MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap |

|---|---|---|---|---|

| BTC | 97,140.89 | 5.02% | 60.49% | 1,92 T |

| ETH | 3,128.19 | 0.66% | 11.86% | 376,74 B |

| SOLANA | 238.19 | 1.43% | 3.56% | 113,05 B |

| XRP | 1.111 | 2.30% | 1.99% | 63,22 B |

| DOGE | 0.3842 | -0.88% | 1.78% | 56,44 B |

| CARDANO | 0.7816 | -0.87% | 0.86% | 27,42 B |

| TRX | 0.1974 | -0.31% | 0.54% | 17,04 B |

| SHIB | 0.00002407 | -1.24% | 0.45% | 14,18 B |

| AVAX | 33.77 | -0.27% | 0.43% | 13,80 B |

| LINK | 14.53 | 0.27% | 0.29% | 9,11 B |

| DOT | 5.70 | -2.17% | 0.27% | 8,67 B |

Prepared on 11.21.2024 at 06:00 (UTC)

WHAT’S LEFT BEHIND

Trump Team Plans First Crypto Position in the White House

According to Bloomberg, Donald Trump’s new administration is considering creating a special White House position that will focus on the digital asset industry and cryptocurrency policies. This would be the first time in the US government that the position would be dedicated to cryptocurrencies. The candidate screening process is still ongoing.

Corporate Demand for Bitcoin Increases from US Companies

Publicly traded US companies Hoth Therapeutics and Acurx Pharmaceuticals have purchased a total of $2 million worth of Bitcoin as a reserve asset with board approval. This step once again demonstrates the growing interest of corporate companies in digital asset investments.

Record Financial Results from Nvidia

Nvidia achieved revenues of $35.1 billion in the third quarter of fiscal 2025, far exceeding expectations. Revenues, which increased 94% year-on-year, exceeded the market expectation of $ 33 billion. The company’s net profit reached $19.31 billion. Data center revenues increased 112% to $30.8 billion, while gaming revenues were $3.3 billion.

South Korea Rejects Crypto ETF Investments

According to Korea Economic Television, South Korean financial regulators continue to ban the issuance of cryptocurrency ETFs. They also refused to approve funds investing in exchanges and other crypto companies. This decision limits the expansion of crypto investment vehicles in the country.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| 13:30 | US Initial Jobless Claims | 220K | 217K |

| 13:30 | US Philadelphia Fed Manufacturing Index (Nov) | 7.4 | 10.3 |

| 13:45 | FOMC Member Hammack Speaks | – | – |

| 15:00 | US Existing Home Sales (Oct) | 3.95M | 3.84M |

| 17:25 | FOMC Member Goolsbee Speaks | – | – |

| 17:30 | FOMC Member Hammack Speaks | – | – |

| 21:40 | FOMC Member Barr Speaks | – | – |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

Despite Nvidia’s better-than-expected third quarter results, fourth quarter projections failed to impress investors. This morning, after a lackluster close in the Wall Street indices, Asian stock markets are generally selling off amid rising geopolitical concerns.

Ukraine’s second attack on Russia with Western-made weapons is having an impact on asset prices in global markets, with the prospect of a wider war looming large. In traditional markets, demand for instruments considered to be relatively less risky has increased, while this has not been felt as much on the digital asset front. On the other hand, the US veto of the United Nations vote on a possible ceasefire in Gaza, citing the release of hostages as a condition, triggered expectations that tensions in the Middle East would continue. European stock markets are also expected to start the new day on the downside.

A different story is being written on the digital assets side of Bitcoin’s dominance. The launch of BlackRock’s spot BTC ETF options on Tuesday added another positive catalyst to the “post-Trump victory” period. There are divergent sentiments on the US Federal Reserve’s (FED) entry into a rate-cutting cycle, one of the key dynamics of the uptrend. According to CME FedWatch Tools, the probability of the Bank cutting rates by 25 basis points at its December meeting has fallen to 52% and the probability of leaving them unchanged is 48%. How the FED will decide on December 18 with new dynamics (such as geopolitical risks rising again…) and macro indicators will remain on our radar as it is an important issue in terms of pricing behavior.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our forecasts. The continuation of the Fed’s rate cut cycle (albeit with cautious messages from Powell in his last speech…) and the volume in BTC ETFs, indicating an increase in institutional investor interest (in addition, MicroStrategy’s BTC purchases, Microsoft starting to evaluate the purchase issue, BlackRock’s BTC ETF options started trading…) support our upside forecast for the big picture for now.

In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional respite or pullbacks in digital assets. At this point, it is worth reiterating that fundamental dynamics remain bullish. While Bitcoin, the largest digital currency, extending each of its record highs may continue to whet the appetite of buyers to take new, upside positions, we will watch this group struggle with the masses who may be looking for profit realizations and speculators looking to exploit potential declines after rapid rises. On the BTC front, we can say that buyers are leading the battle for now.

TECHNICAL ANALYSIS

BTC/USDT

The Trump administration’s attempts to establish a special team to focus on the digital asset industry and cryptocurrency policies pushed the Bitcoin price to a new high, reaching 97,862. Another prominent development in the US was that Hoth Therapeutics and Acurx Pharmaceuticals purchased a total of $2 million worth of Bitcoin as a reserve asset with board approval. In addition, given Bitcoin’s correlation with technology companies, Nvidia’s $35.1 billion revenue announcement, performing well above expectations, also attracted attention.

In the light of all these developments, when we look at the BTC technical outlook, as we mentioned in the previous analysis, the price rose rapidly after breaking the 95,000 level and moved the ATH level to 97,862. BTC, which is currently 2.40% away from six-digit levels, is trading at 97,300. BTC, which completed the consolidation phase between 87,000 and 92,000 levels, brought a new uptrend with the increase in upward momentum. With the effect of positive fundamental developments, the level that will appear as the psychological resistance level in the continuation of the rise is the 100,000 level. In a possible pullback, we will follow the 95,000-support level.

Supports 95,000 – 92,500 – 90,000

Resistances 97,862 – 100,000 – 105,000

ETH/USDT

ETH continues its sideways movement by not losing the support zone indicated by the blue area by taking support from the trend line with the decline it experienced yesterday evening. ETH, which rose up to 3,145, the lower band level of the Kumo cloud, faced selling pressure again here. When Cumulative Volume Delta (CVD) is analyzed, it is seen that sales come from futures and purchases come from spot. With the support ETH received from the trend line, the Chaikin Money Flow (CMF) value has returned to the positive area. Relative Strength Index (RSI) has started its upward movement. The previously mentioned support and resistance zones for ETH remain valid. Closes above the 3,145 intermediate resistance may come up to 3,256 levels. The loss of 3,045 support may bring declines to 2,923 levels. However, the positive outlook on CMF and RSI suggests that the bullish scenario is more likely to materialize.

Supports 3,118 – 3,045 – 2,923

Resistances 3,256 – 3,353 – 3,534

XRP/USDT

As mentioned in the XRP evening analysis, XRP is trying to rise above the 1.12 level after another drop to the 1.07 support level. However, it is seen that the momentum for XRP, which faced high selling pressure at this level, is heading up again. Chaikin Money Flow (CMF) and the double bottom formed on the price can be considered as important factors that support the positive outlook. Provided that the Relative Strength Index (RSI) rises above the 60 level and the price gains the 1.12 zone, we can see another rise to 1.23 levels. The support zone between 1.07 – 1.03 remains valid, but its loss may cause the decline to deepen.

Supports 1.0709 – 1.0333 – 0.9382

Resistances 1.2386 – 1.3487 – 1.4463

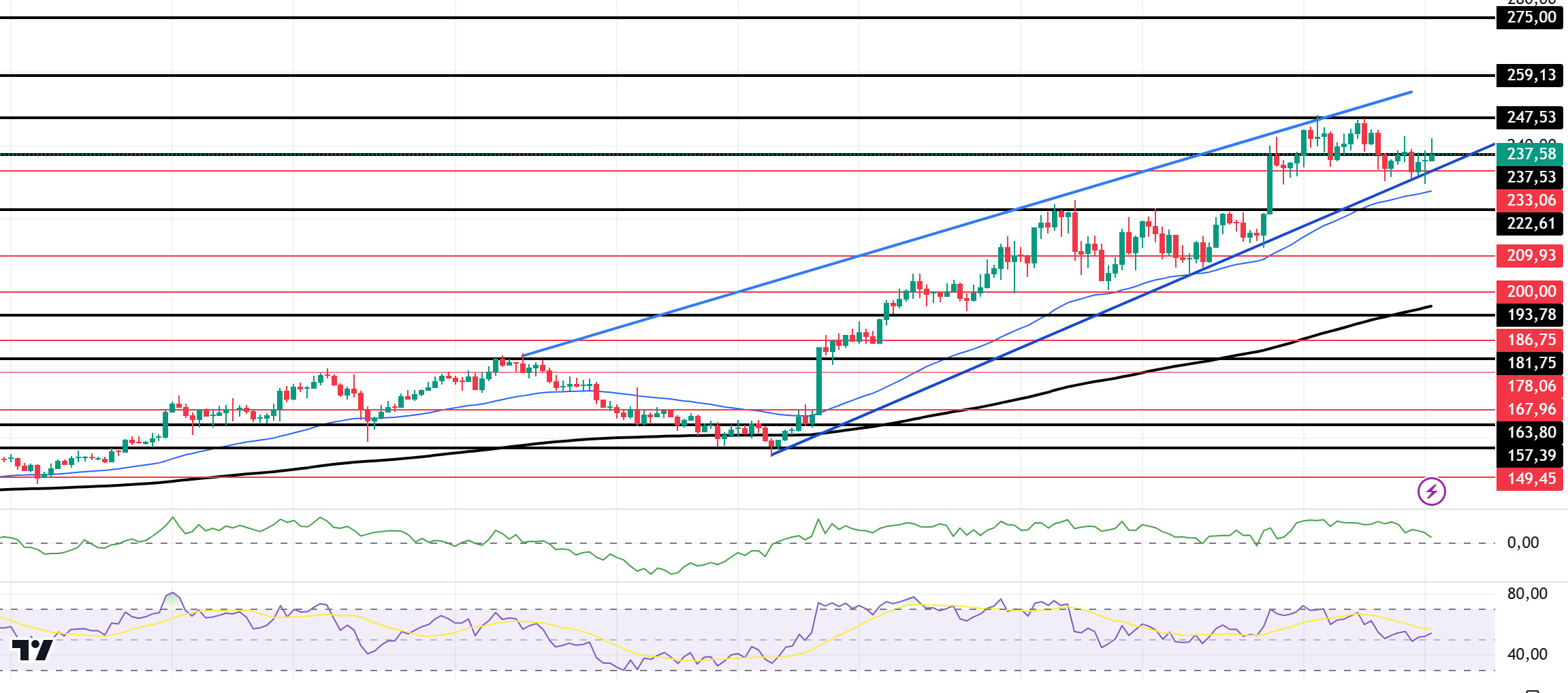

SOL/USDT

Bitwise, a leading asset manager, has reportedly filed for a Solana ETF Trust in Delaware, according to multiple social media posts. Based on available data, the firm officially filed a Form S-1 with the United States Securities and Exchange Commission (SEC) on November 20, 2024 under the name “BITWISE SOLANA ETF”. In the Solana ecosystem, the price has been rising with bullish momentum amid market optimism, DeFi growth and ETF speculation, targeting important milestones this month. Bitcoin’s surge above $97K has boosted Solana price and altcoin optimism. Solana ETF speculation boosted institutional and retail buying interest. Solana increased stablecoin supply to over $4.5 billion. DeFi growth and stablecoin adoption enabled Solana’s ecosystem to expand. Solana achieved notable success, with its Total Value Market (TVL) surpassing $8.43 billion. This shows the growing interest in the decentralized finance (DeFi) space of blockchain. According to data from Santiment, 9.9 billion SOLs were traded on November 17, the second highest daily volume in the 90 days since August 5. However, market demand for Solana has declined significantly following the rejection at the $250 resistance level. According to the latest data, investors traded only 6.7 billion SOL on November 19, a sharp 52% drop in trading volume in 48 hours.

Technically, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line) in the 4-hour timeframe. Since November 4, SOL, which has been in an uptrend since November 4, continues to be priced by maintaining this trend. At the same time, we see a rising wedge pattern emerging on the chart. A rising wedge is often seen as a bearish signal. However, when we examine the Chaikin Money Flow (CMF)20 indicator, although money inflows are positive, inflows have started to decrease significantly. At the same time, the Relative Strength Index (RSI)14 has moved from overbought to intermediate levels. The 247.53 level is a very strong resistance point in the uptrend driven by both macroeconomic conditions and innovations in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements due to possible macroeconomic reasons or profit sales, the support levels of 222.61 and 193.78 may be triggered again. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 233.06 – 222.61 – 209.93

Resistances 237.53 – 249.53 – 259.13

DOGE/USDT

BTC refreshes ATH while DOGE continues to move sideways. The market dynamics surrounding Dogecoin have changed in a positive direction. While the Volume Weighted Average Price (VWAP) is currently below the market price, indicating increased short-term demand, on-chain trade flows have indicated that selling pressure has subsided.

Technically, Doge continues to consolidate above 0.35 since our analysis yesterday. However, a bull flag pattern has formed. If the pattern works after a short pullback or consolidation, the uptrend may continue. On the 4-hour timeframe, the 50 EMA (Blue Line) is above the 200 EMA (Black Line). This may mean that the uptrend will continue. But the gap between the two averages is still too wide. This could cause pullbacks. At the same time, the Relative Strength Index (RSI)14 has moved from overbought to neutral. However, when we examine the Chaikin Money Flow (CMF)20 indicator, it remains neutral. The 0.42456 level stands out as a very strong resistance point in the rises driven by both macroeconomic conditions and innovations in the Doge coin. If DOGE, which tested here, maintains its momentum and rises above this level, the rise may continue strongly. In case of retracements due to possible macroeconomic reasons or profit sales, the support levels of 0.33668 and 0.28164 can be triggered again. If the price hits these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.36600 – 0.33668 – 0.28164

Resistances 0.42456 – 0.45173 – 0.50954

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.