Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap |

|---|---|---|---|---|

| BTC | 91,346.24 | 2.00% | 58.85% | 1,81 T |

| ETH | 3,091.88 | 0.89% | 12.10% | 372,14 B |

| SOLANA | 241.02 | 0.86% | 3.73% | 114,73 B |

| XRP | 1.0824 | -4.46% | 2.01% | 61,84 B |

| DOGE | 0.3887 | 7.82% | 1.86% | 57,23 B |

| CARDANO | 0.7277 | -0.28% | 0.83% | 25,55 B |

| TRX | 0.2017 | 0.05% | 0.57% | 17,44 B |

| SHIB | 0.00002495 | 2.77% | 0.48% | 14,73 B |

| AVAX | 34.10 | -0.50% | 0.46% | 13,99 B |

| LINK | 14.67 | 2.47% | 0.30% | 9,19 B |

| DOT | 5.790 | 1.46% | 0.29% | 8,80 B |

*Prepared on 11.19.2024 at 13:30 (UTC)

WHAT’S LEFT BEHIND

Institutional Investment Wave Begins in Bitcoin

Options trading on BlackRock’s Bitcoin spot ETF begins today on Nasdaq. Analysts at QCP Capital noted that this development could usher in a new wave of institutional investment for Bitcoin. The company emphasized that derivatives markets usually grow up to 10 to 20 times the market capitalization of the relevant asset, adding that this move has great potential for the market.

Trump’s Bakkt Move Boosts Stocks

A report in the British media outlet Financial Times that Donald Trump’s media company will buy all the shares of the cryptocurrency exchange Bakkt led to a huge jump in the exchange’s shares. Bakkt shares gained 162% in just a few hours after the news, bringing new hope to the financially struggling exchange.

Wall Street Giants Pivot to MicroStrategy Shares

With 330,000 Bitcoin reserves, MicroStrategy, the world’s largest Bitcoin investor, is attracting the attention of Wall Street giants. According to SEC data, the number of institutional investors holding MSTR shares increased from 667 to 738. Interestingly, Vanguard, which has distanced itself from Bitcoin and announced that it will not offer a Bitcoin spot ETF, is among these companies.

Armstrong: Elon Musk’s $2 Trillion D.O.G.E Plan is a Big Opportunity

The Department of Government Efficiency (D.O.G.E.) initiative, which aims to reduce government spending in the US by $2 trillion, was launched under the leadership of SpaceX CEO Elon Musk and former presidential candidate Vivek Ramaswamy. This plan to downsize government bureaucracy has attracted a lot of attention in the crypto world. While the name of the plan and Musk’s connections to Dogecoin have created excitement, especially in the crypto community, there is ongoing debate about its potential impact.

Valhalla Announcement by FLOKI

FLOKI Inu, a meme coin project, has made its long-awaited announcement. The FLOKI team announced that it has launched an extensive marketing campaign for its PlayToEarn MMORPG game Valhalla in and around Delhi, the capital of India. However, this announcement did not have any impact on the FLOKI price.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| 18:10 | FOMC Member Schmid Speaks |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

Geopolitical risks, which had been at the bottom of the markets’ agenda some time ago, came to the fore again today. Asset prices, which had become less sensitive to the tensions in the Middle East, were this time affected by the escalating Russia-Ukraine tensions. As Ukraine struck Russia for the first time with long-range missiles provided by the US, Russian leader Putin said earlier that this could spark a bigger war. On the other hand, this morning Putin updated the country’s conditions for the use of nuclear weapons. According to this new doctrine, if another country launches a ballistic missile attack on Russia, the country is allowed to respond with nuclear weapons. With these latest developments increasing tensions, losses in European stock markets and declines in US index futures were observed. Instruments seen as safe havens in traditional markets, such as gold and the Japanese Yen, gained value.

For now, digital assets do not seem to have suffered a major damage from this situation. However, if the tension escalates further, the declines may deepen and we may need to revise our long-term bullish expectation. In the current situation, we will continue to monitor the issue closely.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our forecasts. The continuation of the Fed’s rate cut cycle (albeit with Powell’s cautious messages…) and the entry into BTC ETFs, indicating increased institutional investor interest (in addition, MicroStrategy’s BTC purchases, Microsoft’s start to evaluate the purchase, BlackRock’s options to start trading…) support our upside forecast for the big picture for now.

In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional respite or pullbacks in digital assets. At this point, it is worth reiterating that fundamental dynamics remain bullish. While Bitcoin, the largest digital currency, has extended its record highs several times in recent weeks, which may continue to whet the appetite of buyers to take new, upside positions, we will watch this group struggle with the masses who may want to take profit realizations and speculators who want to take advantage of potential declines after rapid rises.

TECHNICAL ANALYSIS

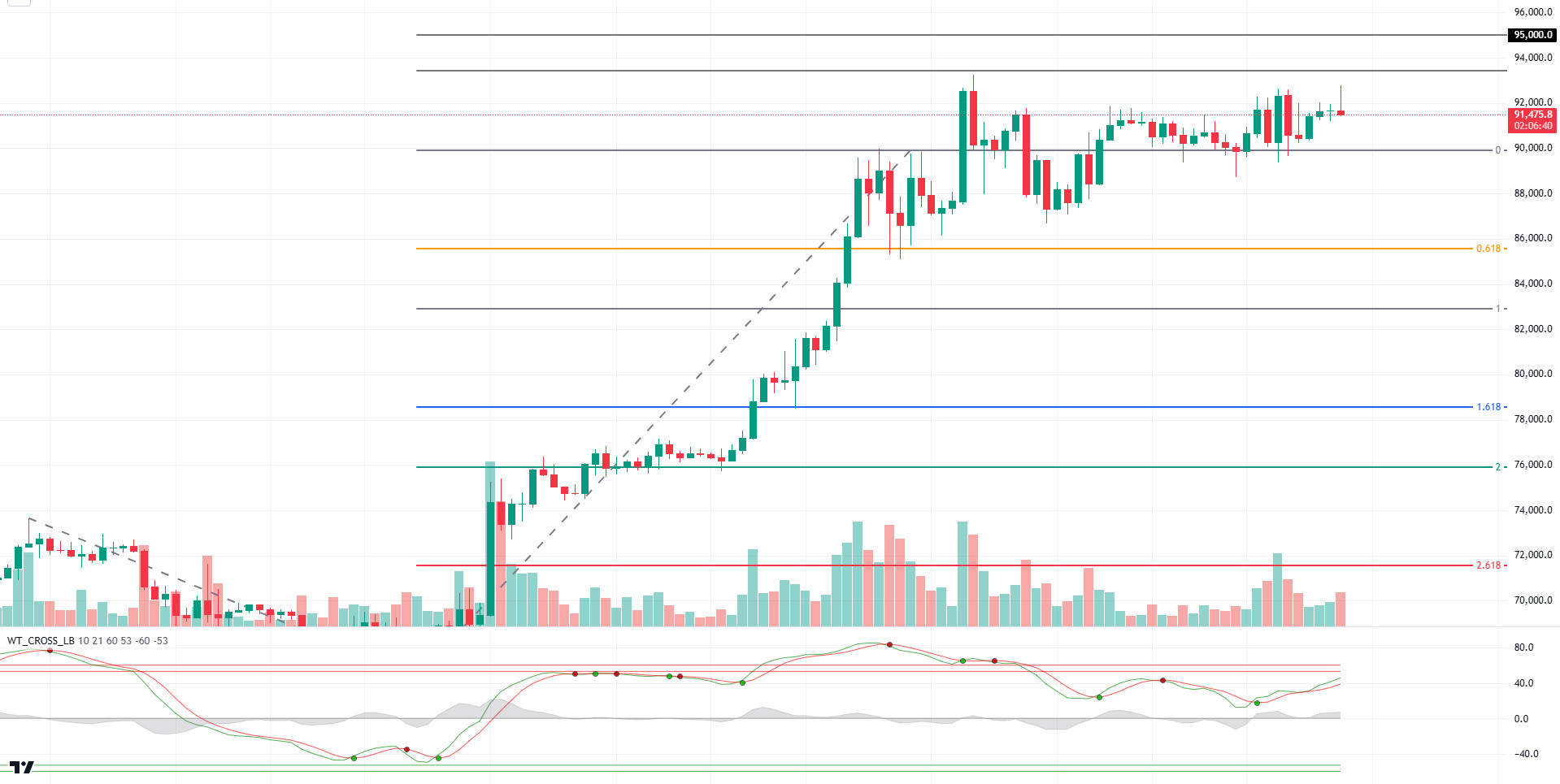

BTC/USDT

Bitcoin spot ETFs stood out with positive net inflows again after a two-day negative streak. As of yesterday, a total net inflow of 255 million dollars was recorded. While $ 90 million of these inflows came from BlackRock’s iBit platform, Fidelity attracted attention with its contribution of $ 60 million.

When we look at the technical outlook with the impact of spot ETFs on BTC price, we observed that the price approached the ATH level by reaching 92,750 during the day. As we mentioned in the previous analysis, pricing above the 90,000 level continues to support the uptrend as positive sentiment continues. Short trades accumulating around the ATH level on the liquidation chart cause the price to retest at these levels. For BTC, which is currently priced at 91,700, this level may cause a strong momentum for the rest of the week with ETF inflows. In case of a breakout, the 95,000 level appears as psychological resistance, while the 100,000 level can be tested quickly if this level is exceeded. When we look at the exchange trade long-short ratios, the loss of the 90,000-support level brings the 87,000 level to the agenda again in case of a retreat with the short-weighted transactions being somewhat more dominant.

Supports: 90,000 – 87,000 – 85,500

Resistances: 91,350 – 93,000 – 95,000

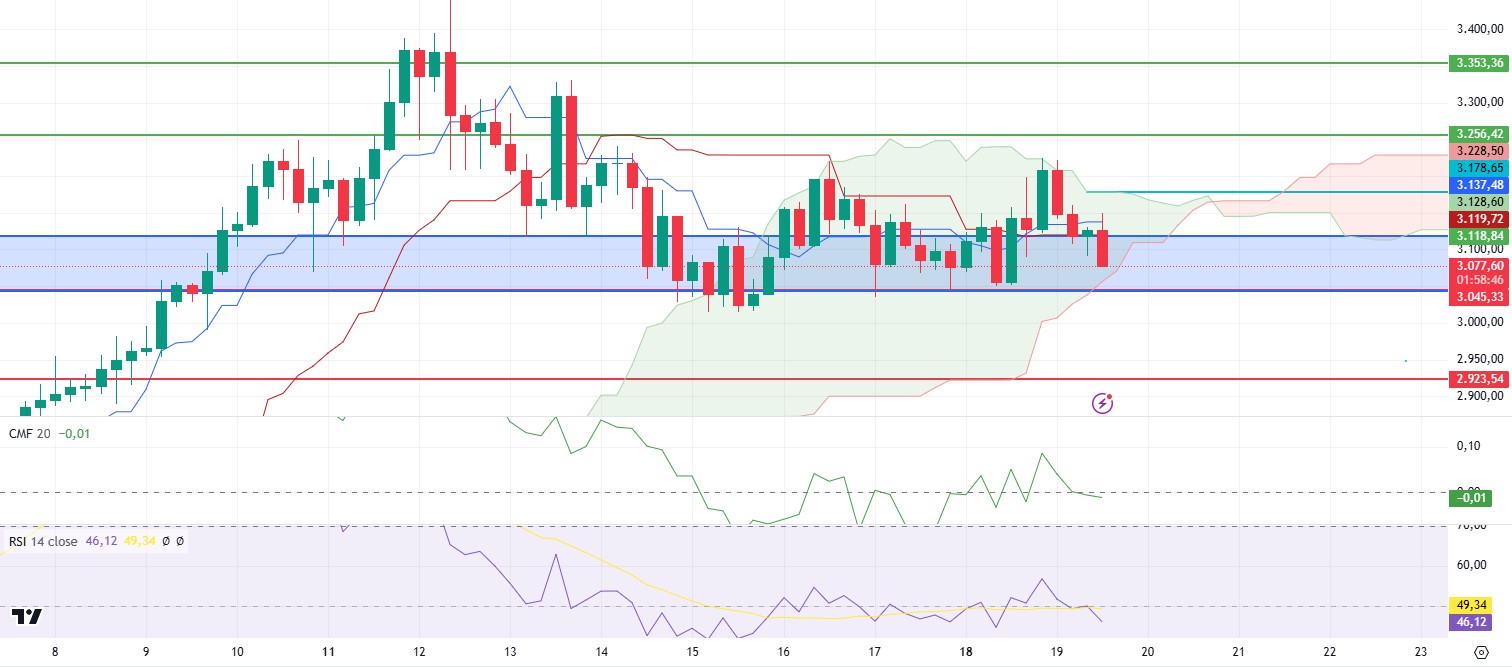

ETH/USDT

ETH gained the 3.118 level in the morning hours, but then remained below this level again. It is seen that the bullish movement in the overnight hours was reacted by the kumo cloud resistance. Chaikin Money Flow (CMF) and Relative Strength Index (RSI) are also seen heading down again. It seems very likely that the bullish scenario for ETH will start with the break of the 3,178 intermediate support, which is also the sand cloud resistance level. RSI, CMF and momentum also support this idea. In addition, the area shown in blue on the chart remains the main support. Possible breaches of this zone could bring sharp declines in ETH.

Supports: 3,118 – 3,045 – 2,923

Resistances: 3,256 – 3,353 – 3,534

XRP/USDT

XRP, which has been slightly negative during the day, is approaching critical support zones. In particular, the Chaikin Money Flow (CMF) value quickly turned negative and the negative divergence on the Relative Strength Index (RSI) indicates that the price may fall to the main support zone between 1.07 and 1.03. A downside break of this level may bring rapid declines up to 0.93. On the other hand, breaking the 1.12 intermediate support may be an important signal for the beginning of a positive process. On closes above this level, 1.23 levels may be retested, provided that there is no divergence on oscillators.

Supports 1.0709 – 1.0333 – 0.9382

Resistances 1.2386 – 1.3487 – 1.4463

SOL/USDT

DEX volume reaches $41 billion, surpassing Ethereum, fueled by memecoin activity. SOL is nearing a new all-time high, supported by strong market momentum. The asset’s Open Interest data (OI) reached a record price of $5.64 billion. This increase shows that investors are growing in confidence as they commit significant capital to SOL during the ongoing uptrend. On the other hand, popular meme coin platform Pump.fun’s account sold 105,000 SOL (approximately $25.14 million) on a centralized exchange in recent hours.

Technically, in the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). Since November 4, SOL, which has been in an uptrend since November 4, continues to be priced by maintaining this trend. This may mean that the uptrend will continue. However, when we examine the Chaikin Money Flow (CMF)20 indicator, money inflows are positive and inflows have started to increase. At the same time, Relative Strength Index (RSI)14 remained in the overbought zone. This may mean that there may be a sell-off. The 247.53 level is a very strong resistance point in the uptrend driven by both macroeconomic conditions and innovations in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements due to possible macroeconomic reasons or profit sales, the support levels of 222.61 and 193.78 may be triggered again. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports: 237.53 – 233.06 – 222.61

Resistances: 247.53 – 259.13 – 275.00

DOGE/USDT

Dogecoin has seen a significant price increase recently with the potential for further growth. Current market conditions suggest that Dogecoin could go higher. The general bullish sentiment and positive market indicators make Dogecoin a good investment opportunity. On May 7, 2021, the price of Dogecoin peaked at $0.7376. Currently, it needs to rise by 73.92% at the time of writing to reach its all-time high. The MVRV (Market Value to Realized Value) ratio of about 42% shows that there is still potential for Dogecoin to rise.

Technically, Doge continues to consolidate above 0.35 since our analysis yesterday. However, a bull flag pattern has formed. If the pattern works after a short retracement or consolidation, the uptrend may continue. On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). This could mean that the uptrend will continue. But the gap between the two averages is still too wide. This could cause pullbacks. At the same time, the Relative Strength Index (RSI)14 is slightly away from the overbought zone. However, the Chaikin Money Flow (CMF)20 indicator remains neutral. The 0.42456 level stands out as a very strong resistance point in the rises driven by both macroeconomic conditions and innovations in the Doge coin. If DOGE, which tested here, maintains its momentum and rises above this level, the rise may continue strongly. In case of retracements due to possible macroeconomic reasons or profit sales, the support levels of 0.33668 and 0.28164 can be triggered again. If the price hits these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.36600 – 0.33668 – 0.28164

Resistances 0.42456 – 0.45173 – 0.50954

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.