BTC/USD

Bitcoin left behind another busy trading week with developments that had a significant impact on the market. Bitcoin, which approached its all-time high (73,750), retreated from this level. Among the developments affecting the market agenda last week were US economic data, earnings reports from technology companies, allegations of an investigation into Tether and tensions in the Middle East. These developments led to fluctuations in the Bitcoin price. This week, on the other hand, an important and historic week awaits us with critical developments such as the US elections and the FED interest rate meeting that will determine the direction of the market.

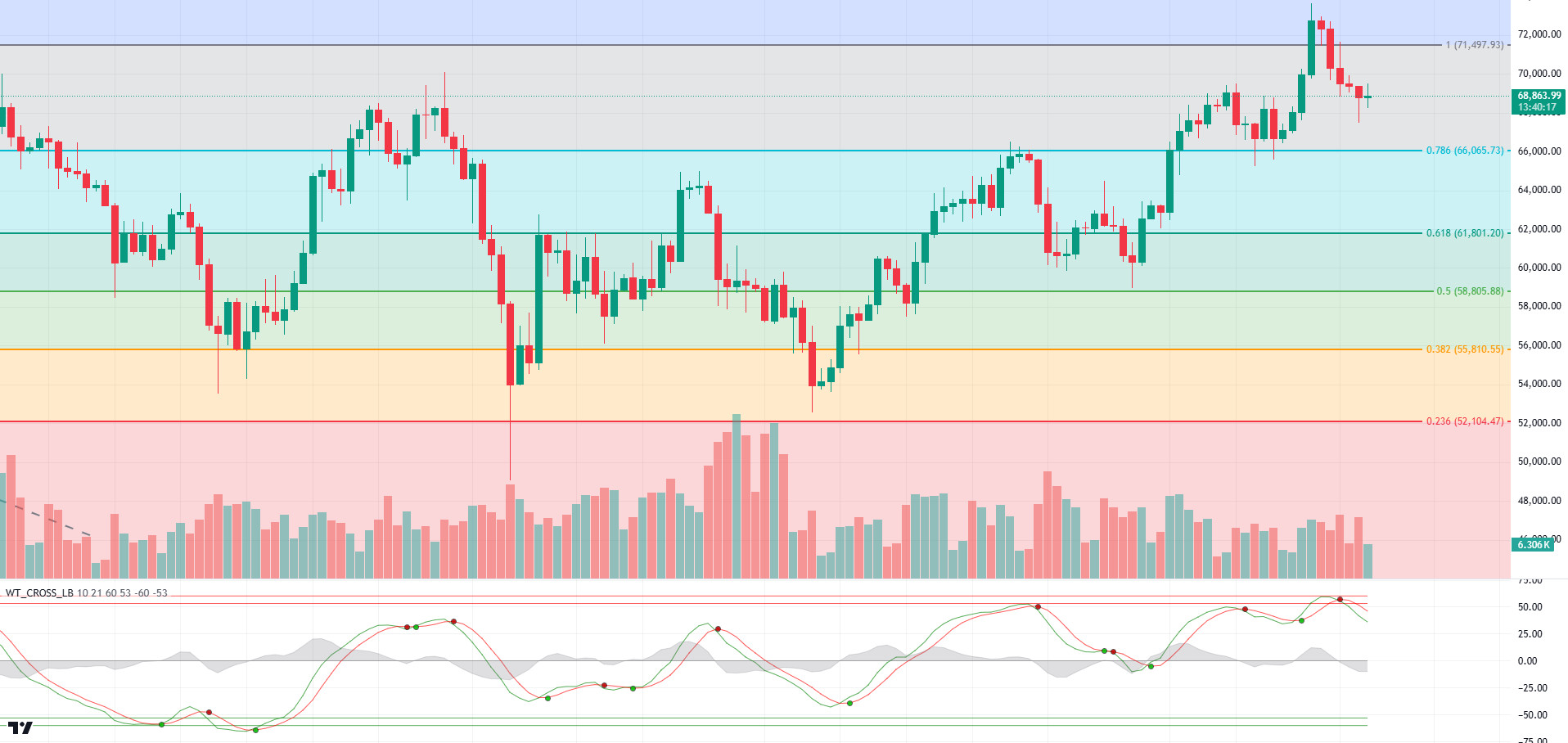

On the BTC daily technical outlook, the price, which broke through the Fibonacci 1 (71,497) level, retreated to 67,500 levels with intense selling pressure in the ATH zone. One day before the US elections, volatility is expected to increase considerably in the market. Unlike hourly timeframes, the fact that technical oscillators give a sell signal on the daily chart may indicate that there may be sharp movements in the market. The support point that will meet us with the deepening of the retreat will be the level of 0.785 (66.065). The predominance of short trades above the 70,000 level on the weekly liquidation chart may cause liquidation clearance. In case the price experiences an upward movement again, we will follow the 71,500 level.

Supports 66,065 – 61,800 – 58,800

Resistances 69,500- 71,497 – 73,700

ETH/USDT

ETH/USDT

Outflows of ETH locked on Eigenlayer continue. Eigenlayer, which has become one of the most important protocols of Ethereum, has lost confidence after the sale of EIGEN tokens from a wallet that should have been locked in recent weeks. It seems that the locked ETHs on the protocol were unlocked and sold on Uniswap. This creates a huge selling pressure on ETH. Currently, the number of locked ETH on the protocol is 4.5 million.

TVL declines in L2 protocols seem to continue. When Dune data is analyzed, it is seen that almost all L2 networks, especially Scroll, Arbitrum and Zksync, have experienced TVL decreases. Starknet, on the other hand, seems to have experienced a TVL increase by standing out with the memetoken fury that has recently started on it.

If we look at ETH technically, the first important structure we see is a 5-contact uptrend. ETH, which is stuck between this trend line and the important resistance level of 2,488 on the daily timeframe, seems to be at an important decision point. Negative structures on Chaikin Money Flow (CMF) and Relative Strength Index (RSI) may lead to another test of the trendline. If ETH, which is in the Kumo cloud, closes the day below the cloud, the decline may deepen. Persistence above the 2.488 level may start a new uptrend up to 2.653.

Supports 2,417 – 2,312 – 2,225

Resistances 2,488 – 2,653 – 2,780

LINK/USDT

LINK/USDT

Was heavily affected by the general market decline, as all altcoins were, and fell back below the $11 level. Negative outlooks on Chaikin Money Flow (CMF), Relative Strength Index (RSI) and momentum continue, while a positive mismatch on Commodity Channel Index (CCI) appears to be forming. With this mismatch, it seems possible to see slight rises towards the $11 levels. On the other hand, the negativity on RSI and CMF indicates that the declines may deepen with the break of 10.26 support.

Supports 10.26 – 9.46 – 8.21

Resistances 11.01 – 11.61 – 12.33

SOL/USDT

Last week, non-farm payrolls in the US were marked by the strike and hurricane effect. The incoming data was announced as 12 thousand. The expected 106 thousand and the previous figure was 254 thousand. However, average hourly earnings were announced 0.4% above expectations on a monthly basis. Expectations were for the data to come in at 3.0%. The increase in wages continues. Inflation will increase with growth. Unemployment rate was announced as 4.1% as expected. This shows that the labor market remains stable and the economy is on a balanced course. In another data, it was stated that gross domestic product expanded by 2.8% on an annual basis in the 3rd quarter. This rate was below the expected growth of 3%. It also shows us that the FED has started the interest rate cut cycle and inflation is falling. In the crypto market, Tether (USDT), a stablecoin worth $1 billion, was minted. This signaled an influx of cash into the blockchain ecosystem. In the Solana ecosystem, whales bought SOL from centralized exchanges. On October 28, Lookonchain reported on its X platform that whales accumulated 202,400 SOLs worth $35 million last week. The meme token frenzy in the ecosystem continues. Solana’s meme coin market reached $ 12 billion. In a significant development in the digital asset management space, VanEck announced a partnership with Kiln to facilitate Solana staking as part of its comprehensive Solana Strategy. This initiative aims to provide institutional investors with an easier entry point into the Solana ecosystem through the regulated products Exchange Traded Notes (ETNs) and Exchange Traded Funds (ETFs). At the same time, amid Solana’s (SOL) growing dominance, Canary Capital, an investment management firm founded by Steven McClurg of Valkyrie Funds’ founding team, has filed with the United States Securities and Exchange Commission (SEC) to offer its spot ETF. In network activity, the number of active daily addresses on the Solana blockchain is approaching 10 million and daily revenues recently hit a six-month high of $2 million, according to Token Terminal data. The most important thing to watch in the coming week is the US elections. If Trump is elected, an uptrend for cryptocurrencies can be foreseen. In the data from Polymarket, Trump seems to be ahead with a rate of 57.7%. Another important data will be the FED’s interest rate decision. According to the data from CME, the probability of a 25 basis point interest rate cut is seen as 99.8%. Technically, on our daily chart, the 50 EMA (Blue Line) continues to accelerate upwards, finding support from the 200 EMA (Black Line). This indicates that the trend will continue upwards. The 162.99 level, which is a strong resistance, is working as a support after being broken by a voluminous candle last week. This is an important support level for the continuation of the uptrend. At the same time, the Relative Strength Index (RSI) 14 is at neutral levels but a supportive trend has formed. This supports the upward trend of the price. The first major resistance level of 185.60 may be tested once again if the positive results in macroeconomic data and positive developments in the ecosystem continue. In case of declines due to political developments or negative news in the Solana ecosystem, the 150.23 level can be followed as a buying point.

Supports 162.99 – 150.23 – 141.80

Resistances 170.05 – 173.58 – 180.45

ADA/USDT

Last week, non-farm payrolls in the US were marked by the strike and hurricane effect. The incoming data was announced as 12 thousand. The expected 106 thousand and the previous figure was 254 thousand. However, average hourly earnings were announced 0.4% above expectations on a monthly basis. Expectations were for the data to come in at 3.0%. The increase in wages continues. Inflation will increase with growth. Unemployment rate was announced as 4.1% as expected. This shows that the labor market remains stable and the economy is on a balanced course. In another data, it was stated that gross domestic product expanded by 2.8% on an annual basis in the 3rd quarter. This rate was below the expected growth of 3%. It also shows us that the FED has started the interest rate cut cycle and inflation is falling. In the crypto market, Tether (USDT), a stablecoin worth $1 billion, was minted. This signaled an influx of cash into the blockchain ecosystem. There was an important development in the Cardano ecosystem. Following speculation involving a potential partnership with the National Aeronautics and Space Administration (NASA), the price could indeed go to the moon. Official information from Renagh Mooney, Cardano’s director of global communications, suggests that the rumors may have some validity. Mooney writes that in highlights of the two-day Cardano Summit in Dubai, NASA Systems Engineer Matthew Vaerewyck explained how blockchain could be used to “transform space mission design and efficiency by integrating a digital decentralized tracking technology that eliminates intermediaries and reduces costs for multinational companies.” Founder Charles Hoskinson shared a bold vision in the protocol that could foster better decentralization and self-managing systems. In a video posted on X, Hoskinson shared the reasons why his plans work. Running a nation-state by 2030 may seem ambitious, but he believes Cardano can make it happen. In another statement. In another statement, Hoskinson said that he envisions a future where Cardano plays an important role not only as a cryptocurrency, but also in the governance of nation-states. He added that Cardano will now be positioned as a Bitcoin Layer 2 solution. This new strategy means that Cardano will focus on making Bitcoin more functional, aiming to complement its current shortcomings. With this move, Cardano aims to increase Bitcoin’s potential by adding speed and new features. In the Cardano ecosystem, Phase 1 of the Cardano Chang Hard Fork went live weeks ago and EMURGO announced the 5 updates to watch for Phase 2. It will offer 5 important enhancements to increase the quest for decentralization. These are delegate representative (DRep) voting, SPO (Share Pool Operator) voting, governance actions, treasury withdrawals and an expanded constitutional committee. On the network, the number of addresses holding between 1 million and 10 million ADA has remained stable in recent days. From October 20 to October 28, the number increased from 2,444 to 2,452. This means that whales have not been taking action on their wallets lately. However, TVL has been rising steadily with this recent increase. According to DefiLlama data, Total Value Locked (TVL) currently stands at $225.48 million, marking an increase of 1.58% in the last 24 hours. This represents a gradual increase in network usage and adoption of Cardano. Increased activity on the blockchain could contribute to upward price momentum, especially if the broader cryptocurrency market turns bullish in the coming weeks. According to BeInCrypto, more than 260,000 Cardano addresses bought 6.68 billion ADA in the range of 0.3400 to 0.3600. At an average price of $0.3400, these assets are worth about $2.77 billion. Given this situation, Cardano’s price may have a hard time breaking through this range. IntoTheBlock’s data shows that the altcoin’s holding period, the average time investors hold their coins before selling them, has increased by 371% in the last 7 days. It shows that the longer the holding period increases, the more confidence investors have in a coin’s long-term potential. The most important thing to watch next week is the US elections. If Trump is elected, a bullish outlook for cryptocurrencies is foreseeable. According to data from Polymarket, Trump seems to be ahead with a rate of 57.7%. Another important data will be the FED’s interest rate decision. According to the data from CME, the probability of a 25 basis point interest rate cut is seen as 99.8%. Looking at the daily chart, the 50 EMA (Blue Line) remains below the 200 EMA (Black Line). This shows us that there is still a downtrend. On the other hand, the symmetrical triangle pattern may test once again, although it has risen twice with support from the base level. When we look at the Chaikin Money Flow (CMF)20 indicator, it indicates that money flows are decreasing in support of this decline. In the event of possible macroeconomic conditions and negative developments in the Cardano ecosystem and the continuation of the downtrend, the symmetrical triangle base level appears as a strong support. In case of an uptrend, the 50 EMA should be followed as a strong resistance.

Supports 0.3297 – 0.3206 – 0.3038

Resistances 0.3397 – 0.3596 – 0.3787

AVAX/USDT

AVAX, which started the previous week at 25.77, fell 8.5% during the week and closed the week at 23.54. This week, services purchasing managers’ index, non-manufacturing purchasing managers’ index, applications for unemployment benefits and FED interest rate decision will be announced in the US. US presidential elections will also be held this week. The market will continue to look for direction according to these data and news from the Middle East. These data will also affect the market and AVAX. High volatility may occur in the market during and after the data release.

AVAX, which is currently trading at 23.43 and continues its movement within the bullish channel on the daily chart, may move from the lower band of the channel to the upper band with the positive perception of the upcoming data by the market. In such a case, it may test the 24.83 and 26.29 resistances. Especially with the candle closure above 26.29 resistance, its rise may accelerate. If the data to be announced creates recession anxiety, if the election results negatively affect the market or if there is news from the Middle East that tensions are increasing, selling pressure may occur and it may test the supports of 23.21 and 21.84 by trying to break the lower band of the channel. As long as there is no candle closure below 19.79 support on the daily chart, the upward appetite may continue. The decline may deepen with the candle closure below this support.

Supports 23.21 – 21.84 – 19.79

Resistances 24.83 – 26.29 – 27.99

TRX/USDT

TRX, which started last week at 0.1640, rose slightly during the week and closed the week at 0.1650. This week, services purchasing managers index, non-manufacturing purchasing managers index, unemployment claims and FED interest rate decision will be announced in the US. These data are important to affect the market and data to be announced in line with expectations may have a positive impact.

TRX, which is currently trading at 0.1652 and moving within the bullish channel on the daily chart, is located in the middle band of the channel. With a Relative Strength Index value of 57, it can be expected to decline slightly from its current level and move to the lower band of the channel. In such a case, it may test the 0.1565 support. If it cannot break the 0.1565 support and rises with the next buying reaction, it may want to test the 0.1700 resistance. On the daily chart, the bullish demand may continue as long as it stays above 0.1229 support. If this support is broken, selling pressure may increase.

Supports: 0.1565 – 0.1481 – 0.1393

Resistances 0.1660 – 0.1700 – 0.1770

“DOT/USDT”

Gecko Sec, one of the winners of the EasyA x Polkadot hackathon, has achieved a remarkable success for the Polkadot ecosystem by being accepted to Y Combinator. The security software developed by Gecko Sec aims to make it easier for Web3 developers to write secure code and can especially contribute to Polkadot projects. This development could strengthen Polkadot’s security infrastructure and support the expansion of the ecosystem by increasing developer interest.

When we examine the DOT chart, we see that the price retreated with increasing selling pressure after October 29. The target of the Head&Shoulders pattern seems to be 3.100 support levels. When we examine the Williams %R oscillator, we can say that the trend continues downward. In this context, if the price loses the 3.715 level, it may retreat towards 3.550 levels. On the other hand, if the price moves upwards with the reaction from 3,715 levels, we can see a movement towards the first resistance level of 4,220 levels.

Supports 3,715 – 3,550 – 3,100

Resistances 4.220 – 4.918 – 5.889

SHIB/USDT

Shiba Inu (SHIB) continues its updates with ShibaSwap 2.0, aiming to enhance the user experience and increase transactions on the Shibarium network. The new features can strengthen SHIB’s position as a leading DEX in the Shibarium ecosystem and increase transaction volume. With marketing lead Lucie announcing new features exclusive to Shiboshi NFT holders, NFT holders are encouraged to take a more active role in the ecosystem, fostering community interaction. In addition, the new NFT bridge, which enables Ethereum-based NFTs to migrate to Shibarium, can attract more users and liquidity by reducing transaction fees.

Shytoshi Kusama emphasized SHIB’s impressive growth rate, noting that new products will soon be available in the ecosystem. This could increase interest in SHIB, adding to the token’s value. Furthermore, the Shiba Inu community has called for the BONE token to be listed on Binance, which could support the token’s visibility and demand-driven value growth. Finally, Robinhood’s promotion of SHIB as an innovative force in the meme coin universe has the potential to spread SHIB’s popularity to a wider audience.

When we examine the SHIB chart, a rise towards 0.00001983 levels was observed after the positive divergence between the price and the On Balance Volume (OBV) oscillator mentioned in the previous weekly analysis. With the increase in selling pressure at 0.00001983 levels, the price retreated to the 0.00001628 support level. When we examine the Chaikin Money Flow (CMF) oscillator, we can say that the selling pressure is stronger. In this context, if the price fails to close the daily candle above the 0.00001690 level, it may want to test the 0.00001628 levels again. On the other hand, if the price, which is in the lower band of the triangle pattern, closes the daily candle above 0.00001690, we may see a rise towards 0.00001860 levels.

Supports 0.00001628 – 0.00001505 – 0.00001450

Resistances 0.00001690 – 0.00001742 – 0.00001860

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.