MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 105,113.92 | 2.94% | 57.45% | 2,08 T |

| ETH | 3,397.78 | 6.11% | 11.27% | 408,26 B |

| XRP | 3.155 | 1.24% | 5.01% | 181,53 B |

| SOLANA | 263.93 | 7.01% | 3.54% | 128,26 B |

| DOGE | 0.3585 | 1.94% | 1.46% | 52,86 B |

| CARDANO | 1.0010 | 3.61% | 0.97% | 35,17 B |

| TRX | 0.2575 | 4.63% | 0.61% | 22,19 B |

| LINK | 26.27 | 7.81% | 0.46% | 16,71 B |

| AVAX | 35.98 | 1.80% | 0.41% | 14,81 B |

| SHIB | 0.00002026 | 1.52% | 0.33% | 11,95 B |

| DOT | 6.452 | 2.50% | 0.27% | 9,96 B |

*Prepared on 1.24.2025 at 07:00 (UTC)

WHAT’S LEFT BEHIND

Trump Signs Cryptocurrency Executive Order

President Trump signed an executive order evaluating the creation of a national digital asset reserve and banning CBDC. The Presidential Digital Asset Market Task Force, chaired by David Sacks, was tasked with developing a regulatory framework.

US SEC Cancels SAB 121 Policy

The SEC announced that it has withdrawn guidance on the SAB 121 policy on accounting for crypto assets. This affects accounting policies related to the obligation to safeguard crypto assets held by platform users.

Ivanka Trump Warns Against Fake Meme Coins

Donald Trump’s daughter, Ivanka Trump, warned investors against scams related to the fake meme coin named after her ($IVANKA) and said she has no connection to these projects.

Senator Lummis Named Chairman of the Digital Assets Subcommittee

Senator Cynthia Lummis stated that a comprehensive legal framework for digital assets should be established and that she would support the US strategy to strengthen its Bitcoin reserves.

North Korea Suspected in Phemex Hack Attack

It has been suggested that North Korean hackers may be behind the $70 million in funds stolen from Phemex. After the attack, Phemex suspended withdrawals.

Ledger Founder Rescued from Kidnapping

David Balland, founder of crypto wallet maker Ledger, was rescued in a police operation after a kidnapping.

OpenAI Unveils New AI Tool ‘Operator’

OpenAI launched Operator, the first AI tool that can perform web-based operations on behalf of users. They also announced that they will launch O3-mini, the free version of ChatGPT.

Circle Launches USDC Paymaster Feature

Circle announced the Paymaster feature where users can pay transaction fees with USDC on Arbitrum and Base instead of ETH. This aims to streamline the transaction process.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| Immutable (IMX) | 24.52MM Token Unlock | — | — |

| Arbitrum | BoLD Activation Vote | — | — |

| 14:45 | US Flash Manufacturing PMI | 49.8 | 49.4 |

| 14:45 | US Flash Services PMI | 56.4 | 56.8 |

| 15:00 | US Existing Home Sales (Dec) | 4.19M | 4.15M |

| 15:00 | US Michigan Consumer Sentiment (Jan) | 73.3 | 73.2 |

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

New President Trump signed the highly anticipated decree on the Cryptocurrency Labor Unit yesterday. Trump’s silence on the crypto world, which has put pressure on digital asset prices in recent days, has come to an end. In the details of the decree, we see that almost every issue mentioned by the President during the election campaign is included, and the Unit in question is expected to submit a report to Trump after six months. Following this long-awaited news, we didn’t see any unusual rallies in major assets and BTC showed some gains, followed by sideways price changes. Still, we think this latest development will produce a positive outcome for digital assets in the long run.

On the Asia-Pacific front this morning, the Bank of Japan’s (BoJ) decision to raise interest rates to the highest level since 2008 and China’s recent steps to support its economy and markets are being watched. In addition, Trump’s statement that he would prefer to reach an agreement with China instead of using tariffs after his meeting with President Xi Jinping contributed to the positive mood on the continent. European stock markets are also expected to start the new day with a rise, while Wall Street futures seem to be affected by profit sales after yesterday’s rises.

From the short term to the big picture.

The victory of former President Trump on November 5, one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our predictions. In the aftermath, the appointments made by the president-elect and the increasing regulatory expectations for the crypto ecosystem in the US and the emergence of BTC as a reserve continued to be in our equation as positive variables. Then, 4 days after the new President took over the White House, he signed the decree of the Cryptocurrency Work Unit, which was among his election promises, and we think that the outputs that this will produce in the coming days will continue to reflect positively on digital assets.

On the other hand, although it is expected to continue at a slower pace, the expectations that the FED will continue its interest rate cut cycle (for now) and the fact that the volume in ETFs based on crypto assets indicates an increase in institutional investor interest support our upward forecast for the big picture for now. In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional pauses or pullbacks in digital assets. However, at this point, it is worth emphasizing again that we think that the fundamental dynamics continue to support the rise.

TECHNICAL ANALYSIS

BTC/USD

The executive order that markets have been waiting for, evaluating the creation of a national digital asset reserve and banning CBDC, was signed by D. Trump. The task force will be headed by David Sacks, the White House’s “Director of Artificial Intelligence and Cryptocurrency,” and will include the Secretary of the Treasury, the SEC Chairman, and the heads of other relevant departments and agencies. On the other hand, Trump reiterated that the US will be the capital of the world in the field of artificial intelligence and cryptocurrency and emphasized low interest rates.

When we look at the technical outlook with all these developments, BTC, which was in a downward trend and moving at the level of 102,000 before the announcement, rose sharply to 106,800 levels. After the impact of the news, BTC retreated with the same hardness and retested 102,300 levels. BTC, which started the day with a rise this morning, is currently trading at 104,970 just below the 105,000 resistance level. The price, which pushed the resistance level of 105,000, has not yet exceeded this level. We observe that technical oscillators continue to signal buying and the momentum indicator signals a transition back to the positive zone. In the continuation of the rise, the price may retest 107,000 levels with closures above 105,000. In a possible pullback, we will follow the 104,400 minor support zone.

Supports: 104,400 – 102,800 – 101,400

Resistances 105,000 – 102,800 – 105,000

ETH/USDT

Yesterday was a very active day for the world economy and cryptocurrency markets. In particular, US President Trump’s directive to develop a national digital asset reserve sparked a wave of volatility in global markets. Following this development, President Trump’s statement that “I want interest rates to be lowered significantly” and the SEC’s official cancellation of the long-debated SAB 121 directive had an upward impact on the ETH price. Later in the day, the Bank of Japan cut interest rates by 25 basis points, in line with market expectations, instead of the feared 50 basis points, further supporting the price of ETH. As a result of these positive developments, the Ethereum price rose as high as 3,410 during the day. However, since this level coincides with the downtrend line that has been in place since December 16, there was a rejection from this point.

Technical indicators show that ETH has started to regain upward momentum after this rise. The Relative Strength Index (RSI) continues its bullish trend and is expected to take a more positive outlook if the price breaks through the blue trend line and the critical 3,452 resistance. However, unlike the RSI, the Chaikin Money Flow (CMF) indicator is not supporting price action and has formed a negative divergence. This suggests that the market has not found enough support in terms of volume and buying pressure may remain weak. Looking at the Ichimoku indicator, the price moving out of the kumo cloud indicates that the uncertainty in the market is decreasing. Also, a buy signal is observed as the tenkan level crosses the kijun level upwards, raising the possibility that the price may move higher.

In light of this data, it can be said that the Ethereum price is at a critical decision point. A daily close above 3,452 could allow for a strong upside momentum to continue and a breakout towards the upper resistance levels. However, another point to note is the potential impact of the negative divergence on CMF. If this divergence works and the price closes below 3,292, a deeper bearish wave could be triggered. In this case, Ethereum can be expected to retrace towards the next support levels. The market’s reaction above these critical levels will be one of the most important factors that will determine the short-term direction of ETH in the coming days.

Supports 3,292 – 3,131 – 2,992

Resistances 3,382 – 3,452 – 3,565

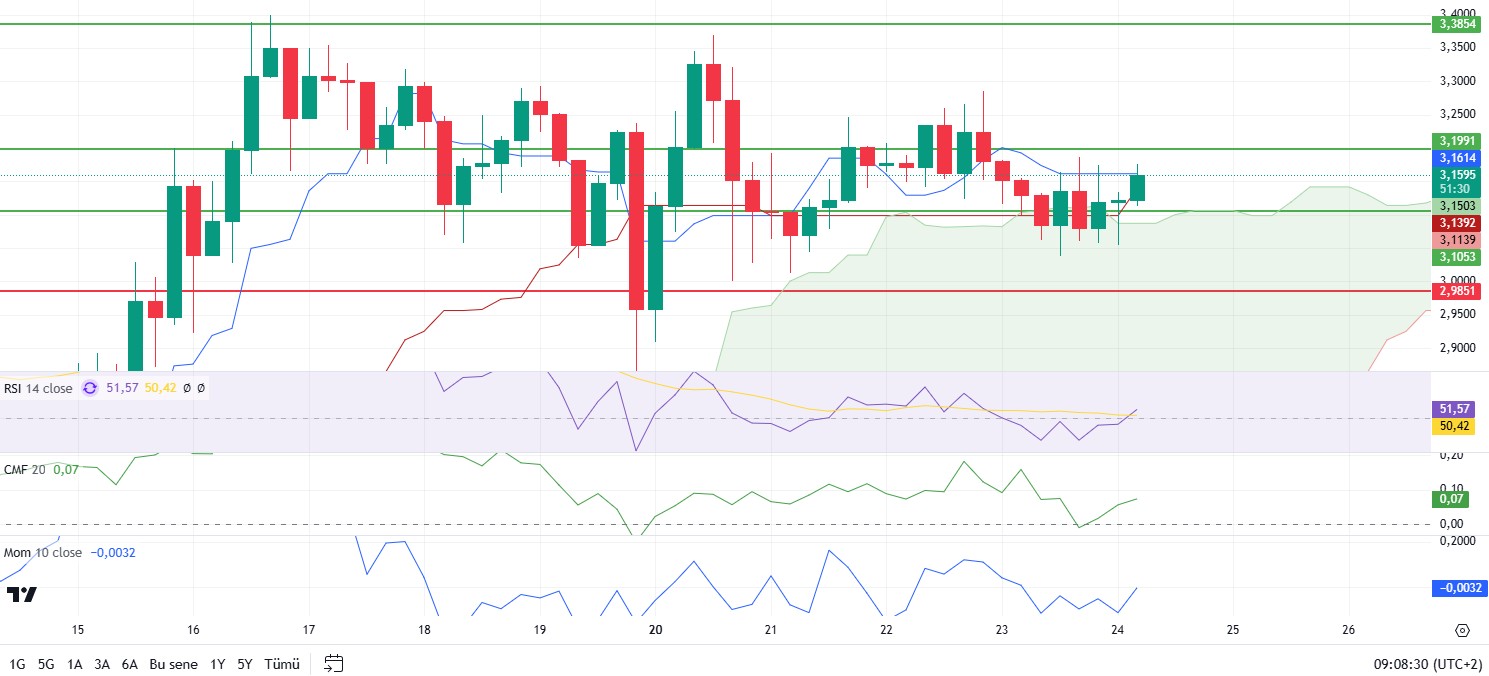

XRP/USDT

Yesterday, US President Trump’s remarks on plans to develop digital reserves and the Bank of Japan’s interest rate decision led to remarkable volatility for XRP. After President Trump’s speech, there was a general volatility in the cryptocurrency markets, while the announcement of the Bank of Japan’s interest rate decision in line with expectations in the night hours brought some relief to the markets. In parallel with these developments, XRP started pricing above the Ichimoku cloud again and continued its upward trend.

When technical indicators are analyzed, the fact that the Chaikin Money Flow (CMF) indicator is on the rise without any negative divergence indicates that the buying pressure in the market is strengthening. Likewise, the Relative Strength Index (RSI) indicator maintaining its positive trend stands out as another important factor supporting XRP’s upward momentum. In addition, the upward trend of the Momentum indicator also contributes to the overall positive market outlook. When we look at the Ichimoku indicator, it is observed that the price is stuck between the tenkan and kijun levels. This suggests that it would be healthier to wait for these levels to be broken to get a clear signal about the direction of the price.

In light of this data, critical levels for the XRP price should be carefully monitored. If the price breaks through the tenkan level and the 3.20 resistance, it could set the stage for a strong upward movement. However, a re-break of the 3.10 level, which is considered as the support of the Ichimoku cloud, may cause slight pullbacks and sideways movements for a while.

Supports 3.1053 – 2.9851 – 2.7268

Resistances 3.1991 – 3.3854 – 3.5039

SOL/USDT

SOL GLOBAL announced that it has received binding commitments from strategic investors for a $10 million bond private placement. 70% of the net proceeds will be used for SOL acquisitions. President Donald Trump’s team has reportedly increased their holdings in Solana, a leading cryptocurrency. Recent transactions show that Trump’s team has purchased 412 more SOL, worth approximately $103,770.

The LEFT continues to experience fluctuations. The asset, which started to rise again from the support of the symmetrical triangle pattern, continues to be inside the triangle. The price continues to be above the 50 EMA (Blue Line) 200 EMA (Black Line) on the 4-hour timeframe. At the same time, the SOL is above the 50 EMA and the 200 EMA. These could mean that the uptrend will continue in the medium term. When we examine the Chaikin Money Flow (CMF)20 indicator, it is seen that money inflows accelerated by moving from the neutral zone to the positive zone. However, the Relative Strength Index (RSI)14 indicator has reached the middle level of the positive zone. The 275.00 level stands out as a very strong resistance point in the rises driven by both the upcoming macroeconomic data and the news in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements for the opposite reasons or due to profit sales, the 209.93 support level can be triggered. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 247.53 – 237.53 – 222.61

Resistances 259.13 – 275.00 – 291.00

DOGE/USDT

Asset manager Bitwise recently filed for registration of the Dogecoin exchange-traded fund (ETF). Onchain’s open interest decreased by 15.61% in the last week, while the long-to-short ratio was 0.96%. On the other hand, there has been a significant increase in trading volume in the last 24 hours. The total volume recorded on a centralized exchange stands at 135,428,813 DOGE

DOGE has been moving horizontally since our analysis yesterday. On the 4-hour timeframe, a falling wedge pattern seems to have formed. If this pattern works, the price may rise strongly. The asset has crossed below the 50 EMA (Blue Line) and the 200 EMA (Black Line). The 50 EMA continues to hover above the 200 EMA. However, the 50 EMA has turned down. This could lead to a bullish reversal. When we examine the Chaikin Money Flow (CMF)20 indicator, it moved from the neutral zone to the positive zone and money inflows seem to have increased. However, Relative Strength Index (RSI)14 is in the neutral zone. The 0.39406 level appears as a very strong resistance point in the rises due to political reasons, macroeconomic data and innovations in the DOGE coin. In case of possible pullbacks due to political, macroeconomic reasons or negativities in the ecosystem, the 0.33668 level, which is the base level of the trend, is an important support. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.33668 – 0.30545 – 0.28164

Resistances 0.36600 – 0.39406 – 0.42456

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.