Risk Aversion and Historic Losses in Digital Assets

We are experiencing a period of historic losses in global markets and digital assets. This time, while rising geopolitical tensions due to Iran-US tensions had a limited impact on asset prices, US investors’ growing concerns about the future of AI companies and the questioning of Trump’s nominee for the US Federal Reserve (Fed) chairmanship were the main dynamics negatively affecting risk appetite.

Trump, who strongly advocates for lower interest rates, announced that he would nominate Kevin Warsh, known for his distanced stance on loose monetary policies, which seems to reduce the likelihood of the FED pursuing a path of rapid interest rate cuts next year. However, this remains highly uncertain. Furthermore, concerns about the financial health of large companies continuing to burn cash in the race to capture a significant share of the AI market, coupled with Trump’s surprise nominee, have prompted investors to remain cautious. While Bitcoin and other digital assets recorded significant losses, declines in gold and precious metals also reached notable levels.

The outcomes of the rebalancing transformations in their portfolios by the large investor group pricing the best-case scenario, in response to the new information flows in the key variables mentioned above, have led to profound changes in many financial instruments. Furthermore, the government shutdown, albeit for a very short period, and the disruption in macro data flows have forced investors to remain somewhat myopic.

Over the coming week, we will be closely monitoring the course of Iran-US talks in terms of geopolitical risks. The possibility of Trump ordering an attack on Iran remains a significant risk. In addition, we will be closely watching macro indicators that will provide information about the Fed’s interest rate cut path. The delayed labor market statistics and inflation data will be critical and will provide clues as to whether the markets will find the courage to expect a new flow of liquidity that could stem the bleeding.

February 8 – Japan Lower House Elections

In Japan, the world’s third-largest economy with a currency that holds sway in global markets, voters will head to the polls at the end of the first week of the new year. This decision was made by Japan’s new Prime Minister Sanae Takaichi on January 23, and the Prime Minister dissolved the Lower House and announced early elections on February 8.

There is speculation that Takaichi’s move aims to strengthen the ruling Liberal Democratic Party (LDP) and the coalition’s power in parliament by capitalizing on her party’s high approval ratings. Although the Lower House’s term is set to continue until October 2028, it remains to be seen whether this is a logical move for approval or a risky decision taken prematurely. Takaichi is a popular figure, but the LDP’s power is being questioned. Following the surprise alliance between the main opposition party and the former LDP coalition partner, the opposition has grown stronger, and Takaichi’s early move could lead to an unexpected surprise, as reported in the global press.

The recent fluctuations in the Japanese currency and bonds have been felt across all markets due to the interconnectedness brought about by globalization. Therefore, the outcome could also impact the digital asset market. While we do not anticipate it causing profound changes, it would be prudent to be prepared for potential surprise election results. Takaichi stands out as a pro-monetary easing administrator. In response to the side effects of this , the Bank of Japan (BoJ) is making some moves with its monetary policy tools, and there are price movements indicating that the BoJ is close to a new interest rate hike this year. A possible surprise from the Lower House election results could pose obstacles to Takaichi achieving his policy goals. It also carries the potential to create political uncertainty. It will be difficult to gauge the impact of these factors on the yen. However, if the country’s currency continues to lose value, fragile confidence could be tested again, and we may see pressure on global markets.

February 11 – Critical and Delayed US Employment Data

Employment indicators, which will provide information about the possible roadmap for the US Federal Reserve (Fed) in the new year after it decided to end its series of cuts and keep its policy rate unchanged at its last meeting, will be the first important macro data of the new month. These figures, which will be extremely important for global market participants, will be closely scrutinized by investors. Due to the government shutdown, the employment data in question will be released with a five-day delay.

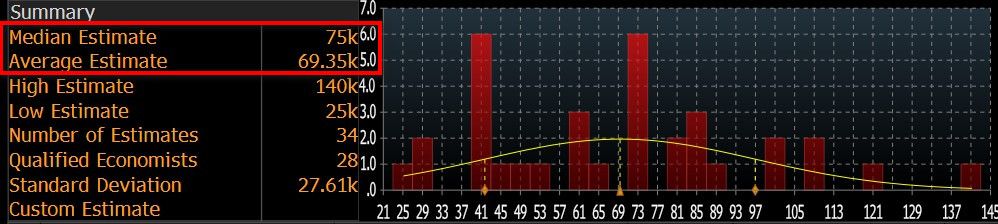

Among the labor market statistics to be released on February 11, the Nonfarm Payrolls (NFP) for January will shed light on the Federal Open Market Committee’s (FOMC) interest rate cut path this year.

Source: Bloomberg

Our forecast for the highly market-sensitive NFP data is that the U.S. economy may have achieved higher-than-expected employment growth in non-farm sectors in January. At the time of writing, we see that the consensus (median forecast) in the Bloomberg survey is around 75,000 (this expectation figure may change later with new forecasts and new surveys, and most likely will change. However, it is still important to see the approximate analyst forecasts and understand market expectations. The average of the forecasts is around 69,300.

Source: Bloomberg

We believe that if January’s NFP data falls below expectations, it could strengthen expectations that the Fed may be more aggressive in lowering interest rates, thereby increasing risk appetite and having a positive impact on financial instruments, including digital assets. We believe that data above expectations could have the opposite effect.

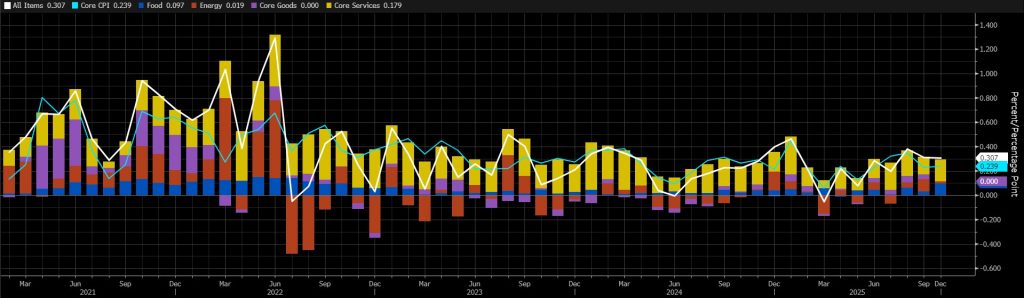

February 13 – US Consumer Price Index: CPI

One of the key macro indicators that could provide insight into the Federal Reserve’s (Fed) interest rate cut path will be January inflation, specifically the change in the Consumer Price Index (CPI). Fed Chair Powell has been relatively more optimistic about inflation in his recent statements. However, we believe that it is still difficult to measure price increases resulting from tariffs. That said, it should be noted that we do not have deep concerns about inflation being passed on to consumers due to increased customs tariffs.

Source: Bloomberg

The Bureau of Labor Statistics (BLS) did not publish indicators for October and November because it was unable to collect data for the October 2025 period due to the government shutdown. U.S. consumer prices rose 0.3% month-on-month in December 2025, meeting market expectations. Core CPI, excluding food and energy, rose 0.2%, slightly below expectations of 0.3%. Our forecast is that, although we may see a decline in annual headline inflation, the monthly CPI data for January could come in at 0.41%, slightly above market expectations.

A CPI figure below market expectations could be interpreted as giving the Fed more leeway on interest rate cuts, which could have a positive impact on digital assets. A figure exceeding expectations, on the other hand, could reinforce expectations that the Fed might hesitate to implement another interest rate cut ( ), potentially putting pressure on the market.

Other Key Macroeconomic Indicators and Developments

February 10 – US Retail Sales Data; It is an important measure of consumer spending, which accounts for a large part of overall economic activity. It shows the change in the total value of retail-level sales and is published monthly, about 16 days after the end of the month. A separate measure of the change in the total value of retail-level sales excluding automobiles is called core retail sales. The retail sales data set is generally expected to have a positive impact on digital assets if it is below expectations.

February 12 – US Initial Jobless Claims; This shows the number of people who filed for unemployment insurance for the first time during the previous week and is published weekly, usually on the first Thursday after the week ends. Although it is a lagging indicator, the number of unemployed is considered an indicator of overall economic health because consumer spending is highly correlated with labor market conditions. Market impact can vary from week to week, and market participants tend to focus more on this data when they are more sensitive to recent developments or when macro indicators related to the labor market are at extreme levels.

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for any changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

Legal Notice

The investment information, comments, and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in outcomes that align with your expectations.