MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 105,005.63 | 3.20% | 58.28% | 2,08 T |

| ETH | 3,256.36 | 5.22% | 11.00% | 392,30 B |

| XRP | 3.093 | 1.32% | 5.00% | 178,22 B |

| SOLANA | 240.22 | 5.85% | 3.28% | 116,92 B |

| DOGE | 0.3324 | 2.78% | 1.38% | 49,11 B |

| CARDANO | 0.9600 | 4.63% | 0.95% | 33,76 B |

| TRX | 0.2489 | 4.64% | 0.60% | 21,43 B |

| LINK | 24.68 | 8.57% | 0.44% | 15,72 B |

| AVAX | 34.24 | 6.10% | 0.40% | 14,09 B |

| SHIB | 0.00001871 | 3.55% | 0.31% | 11,02 B |

| DOT | 6.063 | 7.63% | 0.26% | 9,35 B |

*Prepared on 1.30.2025 at 14:00 (UTC)

WHAT’S LEFT BEHIND

US Applications for Unemployment Benefits

Applications for Unemployment Benefits Announced.

Announced: 207K Expectation: 224K Previous: 223K

Tesla Announces $600 Million Book Value Gain from Bitcoin Assets

Tesla announced a $600 million book value gain on its Bitcoin assets in the fourth quarter of 2024. This gain was realized thanks to new FASB regulations allowing digital assets to be valued at market prices.

JPMorgan Highlights Correlation Between Cryptocurrencies and Small-Cap Tech Stocks

JPMorgan noted a strong correlation between small-cap tech stocks and crypto markets. According to analysts, stocks in the Russell 2000 technology index stand out as the asset class with the highest parallels with crypto markets. It was emphasized that both stock and crypto markets are driven by individual investors and have high leverage.

Grayscale Launches Bitcoin Mining ETF MNRS

Grayscale listed its MNRS ETF, which invests in Bitcoin mining companies, on the New York Stock Exchange Arca. The ETF includes major mining firms such as Marathon Holdings, Riot Platforms and Core Scientific.

Illinois Advances Bitcoin Strategic Reserve Bill

The state of Illinois has moved forward with a bill proposing to create a special “Bitcoin Strategic Reserve Fund” to hold Bitcoin as a financial asset. It is planned to hold BTC for at least 5 years.

Ethena’s USDe Offering Reaches $5.7 Billion

Ethena issued its USDe custody certificate in January and announced that its total supply has reached $5.739 billion. The bulk of the assets are held in custody by Copper, Ceffu and Cobo.

Jupiter Acquires Sonar Watch and Launches Jupiter Portfolio

Jupiter Exchange announces Jupiter Portfolio for Solana asset management through the acquisition of Sonar Watch. The new platform is integrated with Jupiter Mobile to make on-chain asset management faster and more secure.

Avalanche’s December Upgrade Slashes Transaction Fees by 75

The Avalanche network reduced transaction fees by 75% and increased trading volume by 35% with the Avalanche9000 upgrade on December 16. Daily trading volume reached 354,000.

Ethereum Community Supports Danny Ryan as the Foundation’s New Leader

The Ethereum community has backed Danny Ryan as the new leader of the Ethereum Foundation in an informal on-chain vote. In the vote, 99% of wallets holding more than 50,000 ETH voted for Ryan, but the vote has no official effect.

Norwegian Central Bank Fund Holds $500 Million Stake in MicroStrategy

According to Bitcoin Magazine, Norges Bank Investment Management (Norges Bank Investment Management) has announced that it holds a stake in MicroStrategy worth $500 million.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| 15:00 | US Pending Home Sales (MoM) (Dec) | 0.0% | 2.2% |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations

MARKET COMPASS

Global markets followed macro developments during the day. The European Central Bank (ECB) cut its policy rate by 25 basis points in line with expectations, while US economic growth slowed down more than expected in the last quarter of last year. On the other hand, we learned that fewer Americans applied for unemployment benefits last week than expected. Digital assets, which had the opportunity to breathe after the US Federal Reserve’s (FED) Chairman Powell’s statements yesterday, followed a relatively calm course. Later in the day, we will watch the pending home sales data from the US.

European stock markets are in the green and among Wall Street futures indices other than Dow Jones are pointing to a positive opening. The dollar retreated slightly after the growth data. We think that there may be a desire for upward movement in major digital assets during the US season, but the lack of appetite may prevent this. Tomorrow’s PCE Price Index, which could provide information about what the FED’s next move looks important, after some of the most anticipated US companies released their balance sheets yesterday. Ahead of this data, under the assumption that there will be no surprise news flow, we can only watch the pricing movements that occur due to the nature of the market.

From the short term to the big picture.

Trump’s victory on November 5, one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our predictions. In the process that followed, the appointments made by the president-elect and the increasing regulatory expectations for the crypto ecosystem in the US and the emergence of BTC as a reserve continued to take place in our equation as positive variables. Then, 4 days after the new President took over the White House, he signed the “Cryptocurrency Working Unit” decree, which was among his election promises, and we think that the outputs it will produce in the coming days will continue to reflect positively on digital assets.

On the other hand, the expectations that the FED will continue its interest rate cut cycle, albeit on hiatus for now, and the fact that the volume in crypto-asset ETFs indicates an increase in institutional investor interest, support our upside forecast for the big picture. In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional pause or pullbacks in digital assets. However, at this point, it is worth emphasizing again that we think that the fundamental dynamics continue to be bullish.

TECHNICAL ANALYSIS

BTC/USD

In line with FED Chairman Powell’s emphasis on the strong labor market, macro data released today showed that unemployment claims remained below expectations with 207K. On the other hand, Tesla, which is estimated to own 11,509 BTC, reported a book value gain of $600 million from Bitcoin assets in the fourth quarter of 2024.

When we look at the technical outlook with the latest developments, unlike yesterday, low volatility is observed in BTC. Moving above the 105,000 point within the ascending trend channel, BTC seems to be in an effort to protect its gains. Currently trading at 105,010, BTC’s technical oscillators continue to give a weakening buy signal in the overbought zone, while the momentum indicator is gaining strength in the positive zone. In the continuation of the rise, closes above 105,000 will be followed and the minor resistance point of 105,900 will be followed. In a possible correction, we will follow the price to hold within the rising trend channel, in case of a breakout, the 103,000 support level may welcome us again.

Supports: 105,000 – 102,800 – 101,400

Resistances: 107,000 – 108,000 – 109,700

ETH/USDT

Ethereum, after following a horizontal course during the day, gained an upward momentum after the European Central Bank cut interest rates by 25 basis points and rose as high as 3,275. However, technical indicators remain positive for ETH, which faced selling pressure in this region.

The Chaikin Money Flow (CMF) indicator crossed into positive territory, indicating strong capital inflows into the market, suggesting that buyer interest is high and the bullish move is supported. Similarly, the Relative Strength Index (RSI) continued to rise, indicating that momentum remains strong and price action may continue upwards. The convergence of the tenkan level to the kijun level on the Ichimoku indicator also contributes to the positive outlook, while the price hovering above the kijun level helps maintain the uptrend.

In line with the current price movements, the 3,292 level and the 3,322 level where the trend line crosses stand out as critical resistance zones. If these levels are exceeded, a new uptrend for Ethereum could begin and the price could reach higher levels. On the other hand, the 3,131 level remains a strong support point and a downside break of this level could see sharp selling pressures. Given the technical indicators and the current market structure, it can be said that Ethereum maintains its positive outlook and continues to have bullish potential.

Supports 3,131 – 2,992 – 2,890

Resistances 3,292 – 3,350 – 3,452

XRP/USDT

XRP managed to rise up to the kumo cloud after yesterday’s rise and advanced up to 3.13. However, it was rejected from this region during the day and fell back below the kumo cloud and 3.10 support.

With this price action, the Relative Strength Index (RSI) started to decline again, signaling a pullback. On the other hand, Chaikin Money Flow (CMF) continued to rise, indicating that money flow is rising unabated and buyers are maintaining their strength despite the pullbacks.

As a result, it is critical for XRP to close above the ichimoku cloud and the trend line drawn on the chart for an uptrend to begin. In this case, XRP can quickly rise towards the upper resistance points. However, closes below the 3.10 level may also weaken momentum and bring pullbacks to the 2.98 level.

Supports 3.1053 – 2.9851 – 2.7267

Resistances 3.2000 – 3.2927- 3.3999

SOL/USDT

SOL broke the downtrend that started on January 19 without volume. This may be a fake breakout. At the time of writing, the asset, which is supported by the 50 EMA (Black Line), continues its horizontal movement here. On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). This may mean that the uptrend will continue in the medium term. At the same time, the asset started pricing above the 50 EMA and 200 EMA. This could be a bullish harbinger in the medium term. When we examine the Chaikin Money Flow (CMF)20 indicator, it is in the positive zone, but at the same time, money inflows have increased. However, the Relative Strength Index (RSI)14 indicator is in the neutral zone and the RSI continues the uptrend that started on January 27. The 259.13 level stands out as a very strong resistance point in the rises driven by both the upcoming macroeconomic data and the news in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements for the opposite reasons or due to profit sales, the 209.93 support level can be triggered. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 237.53 – 222.61 – 209.93

Resistances 247.43 – 259.13 – 275.00

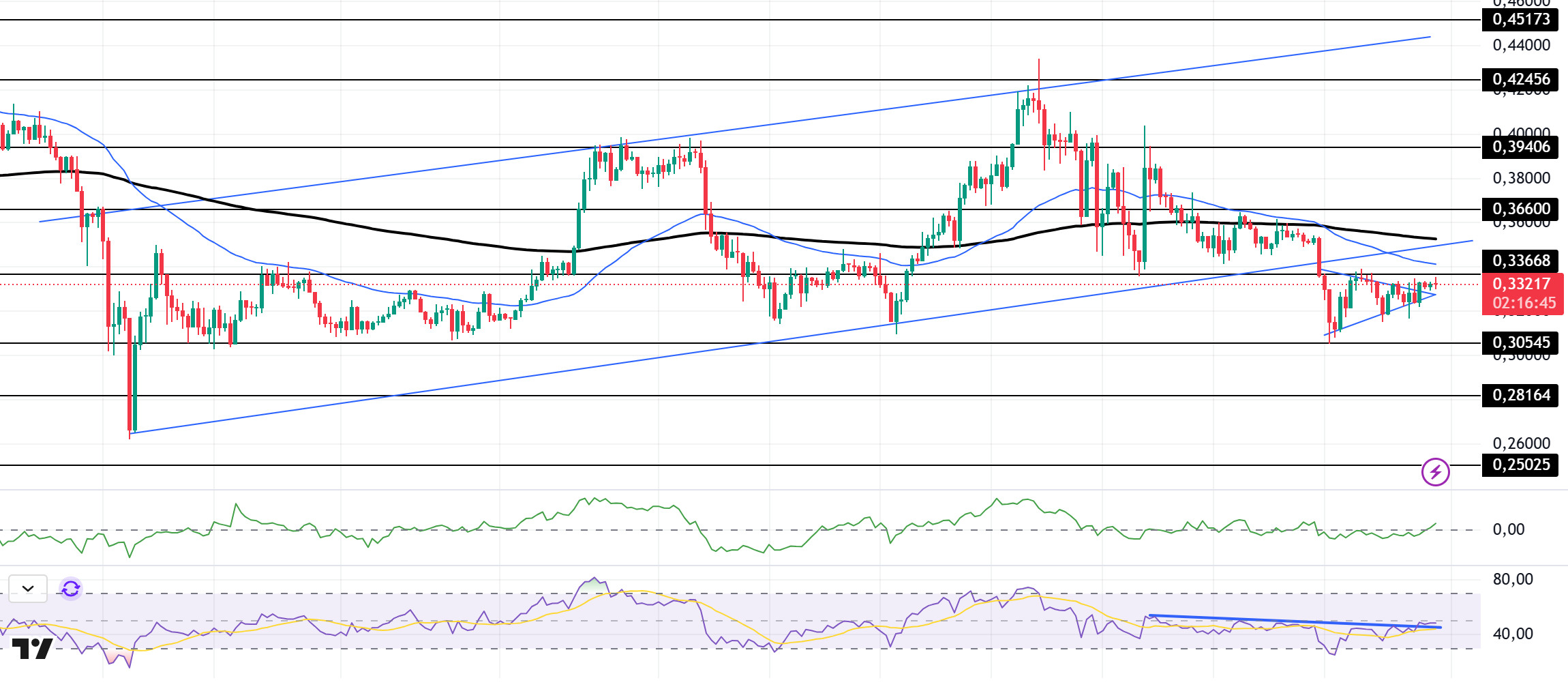

DOGE/USDT

Since our analysis in the morning, DOGE has continued its horizontal course, albeit without volume. Breaking the December 20 uptrend with a strong downside candle, the asset tested the base level of the uptrend as resistance and retreated from there, forming an inverted pennant pattern. Breaking it to the upside, Dogecoin may continue its uptrend. On the 4-hour timeframe, the 50 EMA (Blue Line) remains below the 200 EMA (Black Line). This could mean that the decline could deepen in the medium term. At the same time, the price is below the 50 EMA (Blue Line) and the 200 EMA (Black Line). The Chaikin Money Flow (CMF)20 indicator is in the positive territory, indicating that inflows have increased. However, Relative Strength Index (RSI)14 is in neutral territory. At the same time, the RSI indicator broke the downtrend by breaking the downtrend upwards. This shows us that the price is strengthening here. The 0.39406 level appears to be a very strong resistance point in the rises due to political reasons, macroeconomic data and innovations in the DOGE coin. In case of possible pullbacks due to political, macroeconomic reasons or negativities in the ecosystem, the 0.28164 level, which is the base level of the trend, is an important support. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.30545 – 0.28164 – 0.25025

Resistances 0.33668 – 0.36600 – 0.39406

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.