MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 101,948.53 | 5.47% | 55.22% | 2,02 T |

| ETH | 3,853.39 | 4.34% | 12.72% | 464,77 B |

| XRP | 2.316 | -11.06% | 3.62% | 132,19 B |

| SOLANA | 23.84 | -1.43% | 3.05% | 111,34 B |

| DOGE | 0.4357 | 4.13% | 1.76% | 64,27 B |

| CARDANO | 1.192 | -3.00% | 1.15% | 41,83 B |

| TRX | 0.3285 | -15.60% | 0.78% | 28,37 B |

| AVAX | 51.93 | -4.37% | 0.58% | 21,26 B |

| SHIB | 0.00003140 | 3.29% | 0.51% | 18,50 B |

| DOT | 10.47 | 4.35% | 0.44% | 15,98 B |

| LINK | 23.84 | -2.35% | 0.41% | 14,94 B |

*Prepared on 12.5.2024 at 07:00 (UTC)

WHAT’S LEFT BEHIND

Bitcoin price surpasses 100 thousand dollars

Bitcoin surpassed the critical $100,000 level thanks to the names included in US President Donald Trump’s team for crypto-friendly policies. Breaching this psychological threshold gave the crypto market a huge boost.

Fed Chair Powell: “Bitcoin looks like gold”

Fed Chairman Jerome Powell said that Bitcoin is a speculative asset and more similar to gold. Powell stated that Bitcoin is not a competitor to the dollar and stated that he cannot hold Bitcoin because of his personal identity.

Fed’s Musalem: It may be time to slow rate cuts

Fed official Musalem said rate cuts could be paused and policy options should be kept open. Inflation is expected to converge to 2% in the next two years.

Trump picks crypto-friendly Paul Atkins to head SEC

Donald Trump officially announced his nomination of pro-crypto Paul Atkins for the chairmanship of the Securities and Exchange Commission (SEC). It is stated that Atkins will play an important role in crypto regulations.

Mt. Gox realized $2.4 billion in Bitcoin transfers

According to Arkham Intelligence, bankrupt crypto exchange Mt. Gox transferred 24,000 BTC (about $2.4 billion) to an unknown address just as Bitcoin reached the $100,000 milestone. The purpose of the transfer and the owner of the new address are not yet known.

Crypto trading volume surpassed $10 trillion in November

In November, crypto trading volume reached an all-time high of $10 trillion. On centralized exchanges, spot trading volume increased by 128% and derivatives volume by 89%. The price of Bitcoin rose 38% over the same period.

South Korea postpones crypto earnings tax again

South Korea plans to postpone the 20% crypto earnings tax for another two years. The tax regulation covers earnings over 2.5 million won and this will be the third postponement. The vote is expected to take place today.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| – | GALA (GALA): FILM Release | – | – |

| – | Stellar (XLM): Mainnet Upgrade Vote | – | – |

| – | Taiko (TAIKO): 9.29MM Token Unlock | – | – |

| – | Immutable (IMX): RavenQuest Phase 3 Begins | – | – |

| 13:30 | US Unemployment Claims | 215K | 213K |

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

Digital asset investors are witnessing historic moments. Bitcoin rose above 100,000 for the first time, hitting over 104,000 dollars. The US President-elect Donald Trump’s continued appointments of people who strengthen the possibility of regulation on cryptocurrencies to important positions formed the backdrop for the recent value gains.

The largest cryptocurrency, which retreated in its first rally without seeing six-digit price levels, crossed the barrier this time when Trump announced on social media that he would choose Paul Atkins as the Chairman of the US Securities and Exchange Commission (SEC). “He recognizes that digital assets and other innovations are vital to making America greater than ever,” Trump said of Atkins.

In addition, it was noteworthy that US Federal Reserve Chairman Powell used positive statements for his country’s economy and likened Bitcoin to gold. These evaluations also contributed to the rise in Bitcoin price. Other factors were the inflow of BTC EFTs and statements that some large companies were accumulating BTC as reserves.

Global markets, which started the new week under the shadow of political tensions in the Far East and Europe, are trying to maintain their positive mood in general. There is a mixed picture in Asia-Pacific stock markets and European futures indices. In the rest of the day, we expect the positive mood to continue with intermediate profit realizations in digital assets.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our forecasts. In the aftermath, the president-elect’s appointments to Congress and the increased regulatory expectations for the crypto ecosystem in the US remained in our equation as a positive variable. FED continued its interest rate cut cycle and the volume in BTC ETFs indicates an increase in institutional investor interest (in addition, MicroStrategy’s BTC purchases, Microsoft’s start to evaluate the purchase issue, BlackRock’s BTC ETF options start trading…) supports our upward forecast for the big picture for now.

In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional respite or pullbacks in digital assets. However, at this point, it would be useful to underline again that the fundamental dynamics continue to be bullish.

TECHNICAL ANALYSIS

BTC/USDT

Bitcoin managed to exceed the $100,000 level, which is seen as a critical threshold. US President Donald Trump continues to take pro-crypto steps in line with his election promises. Most recently, his selection of crypto-friendly Paul Atkins to head the SEC had a positive impact on the market, pushing the price of Bitcoin to six-digit levels.Following Trump’s election victory, Bitcoin has gained more than $35,000, an increase of nearly 135% since the beginning of the year. In the three years after the 2021 bull market, BTC’s value increased nearly 6-fold, while in five years, the increase was nearly 20-fold.Bitcoin’s market capitalization also surpassed $2 trillion, overtaking silver as the world’s most valuable asset and moving up to seventh place.

When we look at the technical outlook after historical data, as we stated in previous analyzes, the upward momentum would be supported by the persistence above the 95,000 level. As a matter of fact, with the developments on the fundamental side, the BTC price tested the 104,000 level by crossing the 100,000 level. BTC, which retreated a little with the reverse transactions opened in the futures market after the sharp rise, is currently trading at 101,900. While technical oscillators maintained their buying signals, the momentum indicator also switched to the positive zone. Although we will follow the 105,000 level in the continuation of the rise, the support level we will refer to in a possible correction will be the 100,000 point.

Supports 100,000 -95,000 – 92,500

Resistances 104,000 – 105,000 – 110,000

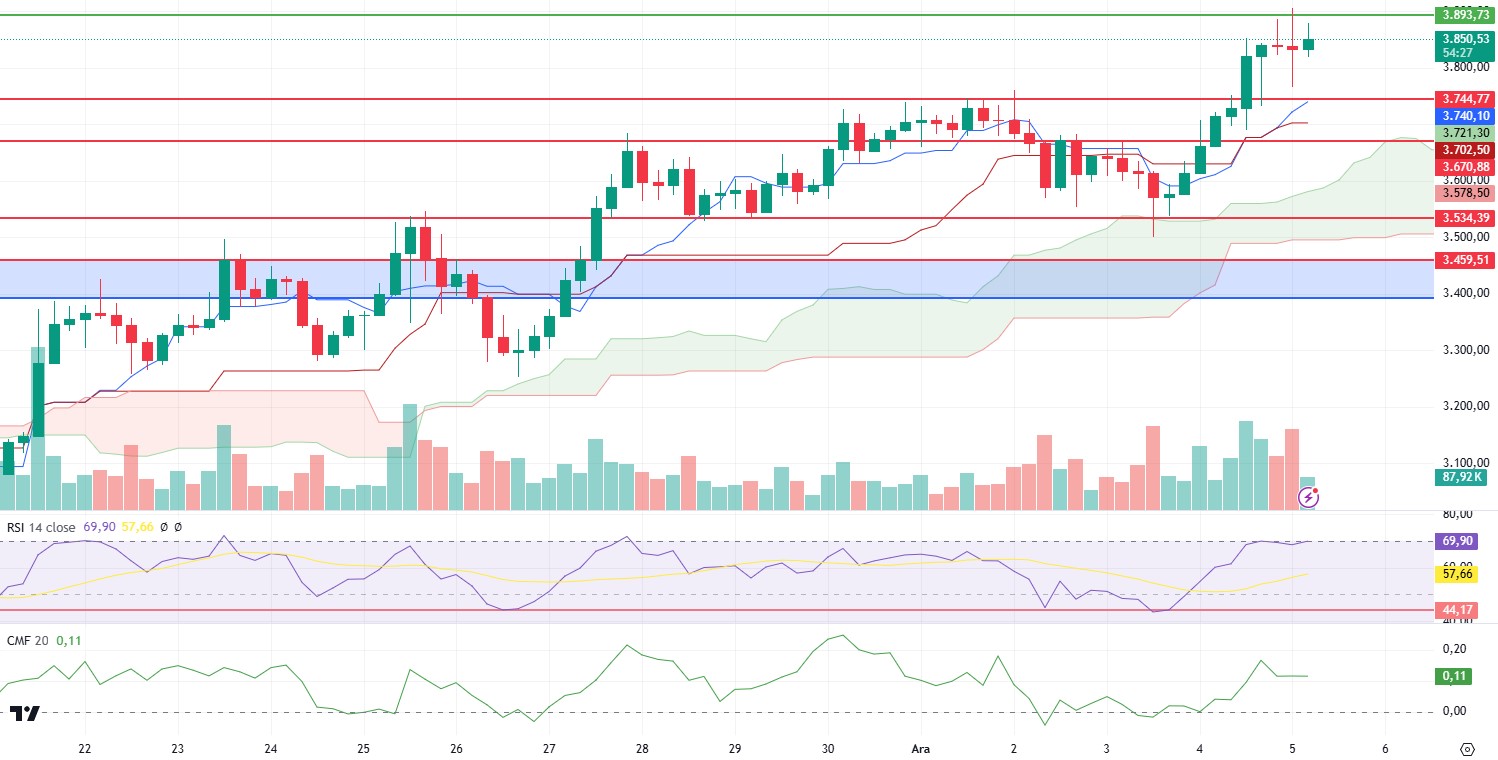

ETH/USDT

As mentioned in the analysis yesterday evening, ETH rose rapidly to 3,839 resistance after gaining the 3,744 level. After receiving a reaction from this level, it has managed to rise above it with momentum. The fact that this rise is realized in volume and is directly proportional to Chaikin Money Flow (CMF) makes ETH look quite bullish. We see that the sell signal formed in ichimoku in the past days has also been eliminated with the tenkan level rising above the kijun level. The rise of the Kumo cloud can be listed as another positive factor. The Relative Strength Index (RSI), which came up to the overbought zone, has moved upwards without negative divergence. After breaking the 3,893 level, it can be said that the price can quickly move up to 4,093. The 3,744 level attracts attention as the main support point. Closures below this region may cause pullbacks to the 3.670 level.

Supports 3,744- 3,670 – 3,534

Resistances 3,893- 4,093 – 4,299

XRP/USDT

XRP fell below its 2.5 main support and retreated to 2.19, as expected, as BTC rose above the $100,000 level last night. It is seen that the Relative Strength Index (RSI) level, which fell below 50 during this decline, started to move upwards again. Chaikin Money Flow (CMF) and momentum are still under downward pressure. The high volume of sales and the relatively lower volume of the reaction indicate that the decline may deepen with the loss of the 2.19 level. Below this level, the price may rapidly decline to 1.87. For the positive scenario, regaining the 2.5 resistance seems to be of great importance.

Supports 2.1982 – 1.8758- 1.2333

Resistances 2.5014 – 2.6971 – 3.105

SOL/USDT

Trump chose pro-crypto Paul Atkins as SEC chairman. On the other hand, Powell said yesterday, “I am very pleased with where we are on monetary policy. The US economy is in remarkably good shape. We have moved very quickly on interest rates, unemployment is still very low and we are making progress on inflation.

Austin Federa, strategy lead at the Solana foundation, has announced his departure to build a new permissionless network protocol. Austin Federa said: “After four years on the Solana project, I have taken a step back and will head a new protocol that sets out to solve a problem at the heart of the internet and high-performance blockchain by building the doublezero protocol. Meanwhile, according to Solscan data, the Solana Web3.js library was compromised in a targeted supply chain attack. The breach led to $160,000 in stolen assets, including SOL tokens and other crypto assets.

The LEFT has no direction to go. The struggle of the bear and the bull continues in the asset. When we look at the last 4 days, it is stuck between the 200 EMA and the falling trend. When we look at the chart, the 50 EMA (Blue Line) is above the 200 EMA (Black Line) in the 4-hour timeframe. Since November 22, SOL, which has been in a downtrend since November 22, continues its horizontal course. Priced at $233.45, the asset has fallen to a market capitalization of about 111.33 billion. When we analyze the Chaikin Money Flow (CMF)20 indicator, it is seen that there is an increase in money inflows. This can be shown as a bullish signal. However, Relative Strength Index (RSI)14 is at neutral level. Another potential directional indicator on the chart, the shoulder head and shoulders pattern, has started to work. This could lead to a decline to 189.54 if the pattern continues to work. On the other hand, although the price started to trend up with support from the 200 EMA, the momentum started to decline. The 247.53 level is a very strong resistance point in the uptrend driven by both macroeconomic conditions and innovations in the Solana ecosystem. If it breaks here, the rise may continue. In case of possible retracements due to macroeconomic reasons or profit sales, the support levels of 209.93 and 189.54 may be triggered again. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 222.61 – 209.93 – 200.00

Resistances 237.53 – 247.53 – 259.13

DOGE/USDT

Trump chose pro-crypto Paul Atkins as SEC chairman. On the other hand, Powell said yesterday, “I am very pleased with where we are on monetary policy. The US economy is in remarkably good shape. We have moved very quickly on interest rates, unemployment is still very low and we are making progress on inflation.

While DOGE prices have remained flat over the past two weeks, whale transactions above $100,000 and $1 million have steadily increased over the past few days. Data from Santiment highlighted that addresses that traded over $100,000 and $1 million collectively purchased more than 240 million DOGE tokens in December. Open Interest reached an all-time high of $4.05 billion on November 24. Since then, OI has fallen to $3.48 billion, but relative participation remains at all-time highs.

When we look at the chart, the asset, which has been in an uptrend since November 11, has risen with support from both the base level of the trend and the 50 EMA. If the upward momentum is strong, the 0.50954 level may be triggered. On the 4-hour timeframe, the 50 EMA (Blue Line) is above the 200 EMA (Black Line). But the gap between the two averages is still too wide. This may cause pullbacks. On the other hand, when we look at the RSI 14 indicator, we see that it is accelerating towards the overbought zone. However, when we examine the Chaikin Money Flow (CMF)20 indicator, we see that there are money outflows. The 0.50954 level appears to be a very strong resistance point in the rises driven by both macroeconomic conditions and innovations in Doge coin. If DOGE maintains its momentum and rises above this level, the rise may continue strongly. In case of retracements due to possible macroeconomic reasons or profit sales, the 0.36600 support level can be triggered again. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.42456 – 0.36600 – 0.33668

Resistances 0.45173 – 0.50954 – 0.55889

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.