MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 102,307.18 | -1.63% | 57.44% | 2,03 T |

| ETH | 3,233.53 | -1.58% | 11.07% | 389,37 B |

| XRP | 3.090 | -2.68% | 5.04% | 177,77 B |

| SOLANA | 246.21 | -5.30% | 3.40% | 119,81 B |

| DOGE | 0.3503 | -3.01% | 1.47% | 51,70 B |

| CARDANO | 0.9731 | -2.00% | 0.97% | 34,22 B |

| TRX | 0.2467 | -2.87% | 0.60% | 21,25 B |

| LINK | 24.69 | -2.60% | 0.45% | 15,76 B |

| AVAX | 35.40 | -3.67% | 0.41% | 14,55 B |

| SHIB | 0.00001999 | -1.73% | 0.33% | 11,77 B |

| DOT | 6.339 | -2.76% | 0.28% | 9,77 B |

*Prepared on 1.23.2025 at 14:00 (UTC)

WHAT’S LEFT BEHIND

Critical US jobless claims data released

Applications for unemployment benefits in the US this week increased by 6K to 223K, above expectations. Non-farm payrolls increased by 256,000 in December. While the economy created 2.2 million jobs last year, an average of 186,000 positions per month, this figure declined to 3.0 million in 2023.

Phemex Sees Suspicious Fund Outflows

Cryptocurrency exchange Phemex has detected suspicious transactions involving more than $29 million in digital assets in its hot wallets. The assets include $BNB, $ETH, $OP, $POL, $BASE and $ARB.

BlackRock CEO Fink Seeks SEC Approval for Tokenization

BlackRock CEO Larry Fink said he hopes the SEC will approve tokenization of bonds and equities.

Deribit Options Data

Options expire on January 24 at 08:00 UTC:

BTC: $2.99 billion nominal | Max Ac: 99 thousand dollars | Put/Call: 0.

ETH: $542 million nominal | Maximum Agony: $3,300 | Put/Call: 0.47

While BTC’s maximum pain is increasing, ETH traders are taking positions near significant levels.

CryptoQuant CEO: Market-Driven Narratives Can Unite the Crypto Community

Ki Young Ju, CEO of CryptoQuant, said that Ethereum’s core narrative has been lost and only market-driven narratives can unite the crypto community.

WazirX to Pay Back $235 Million in Hacker Funds

Indian crypto exchange WazirX has launched a plan to refund 75-80% of the $235 million in funds stolen by North Korea’s Lazarus Group to user accounts.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| 16:00 | President Trump |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations

MARKET COMPASS

The effects of the fact that Donald Trump, who entered the presidential election as a crypto-friendly candidate, did not make a concrete statement about digital assets after taking office continue. In addition, CME’s denial of the news about some cryptocurrency applications was among the sources of pressure. In traditional markets, stabilization is being observed as the positive impact of the news from the Trump front regarding artificial intelligence investments has diminished. European stock markets and Wall Street futures are showing a flat and mixed outlook. Against this backdrop, US weekly jobless claims (223K) came in and were not far enough from expectations to lead to a new course. Later in the day, Trump’s scheduled speech at the World Economic Forum in Davos via video call will remain in focus.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our predictions. Afterwards, the appointments made by the president-elect and the increasing regulatory expectations for the crypto ecosystem in the US and the emergence of BTC as a reserve continued to take place in our equation as positive variables. Although Trump, who took over the presidency with the inauguration ceremony on January 20, did not say anything for the digital world, we maintain our expectations on the subject in the coming days. On the other hand, although it is expected to continue at a slower pace, the expectations that the FED will continue its interest rate cut cycle (for now) and the volume in ETFs based on crypto assets indicating an increase in institutional investor interest support our upward forecast for the big picture for now. In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional pauses or pullbacks in digital assets. However, at this point, it is worth emphasizing again that we think that the fundamental dynamics continue to be bullish.

TECHNICAL ANALYSIS

BTC/USDT

According to Deribit data, BTC options expiring on January 24 have a notional size of $2.99 billion, with maximum pain reaching $99,000. The Put/Call ratio is 0.48, indicating that BTC’s maximum pain has increased, and traders face a higher risk of loss. This suggests that the price could squeeze or overshoot, as well as large liquidations and sudden price movements. On the other hand, US jobless claims were slightly higher than expected today at 223K.

When we look at the technical outlook, BTC, which displayed a sellers’ image during the day, retreated to 101,350 support point. Then, the price, which managed to recover again, is currently trading at 102,300. When we look at the technical oscillators, we observe that the sell signal continues, and the momentum indicator is weakening. With the weakening sell signal, we will follow the resistance level of 102,800 with the arrival of a buy signal, and if it is passed, it may bring an attack towards the level of 105,000. In case the decline deepens, the loss of the 101,400 point is among the possibilities of losing six-digit levels again.

On the other hand, positive statements that may come from the D.Trump front towards BTC may bring sharp movements in the upward direction.

Supports: 105,000 – 102,800 – 101,400

Resistances 102,800 – 105,000 – 106,800

ETH/USDT

ETH, which fell below the kumo cloud support with the decline in the morning hours, started pricing above the 3,230 level again with the unemployment benefit applications coming slightly above expectations.

The Relative Strength Index (RSI) indicator is seen to be heading up with the support it found at 41.80. Chaikin Money Flow (CMF) is moving horizontally. On the Ichimoku indicator, we see a sell signal formed by the tenkan level cutting the kijun level downwards. However, the rapid recovery of the price after breaching the kumo cloud makes this signal weak for now.

As a result, if the price holds above the kumo cloud again, it may bring rises up to 3,292 levels. However, the break of the support may cause pullbacks up to 3,131.

Supports 3,131 – 2,992 – 2,890

Resistances 3,292 – 3,382 – 3,452

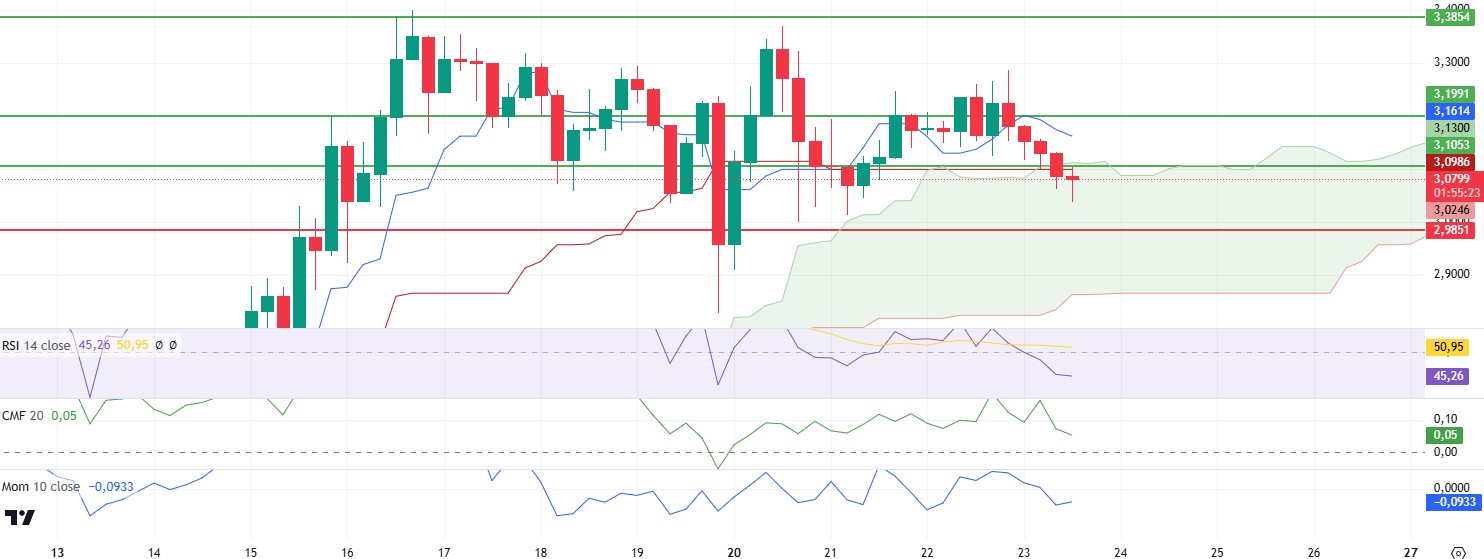

XRP/USDT

XRP, which broke the upper band of the kumo cloud with its recent decline and fell to 3.03, has recovered rapidly and has risen to 3.1 again. With this movement, some changes in indicators also attract attention.

First of all, a positive divergence in the Relative Strength Index (RSI) indicator attracts attention. However, Chaikin Money Flow (CMF) continues to decline, indicating that buyer pressure is weakening. Momentum, on the other hand, has been trending upwards again with the candle in the last four hours.

In the light of this data, the uptrend may start with the kumo cloud and kijun level of 3.10 exceeded during the day. However, closures below this zone may cause a retest of the 2.98 level.

Supports 3.1053 – 2.9851 – 2.7268

Resistances 3.1991 – 3.3854 – 3.5039

SOL/USDT

According to Block Beats, on January 23, Multicoin Capital founder Kyle Samani highlighted Solana as a leading public blockchain supporting internet capital markets in his latest investment thesis. The US SEC first faces its deadline today to rule on Grayscale’s application to convert its Solana Trust (GSOL) into an ETF. Solana ETFs proposed by VanEck, 21Shares, Canary Capital and Bitwise are expected to be decided by the regulator on January 25.

SOL has deepened its decline since our morning analysis. Breaking the symmetrical triangle pattern to the downside, the asset may find support from the 50 EMA (Blue Line). The price continues to be above the 50 EMA (Blue Line) 200 EMA (Black Line) on the 4-hour timeframe. At the same time, the SOL is above the 50 EMA and the 200 EMA. These could mean that the uptrend will continue in the medium term. When we examine the Chaikin Money Flow (CMF)20 indicator, it is seen that money outflows accelerated from the neutral zone to the negative zone. However, the Relative Strength Index (RSI)14 indicator moved from positive to negative. Today, Trump’s speech may cause fluctuations. The 275.00 level appears to be a very strong resistance place in the rises driven by both the macroeconomic data to come and the news in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements for the opposite reasons or due to profit sales, the 209.93 support level can be triggered. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 237.53 – 222.61 – 209.93

Resistances 247.53 – 259.13 – 275.00

DOGE/USDT

DOGE has turned bearish after a sudden rise. On the 4-hour timeframe, a falling wedge pattern seems to have formed. If this pattern works, the price may rise strongly. The asset has crossed below the 50 EMA (Blue Line) and the 200 EMA (Black Line). The 50 EMA continues to hover above the 200 EMA. However, the 50 EMA has turned down. This could lead to a bullish reversal. When we examine the Chaikin Money Flow (CMF)20 indicator, it moved from the positive zone to the negative zone and money inflows seem to have decreased. However, Relative Strength Index (RSI)14 is at the mid-level of the negative zone. On the other hand, Trump’s speech today may cause fluctuations. The 0.39406 level is a very strong resistance point in the rises due to political reasons, macroeconomic data and innovations in the DOGE coin. In case of possible pullbacks due to political, macroeconomic reasons or negativities in the ecosystem, the 0.33668 level, which is the base level of the trend, is an important support. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.33668 – 0.30545 – 0.28164

Resistances 0.36600 – 0.39406 – 0.42456

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.