MARKET SUMMARY

Latest Situation in Crypto Asset

| Assets | Last Price | 24h Change | Dominance | Market Cap |

|---|---|---|---|---|

| BTC | 98,215.34 | -0.26% | 58.08% | 1,94 T |

| ETH | 3,383.14 | -1.29% | 12.18% | 407,48 B |

| SOLANA | 252.20 | -1.66% | 3.58% | 119,69 B |

| XRP | 1.460 | -0.17% | 2.48% | 83,07 B |

| DOGE | 0.4237 | -3.47% | 1.86% | 62,17 B |

| CARDANO | 1.0383 | -2.33% | 1.09% | 36,43 B |

| TRX | 0.2086 | -3.52% | 0.54% | 18,01 B |

| AVAX | 43.18 | 1.47% | 0.53% | 17,62 B |

| SHIB | 0.00002571 | -4.16% | 0.45% | 15,13 B |

| DOT | 9.285 | 3.82% | 0.42% | 14,02 B |

| LINK | 18.01 | 1.28% | 0.34% | 11,29 B |

*Prepared on 11.25.2024 at 06:00 (UTC)

WHAT’S LEFT BEHIND

Bitcoin Spot ETFs Record Net Inflows

US Bitcoin spot ETFs reached an all-time high weekly net inflow of $3.38 billion last week. BlackRock’s IBIT ETF led the way with weekly net inflows of $2.05 billion, bringing its total historical net inflows to $31.33 billion, according to SoSoValue data. Fidelity’s FBTC ETF ranked second with weekly net inflows of $773 million, bringing its total historical net inflows to $11.54 billion. In contrast, the Grayscale ETF GBTC recorded a weekly net outflow of $52.85 million.

Current Situation in Crypto Liquidations

According to data from crypto liquidations tracker Coinglass, total crypto liquidations as of November 24 amounted to $500.45 million on 197,551 investors.

Breakdown of Liquidations: Long position liquidations: $380 million, Short position liquidations: USD 120 million

Crypto Asset Based Liquidations: Bitcoin: 70.4 million dollars, Ethereum: 43.4 million dollars, Dogecoin: $35.3 million

Trump’s Commerce Secretary Nominee Plans Bitcoin Loan Program

Howard Lutnick, Donald Trump’s nominee for Secretary of Commerce, plans to launch a $2 billion program to provide dollar loans to customers who use Bitcoin as collateral. Lutnick’s company is exploring the possibility of collaborating with stablecoin giant Tether to carry out this project.

South Korea Rejects National Bitcoin Reserve Plan

Kim Byung-hwan, Chairman of South Korea’s Financial Services Commission, announced that they have rejected the idea of creating a national Bitcoin reserve for now. Kim stated that Seoul does not need to accumulate crypto and will wait to see how other countries react to US President Donald Trump’s crypto adoption plans.

Crypto Trading Service from Hong Kong’s ZA Bank

Hong Kong-based digital bank ZA Bank has launched a Bitcoin and Ethereum trading service on its app. By offering this service to retail users, the bank announced that it is the first bank in Asia to offer crypto services.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| xExchange MEX Tokenomics Vote | – | – | |

| iExec RLC Competition Hackathon (iExec RLC & Encode Club) | – | – | |

| Seedify.fund (SFUND) Venture Mind AI Open Sale | – | – |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

Global markets started the new week with the effects of hedge fund manager Scott Bessent, Trump’s choice for Treasury Secretary. Bessent is thought to be in favor of balanced policies and close to crypto assets. Thus, in the face of Trump’s aggressive policies, Bessent could act as a stabilizer if confirmed by the Senate. Following this appointment, we saw the dollar and US treasury bond yields decline. Digital assets, on the other hand, tried to recover after the weekend pullbacks.

On the first trading day of the week, we see that the markets had a positive mood with US-centered news flows. Macro data from the US, which will have a short trading week due to Thanksgiving, and the minutes of the last meeting of the Federal Open Market Committee (FOMC) will be closely monitored. Also, Trump’s appointments for the Congress will remain on our radar.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our forecasts. Despite Powell’s cautious messages in his last speech, the Fed’s continuation of the interest rate cut cycle, and the volume in BTC ETFs, indicating an increase in institutional investor interest (in addition to MicroStrategy’s BTC purchases, Microsoft’s start to evaluate the purchase, BlackRock’s BTC ETF options trading…), support our upside forecast for the big picture for now.

In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional respite or pullbacks in digital assets. We also evaluate the movement we observed during the weekend transactions within this framework. At this point, it would be useful to underline again that fundamental dynamics remain bullish. While Bitcoin, the largest digital currency, extending each of its record highs may continue to whet the appetite of buyers to take new, upside positions, we will watch this group struggle with the masses who may want to take profit realizations and speculators who want to take advantage of potential declines after rapid rises.

TECHNICAL ANALYSIS

BTC/USDT

Last week, US Bitcoin spot ETFs set an all-time weekly net inflow record with net inflows of $3.38 billion. In the futures market, price volatility led to $500 million in liquidations. The Bitcoin rally, which started in early November, is on the rebound after profit selling at the $100,000 level.

When we look at the technical outlook on the first day of the week, Bitcoin, which fell to 95,926 over the weekend with the sales that started after the ATH level of 99,655 was seen last Friday, recovered again after Trump chose hedge fund manager Scott Bessent as Treasury Secretary. Currently trading at 98,200, Bitcoin is again targeting the psychological resistance level of six-digit levels. Our technical oscillator gives a buy signal on the hourly charts, while the squeeze momentum indicator continues to weaken as mentioned in the previous analysis.

Supports 95,000 – 92,500 – 90,000

Resistances 99,655 – 100,000 – 105,000

ETH/USDT

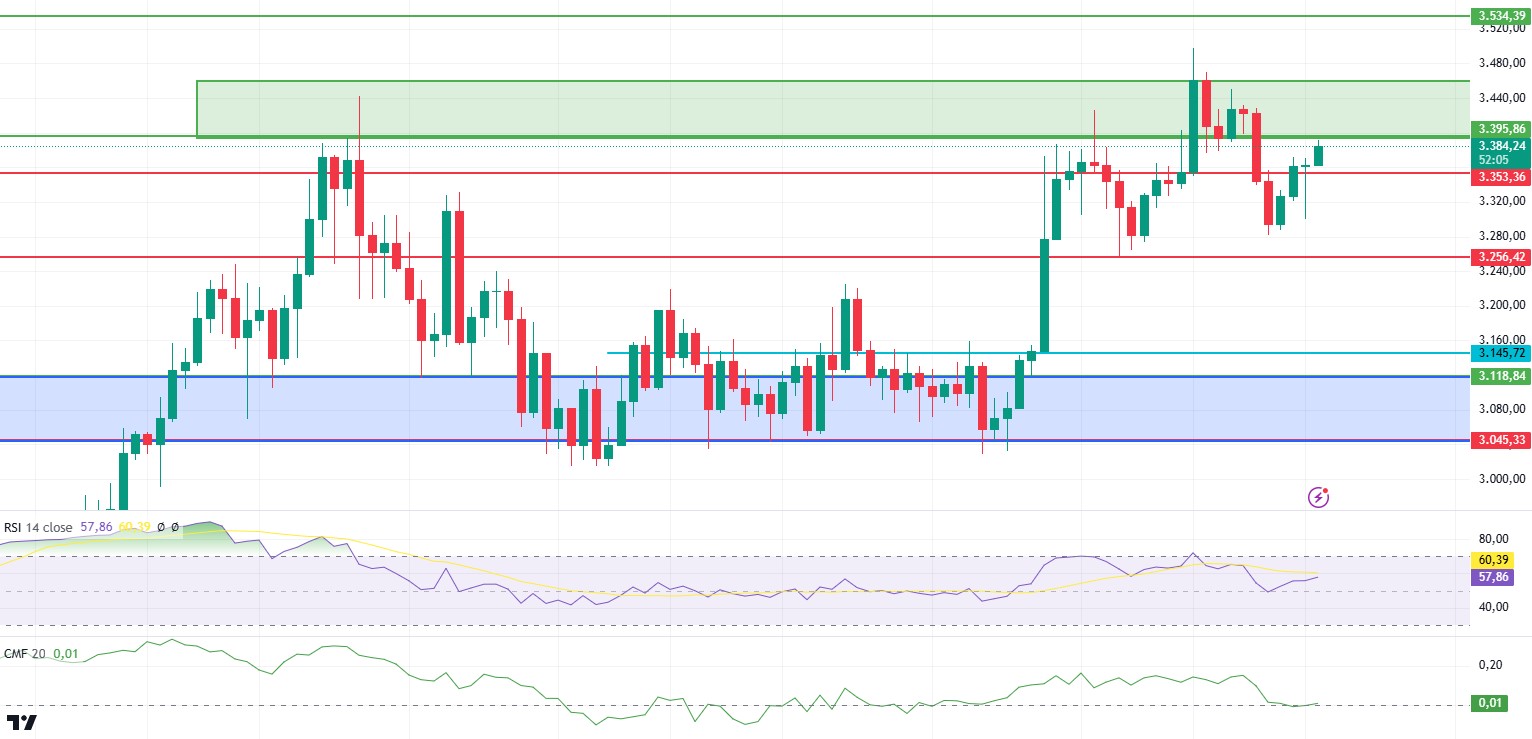

ETH experienced a pullback after rising to 3,500 levels over the weekend, and then continued to rise with the Asian opening in the morning and managed to exceed the 3,353 resistance again. After this price movement, we see that Chaikin Money Flow (CMF) remains in the positive area. However, its progress with mismatches may bring negative effects. Relative Strength Index (RSI) maintains its stable and positive outlook after its correction. Looking at the Cumulative Volume Delta (CVD), we see that spot-weighted purchases continue. In the light of this data, if the 3,395 level is exceeded during the day, we can see rises up to 3,459 and 3,534 levels respectively. If the 3,353 level is lost, declines to 3,256 levels can be seen again.

Supports 3,353 – 3,256 – 3,145

Resistances 3,395 – 3,534 – 3,680

XRP/USDT

XRP seems to be recovering from the weekend drop with the opening of the week. Pricing above the 1.34 resistance again with the opening of the week, XRP is trying to exceed the 1.47 zone. Looking at the Ichimoku indicator, it can be said that the regain of the tenkan level looks quite positive. Taking into account the positive outlook in Relative Strength Index (RSI), Chaikin Money Flow (CMF) and momentum, the rise can be expected to continue up to 1.56 levels, provided that the 1.34 level is not lost. In the negative scenario, the loss of the 1.34 level may bring sharp declines down to 1.23 levels.

Supports 1.3486 – 1.2382 – 1.0710

Resistances 1.4753 – 1.5643 – 1.7043

SOL/USDT

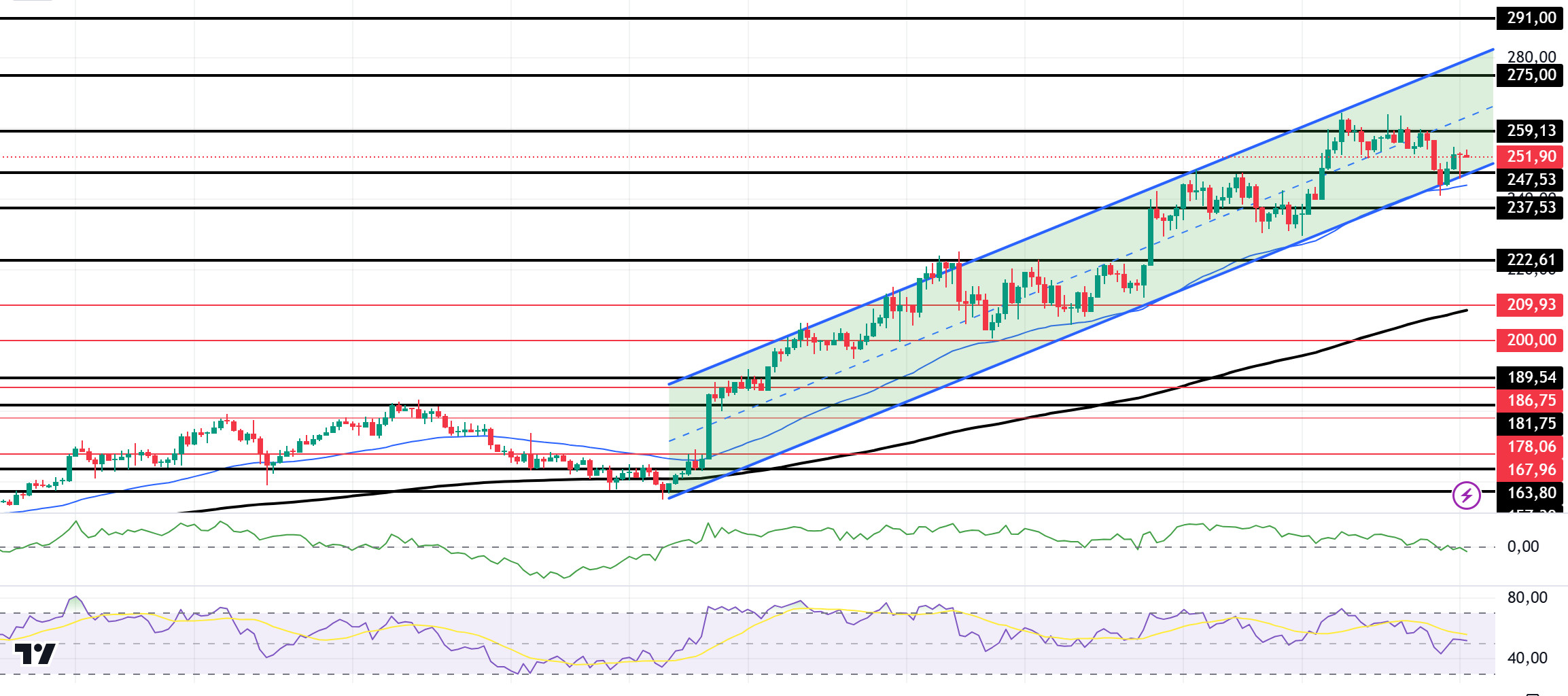

While previous applications for Solana ETFs were withdrawn earlier this year, industry observers are much more hopeful about the success of the new applications, given the changing regulatory mood following Donald Trump’s victory in the recently concluded US presidential election. At the same time, the surge in applications for spot Solana ETFs following the resignation of SEC Chairman Gary Gensler has led to optimism in the cryptocurrency industry. This optimism pushed Solana’s value as high as $263.83.

In the Solana ecosystem, the number of participants involved in the development of Solana increased by 4.2%. This increase in developer participation shows a strengthening community and robust ecosystem, potentially leading to further progress and innovation on the Solana blockchain. In the last 24 hours, Solana’s Open Interest data reached a historic high of $6.01 billion, highlighting the strong demand for SOL in the derivatives market. In addition, the significant increase in TVL to $8.79 billion is indicative of a healthy ecosystem. Indeed, total volume recently surpassed $10 billion, marking one of the network’s busiest periods in recent history, according to data from Dune Anlaytics. The surge reflects a clear increase in demand for Solana-based decentralized finance (DeFi) applications.

Solana (SOL) price continues to move sideways after the buying weakened. On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). Since November 4, SOL, which has been in an uptrend, continues to be priced by maintaining this trend. However, when we examine the Chaikin Money Flow (CMF)20 indicator, money inflows are neutral after a long time, but there is a decline in inflows. At the same time, Relative Strength Index (RSI)14 is moving at intermediate levels, declining from the overbought zone. The 275.00 level is a very strong resistance point in the uptrend driven by both macroeconomic conditions and innovations in the Solana ecosystem. If it breaks here, the rise may continue. In case of possible retracements due to macroeconomic reasons or profit sales, support levels 222.61 and 189.54 may be triggered again. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 247.53 – 237.53 – 222.61

Resistances 259.13 – 275.00 – 291.00

DOGE/USDT

The recent announcement of the partnership between Elon Musk and Donald Trump has sent the price of Dogecoin on a meteoric rise. The meme coin’s valuation continues to rise after Donald Trump endorsed Elon Musk to lead a new executive department. On the other hand, Marjorie Taylor Greene will lead the DOGE Subcommittee under Musk and Ramaswamy and will focus on efficiency reforms. Following new speculation about the long-awaited payment service of Elon Musk’s social app X, an X user in an image shared by Elon guessed that DOGE could be for X payments, noting that the app has a different dollar symbol than the tipping service. The most important reason for DOGE’s price increase was Elon Musk’s major victory against the SEC. A federal judge rejects Musk’s request for sanctions for failing to attend court-ordered testimony

Whale wallets boost DOGE holdings by 11.26%, boosting investor confidence The crypto market rally is fueling altcoin optimism, boosting Dogecoin price accumulation. Wallets holding 1,000 to 10,000 DOGE increased by 1.05% from 1.91 billion to 1.93 billion coins. Larger wallets holding 10 million to 100 million DOGE recorded a significant growth of 11.26%, increasing their holdings from 18.54 billion to 20.63 billion. This accumulation showed us that confidence in cryptocurrency is growing across different categories of investors.

Technically, there seems to be a bullish divergence between Relative Strength Index (RSI) 14 and the chart. If this works, 0.58043 may be the target location. On the 4-hour timeframe, the 50 EMA (Blue Line) is above the 200 EMA (Black Line). But the gap between the two averages is still too wide. This may cause pullbacks. At the same time, RSI 14 has moved from overbought to neutral. However, when we examine the Chaikin Money Flow (CMF)20 indicator, it has turned negative. This shows us that there are money outflows. The 0.50954 level appears to be a very strong resistance level in the rises driven by both macroeconomic conditions and innovations in the Doge coin. If DOGE maintains its momentum and rises above this level, the rise may continue strongly. In case of retracements due to possible macroeconomic reasons or profit sales, the support levels of 0.36600 and 0.33668 can be triggered again. If the price hits these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.36600 – 0.33668 – 0.28164

Resistances 0.42456 – 0.45173 – 0.50954

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.