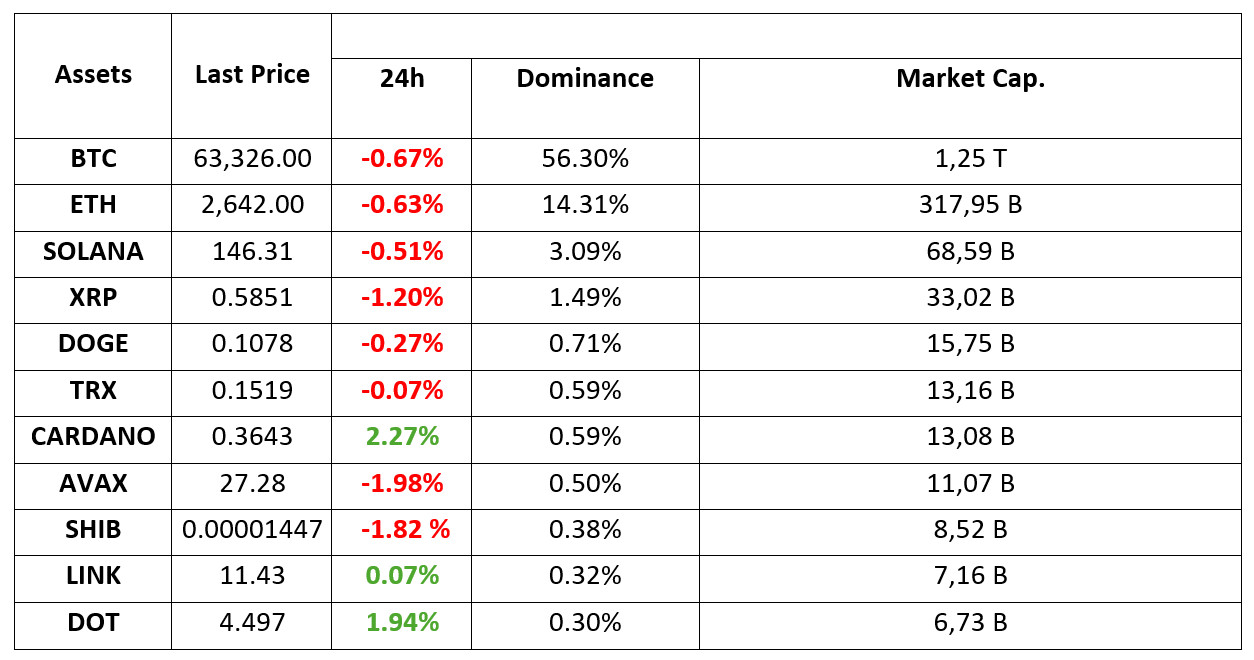

MARKET SUMMARY

Latest Situation in Crypto Assets

*Prepared on 24.09.2024 at 07:00 (UTC)

WHAT’S LEFT BEHIND

The war between Bitcoin miners is over

The acquisition dispute between RIOT Platforms and Bitfarms, which has been frequently discussed in the cryptocurrency world in recent months, has ended. The two parties announced that they reached an agreement with their statements.

JPMorgan on Stage Again!

JPMorgan Chase’s blockchain-based payment system Onyx was used by German industrial giant Siemens AG to issue and pay for digital commercial paper. Siemens issued 100,000 euros of crypto securities under Germany’s Electronic Securities Act (eWpG).

Bernstein: Trump Victory Could Lead to a Strong Rally

The cryptocurrency community expects more transparency despite Harris’ vague statements. A stronger rise in the crypto market is predicted if Trump becomes president again.

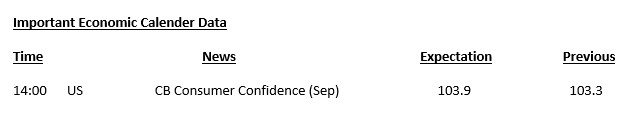

HIGHLIGHTS OF THE DAY

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

Central banks’ monetary policy easing continues to be at the forefront of the agenda in global markets. Following the FED’s 50 basis point cut, the People’s Bank of China (PBOC), which manages the monetary policy of the world’s second largest economy, announced new incentives this morning. In addition, the statements from the Federal Open Market Committee (FOMC) members also included messages that the FED may continue to cut interest rates.

Despite the escalating tensions in the Middle East and yesterday’s lower-than-expected PMI data in Europe, the easing of monetary policies by central banks is more effective on prices. While Asian stock markets gained value led by China, European indices are also expected to start the new day with a rise. Digital assets reacted more conservatively to the recent PBOC and FED officials’ statements than traditional markets. Although significant rises were recorded with the FED’s interest rate cut decision, we did not fully see the reflections of the increased risk appetite with the news of Asia-based easing. Major assets BTC and ETH gave back most of Monday’s gains. There are also signs that this trend may continue for a while.

No critical news or data flow is expected for the rest of the day. Under the assumption that the current market environment will continue, we think that we may see rapid rises and falls in digital assets from time to time. This could be in the form of rallies, which may not be accompanied by increased risk appetite, or declines, which may be driven by the anxiety-inducing effect of cash inflows into digital assets. Continued inflows into risky assets in traditional markets and a further delay in the spillover into crypto assets could increase downside risks.

TECHNICAL ANALYSIS

BTC/USDT

Consolidation in Bitcoin! The leading cryptocurrency Bitcoin continues to maintain the gains it has made since the FED rate cut and consolidates at the 63,000 level. The messages of support given by the political conflicts on the US side are one of the factors behind the strong stance in Bitcoin price. In this direction, Bitcoin, which has been correlated with US stocks for a long time, seems to be equally affected by macroeconomic movements such as the FED interest rate cut last week. Therefore, the liquidity that will come to the stock market with interest rate cuts may also have a positive impact on Bitcoin. In the BTC 4-hour technical analysis, the price, which moves within the uptrend, continues to consolidate at 63,000 levels, retreating after testing the 64,000 level once. The search for direction continues for BTC, which is priced in a narrow band between the intermediate support zone of 63,300 and 63,500 points. The 65,725 level can be tested with a new attack attempt towards the 64,000 level of BTC, which is expected to regain momentum to continue its upward movement. In case of a pullback, the support point we will encounter is the 62,300 level.

Supports 62,300 – 60,650 – 59,400

Resistances 64,450 – 65,725 – 67,300

ETH/USDT

As expected, Ethereum, which realized its correction up to 2.606, reacted from this level and priced up again. However, the negative structure in the RSI indicates that declines may come down to 2,606 levels again during the day. In addition, when looking at CVD spot and futures, it can be said that the possibility of a decline is strengthening, considering that the last reaction rise came on the futures side and the funding rates turned sharply positive. The gain of 2.669 level may continue the positive trend and open the door to rises to 2.815 levels.

Supports 2,606 – 2,558 – 2,490

Resistances 2,669 – 2,721 – 2,815

LINK/USDT

For LINK, it seems positive that the last decline did not close below the kijun support 11.29 level. In addition, the positive structure formed in CMF also attracts attention. However, despite all this, LINK, which cannot break the 11.64 main resistance level, draws attention with its descending tops. When the weakness in Ethereum is added to all this, 11.13 levels can be expected to come again with a correction movement. Breaking the 11.64 resistance may continue the positive trend.

Supports 11.29 – 10.85 – 10.54

Resistances 11.64 – 12.19 – 12.42

SOL/USDT

Today, US SEC Chairman Gensler’s speech may be important. In the Solana ecosystem, Travala, a crypto-based travel platform, recently announced its integration with Solana, allowing users to book flights and accommodation using Solana’s assets. In addition, Virtune will list the Staked Solana ETP on Euronext Amsterdam to increase crypto access as a company that manages digital assets and offers crypto Exchange Traded Products (ETPs). On the other hand, the outflow of money from the Solana ecosystem yesterday exceeded $90 million. This means that investors are wary of possible price drops. Technically, SOL, which tried to break 150, seems to have lost its momentum. SOL, which has been priced in a horizontal course since our analysis yesterday, continues to move in a cup-and-handle pattern. Both macroeconomic conditions and innovations in the Solana ecosystem, 147.40 – 151.12 levels appear as resistance levels. If it rises above these levels, the rise may continue. It can support the 200 EMA average in the pullbacks that will occur if investors make profit sales. 143.64 – 137.77 levels can be followed as support. If it comes to these support levels, a potential rise should be followed.

Supports 143.64 – 137.77 – 135.18

Resistances 147.40 – 151.12 – 161.63

ADA/USDT

Today’s speech by US SEC Chairman Gensler could be important. In the ADA ecosystem, the latest development is a smart contract built on Plutus V3 that allows Bitcoin wallets to control it directly. This could potentially allow BTC users to send and stake ADA coins to any Cardano pool without creating new wallets on the Cardano chain. Technically, ADA’s funding rate of 0.0099% is due to the fact that buyers are willing to pay this amount and carry long positions and predict that the price will rise. ADA price, which has been moving in an upward channel since September 2, may break the resistance of the rising channel if it closes its 4-hour candle above the $ 0.3724 level. In retracements due to possible profit sales, it may gain momentum from the 200 EMA average. In this scenario, 0.3596 – 0.3460 levels appear as support. In the rises that will take place with the continuation of the positive atmosphere in the ecosystem, 0.3651 – 0.3724 levels can be followed as resistance points.

Supports 0.3596 – 0.3460 – 0.3402

Resistances 0.3651 – 0.3724 – 0.3951

AVAX/USDT

AVAX, which opened yesterday at 27.30, rose slightly during the day and closed the day at 27.39. Conference board consumer confidence data will be released by the US today. It is important for a market with recession sensitivity.

For AVAX, which is currently trading at 27.20, we see that a rising flag pattern has formed on the 4-hour chart. It continues to consolidate in the falling channel near the horizontal and can be expected to break the channel upwards after moving in the channel for a while. In such a case, it may test 28.86 and 29.52 resistances. If the data from the US is perceived as a sign of recession and creates selling pressure, it may break the channel downwards. In this case, it may test 26.81 support. As long as it stays above 24.65 support during the day, it can be expected to continue its upward trend. With the break of 24.65 support, selling pressure may increase.

Supports 27.20 – 26.81 – 26.20

Resistances 28.00 – 28.86 – 29.52

TRX/USDT

TRX, which started yesterday at 0.1518, closed the day at 0.1523. US conference board consumer confidence data to be released today may create volatility in the market. TRX, which continues its horizontal and volume-free movement and is currently trading at 0.1517, is in an ascending channel on the 4-hour chart. The RSI is in the middle band of the rising channel with a value of 50 and some upside can be expected from here. In such a case, it may move to the upper band of the channel and test the 0.1532 support. However, it may move to the lower band with the sales reaction that may come from the middle band of the channel. In such a case, it may test 0.1500 support. As long as TRX stays above 0.1482 support, the desire to rise may continue. If this support is broken downwards, sales can be expected to increase.

Supports 0.1500 – 0.1482 – 0.1429

Resistances 0.1532 – 0.1575 – 0.1603

XRP/USDT

XRP closed yesterday at the daily closing level of 0.5845. XRP, which continues to move within the horizontal band, is currently trading at 0.5848. When the 4-hour analysis is analyzed, we can see that it is stuck between EMA20 and EMA50 and moves in this range. RSI data is close to the oversold zone and with the purchases that may come, XRP may rise and test the resistance levels of 0.5909-0.6003-0.6136 if it continues its rise by breaking the EMA20 level. In case of a decline, if the EMA50 level is broken, it may test the support levels of 0.5807-0.5723-0.5628 in the continuation of the decline.

XRP may rise with possible purchases at the 0.5723 support level on the decline and may offer a long trading opportunity. On the rise, it may fall with possible sales at 0.6003 and may offer a short trading opportunity.

EMA20 (Blue Line) – EMA50 (Green Line) – EMA200 (Purple Line)

Supports 0. 5807 – 0.5 723 – 0.5628

Resistances 0.5909 – 0.6 003 – 0.6136

DOGE/USDT

In the 4-hour analysis, DOGE closed at 0.1080 with a rise in the last candle yesterday. DOGE, which started with a rise in the opening candle today, rose to 0.1088, then declined with the sales that came after it rose to 0.1088, and with the decline it experienced in the last candle today, it is currently trading at 0.1076. In the 4-hour analysis, when DOGE declines, it continues to trade within a horizontal band after rising with purchases at the EMA20 level. If it starts to rise, it may test the resistance levels of 0.1080-0.1101-0.1122. If it retests and breaks the EMA20 level that it tested with its decline in the last candle, it may test the support levels of 0.1054-0.1035-0.1013 in the continuation of the decline.

DOGE may rise with possible purchases at EMA50 and EMA200 levels in its decline and may offer a long trading opportunity. In its rise, the 0.11 resistance zone comes to the fore and it may decline with the sales that may come at this level and may offer a short trading opportunity.

EMA20 (Blue Line) – EMA50 (Green Line) – EMA200 (Purple Line)

Supports 0.1054 – 0.1035 – 0.1013

Resistances 0.1 080 – 0.1101 – 0.1122

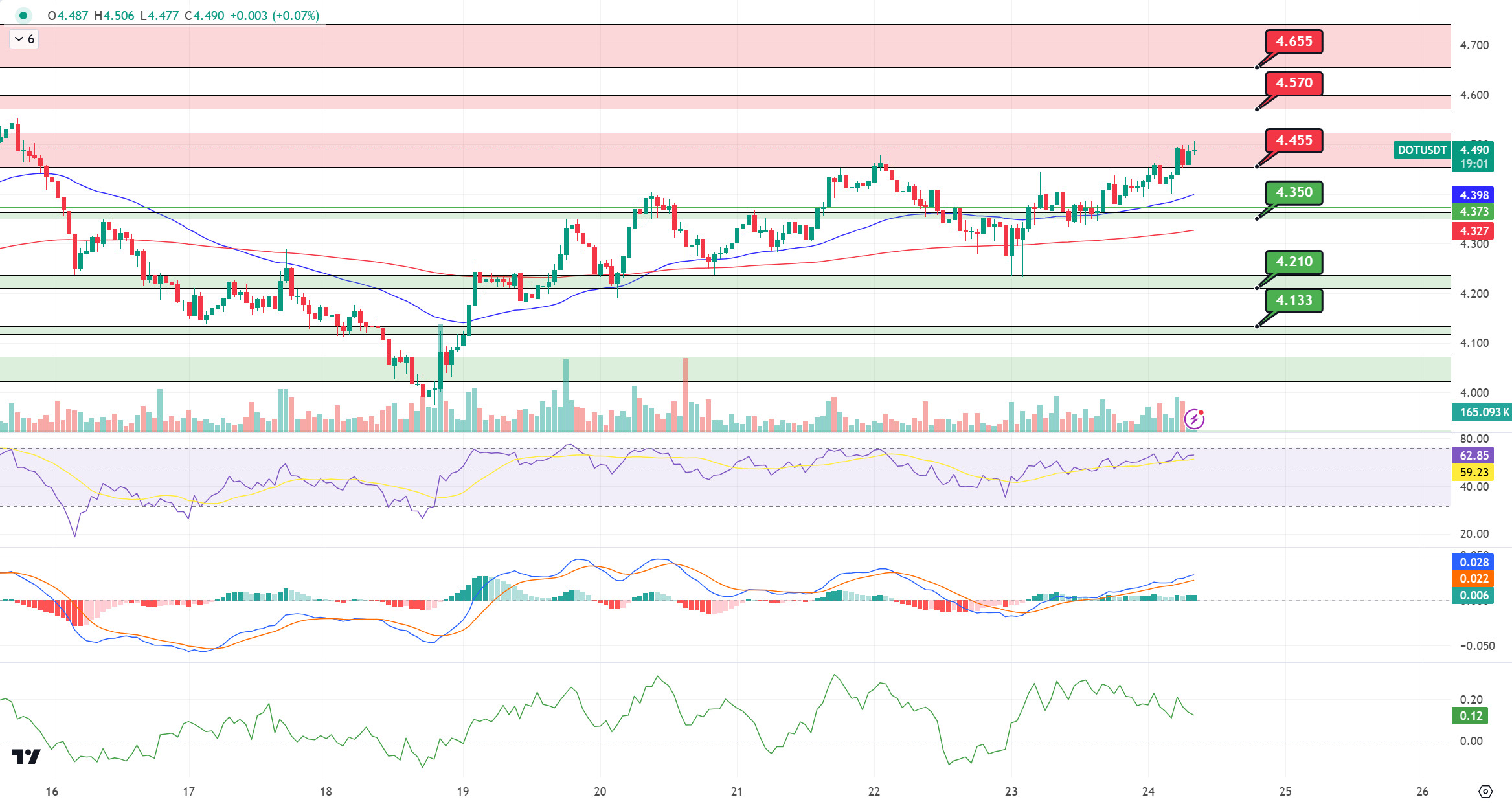

DOT/USDT

When we examine the Polkadot (DOT) chart, as we mentioned in our previous analysis, the price rose to the 4,455 band, which is our resistance level, after maintaining above the 4,350 level. If the price maintains above the 4.455 band, its next target could be the 4.570 resistance. On the other hand, if the price wants to make a correction of this rise, a retracement up to the EMA50 level may occur.

(Blue line: EMA50, Red line: EMA200)

Supports 4,350 – 4,210 – 4,133

Resistances 4.455 – 4.570 – 4.655

SHIB/USDT

When we examine the chart of Shiba Inu (SHIB), we see that the price is moving sideways. The EMA50 level worked as a resistance and the price seems to have moved sideways at 0.00001443. When we examine the MACD oscillator, we can say that the buyer pressure is increasing. If the price maintains above the 0.00001443 level, its next target may be 0.00001475 levels. On the other hand, if the price fails to sustain above the 0.00001443 level, we can expect a retracement towards the 0.00001412 support band, which is our first support level.

(Blue line: EMA50, Red line: EMA200)

Supports 0.00001412 – 0.00001358 – 0.00001300

Resistances 0.00001443 – 0.00001475 – 0.00001507

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.