MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 99,164.68 | -0.56% | 54.17% | 1,96 T |

| ETH | 3,920.22 | -1.55% | 13.03% | 472,41 B |

| XRP | 2.459 | -3.84% | 3.87% | 140,24 B |

| SOLANA | 230.80 | -3.17% | 3.03% | 109,90 B |

| DOGE | 0.4461 | -4.71% | 1.81% | 65,60 B |

| CARDANO | 1.157 | -3.23% | 1.12% | 40,66 B |

| TRX | 0.3049 | -4.02% | 0.73% | 26,31 B |

| AVAX | 51.50 | 0.36% | 0.58% | 21,12 B |

| SHIB | 0.00003088 | -5.50% | 0.50% | 18,22 B |

| LINK | 26.30 | 3.52% | 0.46% | 16,49 B |

| DOT | 9.937 | -5.16% | 0.42% | 15,19 B |

*Prepared on 12.9.2024 at 07:00 (UTC)

WHAT’S LEFT BEHIND

Michael Saylor Points to Increase in Bitcoin Tracker

MicroStrategy founder Michael Saylor shared Bitcoin Tracker information for the fifth week in a row. Saylor, who stated, “There’s a lot of blue on the SaylorTaker website,” pointed out that according to MicroStrategy’s past model, it increased Bitcoin purchases after such posts.

National Center for Public Policy Research Proposes Bitcoin Treasury to Amazon

The National Center for Public Policy Research, a Washington-based free-market advocacy think tank, has submitted a proposal to Amazon that includes the adoption of Bitcoin as a corporate treasury strategy. This proposal will be considered at the shareholder meeting in April 2025.

US Strategic Bitcoin Reserves Move to the States

The Trump administration’s plan to create a national Bitcoin reserve has gained momentum on a state-by-state basis. Florida plans to establish a strategic reserve in the first quarter of 2025, while Pennsylvania aims to invest 10% of its general funds in Bitcoin. Michigan and Wisconsin prefer to invest in

Bitcoin ETFs with a more conservative approach.

Trump Does Not Consider Replacing Fed Chairman Jerome Powell

In an interview with NBC, US President-elect Donald Trump stated that he is favorable to the continuation of Fed Chairman Jerome Powell. “I don’t plan to replace him,” Trump said.

Trump: No Plans to Exit Truth Social

US President-elect Trump said he would consider raising the federal minimum wage but would decide in consultation with state governors. Trump also said he has no plans to exit

the social media platform Truth Social.

Iran Adopts Regulatory Approach for Digital Currencies

Iran’s Minister of Economic Affairs and Finance Abdolnasser Himmeti announced that they will focus on regulations rather than restrictions on digital currencies. Iran aims to increase the economic benefits of these digital assets.

Argentina Opens Doors to Crypto ETFs

Argentina’s securities regulator CNV announced that it will allow foreign investment products linked to assets such as

Bitcoin, Ethereum and gold to enter the country’s market.

Cardano Foundation X Account Seized

Cardano Foundation’s official X account has been compromised. The account shared misleading content about the alleged SEC lawsuit and that ADA token support would be discontinued. However, it was clarified that this information was not true.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| – | Bitcoin MENA: Conference dedicated to Bitcoin | – | – |

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

Global markets, which started the new week by following political developments, are monitoring the situation in the Middle East after the fall of the regime in Syria and whether there will be a re-vote in South Korea after the impeachment vote of President Yoon Suk Yeol was rejected. The President is reportedly banned from traveling abroad.

Inflation data from China showed that consumer price growth in the world’s second largest economy fell short of expectations. Besides the deep sell-off in the Korean stock market, the continent’s indices are flat to mixed. European futures are pointing to a similar opening.

The first two days of the week will be weak in terms of macro data. On Wednesday, we will receive highly important inflation data from the US. Ahead of this, we have seen appreciation in the dollar and increased volatility in digital assets. We think this course may continue in the first days of the week.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our predictions. Afterwards, the appointments made by the president-elect and the expectations of increased regulation of the crypto ecosystem in the US continued to take place in our equation as a positive variable. Although Powell gave cautious messages in his last speech, the continuation of the FED’s interest rate cut cycle and the volume in BTC ETFs indicating an increase in institutional investor interest (in addition to MicroStrategy’s BTC purchases, Microsoft’s start to evaluate the purchase issue, BlackRock’s BTC ETF options started trading…) support our upward forecast for the big picture for now.

In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional pauses or pullbacks in digital assets. However, at this point, it is worth emphasizing again that the fundamental dynamics continue to be bullish.

TECHNICAL ANALYSIS

BTC/USDT

The positive atmosphere brought to the crypto market by D. Trump, the US president, is attracting the attention of other countries with the actions taken by the states in the country. Finally, Florida plans to establish a strategic reserve in the first quarter of 2025, while Pennsylvania aims to invest 10% of its general funds in Bitcoin. Michigan and Wisconsin prefer to invest in Bitcoin ETFs with a more conservative approach. On the other hand, Argentina welcomes crypto ETFs, while Iran adopts a regulatory approach.

When we look at the technical outlook with all these global developments, BTC, which exhibited relatively fluctuating price movements over the weekend, could not provide permanence above the 100,000 level. BTC, which formed an uptrend channel in the region where it peaked, is currently trading at 99,000. The trend bottom line crossing between the 50- and 100-day SMA lines may indicate that this area will act as a strong support. Technical oscillators are indecisive on the hourly charts, while the momentum indicator is pointing to weakness. With the deepening of the retreat, 97,900 and 97,200 support zones are being monitored, but crossing the 100,000 level in a possible rise with new developments may strengthen momentum.

Supports 99,140 – 97,200 – 95,000

Resistances 100,000 – 101,100 – 104,000

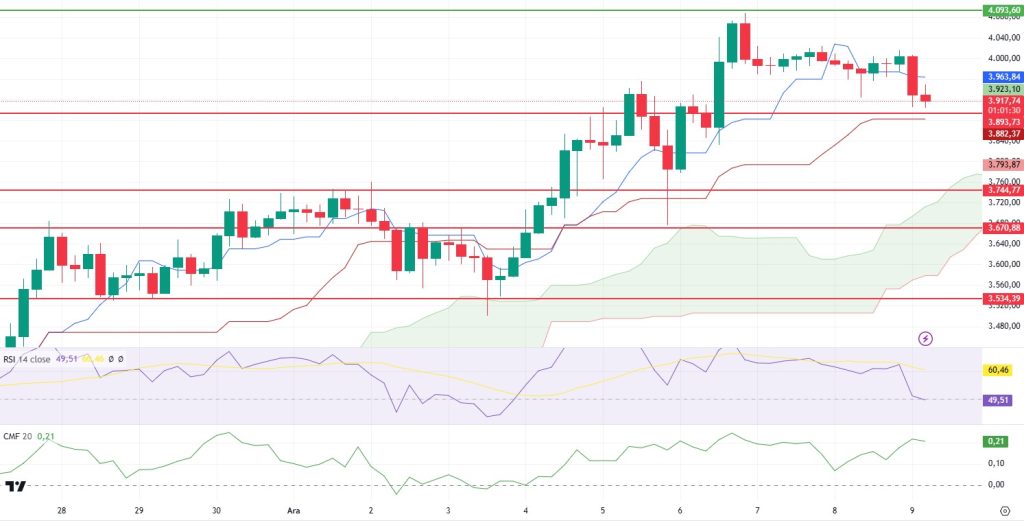

ETH/USDT

ETH managed to reach 4,093 resistance with the rise it experienced on Friday, but it was accumulated in a narrow range over the weekend with the reaction it received from here. With the morning opening, it lost its tenkan level and fell to 3,893 support. With this move, the first detail that catches the eye is the positive divergence on the Relative Strength Index (RSI). However, Chaikin Money Flow (CMF) rose above the 0.20 level, indicating that investor interest has increased. The weakening in momentum supports the negative outlook. When we look at the Cumulative Volume Delta (CVD), we see that the movements in both directions come from spot transactions. Funding fee declined to 0.0277 with the recent decline, which can be listed as one of the positive factors. When all this data is analyzed, it can be said that the loss of this region may deepen the decline somewhat for ETH, which is expected to rise again by getting support from the region between 3.893-3.882 during the day.

Supports 3,893 – 3,744 – 3,670

Resistances 4,093 – 4,299 – 4,474

XRP/USDT

When the ichimoku indicator for XRP, which had a very active weekend, is examined, after the buy signal formed by the tenkan level cutting the kijun upwards, the price loses the tenkan level and retreats to the kumo cloud support. Another positive factor is that Chaikin Money Flow (CMF) also moved above the zero zone for XRP, which can get support from the Kumo cloud. In this case, it can be said that the price may make another attack to the 2.65 level during the day. However, it should be noted that the kumo cloud support is very important and the loss of the level may bring declines up to 2.19 levels.

Supports 2.4110 – 1. 1982- 1. 8758

Resistances 2.6567 – 2.7330 – 3.105

SOL/USDT

Solana-based memecoin launchpad platform Pump Fun has been banned in the UK. Since the platform is based in the UK, there is uncertainty. Meanwhile, President-elect Donald Trump has appointed ‘All In’ podcast host and former PayPal executive David Sacks as the ‘White House AI and Crypto Czar’. Solana bulls were pleased with the announcement, hoping that Sacks’ investment history with Solana will bring the asset to higher levels and prominence in the United States. On-chain, TVL reached a new ATH of $8.98 billion.

On the 4-hour timeframe, the 50 EMA (Blue Line) is above the 200 EMA (Black Line). Since November 22, SOL has been in a downtrend and although it broke the downtrend, we can say that this was a rise due to the general market. As a matter of fact, although the price started to rise with support from the 200 EMA, momentum and price started to fall again. When we examine the Chaikin Money Flow (CMF)20 indicator, we see that there is also a decline in money inflows. This can be shown as a downward signal. However, Relative Strength Index (RSI)14 accelerated from the mid-level to the overbought zone. On the other hand, the symmetrical triangle pattern stands out. If it works, the $ 291.00 level may be the target. The 247.53 level stands out as a very strong resistance point in the rises driven by both macroeconomic conditions and innovations in the Solana ecosystem. If it breaks here, the rise may continue. In case of possible retracements due to macroeconomic reasons or profit sales, support levels 222.61 and 189.54 may be triggered again. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 222.61 – 209.93 – 200.00

Resistances 237.53 – 247.53 – 259.13

DOGE/USDT

On December 6th, Dogecoin co-founder Markus published a celebratory X-post to remind his millions of followers that DOGE was launched 11 years ago today. The Dogecoin Foundation aims to expand adoption with the Dogebox Decentralized Infrastructure System for enterprises in 2025. On the other hand, data from IntoTheBlock showed that the massive trading volume for DOGE increased to $10.40 billion in the last 24 hours, indicating increased participation from whales and institutions. Moreover, exchanges witnessed $103.43 million worth of DOGE outflows.

When we look at the chart, the asset, which has been in an uptrend since November 11, has started to accelerate downwards, although it has managed to stay in the trend with support from both the base level of the trend and the 50 EMA. If this movement is strong, the 0.36600 level may be triggered. On the 4-hour timeframe, the 50 EMA (Blue Line) is above the 200 EMA (Black Line). But the gap between the two averages is still too wide. This may cause pullbacks. On the other hand, when we look at the RSI 14 indicator, we see that it is moving towards its neutral level. However, when we examine the Chaikin Money Flow (CMF)20 indicator, we see that there is a small amount of money inflows. The 0.50954 level appears to be a very strong resistance level in the rises driven by both macroeconomic conditions and innovations in Doge coin. If DOGE maintains its momentum and rises above this level, the rise may continue strongly. In case of retracements due to possible macroeconomic reasons or profit sales, the 0.36600 support level can be triggered again. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.42456 – 0.36600 – 0.33668

Resistances 0.45173 – 0.50954 – 0.55889

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.