Ethereum Total Value Locked

Source: Cryptoquant

The total Ethereum stake decreased by -0.40% (169,840 units) from 34,786,727 on December 5 to 34,616,886 on December 11.

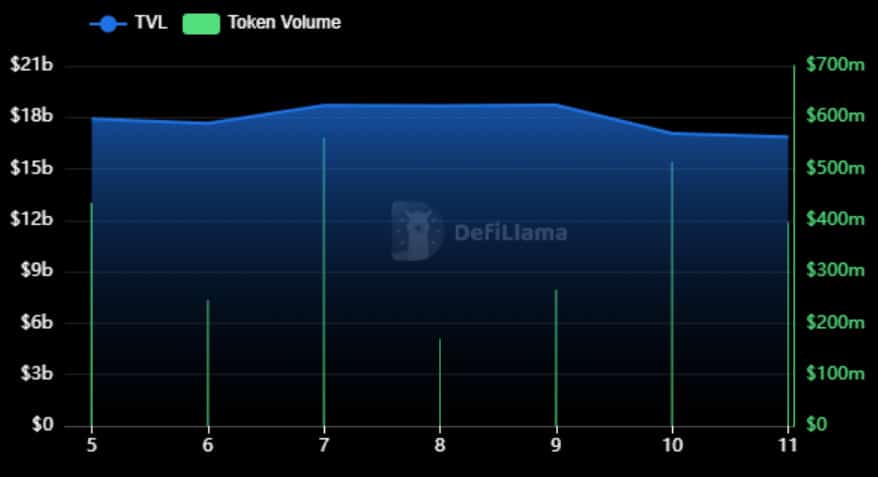

Eigen Layer

On December 11, EigenLayer’s TVL decreased by $1.031 billion (-5.76%) from $17.9 billion on December 5 to $16.869 billion on December 11. Similarly, token trading volume decreased by $68.38 million (-15.76%) from $433.99 million to $365.61 million during the same period.

NETWORK TVL REPLACEMENTS

| Network | December 5 TVL | December 11 TVL | Change (Units) | Change (%) |

|---|---|---|---|---|

| LIDO | 9.85 million | 9.84 million | -0.01M | -0.10% |

| RENZO | 9.85 million | 9.84 million | -0.01M | -0.10% |

| SWELL | 145.62 million | 125.85 million | -19.77M | -13.58% |

| ETHER.FI | 9.762 billion | 9.105 billion | -657.00M | -6.73% |

| PUFFER | 0.15 million | 0.14 million | -0.01M | -4.69% |

General Evaluation

Recent developments in the Ethereum ecosystem suggest that price pressure and staking reductions are having a significant impact on investor behavior. In particular, the price of Ethereum has been on a downward trend for some time, which seems to have led many investors to reduce the amount of ETH they are staking. Price pressure may have prompted investors to look for shorter-term opportunities and increase liquidity. However, the decrease in the amount of ETH staked has not been at high rates. This suggests that investors have not completely lost confidence in long-term investments such as ETH staking but are still affected by market uncertainties and price movements. Furthermore, the decline in the amount staked could mean that investors are only reacting to short-term fluctuations. However, with prices starting to recover, Ethereum staking is likely to increase again. Investors may take the stabilization and increase in prices as an opportunity to increase their staking activity.