MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 86,400.39 | 5.47% | 59.67% | 1.70 T |

| ETH | 3,261.83 | 3.36% | 13.71% | 391.57 B |

| SOLANA | 208.91 | -3.71% | 3.41% | 97.49 B |

| DOGE | 0.3611 | 27.35% | 1.81% | 51.70 B |

| XRP | 0.6411 | 10.56% | 1.27% | 36.27 B |

| CARDANO | 0.5712 | -4.06% | 0.70% | 19.90 B |

| TRX | 0.1762 | 6.87% | 0.53% | 15.21 B |

| SHIB | 0.00002546 | -0.63% | 0.52% | 14.88 B |

| AVAX | 33.94 | 5.84% | 0.48% | 13.66 B |

| LINK | 14.03 | 0.71% | 0.30% | 8.77 B |

| DOT | 5.290 | 3.28% | 0.28% | 7.99 B |

*Prepared on 11.12.2024 at 13:30 (UTC)

WHAT’S LEFT BEHIND

Tesla Bitcoins Worth Over $1 Billion.

With Donald Trump winning the elections, Tesla shares also started to rise. The value of BTCs held by Tesla, which rose 10 percent yesterday and 45 percent in the last week, also started to increase. The total value of 11,500 BTCs held by the company, which sold Bitcoin at 29 thousand dollars 2 years ago, exceeded $ 1 billion for the first time.

Elon Musk Effect Brings 280 Percent

The election of Donald Trump as president of the United States has triggered a serious rise in Dogecoin as well as Bitcoin. While Elon Musk’s ideas of establishing the “Department of Government Efficiency”, abbreviated DOGE, seem to come true under Trump’s administration, this situation has brought about a 300% increase in Dogecoin in the last 1 month.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| 15:00 | US FOMC Member Waller Speaks | – | – |

| 15:15 | US FOMC Member Barkin Speaks | – | – |

| 19:00 | US FOMC Member Kashkari Speaks | – | – |

| 22:00 | US FOMC Member Harker Speaks | – | – |

| 22:30 | US FOMC Member Barkin Speaks | – | – |

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

The “Trump Trade” effect has had a negative impact on European stock markets with potential trade disputes and tariff tensions, while US stock markets are also expected to start the new day on the negative side. The dollar index has settled somewhat after its recent rises to take a breather. However, this equation seems to reflect a cautious stance as treasury yields rise in the country. Digital assets may also be showing the first signs of a consolidation phase after a breathless rise.

The statements of the Federal Open Market Committee (FOMC) members will be on investors’ agenda later in the day. These evaluations, which may provide information about the US Federal Reserve’s (FED) future interest rate cut course, may be effective on asset prices during the day when data flow is weak.

From the short term to the big picture.

The victory of former President Trump, one of the main pillars of our bullish expectation for the long-term outlook for digital assets, produced a result in line with our forecasts. The continuation of the Fed’s rate-cutting cycle and the inflows into BTC ETFs, indicating an increase in institutional investor interest (plus MicroStrategy’s BTC purchases, Microsoft’s consideration of a purchase, etc.), support our big-picture upside forecast for now.

In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see some respite or pullbacks in digital assets from time to time. At this point, it is worth reiterating that fundamental dynamics remain bullish. While the continued extension of record highs by Bitcoin, the largest digital currency, may encourage buyers to take new, upside positions, we will watch this group struggle with the masses who may want to take profit realizations. Buyers have been at the forefront of this battle in recent days. Today, we saw some retracement and stabilization during European trading. We think that this may continue in the rest of the day and there may be intermediate reaction rises.

TECHNICAL ANALYSIS

BTC/USDT

The increase in the crypto funding rate along with the decline in FED interest rates continues to ignite the bull market. Bitcoin reached a new ATH level of 89,956 during the day, with the funding rate reaching 37%, the highest level since March 2024, due to the concentration of long positions. Positions in Bitcoin futures have skyrocketed during this period, with volume reaching $28 billion in November, up from $16 billion in September.

When we look at the BTC technical outlook, we see that the price entered a correction movement at the 89,956 level after consecutive bullish peaks. The fact that the price entered a retracement without seeing the 90,000 level in BTC price shows that the psychological resistance levels we mentioned earlier are valid. As of now, the price, which has fallen to the 86,000 level, displays a weak image at the support levels as these levels are passed upwards quickly. It should be noted that the declines experienced during bull periods when the major trend is upward may be in order to gain momentum. Some deepening of the declines may enable it to test the Fibonacci 1 (83,000) level. Otherwise, we can say that the main target is to exceed the 90,000 level.

Supports 85,000 – 83,000 – 80,000

Resistances 90,000 – 93,000 – 95,000

ETH/USDT

ETH, which could not maintain above the 3,353 level, fell to 3,216 with the loss of this region. With the reaction it received from here, it has risen up to 3,250 again. 3,216 support remains valid as one of the most important levels. Closures below this level may bring candles up to 3,045 levels. The loss of the 3.278 tenkan level can also be counted as one of the negative factors. However, there are positive divergences on Relative Strength Index (RSI) and Money Flow Index (MFI). Provided that the 3.216 level is not lost, the positive outlook on RSI and MFI may carry the price back up to 3.353 levels.

Supports 3,216 – 3,045 – 2,925

Resistances 3,353 – 3,534 – 3,635

XRP/USDT

XRP made a sharp rise by breaking the negative divergences on the Relative Strength Index (RSI) and Money Flow Index (MFI). XRP, which rose to 0.6937, is pricing below 0.6655 again with the rejection from this level. It can be said that the volatility experienced today, when the cryptocurrency market corrected, is normal. Although RSI and MFI maintain their negative structures, the price above the 0.6655 level after the correction may continue to rise. The region marked by 0.6049 and the blue box is the most important support zone, but the violation of this zone may cause the decline to deepen.

Supports 0.6049 – 0.5837 – 0.5453

Resistances 0.6655 – 0.6937 – 0.7430

SOL/USDT

On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). This could mean that the uptrend will continue. However, the gap between the two averages has widened too much to a difference of 13.34%. This could cause pullbacks. At the same time, Relative Strength Index (RSI)14 is in the overbought zone, which may cause profit selling. However, when we examine the Chaikin Money Flow (CMF)20 indicator, although money inflows are positive, inflows have started to decrease. The 222.61 level stands out as a very strong resistance point in the rises driven by both macroeconomic conditions and innovations in the Solana ecosystem. SOL, which tested here, has lost its momentum and has broken the downward uptrend that has formed since November 5. If it starts rising again and rises above the 222.61 level, the rise may continue strongly. In case of retracements due to possible macroeconomic reasons or profit sales, support levels of 193.78 and 181.75 may be triggered again. If the price hits these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 200.00 – 193.78 – 186.75

Resistances 209.93 – 222.61 – 233.06

DOGE/USDT

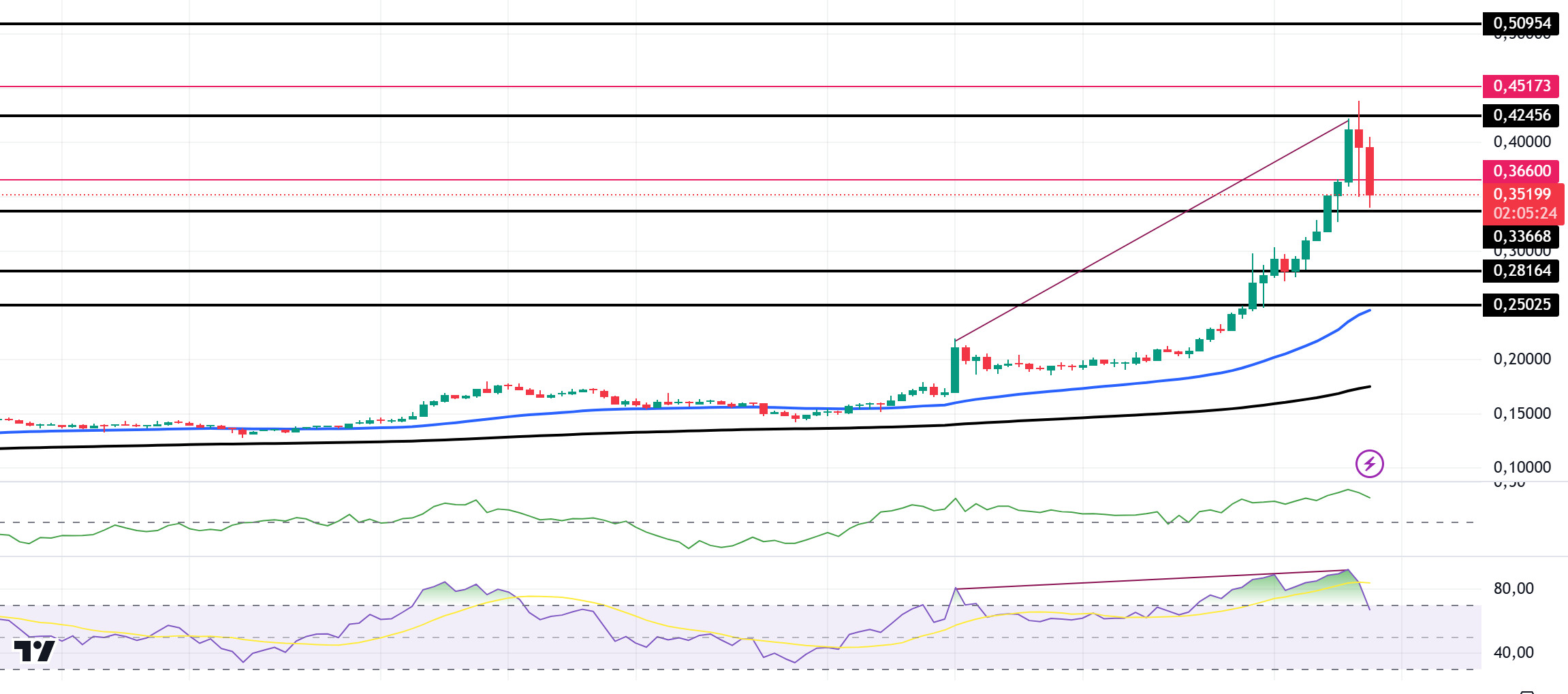

Dogecoin’s recent surge is not happening on its own. It’s partly due to Bitcoin’s impressive climb to a new record high of $89,956, which has boosted the confidence of the entire crypto market. When Bitcoin rises, investors usually feel good about other cryptos as well, and this time Dogecoin has been one of the biggest risers. Dogecoin currently has a market capitalization of $53.96 billion, with a trading volume of $36.42 billion in the last 24 hours. There is also speculation that Elon Musk may join a future administration and support pro-crypto policies. According to one rumor, Musk may even help establish a “Department of Government Efficiency (D.O.G.E.)”, but this is just speculation. Technically, on the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). This could mean that the uptrend will continue. However, the gap between the two averages has widened too much, creating a difference of 39.78%. This could cause pullbacks. At the same time, the Relative Strength Index (RSI)14 is in the overbought zone, but the divergence is noticeable. This may bring profit sales. However, when we examine the Chaikin Money Flow (CMF)20 indicator, money inflows are positive, but inflows have started to decline. The 0.42456 level stands out as a very strong resistance point in the rises driven by both macroeconomic conditions and innovations in the Doge coin. If DOGE, which tested here, maintains its momentum and rises above this level, the rise may continue strongly. In case of retracements due to possible macroeconomic reasons or profit sales, the support levels of 0.33668 and 0.28164 can be triggered again. If the price hits these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.33668 – 0.28164 – 0.25025

Resistances 0.42456 – 0.45173 – 0.50954

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.