Market Compass

Digital Assets Under Pressure, Eyes Turn to Data

While some uncertainties recede, markets continue to focus on new ones. US President Donald Trump’s foreign policy and domestic agenda continue to surprise investors. In the digital asset market, the balancing process within this unpredictable ecosystem continues under the weight of downward pressure.

Trump announced his new US Federal Reserve (Fed) Chair nominee on Friday. Kevin Warsh, who has a more bureaucratic stance than the other candidates mentioned and is not a strong advocate for low interest rates, can be said to have created a somewhat surprising move. However, it may help to allay concerns about the Fed’s independence, at least for a while. Beyond that, the President’s unpredictable personality, coupled with his stance on regions like Greenland and Iran, continues to pose risks for the markets. Furthermore, while the balance sheets released by major US companies pleased investors, concerns over Microsoft’s AI spending emerged as a notable factor influencing market risk appetite.

Following the Federal Open Market Committee’s (FOMC) decision to keep interest rates unchanged, as expected, markets will enter a period with a relatively heavier data flow next week. Indicators providing insights into the health of the U.S. economy will offer clues about the timing of the Fed’s next move. We will detail these data sets below.

Looking at the big picture, we maintain our positive outlook for digital assets and our view of a “search for equilibrium” in the medium term. Although crypto assets started last week with slight gains, they subsequently experienced losses due to uncertainty and a lack of catalysts. We anticipate that in the short term, they will attempt to react to the recent declines.

February 6 – U.S. Employment Data

Employment indicators, which will provide information about the US Federal Reserve’s (FED) possible roadmap for the new year after it decided to end its series of cuts and keep its policy rate unchanged at its last meeting, will be the first important macro data of the new month. These figures, which will be extremely important for global market participants, will be under close scrutiny by investors.

Among the labor market statistics to be released on February 6, the Nonfarm Payrolls (NFP) for January will shed light on the Federal Open Market Committee’s (FOMC) interest rate cut path for this year.

Source: Bloomberg

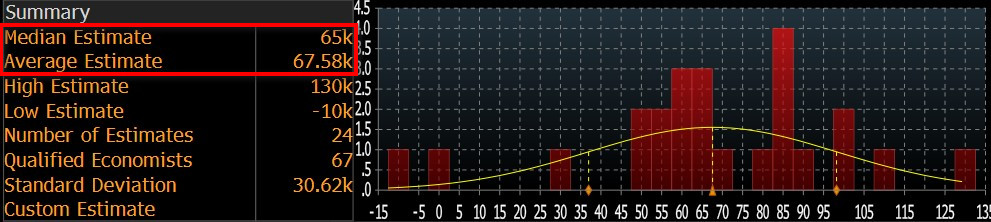

Given the high market sensitivity surrounding the NFP data, our forecast suggests that the U.S. economy may have achieved a higher-than-expected increase in non-farm employment in January. At the time of writing, although the number of forecasts entered is low, we see that the consensus (median forecast) in the Bloomberg survey is around 65,000 (this expectation figure may change later with new forecasts and new surveys, and most likely will change. However, it is still important to see the approximate analyst forecasts and understand market expectations. It would be useful to closely follow Darkex’s weekly newsletters for current forecasts). The average of the forecasts is around 67,500.

Source: Bloomberg

We believe that if January’s NFP data falls below expectations, it could strengthen expectations that the Fed may be more aggressive in lowering interest rates, thereby increasing risk appetite and having a positive impact on financial instruments, including digital assets. We believe that data above expectations could have the opposite effect.

Other Key Macroeconomic Indicators and Developments

February 2 – ISM Manufacturing PMI;

The Purchasing Managers’ Index (PMI) is a diffusion index based on surveys of purchasing managers in the manufacturing industry. Conducted by The Institute for Supply Management (ISM), this survey of approximately 300 purchasing managers asks respondents to assess the relative level of business conditions, including employment, production, new orders, in , prices, supplier deliveries, and inventories. It is usually published monthly on the first business day after the end of the month, with a score above 50.0 indicating that the sector is expanding and below 50.0 indicating contraction. In general, a lower-than-expected ISM Manufacturing PMI is expected to have a positive impact on digital assets by pricing in expectations regarding the monetary policy course of the US Federal Reserve (FED). However, in some cases, it may also lead to pricing based on the strength of the economy. In this case, figures above expectations have a positive effect on digital assets.

February 3 – Job Openings and Labor Turnover Survey (JOLTS);

Shows the number of job openings during the reported month, excluding the agricultural sector. This JOLTS data is closely monitored as job creation is an important leading indicator of consumer spending, which accounts for a large share of overall economic activity. It is released monthly and approximately 35 days after the end of the month. A lower-than-expected release is expected to have a positive impact on cryptocurrencies.

February 4 – ADP Non-Farm Employment Change;

shows the estimated change in the number of people employed in the previous month, excluding the agricultural sector and government, by analyzing payroll data from more than 25 million workers to obtain estimates of employment growth by Automatic Data Processing, Inc (ADP). It usually gives a hint of employment growth 2 days before the employment data released by the government. Typically, lower-than-expected ADP data has a positive impact on digital assets.

February 5 – Initial Jobless Claims;

This shows the number of people who filed for unemployment insurance for the first time during the previous week and is published weekly, usually on the first Thursday after the week ends. Although it is a lagging indicator, the number of unemployed is considered an indicator of overall economic health because consumer spending is highly correlated with labor market conditions. Market impact can vary from week to week, and market participants tend to focus more on this data when they are more sensitive to recent developments or when macro indicators related to the labor market are at extreme levels.

February 6 – US Preliminary UoM Consumer Sentiment;

This is a survey conducted by the University of Michigan (UoM) with approximately 420 consumers, asking respondents to assess the relative level of current and future economic conditions. Financial confidence is a leading indicator of consumer spending, which accounts for a large share of overall economic activity. It has two cycles, 14 days apart, called Preliminary and Revised. The “Preliminary” is usually relatively more influential on prices and is published monthly in the middle of the current month. If the actual data comes in below expectations, it can have a positive impact on cryptocurrencies.

Important Economic Calendar Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for any changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

Legal Notice

The investment information, comments, and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in outcomes that align with your expectations.