Does The Digital Currency Unit Reserve Move Away from Dollarization

Introduction

BRICS countries announced a project called UNIT as a currency to be used in international transactions.

The Institute for Economic Strategies (IRIAS) of the Russian Academy of Sciences stated in its announcement on December 4 that BRICS countries plan to launch a working prototype of a gold backed commercial currency called “UNIT.”

This step aims to move away from the US dollar while making gold part of the new payment mechanism.

As of 2025, BRICS has 10 full member countries.

Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran, and the United Arab Emirates (UAE).

This expanded group of 10 full member countries is sometimes referred to as BRICS+.

In this report, we will examine the effects of the Unit project launched by the BRICS countries on the US dollar.

BRICS Countries’ Reserves

Unit is positioned as a gold backed neutral payment instrument that aims to reduce the need for the US dollar in trade without replacing national currencies.

This project is a digital trade tool backed by a reserve basket consisting of 40% physical gold and 60% BRICS national currencies.

This 60% portion is equally distributed among five currencies, each with a 12% weight.

Real (Brazil)

Yuan (China)

Rupee (India)

Ruble (Russia)

Rand (South Africa)

These currencies represent the core of BRICS, which provides liquidity to financial markets and stable currency infrastructure to national economies.

Pumpkin Batch created a reference set to track the gains or losses of each currency as the reserve basket composition changes.

The main objective of this project is

-

to trade without using US banks

-

Storing value using gold instead of foreign exchange reserves

-

To reduce the risk of exposure to dollar liquidity shocks

-

To establish a cooperative monetary system independent of Western systems

The SWIFT sanctions imposed after Russia’s invasion of Ukraine in February 2022 caused serious concerns.

These sanctions threatened the ability of every country in the world to trade freely.

Since then, they have been searching for an alternative currency.

As a solution, the Russian Academy of Sciences’ Institute for Economic Strategies (IRIAS) launched 100 Units on October 31, each initially pegged to 1 gram of gold.

A Step Away from Dollarization

This project could facilitate a move away from the US dollar by being used in international transactions.

In the long term, it could strengthen global demand for gold.

Low demand for the dollar could gradually erode its purchasing power and fuel concerns about a gradual loss of value.

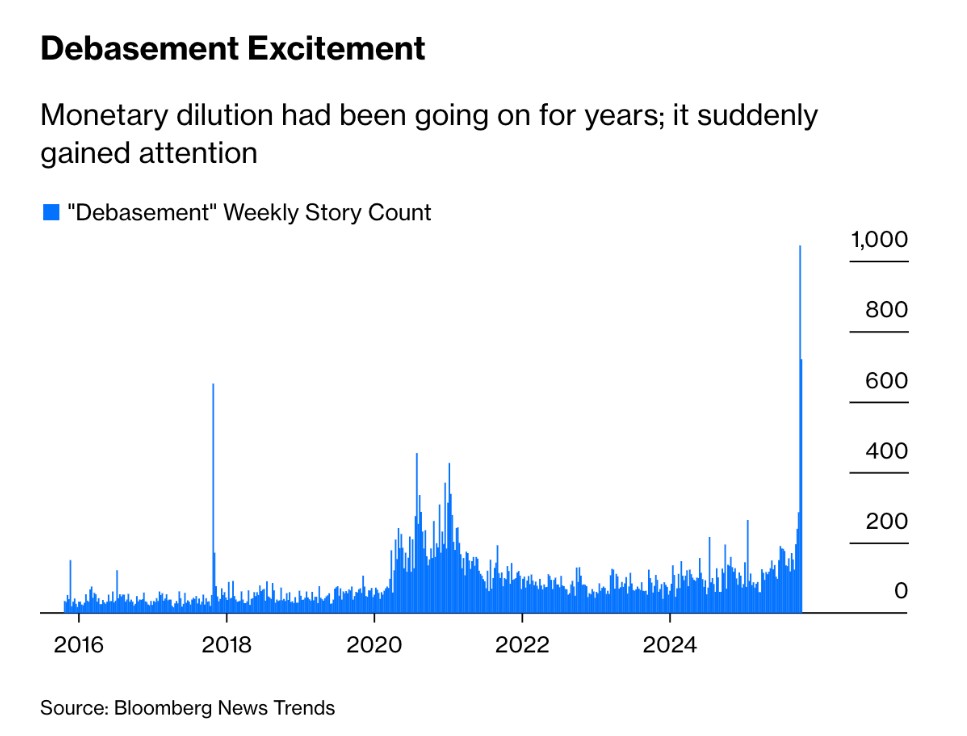

The concept of debasement describes concerns about the dollar’s loss of value.

Google Trends data shows that searches for the term “debasement” saw an unprecedented increase in the last quarter of 2025.

Conclusion and Assessment

The US’s open budget spending and high borrowing are raising doubts about the dollar’s long-term strength.

Rival blocs are seeking alternatives beyond dollar-based systems.

High inflation and price pressures are directing capital toward more stable assets.

With declining purchasing power, many currencies are losing value faster than wages or savings can keep up.

Increased demand for gold continues to drive central banks to build up their reserves.

Unit is transforming gold’s role from a passive reserve to an active trading asset by making it part of daily settlements, not just storage.

Although still in the pilot phase, it is bringing gold back into the spotlight as more than just a hedge instrument.

Disclaimer

This content is for informational purposes only and does not constitute financial or investment advice.

Market conditions may change at any time.