Will the course be redrawn?

The Federal Open Market Committee (FOMC) of the US Federal Reserve (FED), which will conclude today, will be another decisive development for the markets. The next move of the bank, which started the interest rate cut cycle with 50 basis points in September, is eagerly awaited. Expectations are weighted towards a 25 basis point rate cut this time.

In the aftermath of Trump’s victory, the size of the rate cut, Chairman Powell’s statements and the guidance for the next interest rate level will be the main topics that will shape the markets.

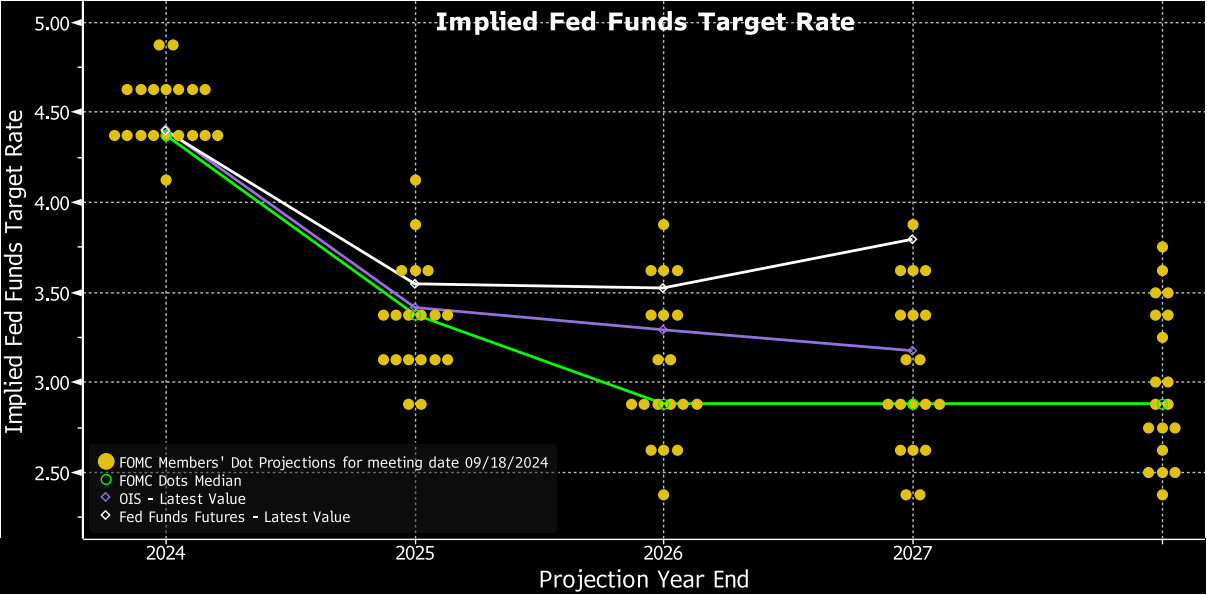

When we look at the “dot plot” graph showing the expectations of the FOMC members, which was published together with the September statement, we see that the officials foresee that by the end of 2024, the policy rate will be at 4.25-4.50% from 4.75-5%. This implies a 50 bps rate cut by the end of the year, and we agree that this course will be followed with two 25 bps rate cuts in the remaining two meetings of the year. However, the key question is, “Would the Fed want to be more cautious about further rate cuts due to inflation that may start to rise again after Trump’s expansionary fiscal policies?” We will try to understand this Powell’s statements.

FOMC Dot Plot Chart

What are the expectations?

When we evaluate the components of the equation, we think that the FOMC will decide for a 25 basis point rate cut in November. In addition, markets also expect another 25 basis point cut at the December meeting, which is in line with our baseline scenario. On the other hand, we think that this route is largely priced in and if the FED cuts today in line with expectations and signals another 25 basis point cut for the December meeting, the positive impact on digital assets will be limited.

One of the roadmaps that would be a surprise would be the FED’s stance that is not very favorable to further rate cuts. This seems to be one of the possible scenarios after Trump’s victory. In such a case, we anticipate that this will have a negative impact on digital assets as the probability of a rate cut in December will decrease. We think that it is very unlikely that the FED will decide to cut interest rates by more than 25 basis points or send such a message for the next meeting.

by Darkex Reseach – 3 min read