MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap |

|---|---|---|---|---|

| BTC | 74,727.89 | +0.88% | 58.83% | 1.48 T |

| ETH | 2,809.58 | +7.13% | 13.49% | 338.33 B |

| SOLANA | 186.25 | -0.48% | 3.50% | 87.84 B |

| XRP | 0.5443 | +2.26% | 1.24% | 30.97 B |

| DOGE | 0.1868 | -6.35% | 1.11% | 27.39 B |

| TRX | 0.1601 | -2.28% | 0.55% | 13.84 B |

| CARDANO | 0.3729 | +4.16% | 0.53% | 13.03 B |

| SHIB | 0.00001848 | -2.53% | 0.43% | 10.87 B |

| AVAX | 26.71 | +0.68% | 0.43% | 10.86 B |

| LINK | 12.19 | +3.39% | 0.30% | 7.63 B |

| DOT | 4.067 | -0.42% | 0.25% | 6.16 B |

*Prepared on 11.7.2024 at 13:30 (UTC)

WHAT’S LEFT BEHIND

Crypto Renaissance Begins in the US

Donald Trump’s victory in the US presidential election pushed Bitcoin to a record high. The world’s largest cryptocurrency surged more than 7% to $76,400 on Trump’s return to the White House

“Bitcoin Reserve” Reminder from Senator Lummis!

US Senator Cynthia Lummis has introduced a bill to create a Bitcoin reserve for the US after Trump’s presidency. This move draws attention with the potential to halve the national debt. The bill is likely to become law with majority support in Congress.

Bitcoin soars 1,900% in Trump’s first term

During Donald Trump’s first term as president of the United States, from November 2016 to November 2020, BTC rose by more than 1,900%. Despite his critical attitude towards crypto at the time, he did so in a famous tweet in 2019, calling BTC “extremely volatile” and claiming its value was “baseless”.

JPMorgan Chase: Bitcoin will benefit from Trump presidency and MicroStrategy’s plans

According to JPMorgan Chase analysts, gold and bitcoin are expected to perform well as Donald Trump wins the US presidential election, according to The Block.

MicroStrategy’s Bitcoin assets exceed $9 billion

Based on Bitcoin’s current price of $75,129.5, MicroStrategy’s Bitcoin position has a variable profit of more than $9 billion, the company reported. As of September 19, 2024, MicroStrategy holds a total of 252,220 Bitcoins with a total purchase cost of approximately $9.9 billion and an average price of approximately $39,266.

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| 19:00 | US FED Interest Rate Decision | 4.75% | 5.00% |

| 19:00 | US FOMC Statement | ||

| 19:30 | US FOMC Press Conference |

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

Global markets are experiencing the “Post Trump Victory” period. US stock markets are preparing to start the new day on a positive note after yesterday’s strong rise. European indices are also generally positive. While the US dollar eased slightly ahead of the critical Federal Open Market Committee (FOMC) decisions after its rise with Trump, digital assets are trying to hold on to their gains. While weekly jobless claims in the US came in line with expectations, the markets turned their eyes to the US Federal Reserve’s (FED) interest rate decision.

After the election of the person who will govern the country with the world’s largest economy for four years, the eyes of the markets turned to the FED. It is almost certain that the Bank will cut its policy rate by 25 basis points. However, the FOMC meeting in December and the course for 2025 are eagerly awaited. In this context, the FED’s decisions to be announced this evening and Chairman Powell’s speech are of great importance.

Please click here to review the special report we have prepared on this issue.

From the short term to the big picture

The victory of former President Trump, which was one of the main pillars of our bullish expectation for the long-term perspective in digital assets, produced a result in line with our forecasts. For the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see some respite or retracement in digital assets after this expectation. At this point, it would be useful to underline again that fundamental dynamics remain bullish. While the expansion of the largest digital currency Bitcoin’s record high may encourage buyers to take new, upside positions, we will watch this group struggle with the crowd that may want to take profit realizations. In addition, the results from the FOMC meeting today will be extremely important and decisive for digital assets

TECHNICAL ANALYSIS

BTC/USDT

Bitcoin focused on the FOMC meeting and FED Chairman Jerome Powell’s speech. In this process, with the increasing optimism after Donald Trump’s presidential victory, investors have reached a consensus on the possibility of a 25 basis point interest rate cut expected to be announced today.

Looking at the technical outlook, BTC is currently pricing at 74,700, just below the level where it ATH. BTC, which has a low volatile image during the day, we can expect volatility to increase in its price in the coming hours. With the increased enthusiasm in the market after the election, the 97% probability that the FED will cut interest rates may increase the risk perception in the market. With the increased risk perception, BTC can be expected to test new ATH levels. Although it is unlikely, if the FED leaves the interest rate unchanged or if there is a discourse that it will be the last interest rate cut of the year, the support levels of 73,789 and then 72,750 levels will be followed in the retreat. If the decline deepens, the 70,000 level may appear as it touches the major rising trend line.

Supports 73,789 – 72,750 – 71,453

Resistances 75,300 – 76,400- 83,060

ETH/USDT

The fear and greed index in the crypto markets has reached very high levels again. Today the US interest rate decision will be announced. If there is no big surprise, there will be a 25 basis point cut, but then we will see the effects of Powel’s speech. On the other hand, technically, we see that Chaikin Money Flow (CMF) is moving horizontally in the positive area and ETH is trying to hold on to the 2,811 level. Since the Relative Strength Index (RSI) is still in the overbought zone, we may see some more sideways movements or a continuation of the correction. With closes above the 2,811 level, we can see the upward acceleration of the rise.

Supports 2,768 – 2,722 – 2,649

Resistances 2,811 – 2,921 – 3,045

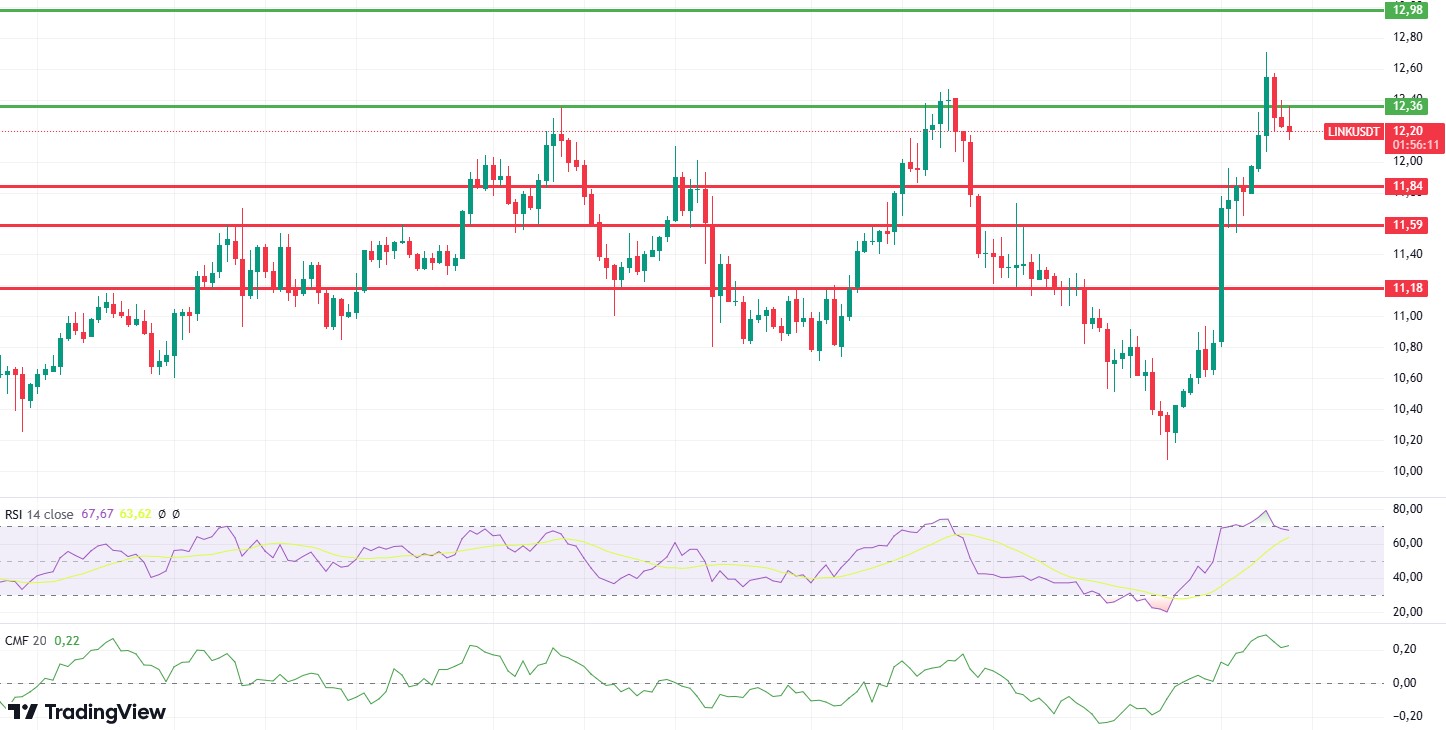

LINK/USDT

Unable to break the 12.36 level mentioned in the morning analysis, LINK continues its correction. The structures on Relative Strength Index (RSI) and Chaikin Money Flow (CMF) indicate that the correction may continue for some more time. Momentum and Money Flow Index (MFI) continue their positive outlook. It can be said that corrections up to the 11.84 level will be healthy and the upward movement may continue by exceeding the 12.36 level. However, the loss of the 11.84 level may cause the decline to deepen.

Supports 11.84 – 11.59 – 11.18

Resistances 12.36 – 12.98 – 13.77

SOL/USDT

Today, the interest rate decision from the US is a very important data to follow. According to the data from CME, the probability of a 25 basis point rate cut at the FED meeting is 97.3%. US jobless claims, which were announced as 218,000 last week, showed a moderate increase this week, coming in at 221,000. In the Solana ecosystem, the Pump.fun platform, launched in January 2024, quickly became a launch pad for meme coins on the blockchain. Since its inception, the platform has attracted a lot of attention and the total market capitalization of coins created on the Pump.fun ecosystem recently reached $3 billion, an all-time high for the ecosystem. So far, nearly 3 million projects have been launched on the platform. This explains the rise in the volume in the ecosystem. Technically, SOL continues its horizontal course since our analysis in the morning. The price strongly broke 181.75, which we call critical resistance, and ran this as a support level. With this move, it has moved upwards from the region where it has been consolidating for about 4 months. On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). This may mean that the rise will continue. Relative Strength Index (RSI)14 is in the overbought zone, which may bring profit sales. At the same time, when we examine the Chaikin Money Flow (CMF)20 indicator, money inflows are positive, and inflows continue to increase. On the other hand, there is a flag pennant pattern. If the pattern works, there may be a 17.58% increase from the price at the time of writing. The 193.78 level is a very strong resistance point in the uptrend driven by both macroeconomic conditions and innovations in the Solana ecosystem. If it rises above this level, the rise may continue strongly. In case of retracements due to possible political reasons or profit sales, the 181.75 support level may be triggered again. If the price hits this support level, momentum may increase, and a potential bullish opportunity may arise.

Supports 186.75 – 181.75 – 178.06

Resistances 193.78 – 200.00 – 209.93

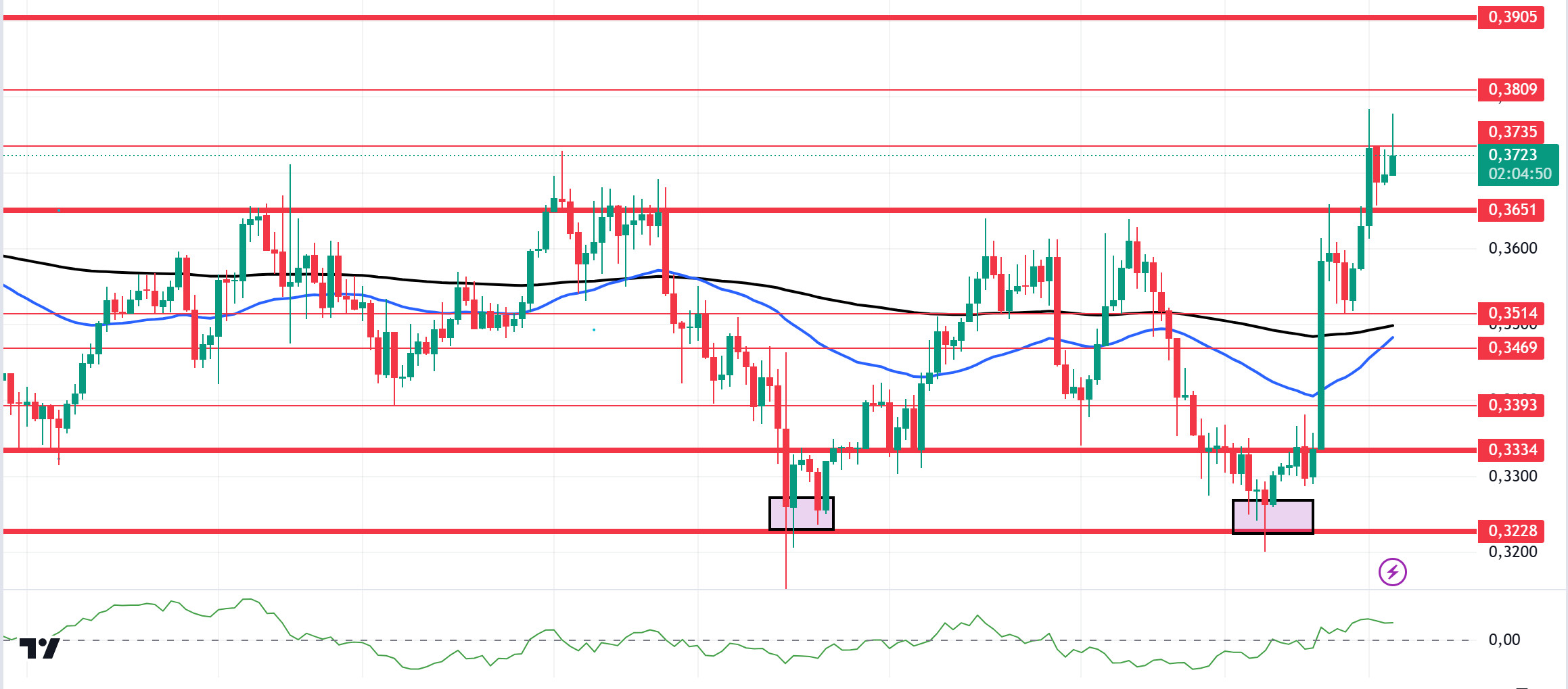

ADA/USDT

Today, the interest rate decision from the US is a very important data to follow. According to the data from CME, the probability of a 25 basis point rate cut at the FED meeting is 97.3%. US unemployment claims, which were announced as 218,000 last week, showed a moderate increase, coming in at 221,000 people this week. Technically, ADA, which has been accumulating since October 1, is pricing above the 50 EMA (Blue Line) and 200 EMA (Black Line) on the 4-hour chart. However, the 50 EMA continues to hover below the 200 EMA. Although this shows us that the trend is bearish, the convergence of the moving averages shows us that the bearish trend is decreasing. At the same time, when we examine the Chaikin Money Flow (CMF)20 indicator, we can say that money flows are increasing by moving into the positive zone. On the other hand, we see that a double bottom formation has formed in the 0.3228 region, which is the strong resistance level, supporting the upward momentum. Considering all these, it has supported the 0.3651 level, which works as resistance. The 0.3651 level, which is the support level, should be followed in the decline that will be experienced due to the macroeconomic data and negativities in the ecosystem or in the retracements brought by profit sales. It may be appropriate to buy when it comes to this price level. In the rises due to macroeconomic data or developments in the ecosystem, the 0.3905 level should be followed. If it breaks this level, the rise may strengthen.

Supports 0.3651 – 0.3514 – 0.3469

Resistances 0.3735 – 0.3809 – 0.3905

AVAX/USDT

AVAX, which opened today at 27.01, is trading at 26.65, down about 1.5% on the day when the FED interest rate decision will be announced. FED interest rate decision will be announced in the evening hours today. The FED is expected to cut interest rates by 25 basis points. There may be high volatility in the market during the interest rate decision. News flows from the Middle East will be important for the market.

On the 4-hour chart, the bullish channel is in the middle band and the Relative Strength Index value is near the overbought level at 62. Some decline can be expected from these levels. In such a case, it may test 26.54 and 25.71 supports. On the other hand, with the interest rate decision to be announced today, it may test the 27.20 and 28.00 resistances. As long as it stays above 22.80 support during the day, the desire to rise may continue. With the break of 22.80 support, sales may increase.

Supports 26.54 – 25.71 – 25.00

Resistances 27.20 – 28.00 – 28.80

TRX/USDT

TRX, which started yesterday at 0.1601, is trading at 0.1600, moving horizontally during the day. Today, the FED interest rate decision to be announced in the evening will be important for the market. In addition, the market closely follows the news flows regarding the tension in the Middle East.

On the 4-hour chart, the bearish channel is in the middle band. The Relative Strength Index value is in the oversold zone with 31 and can be expected to rise slightly from its current level. In such a case, it may move to the upper band of the channel and test the 0.1626 resistance. However, if it cannot close the candle above 0.1626 resistance, it may test 0.1571 support with the sales reaction that may occur. As long as TRX stays above 0.1482 support, the desire to rise may continue. If this support is broken downwards, sales can be expected to increase.

Supports 0.1603 – 0.1571 – 0.1535

Resistances 0.1626 – 0.1641 – 0.1666

DOT/USDT

When we examine the Polkadot (DOT) chart, we can say that it is moving horizontally. DOT, which was horizontal before the FED interest rate announcement, moves to the 4.010 support band with the reaction it received from the 4.150 level. When we examine the Williams %R oscillator, we see that it is below the -80 level. In this context, if the price does not get a reaction from the 4.010 support level, it may retreat towards the 3.875 support level. On the other hand, if the price can provide permanence above the 4.010 support level with increasing buyer pressure, it may want to retest the selling pressure at the 4.150 level.

Supports 4.010 – 3.875 – 3.760

Resistances 4.150 – 4.215 – 4.250

SHIB/USDT

When we examine the chart of Shiba Inu (SHIB), we see that the price broke the 0.00001860 support level down. The Williams %R oscillator seems to have broken the -80 level down. In this context, the price may retreat towards the 0.00001810 support level. On the other hand, if the buyer appetite increases after the FED interest rate announcement, the price may want to break the selling pressure at the 0.00001920 resistance level.

Supports 0.00001860 – 0.00001810 – 0.00001765

Resistances 0.00001920 – 0.00002020 – 0.00002065

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.