MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 107,753.91 | 2.41% | 57.68% | 2,14 T |

| ETH | 3,414.51 | 3.99% | 11.27% | 409,42 B |

| XRP | 3.187 | -0.71% | 4.98% | 181,90 B |

| SOLANA | 257.37 | -5.69% | 3.38% | 123,65 B |

| DOGE | 0.3786 | -4.32% | 1.52% | 55,43 B |

| CARDANO | 1.0578 | -0.93% | 1.01% | 36,90 B |

| TRX | 0.2383 | -1.46% | 0.56% | 20,39 B |

| LINK | 25.74 | 9.91% | 0.45% | 16,53 B |

| AVAX | 37.77 | -3.34% | 0.42% | 15,56 B |

| SHIB | 0.00002128 | -3.39% | 0.34% | 12,54 B |

| DOT | 6.607 | -3.60% | 0.28% | 10,18 B |

*Prepared on 1.20.2025 at 07:00 (UTC)

WHAT’S LEFT BEHIND

Preparing for Inauguration in the US

US President-elect Donald Trump travelled with his family to the capital Washington to attend today’s inauguration ceremony. It was noteworthy that Trump travelled on a US Air Force plane instead of his own. In addition to Trump’s family and politicians, prominent figures from the financial and crypto world are expected to attend the ceremony. There will be CEOs from the technology sector, former presidents and even some world leaders. The CEOs expected to go to the White House are as follows:

Shou Zi Chew /

Mark Zuckerberg / Meta Jeff Bezos

Amazon Elon Musk / X, Tesla

MELANIA: Market Capitalization $6.4 Billion

Trump’s wife Melania introduced the new Meme coin MELANIA. In a statement made on social media, it was announced that MELANIA is on sale. According to GMGN data, the market capitalization of MELANIA is 6.4 billion dollars. After the TRUMP coin announcement, the price briefly dropped below $40, but recovered to $46.

Bitcoin Tracker Data from Michael Saylor

MicroStrategy founder Michael Saylor continues to share Bitcoin Tracker data for 11 consecutive weeks. This time, however, he gave a different message from previous statements, saying, “Tomorrow everything will be different.” MicroStrategy is known to increase its BTC holdings after each announcement.

SEC Sues Nova Labs

The US SEC has sued Helium developer Nova Labs for selling unregistered securities and misleading investors. This could be the last enforcement action of Chairman Gary Gensler’s tenure.

Density and Problems in the Solana Ecosystem

Solana’s decentralized exchange Jupiter announced that the system was overloaded due to high demand and that it was working to restore services to normal. The Phantom wallet also stated that it receives over 8 million transaction requests per minute and that there may be disruptions in transactions.

World Liberty Financial (WLFI) Raises $250 Million in IPO

WLFI, the Trump family’s crypto project, raised $248.7 million by selling 16.58 billion WLFI tokens during its IPO. WLFI also spent 16 million USDT to increase its holdings by 4,869 ETH, bringing its total to 32,852 ETH.

TikTok Resumes Service in the US

TikTok has reached an agreement with internet service providers in the US and restarted its services. Trump is reportedly planning a joint venture to continue TikTok operations.

El Salvador Increases Bitcoin Holdings

El Salvador received another 11 BTC, bringing its total BTC holdings to 6,043.18 BTC. This exceeds $608 million based on the current BTC value.

Solana Sets Record for DEX Trading Volume

Solana set a new record among all chains in January with DEX transaction volume exceeding $158 billion. Solana became the first blockchain to surpass $150 billion.

TRON DAO Invests Another $45 Million in WLFI

Justin Sun announced on the X platform that TRON DAO has invested an additional $45 million in World Liberty Financial (WLFI), the Trump family’s crypto project. With this move, TRON DAO’s total investment in WLFI reached $75 million. Sun emphasized that this strategic investment is an important step for the TRON ecosystem.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Previous |

|---|---|---|

| All Day | Holiday United States – Martin Luther King, Jr. Day | – |

| – | IOTA: Growth Initiative Vote | – |

| – | PinLink (PIN): PinLink V0-Alpha Testnet Launch | – |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

As the digital world is awash with interest in Trump’s coin, which will take over the presidency today, the major cryptocurrencies have also recorded significant gains to start the new week. The fact that a US President is so interested in the issue and also underlines that he will fulfill his promises (regulation, reserves, etc.) has increased the demand for crypto assets. We have seen significant value gains ahead of the President-elect’s inauguration today.

On the other hand, the positive phone call between Trump and Chinese leader Xi Jinping on Friday, which increased optimism about easing tensions between the two countries, seems to have fueled global risk appetite. US stock markets will be closed today due to a holiday. In Asia-Pacific indices , the Trump-Jinping call has positive effects. European indices are expected to start the day horizontally.

For the rest of the day, for major digital assets, after an eventful few hours, attention will turn to Trump’s inauguration. It would not be surprising to expect some respite after recent gains, but even though Wall Street will be closed, it would be worth being careful as Trump in focus could lead to increased volatility in asset prices.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our predictions. Afterwards, the appointments made by the president-elect and the increasing regulatory expectations for the crypto ecosystem in the US and the emergence of BTC as a reserve continued to take place in our equation as positive variables. Although it is expected to continue at a slower pace, the expectations that the FED will continue its interest rate cut cycle (for now) and the volume in ETFs based on crypto assets indicating an increase in institutional investor interest support our upward forecast for the big picture for now. In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional pauses or pullbacks in digital assets. However, at this point, it is worth emphasizing again that we think that the fundamental dynamics continue to support the rise.

TECHNICAL ANALYSIS

BTC/USDT

While the crypto market was moving with a busy agenda, the new President Donald Trump released a token named “Trump” before the inauguration ceremony in the US. Then his wife Melania Trump introduced a new meme coin, “MELANIA”. These developments marked the first time in history that a US President has directly engaged with cryptocurrencies. In his last speech before the inauguration ceremony to be held in the US today, Trump drew attention to the rising stock market and Bitcoin prices and called this situation the “Trump Effect”. With all these developments, at the time of writing, Bitcoin tested the new ATH level, pushing the ATH level above 109,000.

Looking at the technical outlook, BTC, which hit the 106,000 level at the weekend, faced a wave of sales and suffered a sharp retreat. The price, which broke the support levels of 103,000 and then 101,400, dropped to 99,400. The rapidly recovering price brought a new ATH level and is currently trading at 108,500. BTC, which shows an upward trend in line with our expectations, exhibits volatile movements before the US swearing-in ceremony. While technical oscillators in BTC, which we expect to continue its volatile movements, draw attention with the trading signals in the overbought zone, we observe that the falling momentum has regained strength in the last hour. In BTC, which raised the ATH level above 109,000, we will follow the level above 110,000 in the continuation of the rise. In a possible correction, we will follow the 105,000 support level.

Supports: : 108,000 -105,000 – 103,000

Resistances 109,000 – 110,000 – 115,000

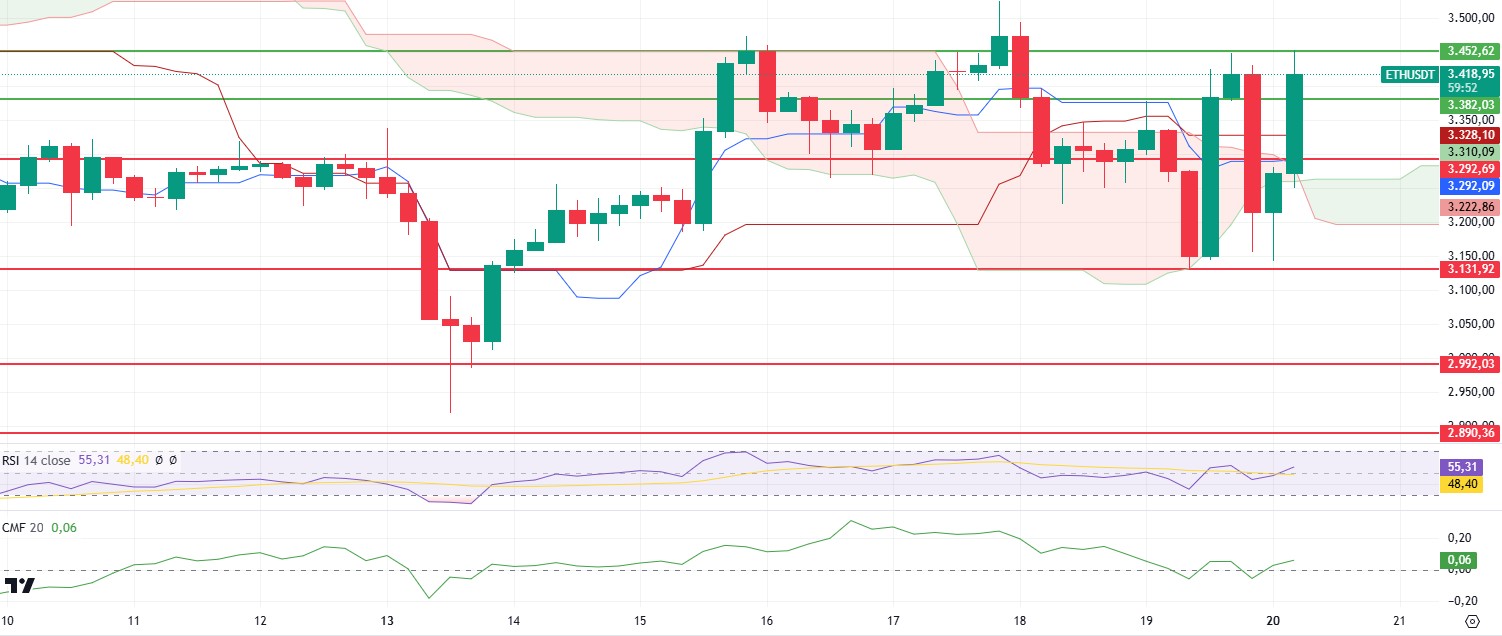

ETH/USDT

At the end of the week when volatility was quite high, ETH is pricing above the 3,382 level again after testing the 3,131 support twice due to the liquidity problem caused by the memecoins created by US President Trump. It can be said that the positive outlook is dominant with the double bottom formed below.

Looking at the technical indicators, it can be said that the positive outlook is dominating again with the momentum and Relative Strength Index (RSI) rising jointly. On the other hand, when the Ichimoku indicator is analyzed, the price regaining the kumo cloud level can be listed as one of the reasons contributing to the positive outlook. Again, the upward movement in the positive zone with the double bottom formed by Chaikin Money Flow (CMF) seems to be another factor contributing to the positive outlook.

With this data, it can be expected that the price will test higher resistance levels with the price gaining the 3,452 level. In particular, reaching the 3,565 level and the reaction from here will be decisive. The 3,131 level remains valid as the main support, but a break of this level may reverse the trend and bring deeper declines.

Supports 3,382 – 3,292 – 3,131

Resistances 3,452 – 3,565 – 3,726

XRP/USDT

After losing the 2.98 level with the decline it experienced over the weekend, XRP continued to rise rapidly, leaving a needle below, and momentarily reached the resistance level of 3.19.

With this price movement, Chaikin Money Flow (CMF), which fell to the negative zone with this price movement, regained the positive zone and continued its rise, which can be compiled as one of the very positive signals that buyers are re-engaged and gaining strength. On the other hand, the upward trend of the Relative Strength Index (RSI) level without any divergence contributes to the positive picture. Momentum also accompanies the rise.

In the light of this data, XRP, which we expect to continue its rise during the day, can open the door to higher resistance points as it gains the main resistance level of 3.38. The 2.98 level remains the main support and its loss may weaken the momentum and cause the trend to change.

Supports 3.1991 – 2.9851 – 2.7268

Resistances 3.3854 – 3.5039- 3.7057

SOL/USDT

Solana is living one of its historic moments. Last Saturday morning, Trump’s ‘Official’ meme coin X and Truth Social announced its launch on their accounts. The fully diluted volume rose to over $14 billion hours after the launch, making it one of the fastest growth rates in the crypto segment. Solana reached an all-time high after Donald Trump’s memecoin launch. On the other hand, Multichain Capital presented its proposal to reduce SOL inflation to 1.5%. It proposes a mechanism organized by share participation to set SOL inflation to a stable level of 1.5% per annum. ProShares has also filed for a Solana Futures ETF. DEX tokens surged amid the Trump memecoin craze. TRUMP memecoin was launched in apparent partnership with several Solana-based protocols, including Moonshot, decentralized exchange Jupiter and liquidity protocol Meteora. TRUMP memecoin entered the top 15 worldwide within 48 hours, sparking rumors of a tax cut. This important milestone reflects Solana’s growing popularity in the market and strengthening trust among investors. The rapid adoption of Solana, especially in DeFi projects and the NFT ecosystem, is considered one of the key factors behind this rise.

After the historic surge due to Trump’s meme money, the Left, after its upward momentum, entered a bearish trend due to the over-inflation of the Relative Strength Index RSI (14) and lost about 18% from the historic peak. Sudden spikes seem to call for sudden declines again. The left is looking for strong support to regain its strength. On the 4-hour timeframe, the 50 EMA (Blue Line) has started to be above the 200 EMA (Black Line). This could mean a bullish continuation in the medium term. At the same time, the asset is above the 50 EMA and 200 EMA. The Chaikin Money Flow (CMF)20 indicator is in positive territory and inflows have reached saturation and started to decline. This may cause a further pullback. However, the Relative Strength Index (RSI)14 indicator has moved from overbought to neutral territory. The removal of this bulge in the RSI may be a bullish harbinger. The 291.00 level stands out as a very strong resistance point in the rises driven by both the upcoming macroeconomic data and the news in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements for the opposite reasons or due to profit sales, the 222.61 support level can be triggered. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 237.53 – 222.61 – 209.93

Resistances 247.53 – 259.13 – 275.00

DOGE/USDT

Dogecoin has declined 8.35% in the last 24 hours. DOGE futures open interest hit a record high of $5.25 billion. Dogecoin could see intense fluctuations on the future price of the asset before the inauguration of President-elect Donald Trump. Dogecoin’s daily active address count is currently hovering around 80,000. This is a sign of increased user activity and participation in the network. On the other hand, blockchain data tracker Whale Alert reported that 131 million DOGE were moved from online trading firm Robinhood in two major transactions. But in a significant transaction that caught the attention of the cryptocurrency community, 90,000,000 DOGE worth approximately $36,438,179 was transferred from an unknown wallet to a centralized exchange.

Doge continued its uptrend, testing the 0.42456 level and retreated from there. Looking at the chart, the asset is between the 50 EMA (Blue Line) and the 200 EMA (Black Line) on the 4-hour timeframe. At the same time, the price has received support from the 200 EMA at the time of writing. The 50 EMA has also started to hover above the 200 EMA. This could be the beginning of a medium-term uptrend. The rising wedge pattern worked and the price retreated. When we analyze the Chaikin Money Flow (CMF)20 indicator, it is in the neutral zone but money inflows and outflows are balanced. However, Relative Strength Index (RSI)14 is back in negative territory. The 0.42456 level stands out as a very strong resistance point in the rises due to political reasons, macroeconomic data and innovations in the DOGE coin. In case of possible pullbacks due to political, macroeconomic reasons or negativity in the ecosystem, the 0.33668 level, which is the base level of the trend, is an important support. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.33668 – 0.30545 – 0.28164

Resistances 0.36600 – 0.39406 – 0.42456

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.