BTC/USDT

President Trump reignited criticism of Fed Chair Powell, continuing his call for lower interest rates, reigniting debates over the Fed’s independence. On the regulatory front, SEC Chair Atkins’ comments suggesting crypto assets could be included in 401k retirement accounts signaled an important shift in the position of digital assets within mainstream finance. On the macro side, jobless claims came in slightly above expectations but showed that the labor market remains generally strong.

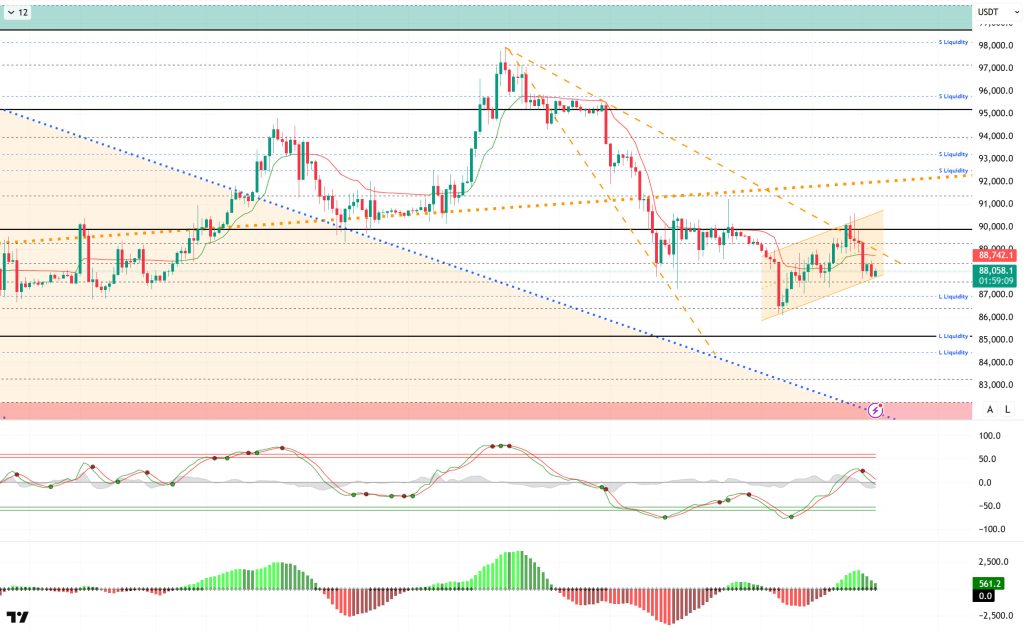

Technically, BTC showed low volatility during the day, testing the lower line of the minor upward channel it formed within the descending wedge. After finding support here for now, the price may move towards the upper line of the descending wedge structure within the channel again following a spike movement and liquidity buying. If this scenario plays out, it will be important to monitor whether the critical 90,000 reference level will be retested. Otherwise, closes below the band could deepen selling pressure.

Technical indicators show that the Wave Trend (WT) oscillator has started to give a sell signal above the channel’s middle band. The histogram on the Squeeze Momentum (SM) indicator is losing momentum in the positive zone once again. The Kaufman Moving Average (KAMA) is currently trading above the price at the $88,740 level.

Looking at liquidation data, the buy level continues to maintain its intensity around the 87,000 level in the short term. The sell level is becoming sparse in the short term, with fragmented intensity recorded above the 91,000 level. In the long term, the 93,000 and 96,000 levels stand out as areas of liquidity.

In summary, while Trump’s calls for interest rate cuts continue, SEC Chairman Atkins made a noteworthy statement regarding the transition of 401k retirement funds to crypto. In the data set, jobless claims came in slightly above expectations. Looking at liquidity data, the recent rise has once again intensified buying levels, while selling levels have cleared.Technically, BTC started the new year with positive momentum, but after testing the 98,000 level, it faced profit-taking and re-entered selling pressure, retreating to the 86,000 level. The price lost its minor upward channel and confirmed the decline with a falling flag pattern.BTC, which rebounded once again, surpassed the 90,000 level once more, but the rise remained fake, causing it to return to the falling channel. From this point on, the upper line of the channel is expected to be tested once again, leading to another test of the 90,000 level. Liquidity buying at the 87,000 level could ensure that the rise is sustainable.

Supports: 87,500 – 86,000 – 85,000

Resistances: 89,000 – 90,000 – 91,400

ETH/USDT

Selling pressure continued to affect the ETH price throughout the day, and the pullback continued with the weak structure formed on the technical side, bringing the price down to the $2,925 level. The intraday movements indicate that upward attempts have not been successful so far and that the market remains cautious. The current pricing points to a process where buyers are trying to regain strength in the support zones.

The liquidity picture is not completely deteriorated, but the loss of momentum is noteworthy. Although the Chaikin Money Flow (CMF) remains in positive territory, it continues its downward trend. This indicates that money continues to flow into the market, but not as strongly as before, and that the uptrend may struggle to find support.

While there is no clear recovery in the Relative Strength Index (RSI), the indicator’s continued downward pressure reveals that buyers have not yet regained control. As long as momentum does not strengthen, upward movements are likely to remain limited.

Technically, the Ichimoku indicator also shows no change in outlook. While the price continues to trade below the kumo cloud, the Tenkan level has not yet been regained. This positioning indicates that short-term technical pressure continues and that upward attempts may struggle at resistance levels.

There is no significant change in the scenario observed in the overall picture. The price is expected to retest the $2,910 support zone, and a break below this area could accelerate selling. Conversely, regaining the $3,026 level could reverse the current weak outlook and pave the way for renewed upward momentum.

Supports: 2,910 – 2,727 – 2,625

Resistances: 3,026 – 3,111 – 3,227

XRP/USDT

The XRP price maintained its weak course throughout the day amid continued selling pressure, gradually retreating to the $1.87 level. Limited recovery attempts throughout the day indicate that buyers are still unable to respond strongly and that the price continues to search for direction at lower levels after losing the critical resistance zone. In the current outlook, the market remains cautious, and the price is trying to find equilibrium with low-volume fluctuations.

On the liquidity side, despite the pullback, there is no sign of a sharp deterioration. The Chaikin Money Flow (CMF) remains in positive territory. This structure indicates that even if the price declines, there is no aggressive outflow of money from the market and interest in the spot side has not completely disappeared. This resilience on the liquidity side suggests that the ground for possible rebound movements has not completely disappeared.

On the momentum side, the pressure has become more pronounced. The Relative Strength Index (RSI) remains below the 50 level, indicating that momentum has weakened again. This structure in the RSI suggests that upward moves may be short-lived and that sellers have regained control in the short term.

The technical outlook also remains weak from the Ichimoku indicator perspective. With the price trading below the kumo cloud and the Tenkan level lost, this positioning indicates that technical pressure continues. This positioning increases the risk that upward attempts will encounter renewed selling at resistance levels.

The critical level observed in the overall picture remains unchanged. Unless the $1.92 region is regained, the price is likely to remain under downward pressure, bringing the $1.81 support area back into focus. Conversely, if the price settles above this level again, it could break the current weak outlook and initiate a new upward recovery process.

Supports: 1.8181 – 1.7705 – 1.6224

Resistances: 1.9211 – 1.9742 – 2.0512

SOL/USDT

The SOL price traded sideways during the day. The asset remained in the upper region of the downtrend that began on January 13, signaling continued buying pressure. Testing the strong resistance level of $127.21 and the 50 EMA (Blue Line) moving average, the asset experienced a pullback from this level. Currently testing the downward trend as support, the price may test the $120.24 level as support in candle closes below this level. If it experiences an uptrend, the 50 EMA moving average should be monitored as a resistance level.

On the 4-hour chart, the 50 EMA (Exponential Moving Average – Blue Line) continues to be below the 200 EMA (Black Line). This indicates that a downtrend may begin in the medium term. At the same time, the price being below both moving averages shows that the asset is trending downward in the short term. The Chaikin Money Flow (CMF-20) remained in positive territory. However, the increase in money inflows may keep the CMF in this region. The Relative Strength Index (RSI-14) remained in the middle of the negative zone, indicating selling pressure. At the same time, it continued to be in the upper region of the upward trend that began on January 20. In the event of an uptrend driven by macroeconomic data or positive news related to the Solana ecosystem, the $150.67 level stands out as a strong resistance point. If this level is broken upwards, the uptrend is expected to continue. In the event of pullbacks due to developments in the opposite direction or profit-taking, it may test the $112.26 level. A decline to these support levels could increase buying momentum, presenting a potential opportunity for an upward move.

Supports: 120.24 – 112.26 – 100.34

Resistances: 127.21 – 133.74 – 138.73

DOGE/USDT

The DOGE price experienced a slight pullback during the day. The asset remained below the 50 EMA (Blue Line) moving average, indicating continued selling pressure. Testing the strong resistance level of $0.12824, the asset experienced a pullback and failed to maintain its momentum. Currently located below the 50 EMA (Blue Line) moving average, the asset may test the $0.11797 level as support if the pullback continues. If it experiences an uptrend, the 50 EMA moving average may be triggered. On the other hand, the developing inverse head and shoulders pattern should be monitored.

On the 4-hour chart, the 50 EMA (Exponential Moving Average – Blue Line) remained below the 200 EMA (Black Line). This indicated a downtrend forming in the medium term. The price being below both moving averages suggests that the price may be trending downward in the short term. The Chaikin Money Flow (CMF-20) remained in positive territory. Additionally, the balance of money inflows could keep the CMF in positive territory. The Relative Strength Index (RSI-14) remained in the middle of negative territory. It also remained below the downward trend that began on January 27, indicating continued selling pressure. In the event of an uptrend driven by political developments, macroeconomic data, or positive news flow in the DOGE ecosystem, the $0.13367 level stands out as a strong resistance zone. Conversely, in the event of negative news flow, the $0.11391 level could be triggered. A decline to these levels could increase momentum and initiate a new wave of growth.

Supports: 0.11797 – 0.11391 – 0.10837

Resistances: 0.12282 – 0.12824 – 0.13367

TRX/USDT

As mentioned in this morning’s analysis, following a limited rise, TRX is currently trading at 0.2952. Currently at the upper band of the bearish channel, TRX is seen attempting to break above the 0.2950 resistance on the 4-hour chart. The Relative Strength Index (RSI) value is 49, placing it in neutral territory. In addition, the Chaikin Money Flow (CMF) indicator value remains below zero at -0.04, indicating continued money outflows. The CMF’s persistence in negative territory signals that downward pressure on the price may increase.

In light of all these indicators, TRX may decline slightly in the second half of the day and move towards the middle band of the bearish channel. In such a case, it may test the 0.2890 support level. If it closes below the 0.2890 support level, it may continue its decline and attempt to test the 0.2820 support level. If the candle does not close below the 0.2890 support level and the CMF moves into positive territory, inflows of money may gain strength. In this case, after a possible rise in the price, the 0.2950 and 0.3015 resistance levels may be tested in succession.

On the 4-hour chart, 0.2765 is an important support level, and as long as it remains above this level, the upward momentum is expected to continue. If this support is broken, selling pressure may increase.

Supports: 0.2890 – 0.2820 – 0.2765

Resistances: 0.2950 – 0.3015 – 0.3080

Legal Notice

The investment information, comments, and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.