Market Compass

Digital Assets Continue to Bleed

Digital assets are experiencing a very harsh fall. The perception that the US Federal Reserve (FED) may pause its interest rate cuts and concerns that artificial intelligence companies may be overvalued have led to sell-offs on Wall Street, negatively affecting investors’ risk perception and causing cryptocurrencies to suffer significant losses. As Darkex Research, we stated in our previous reports that both the “liquidation crisis” on October 10 and the sharp losses on November 11 produced results in line with our projections, and that a new change in the equation was needed for an upturn, but we have not seen this yet. To state upfront what we will conclude later, unfortunately, there is still no new positive input in the variables of our model for digital assets.

The coming week will be a trading period where investors negatively affected by the recent losses need to be extra cautious. US markets will be closed on Thursday for Thanksgiving and will only be open for half a day on Friday. This means brokers leaving the trading floors on Wednesday evening will have a long holiday, and a significant decline in trading volumes will be observed until Monday, December 1. During Friday’s half-day session, junior traders will most likely be doing internships and training. Therefore, in this changing market liquidity environment, it is necessary to be cautious as price limits may fluctuate within a much wider spectrum.

| Market / Trading Type | Closing time (ET – U.S. Eastern Time) | GMT/UTC time |

| Stock market (New York Stock Exchange, Nasdaq Stock Market) | 1:00 PM ET | 6:00 PM GMT |

| Fixed Income Securities (Bond Market) – Early Close | 2:00 PM ET | 7:00 PM GMT |

| Regular stock trading hours – pre-market session | 4:00–9:30 AM ET | 09:00–14:30 GMT |

| Regular stock trading hours – after-hours | 4:00 PM–8:00 PM ET | 9:00 PM–1:00 AM GMT+1 |

With the US government reopening, we finally began to receive critical macro indicators providing information on the health of the world’s largest economy. The country’s official statistics agency, the BLS for short, released delayed September employment data last week. We saw a positive non-farm payrolls change, well above expectations, but the unemployment rate and downward revision for August did not signal to the markets that the US labor market is beginning to improve. In fact, the prevailing view was that employment problems persist and that this data set means the Fed is unlikely to move any closer to a rate cut in December. In other words, a completely negative factor for assets considered relatively risky…

Source: U.S. Bureau of Labor Statistics

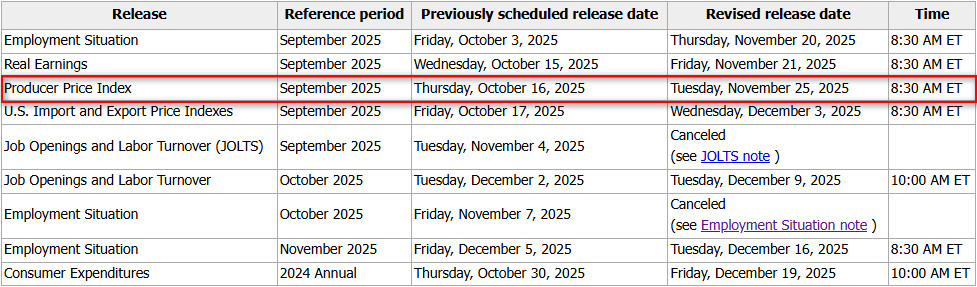

Next week, due to the holiday in the US, we will see a short trading period for traditional market investors. In addition, the data calendar is not very critical, but at least we will see the Producer Price Index (PPI) and retail sales data for September. It is still unclear whether we will receive the GDP (Economic Growth Rate) and PCE Price Index data, which are the FED’s favorite inflation indicators, as scheduled according to the normal calendar, and in fact, they will most likely not be released.

Within the framework mentioned above, if we chart a course for digital assets for the last trading week of November, we are unfortunately still far from being able to make positive statements. At the time this report was prepared, Bitcoin was around $83,700, which is the price level we last saw in April and about 35% below its recent peak… There is still no change in our key independent variables that would allow us to see a recovery process. Sales may slow down, and a breathing period may be observed, of course, but investors need to see a new catalyst for a strong rise. This is not currently available. If we do not see similar positive and surprising news during the week, the downward trend may continue. Especially from the middle of the week onwards, as mentioned above, it would be beneficial to pay attention to possible sharp price changes during Wall Street’s holiday period.

Other Important Macroeconomic Indicators or Developments

November 25 – Producer Price Index (PPI), The PPI, which shows changes in the prices of finished goods and services sold by producers, is published monthly, approximately 13 days after the end of each month. It is a leading indicator of consumer inflation. When producers demand higher prices for goods and services, higher costs are usually passed on to consumers. The Core PPI measures changes in the prices of finished goods and services sold by producers, excluding food and energy. PPI data that falls below expectations is generally expected to have a positive effect on cryptocurrencies. Due to the government shutdown in the country, there has been a change in the data release schedule.

November 25 – US Retail Sales Data; This is an important measure of consumer spending, which constitutes a large part of overall economic activity. It shows the change in the total value of retail sales and is published monthly, approximately 16 days after the end of each month. A separate measure of the change in the total value of retail sales excluding automobiles is called core retail sales. If retail sales data is below expectations, it is expected to have a positive impact on digital assets (due to expectations regarding the FED…). There has been a change in the data release calendar due to the government shutdown in the country.

Tentative – CB Consumer Confidence; This is the result of a survey of approximately 3,000 individual consumers, who are asked to assess the relative level of current and future economic conditions. It measures financial confidence as a leading indicator of consumer spending, which accounts for a large portion of overall economic activity. It is released on the last Tuesday of each month.

November 28 – US Bitcoin Futures Expiration; Option expirations are written on futures contracts with the same expiration date and typically expire on the last Friday of the current month on the CME. Trading volume and price volatility may increase in the days leading up to the expiration date of these contracts.

**Important Notice Regarding US Data

Although the US government has reopened, the release of several key economic data points from agencies appears likely to continue to be affected. Data scheduled for release by the Bureau of Economic Analysis (BEA), the Bureau of Labor Statistics (BLS), the Census Bureau, and the U.S. Department of Agriculture (USDA) may not be published, may be delayed, or may be postponed. Affected data may include the Employment Situation Report, Gross Domestic Product (GDP), Consumer Price Index (CPI), and agricultural reports, but is not limited to these.

Important Economic Calendar Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are provided by the data provider institutions.

Darkex cannot be held responsible for any changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

Legal Notice

The investment information, comments, and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in outcomes that align with your expectations.