MARKET COMPASS – February 13–20, 2026

When will the “Worst” Be Behind Us?

In global markets, concerns that Artificial Intelligence (AI) companies may be overvalued continue to surface at certain times, affecting asset prices. Of course, this pricing behavior emerges as one of the main dynamics of value changes across a wide range of instruments, from bonds to stocks, currencies to digital assets.

In fact, it would be incorrect to attribute recent pricing trends solely to AI companies. Expectations regarding the US Federal Reserve’s (FED) interest rate cut trajectory (which indirectly affects perceptions of highly leveraged technology companies), geopolitical risks, the stance of the US administration, and the trajectory of macroeconomic indicators continue to influence investors’ future expectations and investment horizons.

Digital assets continue to suffer from a lack of catalysts due to the sector’s inherent lack of new news flow, while also feeling the effects of risk-averse behavior in global markets. Consequently, we are not seeing a recovery period following the recent losses in cryptocurrencies, particularly Bitcoin. Although we see intermittent reactions, these do not produce lasting impact models indicating a healthy new upward trend.

Following last week, which saw the release of US employment and inflation data, next week will again focus on macro indicators related to the health of the world’s largest economy. We will examine these developments and data in detail below, as they could influence expectations regarding the timing of the Fed’s next interest rate cut.

Let’s return to the title of this section. If we evaluate the value of Bitcoin and digital assets specifically, we can say that signs that the worst is behind us are not yet clear, but we are seeing evidence that the storm has (for now) subsided. We will see whether this lull is the calm before a new storm or a phase of gathering strength before a recovery phase. Our prediction is that next week, volatility may increase at times, within very short periods, but the period of stabilization will continue. In other words, although prices may deviate from averages from time to time, they seem likely to trend back towards these averages.

February 16 – U.S. Markets Closed

U.S. markets will be closed on Monday for Presidents’ Day. As this carries the risk of creating low and erratic volatility in global markets, investors would be wise to be cautious of potential sharp price movements on the first trading day of the week.

February 18 – FOMC Minutes

The US Federal Reserve (FED) holds eight Federal Open Market Committee (FOMC) meetings each year and publishes the minutes three weeks after each meeting. As a detailed record of the FOMC meeting, they allow us to see what economic and financial factors were at play when voting to set interest rates and can provide clues about the FED’s next move. A more “hawkish” stance than expected could put pressure on digital asset prices, while minutes with relatively “dovish” messages could support gains.

February 20 – FED’s Favorite Inflation Indicator PCE

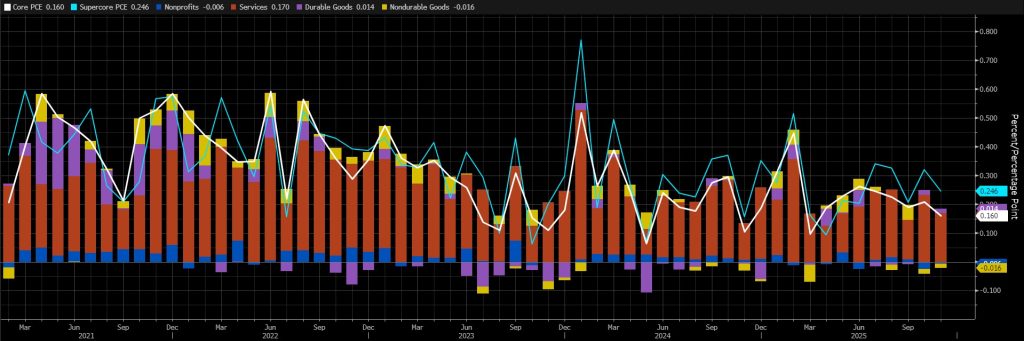

In 2026, markets seeking clues about the Federal Open Market Committee’s (FOMC) interest rate cut path will closely monitor the December Personal Consumption Expenditures (PCE) data. This indicator is known as the inflation gauge preferred by FOMC officials to track changes in inflation. Although it provides delayed information compared to the Consumer Price Index (CPI) data, it is an influential data point in market prices as it is the Federal Reserve’s benchmark inflation indicator.

Source: Bloomberg

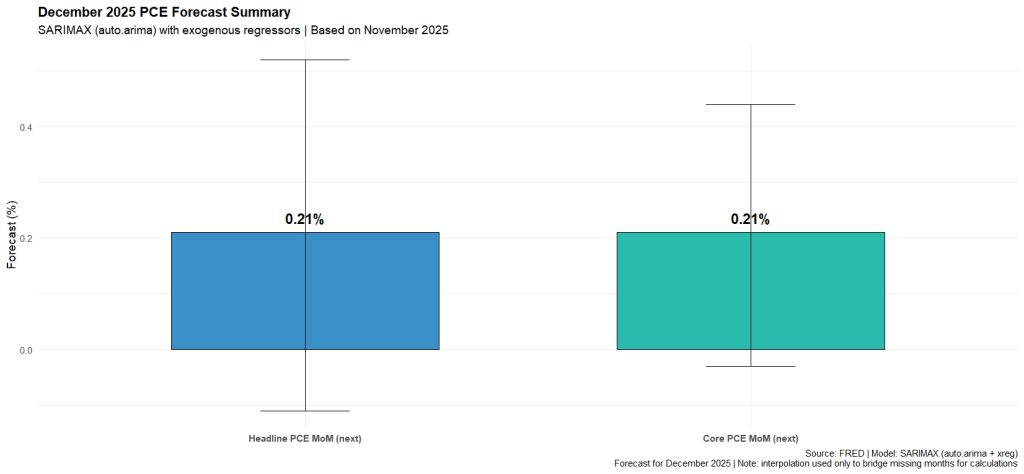

According to data released by the Bureau of Economic Analysis (BEA) with a delay due to the government shutdown, the U.S. personal consumption expenditure price index (PCE), excluding food and energy, rose 0.2% month-on-month in November 2025, unchanged from its pace in October and in line with market expectations. On an annual basis, core PCE inflation rose from 2.7% in October to 2.8% in November, in line with market expectations. Our forecast model, using the latest inputs, projects a 0.21% increase in core PCE on a monthly basis for December.

Source: Darkex Research

Data coming in above market expectations could support expectations that the Fed may be cautious about interest rate cuts, reducing risk appetite and putting pressure on digital assets. Data coming in below expectations, on the other hand, could have the opposite effect and pave the way for gains.

February 20 – US GDP Change

The GDP data, which will show us how much the world’s largest economy grew in the last three months of the past year, will be the first estimate released by the Bureau of Economic Analysis (BEA) for the quarter in question. Of course, it will be closely watched by global markets and will be one of the indicators that determine the level of risk appetite among investors.

As can be seen in the chart below, we are seeing fluctuations in GDP in recent periods. The policies of US President Donald Trump on tariffs and the resulting uncertainty, which has influenced the behavior of economic decision-makers, play a significant role in this. The changes in the Net Exports item in the first and second quarters of 2025 reflect this. With these changes in the item, the US economy contracted by 0.6% in the first quarter of the year and grew by 3.8% in the second quarter. This figure marked the highest economic expansion seen since the 4.7% growth in the third quarter of 2023. According to the latest data, the country’s economy managed to grow by 4.4% in the third quarter of the year.

Source: Bloomberg

The new data to be released will be the first figures we see for the last quarter of the year. Our prediction is that the “deferred demand” that caused the contraction in the first quarter of the year will continue to drive higher-than-normal growth momentum in subsequent quarters, and that growth momentum will be maintained, albeit not as much as we saw in the third quarter.

In terms of the immediate market reaction, we believe that data above consensus expectations could increase risk appetite and have a positive impact on digital assets. Conversely, GDP data below expectations could have a negative impact from this perspective.

Other Key Macroeconomic Indicators and Developments

February 17– U.S. Empire State Manufacturing Index; a diffusion index based on manufacturers participating in a survey in New York State. Published monthly around the middle of the current month, a reading above 0 indicates improving conditions, while a reading below 0 indicates deteriorating conditions. It covers approximately 200 manufacturers in New York State and is compiled from a survey asking participants to assess the relative level of general business conditions. Data above expectations may have a positive impact on digital assets.

February 18 – U.S. Durable Goods Orders shows the change in the total value of new purchase orders placed with manufacturers for durable goods. This data is usually revised with the Factory Orders report released about a week later and “Durable Goods” are defined as products that last longer than 3 years, such as automobiles, computers, appliances, and airplanes. It is a leading indicator of production and provides a preliminary indication of the economy’s vitality. Core Durable Goods Orders shows the change in the total value of new purchase orders placed with manufacturers for durable goods, excluding transportation items. This dataset has been shown to have complex effects on the value of digital assets.

February 19 – U.S. Initial Jobless Claims; This shows the number of people who filed for unemployment insurance for the first time during the previous week and is published weekly, usually on the first Thursday after the weekends. Although it is a lagging indicator, the number of unemployed is considered an indicator of overall economic health because consumer spending is highly correlated with labor market conditions. Market impact can vary from week to week, and market participants tend to focus more on this data when they are more sensitive to recent developments or when macro indicators related to the labor market are at extreme levels.

February 20 – The U.S. Flash Manufacturing PMI is a leading indicator of economic health. Businesses react quickly to market conditions, and purchasing managers have perhaps the most up-to-date and relevant estimate of the company’s outlook for the economy. The Purchasing Managers’ Index (PMI) is a survey of nearly 800 purchasing managers that asks respondents to assess the relative level of business conditions, including employment, production, new orders, prices, supplier deliveries, and inventories. A reading above 50.0 indicates that the sector is expanding, while a reading below 50.0 indicates contraction. There are two versions of this report, Flash and Final, published about a week apart. The Flash version is released on a preliminary and monthly basis, approximately 3 weeks into the current month. A reading below the forecast is expected to produce a positive result for crypto assets.

Important Economic Calendar Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for any changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

Legal Notice

The investment information, comments, and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in outcomes that align with your expectations.