MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap |

|---|---|---|---|---|

| BTC | 92,537.56 | 0.67% | 59.36% | 1,83 T |

| ETH | 3,109.86 | -0.70% | 12.14% | 374,51 B |

| SOLANA | 234.99 | -3.37% | 3.62% | 111,57 B |

| XRP | 1.0868 | -1.75% | 2.01% | 61,93 B |

| DOGE | 0.3875 | -0.49% | 1.85% | 57,00 B |

| CARDANO | 0.7886 | 3.51% | 0.90% | 27,65 B |

| TRX | 0.1979 | -3.90% | 0.55% | 17,11 B |

| SHIB | 0.00002437 | -3.29% | 0.47% | 14,37 B |

| AVAX | 33.87 | -4.57% | 0.45% | 13,87 B |

| LINK | 14.50 | -3.73% | 0.30% | 9,10 B |

| DOT | 5.832 | -2.16% | 0.29% | 8,88 B |

*Prepared on 11.20.2024 at 06:00 (UTC)

WHAT’S LEFT BEHIND

Trump Considers Appointing Teresa Goody Guillén as SEC Chair

US President-elect Donald Trump is considering appointing blockchain law expert Teresa Goody Guillén to head the US Securities and Exchange Commission (SEC). According to CoinDesk, Guillén is a veteran of SEC enforcement actions, serving as partner and co-chair of the blockchain team at Baker Hostetler LLP. Guillén’s experience in blockchain is seen as the beginning of a new era for the crypto industry.

Bitcoin ETF Options Start Trading on Nasdaq

Options on BlackRock’s iShares Bitcoin Trust ETF (IBIT) began trading on Nasdaq yesterday. According to a statement from Nasdaq, options traded 73,000 contracts in the first 60 minutes. This performance placed IBIT in the top 20 of the most active non-index options. This intense interest in options trading once again demonstrated the growing investor demand for Bitcoin ETFs.

IBIT Options Hit $1.9 Billion Trading Volume on First Day

Options trading on BlackRock’s iShares Bitcoin Trust ETF (IBIT) attracted a lot of interest on its first trading day. According to The Block, IBIT options traded around $1.9 billion of notional risk with a total of 354,000 contracts. The Bitcoin price also broke a historic record, surpassing $93,900 after this effect. As the first spot Bitcoin ETF to be approved for options trading, IBIT was a big hit among investors.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| Blockchain Africa Conf..Bitcoin Events 10th Edition: Blockchain Africa Conference, Pretoria (Tshwane) | |||

| European Web3 Summit. European Web3 Summit 2024, Brussels | |||

| NexTech Week Tokyo. NexTech Week Tokyo: AI, blockchain, and quantum computing event, Makuhari Messe, Chiba, Japan | |||

| Open Campus (EDU). Capy Friends Vote (November 13-20) | |||

| 15:00 | FOMC Member Barr Speaks | ||

| 16:00 | FOMC Member Cook Speaks | ||

| 17:15 | FOMC Bowman Cook Speaks |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

Increasing tension on the Russia-Ukraine front was the main factor driving asset prices in global markets yesterday. We continue to monitor the repercussions of this issue. On the other hand, the news that Iran agreed to halt the production of enriched uranium needed for nuclear weapons was noted as a positive development for the solution of a long-standing problem.

In the shadow of the geopolitical risks plaguing investors, the market is watching the statements of the Federal Open Market Committee (FOMC) officials on the US Federal Reserve’s (FED) monetary policy course. On the other hand, President-elect Trump’s cabinet picks are also under close scrutiny.

Despite some decline in risk appetite, losses in digital assets remained limited. While Bitcoin recorded a new record high with the effect of BlackRock’s BTC ETF options starting trading yesterday, it created a basis for limited losses in other major crypto assets. The calendar will not be very busy for the market during the day, but the statements of FOMC officials will be closely monitored. In addition, possible new news flows regarding geopolitical risks and developments regarding Trump’s cabinet will remain on the agenda.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our forecasts. The continuation of the Fed’s rate cut cycle (albeit with cautious messages from Powell…) and the entry into BTC ETFs, indicating increased institutional investor interest (in addition, MicroStrategy’s BTC purchases, Microsoft’s start to evaluate the purchase, BlackRock’s BTC ETF options start trading…) support our upside forecast for the big picture for now.

In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional respite or pullbacks in digital assets. At this point, it would be useful to underline again that fundamental dynamics remain bullish. While Bitcoin, the largest digital currency, extending its record high again, may continue to whet the appetite of buyers to take new, upside positions, we will watch this group struggle with the masses who may be looking for profit realizations and speculators looking to exploit potential declines after rapid rises.

TECHNICAL ANALYSIS

BTC/USDT

Bitcoin added another one to its ATH series. Yesterday, $1.9 billion in trading volume was reached immediately after the launch of options linked to BlackRock’s spot Bitcoin ETF. This development pushed the Bitcoin price to $94,000, setting a new record.

When we look at the technical outlook after BTC spot ETF Options, with the consolidation above the 90,000 level, the price made a new ATH attempt by reaching the 94,000 level. BTC, which is currently trading at 92,400, is losing momentum as the accumulation of short trades at ATH levels is rapidly increasing. Despite the sell signal on technical oscillators, the performance of Spot ETF Options in the US trading market today may cause momentum to increase once again. This could push the BTC price closer to six-digit levels with the arrival of new records. In a possible correction during the day, the minor support level of 91,350 and then the major support level of 90,000 continue to serve as support.

Supports 91,350 – 90,000 – 87,000

Resistances 94,000 – 95,000 – 100,000

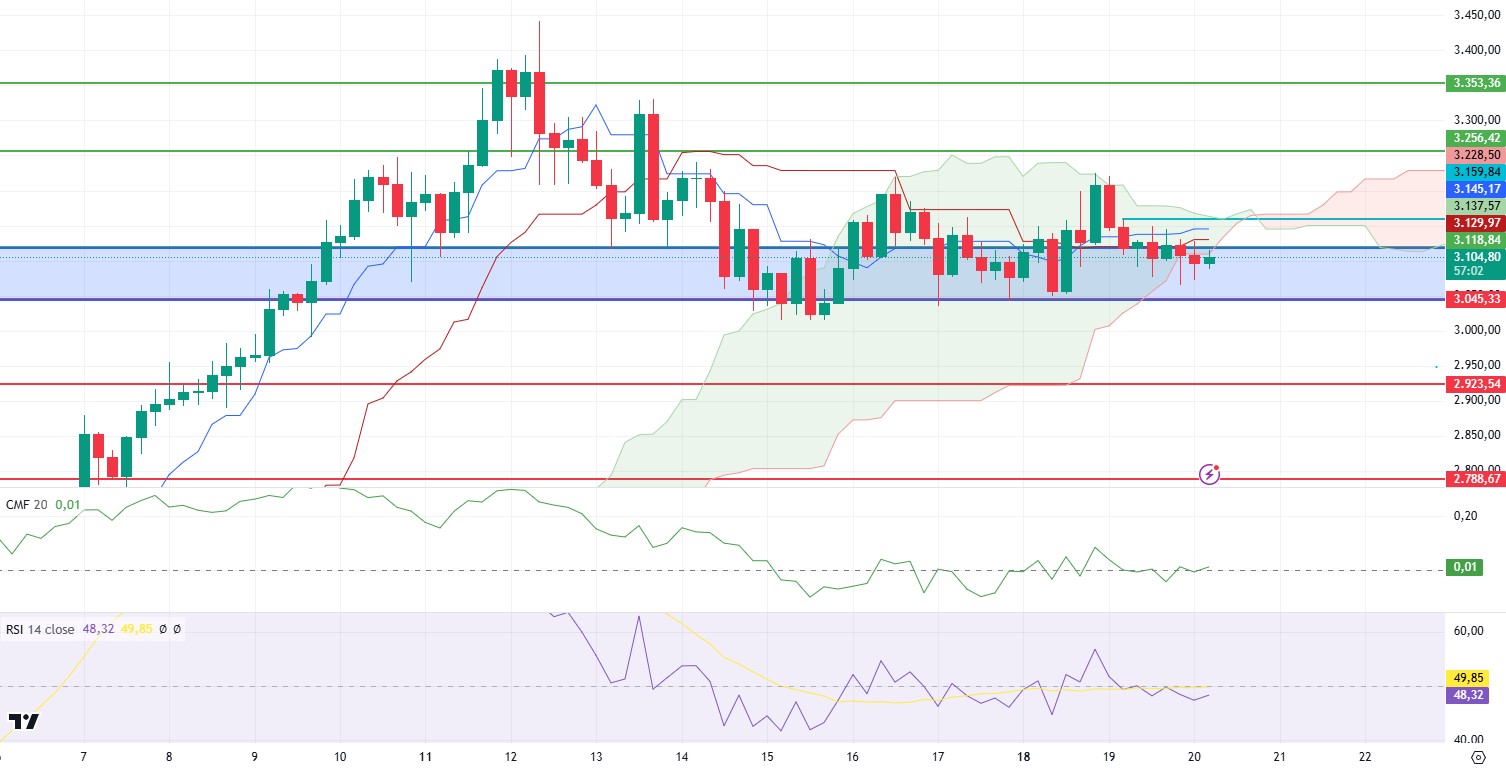

ETH/USDT

ETH remained below the kumo cloud level, unable to react to the rise in Bitcoin overnight. In ETH, which continues to move horizontally within the support area, the Relative Strength Index (RSI) level is also seen moving horizontally. The Chaikin Money Flow (CMF) rising above the zero value indicates that the price may go up as ETH rises above the 3,118 level, especially if the 3,145 intermediate resistance is exceeded. Looking at the Cumulative Volume Delta (CVD), it is seen that the price reacted to the sharp sell-off from futures in the areas where the price rose above the blue area. This situation shows that spot-weighted rises may start with the gain of the 3,145 level. In addition to all these, it can be said that it is very important to protect the 3,045 main support zone and its breakout may lead to sharp declines to 2,923 levels.

Supports 3,118 – 3,045 – 2,923

Resistances 3,256 – 3,353 – 3,534

XRP/USDT

XRP made a correction movement after the rise it has experienced in recent days and fell to the support zone between 1.07 and 1.03. As expected, it is pricing above 1.07 again with purchases from this region. The positive divergence on the Relative Strength Index (RSI) indicates that upward movements in XRP may come, provided that the price does not close below 1.07. Chaikin Money Flow (CMF), on the other hand, is moving upwards again, but it is still in the negative area as it is below the zero line. It can be said that a potential buy signal can be realized on CMF, which is close to the zero line. With the break of 1.119 intermediate support, the rise may accelerate. However, a downside break of 1.07 and especially 1.03 zones may bring sharp declines up to 0.93 levels.

Supports 1.0709 – 1.0333 – 0.9382

Resistances 1.2386 – 1.3487 – 1.4463

SOL/USDT

If we look briefly at the developments in the blockchain ecosystem, Trump said he was considering crypto lawyer Teresa Goody Guillén to be the head of the SEC. On the other hand, another 1 billion USDT was printed. The American stock exchange Nasdaq listed BlackRock’s Bitcoin ETF options yesterday. Bitcoin mining difficulty reached an all-time high of 102.29T.

In the Solana ecosystem, the Solana price continued to attract the attention of the crypto community and remained in the cosolide zone. As market dynamics shift towards speculative assets, Solana’s robust ecosystem is setting the stage for further growth. Leading the way are meme tokens. Solana meme tokens have a current market capitalization of $21.7 billion, down 1.7% in the last 24 hours, but with a 24-hour volume of over $12 billion.

Technically, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line) in the 4-hour timeframe. Since November 4, SOL, which has been in an uptrend since November 4, continues to be priced by maintaining this trend. This may mean that the uptrend will continue. However, when we examine the Chaikin Money Flow (CMF)20 indicator, money inflows are positive and inflows have started to increase. At the same time, Relative Strength Index (RSI)14 moved from overbought to neutral. The 247.53 level is a very strong resistance point in the uptrend driven by both macroeconomic conditions and innovations in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements due to possible macroeconomic reasons or profit sales, the support levels of 222.61 and 193.78 may be triggered again. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 233.06 – 222.61 – 209.93

Resistances 237.53 – 249.53 – 259.13

DOGE/USDT

If we take a brief look at the developments in the blockchain ecosystem, Trump said he was considering crypto lawyer Teresa Goody Guillén to be the head of the SEC. On the other hand, another 1 billion USDT was printed. The American stock exchange Nasdaq listed BlackRock’s Bitcoin ETF options yesterday. Bitcoin mining difficulty reached an all-time high of 102.29T.

In the Doge ecosystem, tech entrepreneur Elon Musk shared a meme tagging himself as “The Dogefather” in a recent post on X that has been viewed more than 14 million times. The black-and-white meme was a classic movie adaptation of Mario Puzo’s iconic novel “The Godfather”. This could be interpreted as a signal that the Doge coin will go higher. DOGE’s market cap is higher than its realized value, with an MVRV of 236.36%. So, if all holders were to sell, they would make an average profit of 236%. Such a high MVRV indicates a long period of price correction as more investors take profits.

Technically, Doge continues to consolidate above 0.35 since our analysis yesterday. However, a bull flag pattern has formed. If the pattern works after a short pullback or consolidation, the uptrend may continue. On the 4-hour timeframe, the 50 EMA (Blue Line) is above the 200 EMA (Black Line). This may mean that the uptrend will continue. But the gap between the two averages is still too wide. This could cause pullbacks. At the same time, the Relative Strength Index (RSI)14 has moved from overbought to neutral. However, when we examine the Chaikin Money Flow (CMF)20 indicator, it remains neutral. The 0.42456 level stands out as a very strong resistance point in the rises driven by both macroeconomic conditions and innovations in the Doge coin. If DOGE, which tested here, maintains its momentum and rises above this level, the rise may continue strongly. In case of retracements due to possible macroeconomic reasons or profit sales, the support levels of 0.33668 and 0.28164 can be triggered again. If the price hits these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.36600 – 0.33668 – 0.28164

Resistances 0.42456 – 0.45173 – 0.50954

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.