MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 95,907.57 | -0.48% | 54.37% | 1,90 T |

| ETH | 3,648.02 | -1.06% | 12.60% | 440,28 B |

| XRP | 2.673 | 9.77% | 4.39% | 153,55 B |

| SOLANA | 227.66 | -0.39% | 3.12% | 109,16 B |

| DOGE | 0.4190 | -4.23% | 1.78% | 62,20 B |

| CARDANO | 1.282 | 11.11% | 1.30% | 45,34 B |

| AVAX | 51.34 | 6.55% | 0.61% | 21,21 B |

| TRX | 0.2293 | 8.72% | 0.57% | 20,01 B |

| SHIB | 0.00002977 | -1.41% | 0.50% | 17,60 B |

| LINK | 24.80 | 26.02% | 0.45% | 15,65 B |

| DOT | 10.040 | 9.47% | 0.44% | 15,48 B |

*Prepared on 12.3.2024 at 07:00 (UTC)

WHAT’S LEFT BEHIND

US Government Transferred 20,000 BTC to a Centralized Exchange

The US government transferred 19,800 Silk Road-linked BTC worth approximately $2 billion to a centralized exchange through an intermediary address. This transaction is considered a preparation for the sale of confiscated Bitcoins. In 2022, the Justice Department seized more than 50,000 Bitcoins and announced plans to sell these assets in bulk. The US government still holds approximately $18 billion worth of seized crypto assets.

Fed Rate Cut Likelihood Rises

According to CME’s “Fed Watch” report, the probability of a 25 basis point rate cut by the Fed in December has increased to 74.5%. While the probability of keeping the current interest rate unchanged is projected at 25.5%, the probability of a 25 basis point cut by January 2025 is 65.1% and the probability of a 50 basis point cut is 14.3%.

Nano Labs Plans $50 Million Bitcoin Purchase

Crypto mining chip design company Nano Labs (Nasdaq: NA) announced plans to buy and hold $50 million worth of Bitcoin over the next five years. Nano Labs announced in November that it would accept payments in Bitcoin.

Genius Group Increases Bitcoin Reserves to 172 BTC

Artificial intelligence company Genius Group Limited (NYSE American: GNS) increased its Bitcoin holdings by $1.8 million, reaching a total of 172 BTC. The total value of the company’s Bitcoin reserves is currently $15.8 million, with an average net cost per Bitcoin of $92,006.

XRP ETF Application from WisdomTree

WisdomTree has filed an S-1 application with the US Securities and Exchange Commission (SEC) for an XRP-based exchange-traded fund (ETF) that will trade on the Cboe BZX Exchange, Inc. If the application is approved, the fund could be the first XRP spot ETF listed in the US

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| All Day | Ethena (ENA): 12.86MM Token Unlock | – | – |

| All Day | FLOKI (FLOKI): MONKY Launch | – | – |

| All Day | LTO Network (LTO): Universal Wallet | – | – |

| All Day | PancakeSwap (CAKE): Reward Distribution | – | – |

| 15:00 | US JOLTS Job Openings (Oct) | 7.51M | 7.44M |

| 17:35 | US FOMC Member Kugler Speaks | – | – |

| 20:45 | US FOMC Member Goolsbee Speaks | – | – |

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

On the second trading day of the week, expectations regarding the interest rate cut course of the US Federal Reserve (FED) are mostly determining asset prices in global markets. FED official Christopher Waller gave messages that a new interest rate cut in December was imminent. In addition, Gongsheng, the Governor of the People’s Bank of China (PBOC), which manages the monetary policy of the world’s second largest economy, stated that they will continue to support the economy.

Trump’s statements on tariffs had a dampening effect on risk appetite yesterday. While the dollar rose with these statements, it continues its upward trend again. In addition, hints from FED officials that the policy should continue to loosen next year seem to have supported the risk appetite in global markets.

Asian stock markets have a positive outlook this morning. On the European front, there is a tendency to control the futures, indicating that the positive perception from Asia will not last with the fear that the political tension in France may spread to the continent. Major digital assets have seen sideways price changes in recent days and we can say that cryptocurrencies are looking for a new catalyst in the short term for a new uptrend. Speaking for the smaller picture, we could see more pressure during European trading and a recovery effort during the US session. Today, the JOLTS data from the US and the statements of FED officials are the dynamics that may affect prices on the macro side.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our forecasts. In the aftermath, the president-elect’s appointments to Congress and the increased regulatory expectations for the crypto ecosystem in the US remained in our equation as a positive variable. Although Powell gave cautious messages in his last speech, the fact that the FED continued its interest rate cut cycle and the volume in BTC ETFs indicates an increase in institutional investor interest (in addition, MicroStrategy’s BTC purchases, Microsoft’s start to evaluate the purchase issue, BlackRock’s BTC ETF options start trading …) supports our upward forecast for the big picture for now.

In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional respite or pullbacks in digital assets. However, at this point, it would be useful to underline again that the fundamental dynamics continue to be bullish.

TECHNICAL ANALYSIS

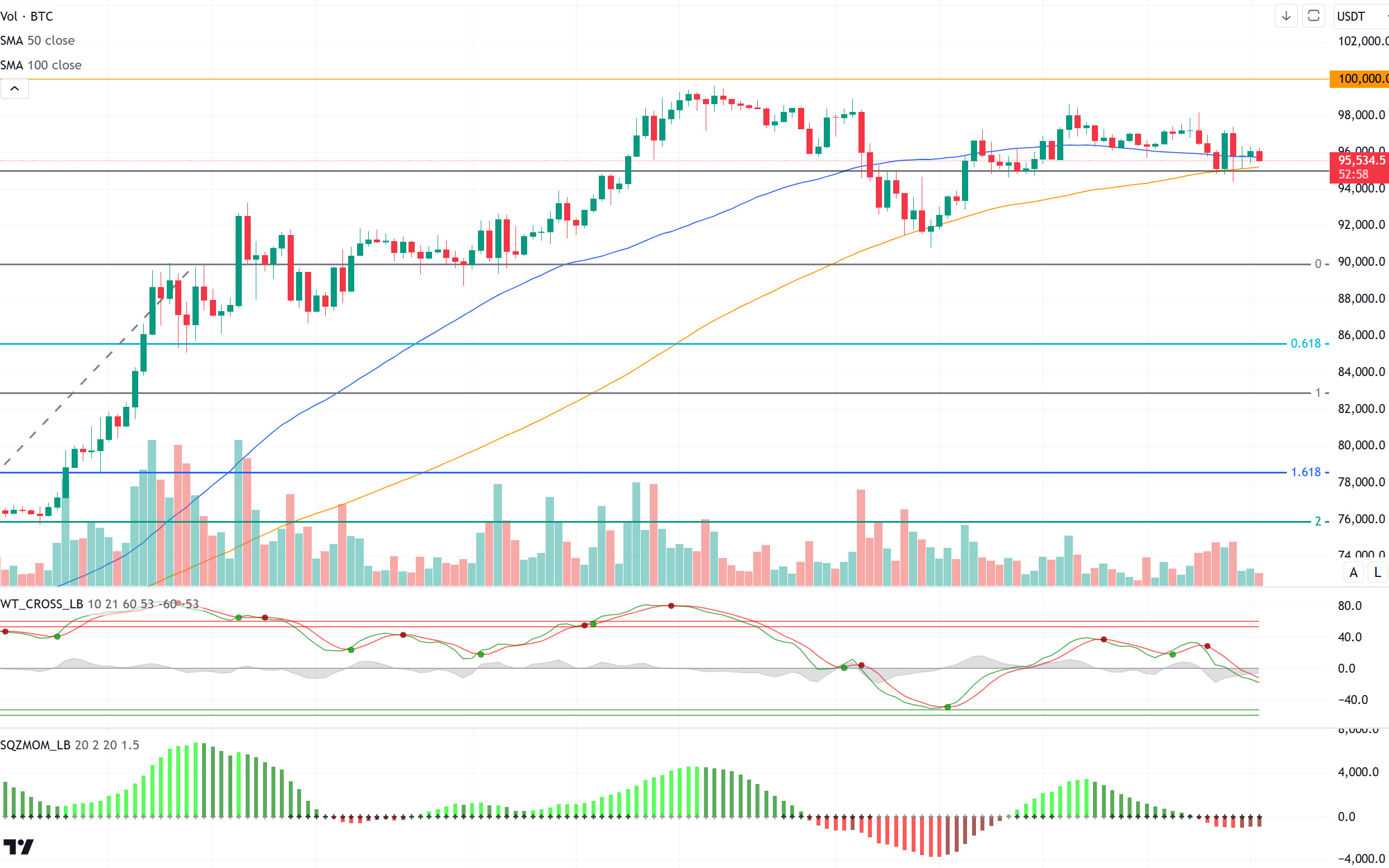

BTC/USDT

Crypto assets recorded inflows totaling $270 million last week, bringing total inflows this year to a record high of $37.3 billion. Bitcoin saw outflows of $457 million for the first time since early September, according to CoinShares data. These outflows were driven by profit sales that took place after Bitcoin approached the psychological limit of $100,000.

When we look at the BTC technical outlook after the fund flow data, we see that the price has settled above the 50 and 100-day SMA lines again. The price, which tested the 95,000 support level from time to time yesterday, turned its direction up again. In BTC, which is currently trading at 95,500, technical oscillators may replace the sell signal with a buy signal during the day. As a matter of fact, the momentum indicator is regaining strength with BTC spot ETF positive entries. If it catches an uptrend, we will first watch the minor resistance level of 97,000 to be crossed. Otherwise, with the transfer of 19,800 BTC from the US front to a centralized exchange, the break of the 95,000 support level may increase the selling pressure.

Supports 95,000 – 92,500 – 90,000

Resistances 99,655 – 100,000 – 105,000

ETH/USDT

ETH continues to price above the 3,600 level after yesterday’s decline. Although it tried to rise above the 3,657 tenkan level again during the night hours, it continues to decline with the reaction it received from here. We see that Chaikin Money Flow (CMF) and momentum continue to be slightly negative. Relative Strength Index (RSI) continues its horizontal movement with the decline. When we look at the Cumulative Volume Delta (CVD), we see that spot purchases are quite high, but the funding rate is still above 0.04, which can be considered as one of the negative factors. If we interpret with all this data, it can be said that ETH can rise up to 3,744 levels during the day, with ETH gaining the 3,657 level. While 3,534 remains the main support, it may find strong support if the price falls to this level.

Supports 3,534 – 3,459 – 3,393

Resistances 3,657- 3,744 – 3,839

XRP/USDT

XRP surpassed the 2.5 psychological resistance after the rise it experienced yesterday and managed to rise up to 2.87. XRP, which retreated to the 2.5 level, is trying to maintain this level. The Relative Strength Index (RSI), which has been in the overbought zone for a long time, exits this region and the decline in Chaikin Money Flow (CMF) indicates that the correction may continue for some more time or we may see horizontal movements above the 2.5 level. New highs could be seen if the price stays above this level. However, a downside break of the level may weaken the momentum and mean that the correction may continue for a while.

Supports 2.5014 – 2.1982 – 1.8758

Resistances 3.105

SOL/USDT

According to Coinglass, while whales and institutions have shown strong confidence and interest in the asset, spot inflow/outflow data witnessed a significant SOL outflow worth $159 million in the last four days. This could be seen as a bullish sign.

On the 4-hour timeframe, the 50 EMA (Blue Line) is above the 200 EMA (Black Line). Since November 22, SOL, which has been in a downtrend since November 22, broke the downtrend last week and moved upwards. However, this did not last long, and it rejoined the downtrend. However, when we examine the Chaikin Money Flow (CMF)20 indicator, it is seen that there is an increase in money inflows. This can be shown as a bullish signal. However, Relative Strength Index (RSI)14 is at neutral level. Another potential directional indicator on the chart is the shoulder-head-shoulder pattern. If this pattern works, there may be a decline to 189.54. On the other hand, the price received support from the 200 EMA. If it breaks it, the declines may deepen. The 247.53 level is a very strong resistance point in the uptrend driven by both macroeconomic conditions and innovations in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements due to possible macroeconomic reasons or profit sales, support levels 209.93 and 189.54 may be triggered again. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 222.61 – 209.93 – 200.00

Resistances 237.53 – 247.53 – 259.13

DOGE/USDT

The US government’s efforts to curb money laundering are failing and public funds are being misused, says Brian Armstrong, chairman of a central exchange. In a post on social media platform X, Armstrong says US anti-money laundering policies should be reviewed by the Department of Government Efficiency (DOGE), a new agency proposed by President-elect Donald Trump that aims to reduce government waste.

In the Solana ecosystem, more than 439 million Dogecoins (DOGE) were moved in the last 24 hours. This can be interpreted as whales preparing for market changes or taking precautions for the next price movement. There has also been a notable increase in daily active addresses, exceeding 1.6 million. This is a significant increase compared to the stagnant activity levels seen earlier in the year. Whale activity is also on the rise.

When we look at the chart, the asset, which has been in an uptrend since November 11, has risen with support from both the base level of the trend and the 50 EMA. If the upward momentum is strong, the 0.50954 level may be triggered. On the 4-hour timeframe, the 50 EMA (Blue Line) is above the 200 EMA (Black Line). But the gap between the two averages is still too wide. This may cause pullbacks. On the other hand, when we look at the RSI 14 indicator, it is also at the neutral level. However, when we examine the Chaikin Money Flow (CMF)20 indicator, we see that there are money outflows. The 0.50954 level appears to be a very strong resistance place in the rises driven by both macroeconomic conditions and innovations in Doge coin. If DOGE maintains its momentum and rises above this level, the rise may continue strongly. In case of retracements due to possible macroeconomic reasons or profit sales, the 0.36600 support level can be triggered again. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.36600 – 0.33668 – 0.28164

Resistances 0.42456 – 0.45173 – 0.50954

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.