Geopolitical Agenda and Macro Outlook

The second full week of January was positive for digital assets. Although it was subsequently postponed, we believe that the excitement generated by Senate members keeping the digital asset market structure bill, known as the Clarity Act, on their agenda played a role in Bitcoin’s gains this week. Senate members were expected to table the bill on Thursday.

Pricing related to the macro and political agenda also paved the way for the crypto market’s rise. The flow of data, which did not cause any significant change in the US Federal Reserve’s (FED) interest rate path, and the slight cooling off of developments on the Venezuela and Iran fronts created an equation that, at the very least, did not hinder upward movements.

Of course, the stance of the Trump-led US administration on foreign policy continues to pose a serious risk factor for the markets. Potential developments on the Greenland, Iran, Ukraine, and Venezuela fronts are important issues that have the potential to influence investor risk perception and appetite, thereby driving prices.

Next week, the World Economic Forum (WEF) in Davos and some macro indicators from the US will be on the global markets’ agenda. The holiday in the US on the first business day of the week, Martin Luther King Jr. Day, may also cause volumes in the digital asset market to remain somewhat low. Subsequently, Donald Trump’s speech on Wednesday, Thursday’s US data, and the Bank of Japan’s (BoJ) interest rate decision will be important.

We are currently in a period where the general upward movement in digital assets that began on December 18 is continuing with interim corrections. Following the gains made in the week we are about to leave behind, we believe the new week is more open to a pullback. In other words, while maintaining our view that the general upward trend will continue, we anticipate that this week may bring relatively longer-lasting value losses.

January 21 – US President Donald Trump’s Speech (WEF – January 19-23)

The World Economic Forum (WEF) will be held in Davos on January 22-23, as usual. Central bankers, prime ministers, finance ministers, trade ministers, and business leaders from over ninety countries will attend the summit and deliver speeches. Global markets will also be closely watching this event.

US President Donald Trump is expected to deliver his WEF speech on Wednesday, January 21. With developments in Iran, Greenland, Russia-Ukraine, and Venezuela, attention this time seems to be focused more on the President’s assessments of political developments. Nevertheless, his statements on the economy could also be influential in the markets and will be under the scrutiny of investors.

The President’s speech will be among the most important developments of the week. It will shape short-term projections and influence the level of risk appetite in the markets. Therefore, we will also be closely monitoring Trump’s statements.

January 22 – The Fed’s Favorite Inflation Indicator, PCE

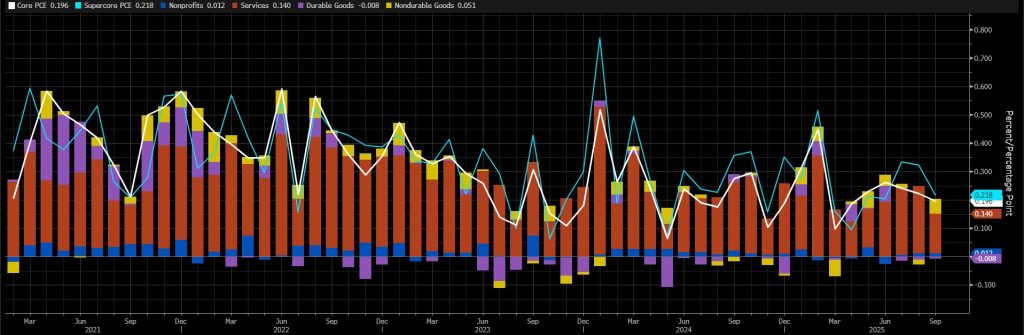

Markets seeking clues about the timing and direction of the Federal Open Market Committee’s (FOMC) interest rate cuts will closely monitor the Personal Consumption Expenditures (PCE) data for October and November, which will be released with a delay. This indicator is known as the preferred indicator used by FOMC officials to monitor changes in inflation.

Source: Bloomberg

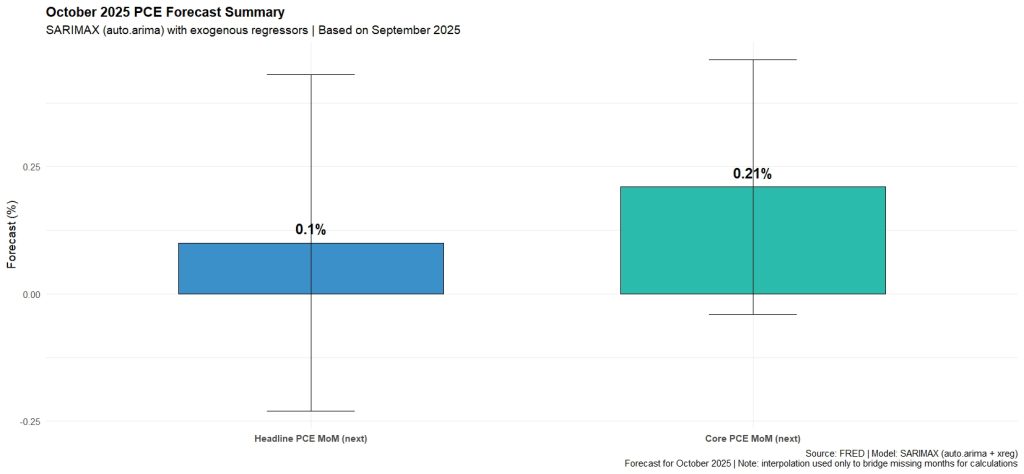

According to the latest data, core PCE rose 0.2% in September compared to the previous month. This was in line with market expectations, as it was in August and July. The index rose 2.8% compared to the previous year. We expect core PCE data to show an increase of around 0.21% in October.

Source: Darkex Research

Data coming in above market expectations could support expectations that the Fed may be cautious about cutting interest rates, reducing risk appetite and putting pressure on digital assets. Data coming in below expectations, on the other hand, could have the opposite effect and pave the way for gains.

January 23 – Bank of Japan Interest Rate Decision

News coming out of Japan this week from the central banks will be under the market spotlight. The Bank of Japan (BoJ), which raised interest rates in December, is expected to keep its policy rate steady at 0.75% on Friday. However, Bank Governor Ueda’s comments will be closely watched.

The yen’s decline to 160 against the dollar on January 14, reaching its lowest level since July last year, continues to keep institutions in the country on edge. Nevertheless, reports in the country’s press suggest that there will be no intervention in the foreign exchange market before the BoJ’s decision. As mentioned, markets do not expect a new interest rate hike decision from the BoJ on January 23, but Ueda’s statements, which may provide information about the path of future hikes, will be closely monitored. In particular, President Ueda’s assessment of how the recent weakness of the Japanese Yen could affect inflation will be closely followed.

We believe the BoJ will not rush into a new rate hike. The possibility of inflation following a relatively moderate path in 2026 may push Ueda and his team to remain cautious, despite the losses in the Yen. We also anticipate that they will consider it necessary not to exhaust their ammunition for new rate hikes too quickly. Therefore, while we do not see major risks for global and digital assets, we would like to warn that it would be beneficial to remain alert to possible surprise decisions. An unexpected interest rate hike or strong interest rate hike messages from Ueda could lead to an appreciation of the Yen, which could also negatively affect digital asset prices.

Other Key Macroeconomic Indicators and Developments

January 22 – US Final GDP is released quarterly, approximately 85 days after the end of the quarter. There are three versions of GDP released one month apart: Advance, Preliminary, and Final. The Advance release is the earliest and therefore tends to have the most impact. Final GDP generally does not have a significant impact on the markets and does not contain major revisions from the previous data.

January 22 – US Initial Jobless Claims; This shows the number of people who filed for unemployment insurance for the first time during the previous week and is published weekly, usually on the first Thursday after the week ends. Although it is a lagging indicator, the number of unemployed is considered an indicator of overall economic health because consumer spending is highly correlated with labor market conditions. Market impact can vary from week to week, and market participants tend to focus more on this data when they are more sensitive to recent developments or when macro indicators related to the labor market are at extreme levels.

January 23 – The US Flash Manufacturing PMI is a leading indicator of economic health. Businesses react quickly to market conditions, and purchasing managers have perhaps the most up-to-date and relevant estimate of the company’s outlook for the economy. The Purchasing Managers’ Index (PMI) is a survey of nearly 800 purchasing managers that asks respondents to assess the relative level of business conditions, including employment, production, new orders, prices, supplier deliveries, and inventories. A reading above 50.0 indicates that the sector is expanding, while a reading below 50.0 indicates contraction. There are two versions of this report, Flash and Final, published about a week apart. The Flash version is released on a preliminary and monthly basis, approximately 3 weeks into the current month. A reading below the forecast is expected to produce a positive result for crypto assets.

Important Economic Calendar Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for any changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

Legal Notice

The investment information, comments, and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in outcomes that align with your expectations.