MARKET COMPASS

The “tariff” issue continues to be a major dynamic in global markets. Finally, President Trump said that Canada and Mexico tariffs are on their way and the one-month delay is over. There are news that the 25% tariffs will be implemented as of March 4th. It is also rumored that the Trump administration is considering tighter restrictions on microchip exports to China. On the political side, yesterday’s Trump-Macron meeting was on the agenda. The summit was important in terms of showing that the two sides have deep differences on Ukraine. The widening gap between the US and Europe on Ukraine does not seem to be a good dynamic.

Risk Avoidance

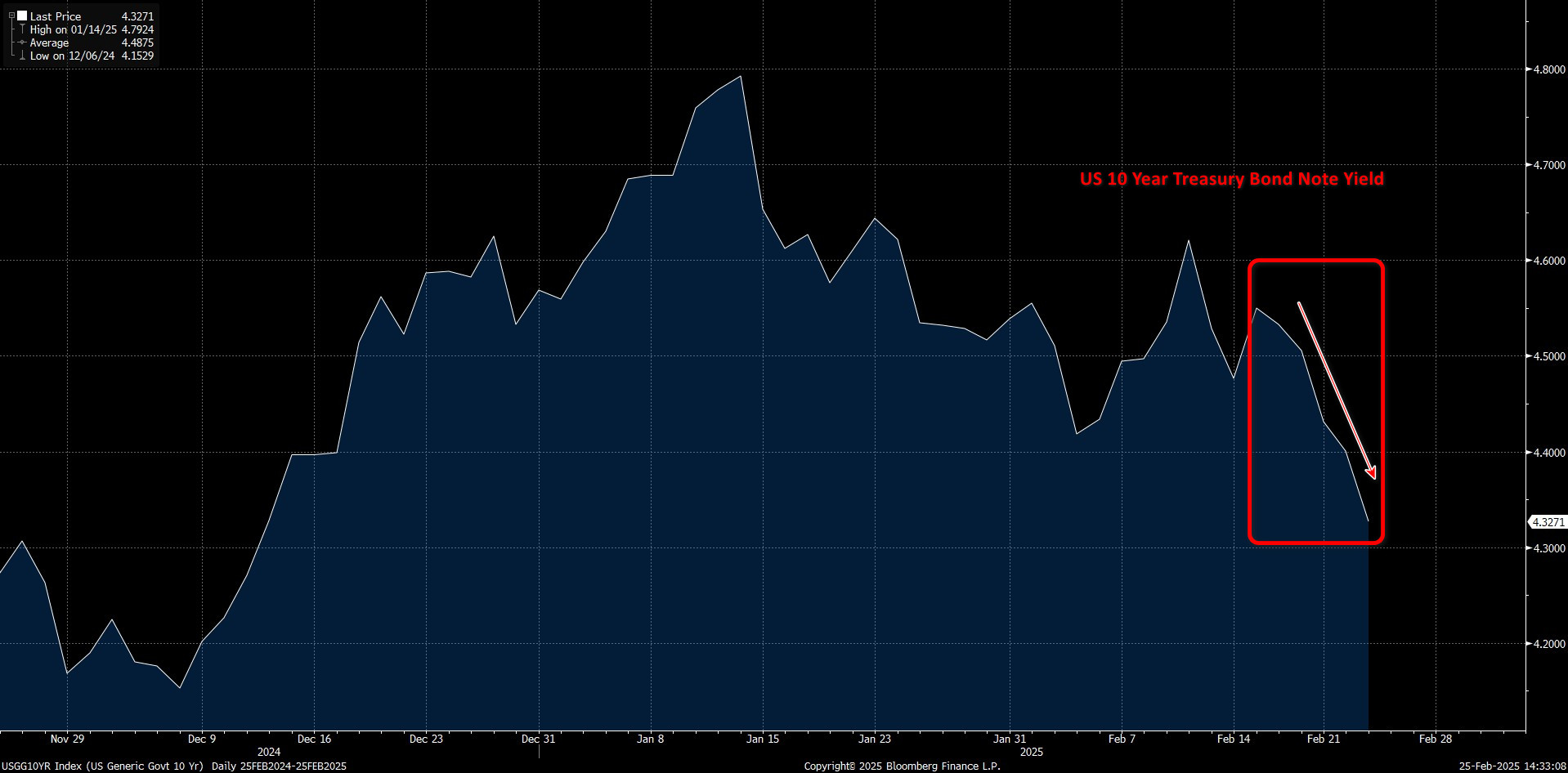

In digital assets, Trump’s recent lack of statements for the crypto world creates a lack of catalysts for a new rise. We should also not ignore the scars left by the recent hacking incident. As a result, we can say that the recent risk-off mood in the traditional markets, combined with this situation and the reasons mentioned above, have created the outlines of the pressurized course. We can highlight the decline in US 10-year bond yields as an indicator reflecting the situation in traditional markets.

Source: Bloomberg

Following the demand for US bonds on risk aversion concerns, the yield on the 10-year note has hit below the 4.33% level last seen in mid-December.

Current situation and CB Consumer Confidence

However, today, we have seen signs of recovery in European stock markets after a weak opening due to the rise in the healthcare sector. Wall Street index futures are also pointing to a flat to positive opening. Major digital assets were very weakly higher during European trading after recent losses. Although macro developments have taken a back seat, data releases for the world’s largest economy later in the day have the potential to impact the market. CB Consumer Confidence should be scrutinized today ahead of GDP and PCE Price Index data later in the week. We maintain our expectation for crypto assets to be volatile in the short term, pressured in the medium term and bullish in the long term.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| 14:00 | US S&P/CS Composite-20 HPI (YoY) (Dec) | 4.4% | 4.3% |

| 15:00 | US CB Consumer Confidence (Feb) | 102.7 | 104.1 |

| 16:40 | FOMC Member Barr Speaks | – | – |

| 18:00 | FOMC Member Barkin Speaks | – | – |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.