Could 2026 Be the Year of the Memecoin?

Introduction

Memecoins made a remarkable comeback in 2026 with an $8 billion rebound. After a year of market contraction and waning excitement, community-focused memecoins once again attracted speculative interest and caught investors off guard by exceeding expectations. Market sentiment surged sharply in the new year, and on January 1, PEPE added approximately $1.3 billion to its market value in just four days, surpassing a total market value of $3 billion. Dogecoin rose by nearly 31%, while Shiba Inu gained approximately 45% in value. Solana-based Bonk surged by nearly 75% in seven days, while Floki gained close to 56% on a weekly basis.

On-chain data also showed accumulation in tokens such as PUMP, BONK, and FLOKI. Trading activity intensified, and volume ratios rose well above market averages. For example, PEPE traded at more than three times the general market volume. As of January, meme coins made a sharp rebound from their 2025 lows, adding more than $8 billion to their market value in just a few days. The sector’s total value currently stands at approximately $44.45 billion, representing a 23% increase since the start of the year. Trading volume reached $9.2 billion, rising alongside prices as short positions were liquidated, supporting the rally.

2026 Outlook

Following a sluggish 2025 marked by waning interest and short-lived rallies, the recovery at the start of 2026 signals a shift in momentum. Retail inflows, tax-related positioning, and increased on-chain activity appear to be breathing new life into a sector many had deemed “dead.” Historically, memecoin rallies, especially at the start of the year, have often been precursors to explosive rallies at the beginning of bull cycles. These movements typically follow prolonged consolidation or downtrends and are triggered by renewed interest from retail investors.

Many analysts view the recent memecoin rally as an early sign of a broader trend reversal after nearly a year of decline. If the current momentum continues, some estimates suggest the total memecoin market cap could reach $69 billion by Q1 2026.

What Happened in the Past?

When altcoins rise while Bitcoin trades sideways, this indicates that capital is moving further along the risk curve. Historically, such a divergence suggests that when speculation exceeds the reference value, unchecked rallies can precede a sharp correction.

Past cycles reveal striking parallels. In late 2020, a quiet December marked by low volumes led to a sharp rise in January 2021, fueled by tax-loss harvesting and renewed speculative appetite. This situation led to the 2021 memecoin boom, during which the sector’s market value surged from below $10 billion to over $100 billion.

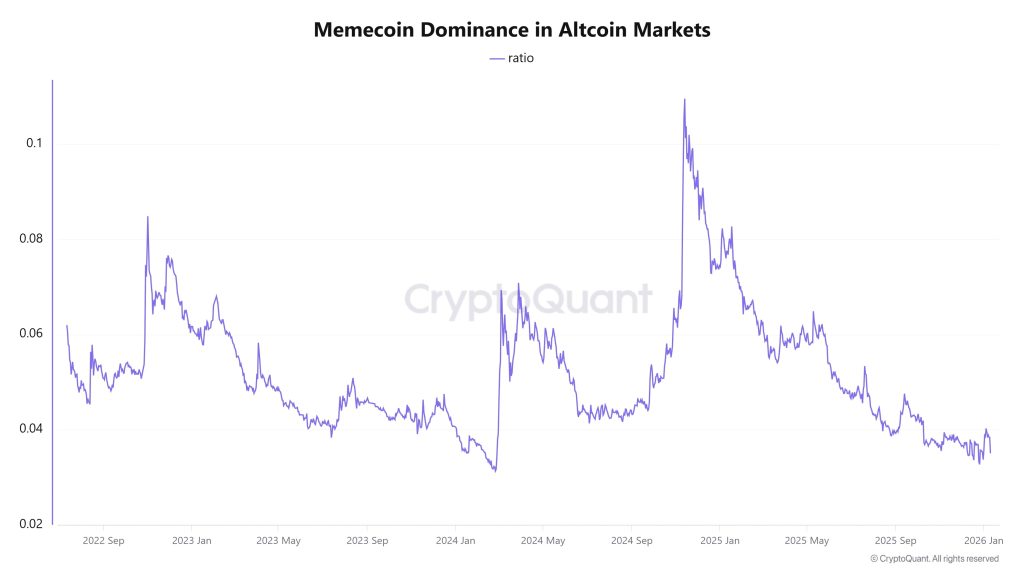

Search interest in memecoins fell by approximately 81.6% in 2025, reflecting the disinterest seen before previous recoveries. CryptoQuant data shows that memecoin dominance fell to around 0.032 in December, marking a historic low, before rising again in recent sessions—highlighting how quickly meme cycles can unfold.

Memecoins and Social Media

Social media discussions about memecoins have increased since the beginning of the year and have followed a parallel trajectory with the rise in market value. This suggests that risk appetite for cryptocurrencies has returned. The Fear and Greed Index moving from extreme fear to neutral reinforces this shift. If whales confirm this with volume, the rally could expand. Otherwise, memecoins may remain a short-lived sentiment trade fueled by social media hype.

Conclusion

Today’s environment shows familiar pre-bull market elements. Increased social activity on X, hints from launchpad founders like Pump.fun, and Bitcoin’s relative stability could lay the groundwork for another memecoin rally. However, caution is warranted. The current move could still be a bull trap if trading volumes decline or macroeconomic pressures intensify.

Key indicators to monitor include open interest growth, ETF-related speculation, and capital shifting to higher-risk assets. If retail participation remains strong, 2026 could mirror the memecoin volatility seen in 2021. Otherwise, high volatility will persist, especially amid geopolitical risks and policy shocks that could rapidly reverse momentum.

Disclaimer

This article is strictly a reference for your benefit and does not constitute investment recommendations, guidance or legal advice. This view is from the author’s own research conclusions and other statistical data on the market, changed without notice. Cryptocurrency markets are highly risky, volatile speculative targets and currency rates vary wildly. Historical performance is not indicative of future outcomes. It is strongly encouraged that readers research any related issues by consulting trusted financial professionals. The author and platform behind the article shall not be held legally responsible for any losses incurred as a result of using the information provided in this article.