threshold. Unless this area is breached, gains are expected to remain limited. The current structure indicates that a controlled and cautious recovery process is continuing on the ETH side.

Below the Form

Supports: 3,019 – 2,910 – 2,727

Resistances: 3,074 – 3,227 – 3,368

XRP/USDT

Following the pullback during the night, the XRP price recovered from the $1.84 level and climbed back to the $1.86 range. This movement indicates that selling pressure has slowed down, but buyers are also reluctant to push the price higher. The limited reaction suggests that a cautious stance still prevails in the market.

A slight uptick is noticeable on the cash flow front. The Chaikin Money Flow (CMF) has moved back into positive territory, but the steepness of the slope is notably weak. This suggests that market entries have begun but lack the strength to sustain an upward move. This limited recovery in liquidity explains why the price continues to linger near the lower band.

The picture is more stagnant on the momentum side. The Relative Strength Index (RSI) is moving sideways below the 50 level. The RSI remaining in this region indicates that buyers have not yet gained momentum and that reaction movements are fragile. Unless there is a clear strengthening in momentum, upward attempts are likely to remain limited.

The technical outlook has not changed from the Ichimoku indicator perspective. The price is still trading below the kumo cloud and remains below the Tenkan and Kijun levels. This structure indicates that the downward pressure is continuing from a technical standpoint. For upward moves to gain strength, these levels need to be broken.

The overall outlook remains cautious, similar to the previous day. The $1.90 level continues to be the main threshold to overcome on the upside. Unless this area is breached, sustained upward attempts appear unlikely. On the downside, the $1.84 region is being monitored as an important short-term equilibrium area. With the current indicators, it can be said that XRP is still searching for direction and that a clear recovery signal has not yet formed.

Supports: 1.8121 – 1.6224 – 1.5146

Resistances: 1.9092 – 2.0543 – 2.1731

SOL/USDT

USDC Treasury recently announced that it had burned over 51 million tokens on the Solana blockchain.

The SOL price experienced a pullback. The asset remained in the upper region of the downtrend that began on October 8. Testing the strong resistance level of $127.21, the price moved below the 50 EMA (Blue Line) moving average. Currently testing the 50 EMA (Blue Line) as resistance, the asset could test the 200 EMA (Black Line) as resistance if it closes above this level. If the pullback continues, the $120.24 level could act as support.

On the 4-hour chart, it remained below the 50 EMA (Exponential Moving Average – Blue Line) and 200 EMA (Black Line). This indicates that the downtrend continues in the medium term. At the same time, the price being below both moving averages indicates that the asset is trending downward in the short term. The Chaikin Money Flow (CMF-20) remained in positive territory. However, the balance of money inflows and outflows may keep the CMF in positive territory. The Relative Strength Index (RSI-14) declined from the middle of positive territory to neutral territory. It also remained above the rising line that began on December 18. This signaled that buying pressure continued. If there is an uptrend due to macroeconomic data or positive news related to the Solana ecosystem, the $138.73 level stands out as a strong resistance point. If this level is broken upwards, the uptrend is expected to continue. In the event of pullbacks due to developments in the opposite direction or profit-taking, the $112.26 level could be tested. A decline to these support levels could increase buying momentum, presenting a potential opportunity for an uptrend.

Supports: 120.24 – 112.26 – 100.34

Resistances: 127.12 – 133.74 – 138.73

DOGE/USDT

The DOGE price traded sideways. The asset tested the 50 EMA (Blue Line) moving average and the descending trend line that began on December 9 as resistance, but failed to hold and retreated. Currently testing the $0.12282 level as support, the price may retest the 50 EMA (Blue Line) moving average and the downward trend as resistance if it closes above this level. If the pullback continues, the $0.11797 level may act as support again.

On the 4-hour chart, the 50 EMA (Exponential Moving Average – Blue Line) remained below the 200 EMA (Black Line). This indicates that the downtrend may continue in the medium term. The price being below both moving averages indicates a downward trend in the short term. Chaikin Money Flow (CMF-20) moved from neutral to positive territory. Additionally, increased cash inflows could push CMF to the upper levels of positive territory. The Relative Strength Index (RSI-14) remained in the middle of the negative zone. It also continued to be in the lower region of the downward trend that began on December 9. This signaled that selling pressure continued. In the event of an uptrend driven by political developments, macroeconomic data, or positive news flow in the DOGE ecosystem, the $0.14237 level stands out as a strong resistance zone. Conversely, in the event of negative news flow, the $0.11797 level could be triggered. A decline to these levels could increase momentum and initiate a new wave of growth.

Supports: 0.12282 – 0.11797 – 0.10837

Resistances: 0.12824 – 0.13367 – 0.14237

BNB/USDT

From a technical perspective, BNB/USDT gained positive momentum with the support provided by new candles and rose to the $930 level; however, increased selling pressure was observed in this region depending on market conditions. With the effect of increased selling pressure, the asset appears to have continued its movement within a declining channel for some time.

However, BNB, which turned upward with the support it received from the middle band of the descending channel, gained positive momentum by breaking the upper band of the channel upward. In this direction, the asset rose above the previously determined target level of $860 and reached the $870 level. Although partial pressure is seen at these levels, the overall technical outlook is considered to maintain its positive structure.

Currently trading in the $850–860 range, technical indicators for BNB show that low trading volume is limiting the upward momentum. Additionally, the RSI indicator reaching the 70 level with the recent rises and reacting from this level indicates that a limited correction movement may continue in the short term.

Within the technical outlook, if buying appetite is maintained and market momentum strengthens, BNB is expected to retest the $880 resistance level in the first stage. Breaking above this level could potentially lead to a move above the descending trend line. If the trend breakout is confirmed and the price manages to hold above this level, a rise towards the $905 and $930 levels is technically possible.

On the other hand, if selling pressure increases, the price is expected to retest the $850 support level. If this level is broken downward, a pullback towards the $835 and $820 support zones may come into play.

Supports: 850 – 835 – 820

Resistances: 860 – 880 – 905

Legal Notice

The investment information, comments, and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.