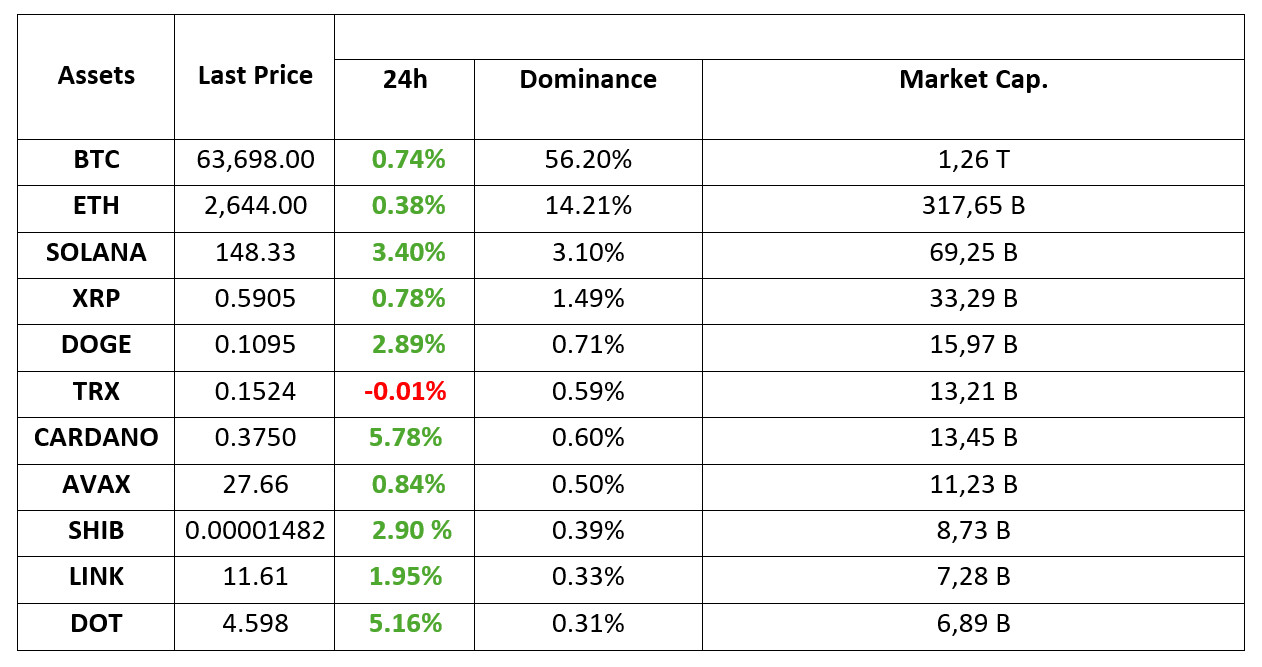

MARKET SUMMARY

Latest Situation in Crypto Assets

*Prepared on 24.09.2024 at 14:00 (UTC)

WHAT’S LEFT BEHIND

Kamala Harris Meets with Ripple and Coinbase Ahead of Election

Harris’ campaign has been in dialog with leading companies such as Ripple Labs and Coinbase. “It’s amazing to see how far the Democratic candidate has come on this issue,” said Paul Grewal, Coinbase’s chief legal officer, noting that the campaign has a deeper understanding of the industry’s needs.

Central Bank of China

China’s latest economic measures, such as interest rate cuts and monetary stimulus, could have a significant impact on global markets. The fact that it will inject liquidity into the market by taking new steps to support the economy is seen as a factor that increases the risk appetite and is interpreted positively for the Bitcoin price.

Historic Meeting for Bitcoin

Elon Musk and Nayib Bukele held a meeting on technology and Bitcoin at Tesla headquarters. Bukele’s leadership was praised as the rise of Bitcoin and El Salvador’s cryptocurrency moves were discussed. The conversation also touched on wide-ranging topics such as artificial intelligence and the future of robotics.

HIGHLIGHTS OF THE DAY

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

The steps taken by central banks to support economies are on the agenda in global markets. Finally, the statements of the Central Bank of China and other institutions of the country increased the risk appetite. However, we saw that this situation was not fully reflected in digital assets.

European stock markets are on the rise today despite yesterday’s poor PMI data. The European Central Bank is expected to continue easing monetary policy to support economic activity. US indices also started the new day slightly on the positive side. However, there is a horizontal course. The pressure on the dollar index, which started in the morning hours, continued. Losses increased slightly after CB Consumer Confidence data came in well below expectations. Despite all these components of the equation, as we mentioned earlier, the rise in digital assets could not find full strength.

As we discussed in our morning analysis, no critical news or data flow is expected for the rest of the day. Under the assumption that the current market environment will continue, we think that we may see rapid rises and falls in digital assets from time to time. This could be in the form of delayed rallies that may not be accompanied by increased risk appetite, or declines that may be triggered by the lack of cash inflows towards digital assets and the triggering of increased concerns in parallel. Continued inflows into risky assets in traditional markets and a further delay in the spillover to crypto assets could increase downside risks.

TECHNICAL ANALYSIS

BTC/USDT

Calm course in Bitcoin! The leading cryptocurrency Bitcoin continues to follow a calm course on the second day of the week. With the euphoria that came with the FED interest rate cuts last week, the price tested 64,000 levels and then came to 63,000 levels, which seems to have been replaced by a stagnant market. The correlation with US stocks, which we mentioned earlier, has shifted the focus to the stock market. The data coming from there can give us a message about the direction. In addition, the latest economic measures such as interest rate cuts and monetary incentives of the Chinese government, which is struggling with the real estate crisis, another important development during the day, can be expected to have a positive impact on the Bitcoin price in the long term. In the BTC 4-hour technical analysis, we see that the price continued to react upwards during the day with an attack towards the 63,800 level. With the selling pressure in BTC considerably decreasing, the correction movement of the rise from 57,000 levels is limited as of now and shows that it continues to be in a strong outlook. With the opening of the US market, there may be activity and the price may test above 64,000 levels again with positive market data. Persistence above these levels brings a movement towards the 67,000 level. In case of a pullback, the 62,300 level appears as a support point, but every pullback may create a buying opportunity in these periods when the rises have started.

Supports 62,300 – 60,650 – 59,400

Resistances 64,450 – 65,725 – 67,300

ETH/USDT

As mentioned in the morning analysis, we see that the negative structure in RSI continues. The negative signal in MACD and the increase in sales on the spot side in CVD data can be listed as valid reasons for the correction expectation to continue. The most important support level in possible retracements seems to be 2,558. The break of this level may deepen the decline. Closures above 2,669 may refute the idea and accelerate the upward acceleration. In this case, we may see rapid rises to 2.815.

Supports 2,606 – 2,558 – 2,490

Resistances 2,669 – 2,721 – 2,815

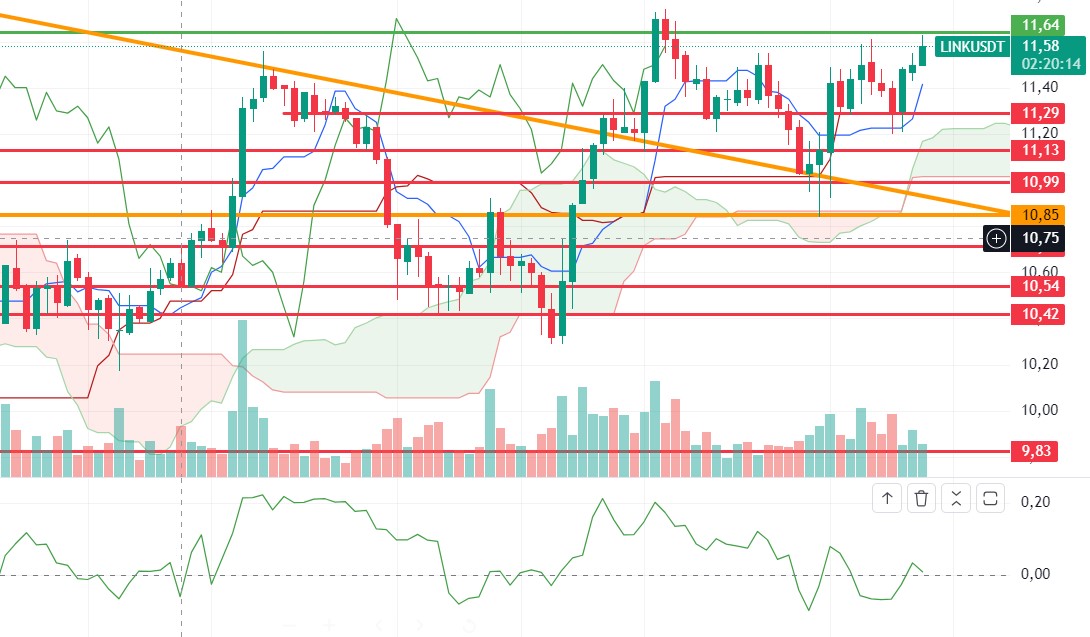

LINK/USDT

For LINK, which has pushed the 11.64 resistance level by clearly differentiating from Ethereum after a long time, the reaction it will receive from this level seems to be the determinant of the movement. It is seen that the positive structure in CMF continues. The voluminous break of 11.64 may bring upward pricing. 12.19 level may be the first target in this case. However, if it reacts from this level and starts to decline, we may see pullbacks to the range of 11.29 – 11.13 levels.

Supports 11.29 – 10.85 – 10.54

Resistances 11.64 – 12.19 – 12.42

SOL/USDT

In the Solana ecosystem, Google announced on its Cloud X platform that it has “partnered with Solana Labs to make Web3 game development easier than ever”. Technically, SOL, which tried to break 150, seems to have lost its momentum. SOL, which has been pricing in a horizontal course since our analysis in the morning, continues to move in a cup-and-handle pattern. In the rises driven by both macroeconomic conditions and innovations in the Solana ecosystem, 147.40 – 151.12 levels appear as resistance. If it rises above these levels, the rise may continue. It can support the 200 EMA average in the pullbacks that will occur if investors make profit sales. 143.64 – 137.77 levels can be followed as support. If it comes to these support levels, a potential rise should be followed.

Supports 143.64 – 137.77 – 135.18

Resistances 147.40 – 151.12 – 161.63

ADA/USDT

It is up 2.68% since our analysis this morning. This price action follows the announcement of the Ouroboros Leios upgrade, which aims to increase Cardano’s speed to over 1500 transactions per second (TPS). However, according to data from Intotheblock, large investors holding over $1 million in ADA have seen declines of up to 18%. This shows that whales that play an important role in the cryptocurrency market are exiting ADA. This may negatively affect the price in the coming days. Technically, ADA’s funding rate of 0.0101% in the last 8 hours is due to the fact that buyers are willing to pay this amount and carry long positions and predict that the price will rise. Since September 2, ADA, which has been moving in an upward channel, seems to break the channel upwards soon. If the 4-hour candle closes above the $ 0.3724 level, it may break the resistance of the rising channel. In retracements due to possible profit sales, it may gain momentum from the 200 EMA average. In this scenario, the 0.3651 level appears as a strong support. In the rises that will take place with the continuation of the positive atmosphere in the ecosystem, the 0.3724 level can be followed as resistance.

Supports 0.3596 – 0.3460 – 0.3402

Resistances 0.3651 – 0.3724 – 0.3951

AVAX/USDT

AVAX, which opened today at 27.29, is trading at 27.60, up 1% during the day. The US conference board consumer confidence data to be announced today is important for a recession-sensitive market. If the confidence index is much lower than expected, it may be perceived negatively as it may trigger fears of recession in the market.

On the 4-hour chart, we see that a rising flag pattern has formed. It continues to consolidate in the falling channel near the horizontal and can be expected to break the channel upwards after moving in the channel for a while. In such a case, it may test 28.86 and 29.52 resistances. If the data from the US is perceived as a sign of recession and creates selling pressure, it may break the channel downwards. In this case, it may test 26.81 support. As long as it stays above 24.65 support during the day, it can be expected to continue its upward trend. With the break of 24.65 support, selling pressure may increase.

Supports 27.20 – 26.81 – 26.20

Resistances 28.00 – 28.86 – 29.52

TRX/USDT

TRX, which started today at 0.1524, continued its horizontal course during the day and is still trading at 0.1524. US conference board consumer confidence data to be released today may create volatility in the market. This volatility may cause voluminous movements for TRX. TRX, which continues its horizontal and volume-free movement at the moment, is in an ascending channel on the 4-hour chart. The RSI is in the middle band of the rising channel with a value of 59 and some upside can be expected from here. In such a case, it can move to the upper band of the channel and test the 0.1532 support. However, it may move to the lower band with the sales reaction from the middle band of the channel. In such a case, it may test 0.1500 support. As long as TRX stays above 0.1482 support, the desire to rise may continue. If this support is broken downwards, sales can be expected to increase.

Supports 0.1500 – 0.1482 – 0.1429

Resistances 0.1532 – 0.1575 – 0.1603

XRP/USDT

XRP continues to trade at 0.5898 today, up about 1%. In the 4-hour analysis, after testing the 0.5909 resistance level with its rise, it fell with the incoming sales and after falling below the EMA20 level, it is retesting the 0.5909 level in the last candle with its rise again and if it breaks it, it may test the resistance levels of 0.6003-0.6136 in the continuation of the rise. If the 0.5909 resistance level cannot be broken and a decline occurs, XRP may continue its movement in a horizontal band between the EMA20 and EMA50 levels. If it falls below the EMA50 level after the fall, it may test the support levels of 0.5807-0.5723-0.5628 with the deepening of the decline.

XRP may rise with possible purchases at the 0.5723 support level on the decline and may offer a long trading opportunity. On the rise, it may fall with possible sales at 0.6003 and may offer a short trading opportunity.

EMA20 (Blue Line) – EMA50 (Green Line) – EMA200 (Purple Line)

Supports 0. 5807 – 0.5 723 – 0.5628

Resistances 0.5909 – 0.6 003 – 0.6136

DOGE/USDT

After starting today at 0.1080, DOGE tested the EMA20 level in the 4-hour analysis with the decline it experienced after starting today at 0.1080 and failed to break it and started to rise with the incoming purchases. DOGE, which continued its rise by breaking the 0.1080 level after its rise with incoming purchases, tested the 0.1101 resistance level in the last candle. It is currently trading at 0.1089 with a decline as a result of sales at the resistance level in question. If the decline continues, it may test the 0.1080 support level and if it breaks, it may test the 0.1054-0.1035 support levels with the deepening of the decline. In case it starts to rise again, it may retest the 0.1101 resistance level and if it breaks it, it may test the 0.1122-0.1149 resistance levels in the continuation of the rise.

DOGE may rise with possible purchases at EMA20 and EMA50 levels in its decline and may offer a long trading opportunity. In its rise, the 0.11 resistance zone comes to the fore and may decline with possible sales at this level and may offer a short trading opportunity.

EMA20 (Blue Line) – EMA50 (Green Line) – EMA200 (Purple Line)

Supports 0.1080 – 0.1054 – 0.1035

Resistances 0.1 101- 0.1122 – 0.1149

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.