MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 75,761.89 | 1.15% | 60.34% | 1.50 T |

| ETH | 2,898.58 | 3.09% | 14.06% | 349.35 B |

| SOLANA | 197.78 | 5.40% | 3.76% | 93.44 B |

| XRP | 0.5494 | -1.21% | 1.26% | 31.28 B |

| DOGE | 0.1994 | 3.85% | 1.17% | 29.37 B |

| CARDANO | 0.4290 | 16.23% | 0.60% | 15.04 B |

| TRX | 0.1605 | -0.43% | 0.54% | 13.89 B |

| SHIB | 0.00001912 | 2.88% | 0.45% | 11.33 B |

| AVAX | 27.23 | 0.99% | 0.45% | 11.09 B |

| LINK | 12.70 | 3.02% | 0.31% | 7.98 B |

| DOT | 4.289 | 4.73% | 0.25% | 6.48 B |

*Prepared on 11.8.2024 at 06:00 (UTC)

WHAT’S LEFT BEHIND

FED Interest Rate Decision Announced

The US Federal Reserve (Fed) cut its benchmark interest rate by 25 basis points to a range of 4.50%-4.75%, in line with market expectations. This was the second rate cut in a row. The decision was unanimous with the policy statement largely unchanged. The Fed emphasized the importance of keeping a close eye on its dual target but gave no clear signal on future rate cuts and did not comment on the US election results. In addition, the phrase “more confident that inflation is moving toward target in a sustainable manner” was removed from the policy text

Powell After Interest Rate Decision

Federal Reserve Chairman Jerome Powell said at a press conference that the Fed’s main objective is still to control inflation at the 2% target and that it will not deliberately keep inflation below 2% to compensate for the overshoots of the past few years, the report said. He pointed out that the US economy is currently outperforming the rest of the world, the labor market remains strong and core inflation remains elevated despite easing. The Fed’s current pace of policy remains restrictive, and Powell said it will continue to adjust interest rates cautiously to avoid the economic risks of moving too fast or too slow.

New ATH in Bitcoin

Bitcoin, which broke a record after Republican candidate Donald Trump won the US elections, renewed its record after the Fed cut interest rates. After the Fed cut the policy rate by 25 basis points at its first meeting after the US elections, it rose above 76 thousand 956 dollars and broke a new record.

Ethereum Foundation Publishes 2024 Report

The Ethereum Foundation (EF) has released its 2024 report, highlighting that its core values include long-term thinking, decentralization, and value preservation. According to the report, EF spent $134.9 million in 2023, of which 37.2% was spent on internal operations, 35.2% on supporting the development of new institutions and 25.7% on L1 R&D. EF has assets of $970 million and maintains a conservative financial strategy to respond to market volatility.

MakerDAO voted to change its brand name to “Sky”

According to The Block, MakerDAO has voted to retain its rebranding as “Sky”, part of the “Endgame” plan proposed by founder Rune Christensen, which aims to launch a new stablecoin and establish a “sub-DAO” to build crypto applications and infrastructure. While some members of the community have doubts about the rebranding of the decentralized protocol, only four of the nearly 20 voting organizations control around 80% of the voting power, and all of them support keeping the Sky brand.

Highlights of the Day

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| Banana Gun (BANANA) – 250K Tokens Unlock | |||

| General Event (CRYPTO) – Staking Summit 2024 | |||

| Internet Computer (ICP) – AI Conference, Lisbon, Portugal | |||

| Ethereum (ETH) – Hackathon, Lisbon, Portugal | |||

| 15:00 | US Michigan Consumer Sentiment (Nov) | 71.0 | 70.5 |

| 16:00 | US FOMC Member Bowman Speaks | ||

| 19:30 | US FOMC Member Musalem Speaks |

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

Global markets are preparing to leave behind the most critical week of the year. After a pivotal trading period in which Trump was elected president and the US Federal Reserve (FED) cut interest rates as expected, investors are wondering how the new dynamics will shape asset prices.

We can say that the FED cut interest rates by 25 basis points last night, as expected, and did not make a new and important direction in the statements of Chairman Powell and the monetary policy statement. Nevertheless, it can be said that the FED will have to fight more on inflation with Trump taking over the presidency.

US stock markets were generally higher yesterday on confirmation that the FED is continuing its rate cut cycle, while Asian indices are mixed this morning. Investors, who have not heard details about the expected stimulus from China, are not too keen on the country’s assets and Trump’s presidential win. On the digital assets front, the rise continues in a more conservative tone after Trump’s victory. Bitcoin has renewed its record high with slower moves. The inflow into EFTs seems to continue and yesterday saw record highs in this cash flow.

From the short term to the big picture

The victory of former President Trump, one of the main pillars of our bullish expectation for the long term perspective in digital assets, produced a result in line with our forecasts. The continuation of the Fed’s interest rate cut cycle and the inflows into BTC ETFs, indicating increased institutional investor interest, support our upside forecast for the big picture for now.

In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see some respite or pullbacks in digital assets from time to time. At this point, it is worth reiterating that fundamental dynamics remain bullish. While the expansion of the largest digital currency Bitcoin’s record high may encourage buyers to take new, upside positions, we will watch this group struggle with the crowd that may want to take profit realizations. For now, we see limited pullbacks in the short term, but we consider the possibility of seeing a slowdown after the last strong uptrend as one of the options on the table.

TECHNICAL ANALYSIS

BTC/USDT

The first FED interest rate meeting took place after the US elections. After the meeting, which resulted in a 25 basis point rate cut in line with expectations, Powell appeared in front of the cameras. Emphasizing maximum employment and controlled inflation, Powell said that we will see the data for the December meeting.

In the technical outlook with all these developments, BTC reached the new ATH level of 76,943 after the interest rate decision. The rising wedge pattern is noticeable on the BTC chart, which is currently below 76,000 levels. The correction in BTC, which has tested and exceeded its peaks, may be important for regaining momentum. With technical oscillators giving a sell signal, a downward break of the 75,300 level in case of a pullback may pull the price to 73,789. With the continuation of the optimistic mood on the US side and new developments on behalf of BTC, a new peak attempt above the 77,000 level may occur.

Supports 75,300 – 73,789 – 72,750

Resistances 76,400- 76,943 – 83,060

ETH/USDT

The Trump effect continues in cryptocurrency markets. Yesterday, after the airdrop and listing of Swell, one of the largest Liquid Staking Tokens (LST) protocols, we saw that the volumes on Decentralized Exchanges (DEXs) went very high. Especially the trade volume on Uniswap and the high inflows to the liquidity pools of the SWELL-ETH pair may have also contributed to the rise in the price.

When we examine it technically, we see that ETH has received some reaction from here, with

ETH rising to the level of 2,921. It can be said that investors may face high volatility in this price range as support levels remain well below and the Relative Strength Index (RSI) level is in the overbought zone. The horizontal course of Chaikin Money Flow (CMF) in the positive area and the net positive outlooks on momentum indicate that the persistence above 2.921 may bring rises up to 3.045 and 3.216 levels respectively.

Supports 2,811 – 2,722 – 2,649

Resistances 2,921 – 3,045 – 3,216

LINK/USDT

LINK surpassed the 12.36 resistance with the rise it experienced yesterday. It is seen that Relative Strength Index (RSI), Chaikin Money Flow (CMF) and momentum maintain their positive outlook for LINK, which continues its rise. It can be said that the reaction from this level will be quite decisive for LINK, which has converged to the most important resistance level of 12.98. While the break of the level may continue the positive trend, it may exhibit some correction movement if it cannot break it.

Supports 12.36 – 11.84 – 10.80

Resistances 12.98 – 13.77 – 14.75

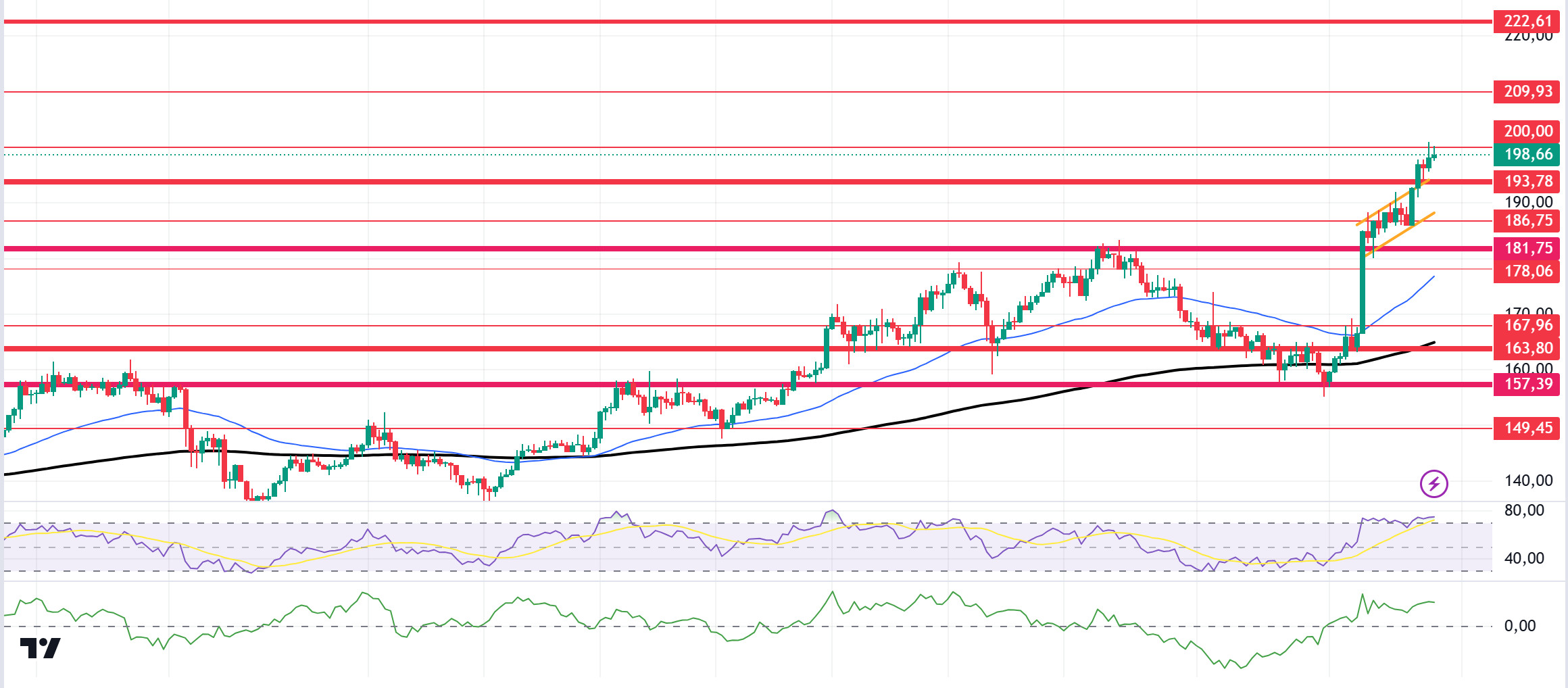

SOL/USDT

The FED cut interest rates by 25 basis points to 4.50-4.75%. Powell said that the risks to the targets remain “roughly balanced”, adding that they need to be careful against inflationary pressures and will do their best not to deviate from the 2% target. In the Solana ecosystem, a short position of 735 million dollars was liquidated in the last 24 hours. Technically, SOL continues to rise. At the time of writing, SOL is trading at 199.50, the highest level it has reached since March. At the same time, it strongly broke the 193.78 level, which we call critical resistance, and ran it as a support level. On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). This could mean that the uptrend will continue. Relative Strength Index (RSI)14 is in the overbought zone, which may bring profit sales. However, when we examine the Chaikin Money Flow (CMF)20 indicator, money inflows are positive, and inflows continue to increase. The 193.78 level stands out as a very strong resistance point in the rises driven by both macroeconomic conditions and innovations in the Solana ecosystem. If it rises above this level, the rise may continue strongly. In case of retracements due to possible political reasons or profit sales, the 181.75 support level may be triggered again. If the price hits this support level, momentum may increase, and a potential bullish opportunity may arise.

Supports 193.78 – 186.75 – 181.75

Resistances 200.00 – 209.93 – 222.61

ADA/USDT

The FED cut interest rates by 25 basis points to 4.50-4.75%. Powell said that risks to the targets remain “roughly balanced” and that they need to be vigilant against inflationary pressures and will do their best to stay within the 2% target. In the Cardano ecosystem, the surge began with the release of Node 10.1, a major upgrade that introduces new governance capabilities and prepares the network for the upcoming Chang 2 hard fork. Node 10.1.1 is the first mainnet node to support the Chang 2 cross-period hard fork, a crucial step in Cardano’s governance evolution. The release also introduces advanced authorization options, allowing share pool operators (SPOs) to authorize predefined voting options. These developments have raised optimism that Cardano’s price could rise in the coming weeks as the network consolidates its infrastructure and prepares for new functionalities. When we look technically, it broke the place where it has been accumulated since October 1 and started its rise. ADA, which has increased by about 17% in the last 24 hours, is trading at 0.4345 at the time of writing. The price is pricing above the 50 EMA (Blue Line) and 200 EMA (Black Line) on the 4-hour chart. However, the 50 EMA has moved above the 200 EMA. This shows us that the trend is bullish. At the same time, when we examine the Chaikin Money Flow (CMF)20 indicator, we can say that there is an excessive flow of money in the positive zone. However, Relative Strength Index (RSI)14 is in the overbought zone, which may bring profit sales. Considering all this, it has made the 0.3905 level support, which works as a strong resistance. The support level of 0.3951 should be followed in the decline that will be experienced due to the macroeconomic data and negativities in the ecosystem or in the retracements brought by profit sales. It may be appropriate to buy when it comes to this price level. In the rises caused by macroeconomic data or developments in the ecosystem, the 0.4656 level should be followed. If it breaks this level, the rise may strengthen.

Supports 0.4155 – 0.4041 – 0.3905

Resistances 0.4285 – 0.4454 – 0.4656

AVAX/USDT

AVAX, which opened yesterday at 27.01, rose by about 1.5% during the day when the FED interest rate cut decision was announced and closed the day at 27.38. There is no planned data to be released by the US today. Therefore, it may be a day when price movement will be limited. News flows from the Middle East will be important for the market.

AVAX, which is currently trading at 27.21, is in the middle band of the bullish channel on the 4-hour chart and the Relative Strength Index value has approached the overbought level with 63. Some decline can be expected from these levels. In such a case, it may test 26.54 support. On the other hand, reports are emerging that the BlackRock tokenization fund BUIDL may be launched in Avalanche. If this situation becomes clear, it may test 28.00 and 28.80 resistances with the voluminous purchases that may occur. As long as it stays above 22.80 support during the day, the desire to rise may continue. With the break of 22.80 support, sales may increase.

Supports 27.20 – 26.54 – 25.71

Resistances 28.00 – 27.20 – 28.00

TRX/USDT

TRX, which started yesterday at 0.1625, fell about 1.5% during the day and closed the day at 0.1601. There is no planned data expected to affect the market today. The market will be closely following the news flows regarding the tension in the Middle East.

TRX, currently trading at 0.1604, is in the middle band of the bearish channel on the 4-hour chart. The Relative Strength Index value has approached the oversold zone with 36 and can be expected to rise slightly from its current level. In such a case, it may move to the upper band of the channel and test the 0.1626 resistance. However, it cannot close the candle above 0.1626 resistance and may test 0.1571 support as a result of selling pressure that may occur with the news of increasing tension from the Middle East. As long as TRX stays above 0.1482 support, the desire to rise may continue. If this support is broken downwards, sales can be expected to increase.

Supports 0.1603 – 0.1571 – 0.1535

Resistances 0.1626 – 0.1641 – 0.1666

DOT/USDT

The Fed cut interest rates by 25 basis points and expressed growing confidence that inflation is moving sustainably towards the 2% target. Technically, we see that Polkadot (DOT) broke the 4.250 resistance level upwards. When we examine the Chaikin Money Flow (CMF) oscillator, we see that it is in the positive area. In this context, if the price maintains above the 4,250 level, it may move towards the next support level of 4,300. On the other hand, if the selling pressure increases, the price may perform a correction towards 4,150 levels.

Supports 4,215 – 4,150 – 4,010

Resistances 4.250 – 4.300 – 4.360

SHIB/USDT

When we examine the chart of Shiba Inu (SHIB), we see that the price broke the 0.00001920 resistance level upwards. The Chaikin Money Flow (CMF) oscillator is positive. In this context, the price may move towards the 0.00002020 resistance level with increasing burn rates. On the other hand, if the price cannot maintain above the 0.00001920 band, it may retreat towards 0.00001860 levels.

Supports 0.00001860 – 0.00001810 – 0.00001765

Resistances 0.00001920 – 0.00002020 – 0.00002065

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.