MARKET COMPASS

Digital assets are going through another challenging week, as is the case for traditional markets. Trump’s actions and statements on tariffs, as well as his decision to bring delegations to Riyadh for peace talks with Russia over Ukraine, bypassing Europe and even Ukraine itself, have received widespread coverage. The new US President continues to govern in an unpredictable manner. The European continent is not very happy about this situation. Germany, the continent’s largest economy, is going to the polls this Sunday. While the anti-immigrant Friedrich Merz is expected to be the next prime minister of Germany, it remains to be seen how he will deal with Trump’s threat of import tariffs if elected. The election results will be important not only for Germany but for the whole of Europe.

Developments in the US economy continue to drive all financial asset prices without exception. Apart from Trump’s governance style, the health of the US economy and the expectations on how the US Federal Reserve (FED) will shape its monetary policy in the face of it remain important. The macro agenda, which took a back seat last week due to the tariffs and the talks in Riyadh, is likely to be more closely monitored this week with growth and inflation data such as the PCE Price Index. Therefore, we think it is appropriate to open a separate parenthesis for these indicators that may affect market expectations and price changes.

The Problem of Economic Growth in the US

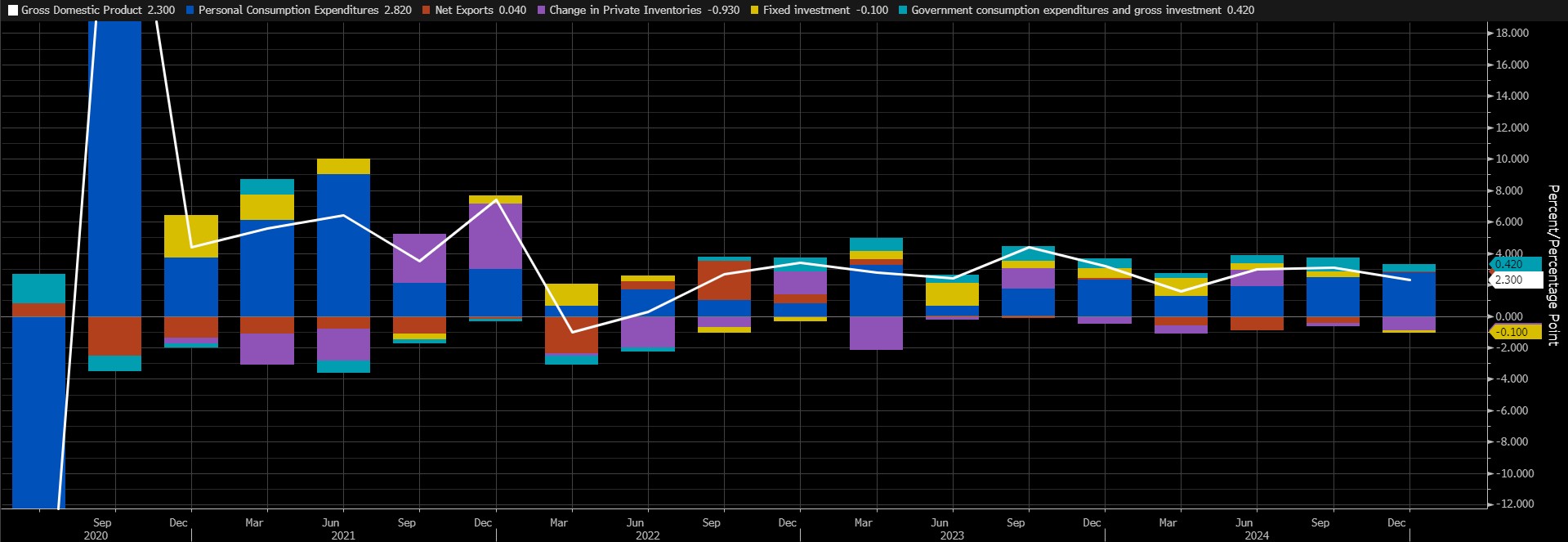

The world’s largest economy grew at an annualized rate of 2.3% in Q4 2024, the slowest pace in three quarters and a more conservative pace of growth than the 3.1% in Q3 and the 2.6% forecast. The new data to be released on Thursday will be the Bureau of Economic Analysis’ second estimate for the final quarter of last year. According to data from Bloomberg, no change is expected from the first published figure of 2.3%.

Source: Bloomberg

In the first data released for this quarter, personal consumption expenditures, which are the driving force of the US economy, were again the largest contributor to economic growth. We do not expect a significant change in this. We also do not think that we will see a significant deviation from the median forecast of 2.3%. Although it is fair to say that the first quarter growth data will be more important in the coming months, it is worth noting that a potentially large revision in the GDP data to be released this week could affect pricing behavior.

At this stage, there are two possible scenarios. We believe that a GDP growth figure that is slightly above or slightly below forecasts will drive expectations regarding the monetary policy of the US Federal Reserve (FED). In this context, a GDP data slightly below forecasts (such as 2.2%-2.1%) may increase risk appetite in the markets by supporting expectations that the FED will be bolder for a new interest rate cut, which may pave the way for the appreciation of digital assets. A slightly higher-than-expected data (2.4%-2.5%) could support the perception that the FED will wait longer to cut rates in a hurry. In such a case, losses may be observed in asset classes that are considered to be relatively riskier. In the second scenario, we need to consider the case where GDP comes in significantly different from expectations. A surprise reading of 2% or below could trigger concerns that growth in the world’s largest economy is indeed problematic. While this would likely bring the Fed closer to cutting interest rates, concerns about growth (and perhaps recession) could cause a significant shift in risk appetite, which could put selling pressure on financial instruments, including digital assets. It is worth underlining that a significantly positive data, although we think it will not have as much impact as bad pricing, may increase risk appetite and provide a basis for rises.

In sum, the US growth data will be an important input for all markets. However, its importance for financial markets can be reduced to how far away from expectations we will see a number that will surprise the markets. While we believe that we are unlikely to see a set of data that will affect pricing behaviors and cause a shake-up, we do not rule out a scenario where we could see sharp price changes if we see surprise data.

FED’s Inflation Indicator: PCE

US Federal Reserve Chairman Powell’s speech at the Jackson Hole Symposium last year led to a significant shift in the equation. Powell shifted the focus from inflation to the strength of the labor market and gave messages that the FED would now give more importance to the strength of the labor market in its decisions. Or at least that is how the markets interpreted these statements. Recent months have shown that this may not be the right approach.

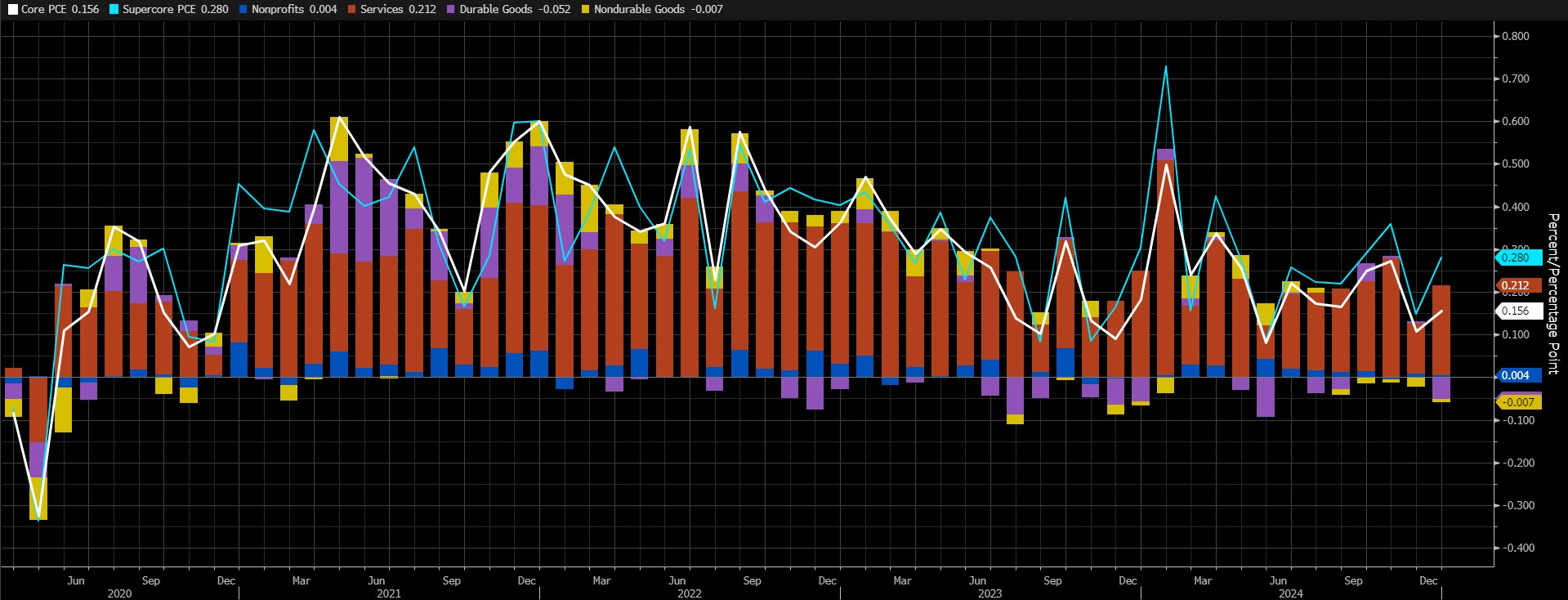

In January, the Consumer Price Index (CPI) came in at 3% on an annualized basis. In September, with a reading of 2.4%, it pointed to the lowest inflation increase since February 2021. So this CPI from September points to higher increases. In this regard, we can say that the FED has followed a path that can be criticized. On the other hand, the core PCE Price index (annualized), which the FED considers monitoring changes in inflation, has been unchanged (2.8%) for the last three months (October-November-December). The monthly data for this indicator had pointed to an increase of 0.2% in December. We think that this is the data that will be important for the markets on Friday.

Source: Bloomberg

Some items of the Producer Price Index (PPI), which constitute some components of the PCE data, drew attention as the PPI data released on February 13th came in above the forecasts. However, the change in retail sales for the same month (January data), which is also calculated by monthly change, indicated that spending in the country declined faster than expected. In other words, we can say that we watched two macro data in the previous week that made PCE forecasting difficult.

According to Bloomberg, Core PCE Price Index (m/m) data is expected to point to an increase of 0.3% in January. A higher-than-median forecast could support expectations that the Fed will maintain its cautious stance on rate cuts, reducing risk appetite and weighing on digital assets. A lower-than-expected reading, on the other hand, could have the opposite effect and pave the way for value gains.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Weekly BTC Onchain Analysis – February 19

Weekly ETH Onchain Analysis – February 19

High Correlation Between Bitcoin and the Russell 2000 Index: Causes and Consequences

The Digital Asset Fund Revolution: Altcoin ETF Process

Canada And Mexico Tariffs Under Donald Trump Tariffs

DeepSeek’s Rise and Nvidia’s Decline: The New Balance in the Artificial Intelligence Market

Blackrock’s Of Rwa-Specific Fund and Performances of Ondo, Maple, Pendle

Click here for all our other Market Pulse reports.

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.