Market Compass

Trade Wars, Geopolitical Agenda, and the FED

President Trump’s harsh and surprising statements on tariffs continue to cause increased volatility in global markets, while also affecting confidence and investor psychology. Following his October 10 statements, which caused unprecedented sell-offs, digital assets attempted to recover, but this time news from the Middle East caused concern. However, the continuation of the ceasefire between Israel and Hamas and Trump’s statements pointing to the need for trade negotiations with China to continue somewhat reassured investors.

This week, we will closely monitor both developments in trade talks and inflation indicators coming out of the US. Although the government remains shut down, we will be able to obtain Consumer Price Index (CPI) data, which is an important input for the US Federal Reserve’s (Fed) monetary policy decisions. Ahead of the Federal Open Market Committee (FOMC) meeting on October 29, we will take a closer look at this set of macro indicators, which could shed light on the FED’s interest rate reduction path.

October 24 – US Consumer Price Index: CPI

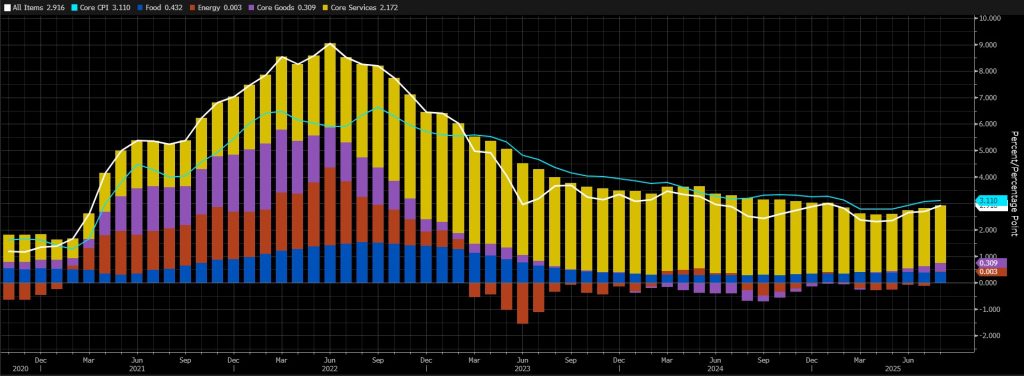

One of the key macro indicators that could provide insight into the Federal Reserve’s (FED) interest rate cut path will be the September inflation rate, the change in the Consumer Price Index (CPI). Within the current challenging economic environment, CPI data, which could signal the direction of the path, will be closely monitored as it may influence pricing behavior.

Source: Bloomberg

After standing at 2.7% in June and July, the annual inflation rate in the US accelerated in line with market expectations in August 2025, rising to 2.9%, the highest level since January. Food (3.2% vs. 2.9% in July), used cars and trucks (6% vs. 4.8%), and new vehicles (0.7% vs. 0.4%) prices rose faster. On a monthly basis, CPI rose 0.4%, exceeding the 0.3% forecast and marking the highest rate since January. Housing increased by 0.4%, creating the largest upward pressure. On the other hand, core inflation remained steady at 3.1%, the same level as in July and the peak in February, while core CPI increased by 0.3% on a monthly basis, in line with July’s pace and market forecasts.

A CPI figure below market expectations could mean the Fed has more leeway to cut interest rates, which could have a positive impact on digital assets. A figure exceeding forecasts, however, could reinforce expectations that the Fed will not rush into another rate cut, potentially putting pressure on the market.

Other Key Macroeconomic Indicators and Developments

October 24 – The Flash Manufacturing PMI is a leading indicator of economic health. Businesses react quickly to market conditions, and purchasing managers have perhaps the most up-to-date and relevant estimate of the company’s outlook for the economy. The Purchasing Managers’ Index (PMI) is a survey of nearly 800 purchasing managers that asks respondents to assess the relative level of business conditions, including employment, production, new orders, prices, supplier deliveries, and inventories. A reading above 50.0 indicates that the sector is expanding, while a reading below 50.0 indicates contraction. There are two versions of this report, Flash and Final, published about a week apart. The Flash version is released on a preliminary and monthly basis, approximately 3 weeks into the current month. A reading below the forecast is expected to produce a positive result for crypto assets.

Important Economic Calender Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based on UTC (Coordinated Universal Time) time zone. The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for any changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

Legal Notice

The investment information, comments, and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in outcomes that align with your expectations.