MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap |

|---|---|---|---|---|

| BTC | 94,528.87 | -3.74% | 57.43% | 1,87 T |

| ETH | 3,417.90 | 0.96% | 12.62% | 411,14 B |

| SOLANA | 238.13 | -5.71% | 3.47% | 113,09 B |

| XRP | 1.425 | -2.43% | 2.50% | 81,41 B |

| DOGE | 0.4029 | -5.22% | 1.82% | 59,30 B |

| CARDANO | 0.9713 | -6.67% | 1.05% | 34,08 B |

| AVAX | 41.62 | -3.32% | 0.52% | 17,03 B |

| TRX | 0.2000 | -4.21% | 0.53% | 17,27 B |

| SHIB | 0.00002512 | -2.62% | 0.45% | 14,80 B |

| DOT | 8.312 | -9.64% | 0.39% | 12,66 B |

| LINK | 17.45 | -3.33% | 0.34% | 10,94 B |

*Prepared on 11.26.2024 at 06:00 (UTC)

WHAT’S LEFT BEHIND

Howard Lutnick and the Tether Connection: Controversial Nomination for Commerce Secretary

Howard Lutnick, chairman and CEO of Cantor Fitzgerald, one of Wall Street’s leading firms, has been nominated by US President Donald Trump for Secretary of Commerce. Lutnick’s close ties with stablecoin issuer Tether are noteworthy. His firm, Cantor Fitzgerald, is known to have made an investment in Tether that gave it a stake of around 5%. These ties could create controversy in the Senate confirmation process of his nomination.

UK Plans Crypto Regime by 2026

The UK’s financial regulator, the Financial Conduct Authority (FCA), has announced plans to implement a comprehensive cryptocurrency regime by 2026 in response to the rapidly growing cryptocurrency ownership in the country. This regime is expected to strengthen investor protection and close regulatory gaps.

Rumble’s Bitcoin Financial Strategy

Popular video sharing platform and cloud service provider Rumble (NASDAQ:RUM) announced that it will allocate some of its excess cash reserves to Bitcoin. The company will realize its $20 million Bitcoin purchase plan as part of its corporate financial diversification strategy.

New Bitcoin Purchase from Semler Scientific

Semler Scientific purchased 297 BTC between November 18 and 22 at a total cost of approximately $29.1 million. Thus, the company’s total Bitcoin holdings increased to 1,570 BTC. The company’s average cost per Bitcoin was $75,039 and its total investment reached approximately $117.8 million.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| – | StarkNet (STRK) STRK Staking | – | – |

| 15:00 | US CB Consumer Confidence (Nov) | 111.8 | 108.7 |

| 15:00 | US New Home Sales (Oct) | 725K | 738K |

| 19:00 | US FOMC Meeting Minutes | – | – |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

After the new US President Donald Trump promised to increase tariffs on China, Mexico and Canada, we saw a desire to stay away from risky assets in the markets as global sentiment deteriorated and concerns about escalating global trade tensions increased. A picture emerged in which stock market indices sold off and the dollar generally appreciated.

Having received the first clue that Trump, who is seen as a digital asset friend, may affect the balance of markets with policies that will affect the world trade balance, investors are likely to focus more on the President’s statements in the coming months. Today, the US Federal Reserve’s (FED) minutes of the last Federal Open Market Committee (FOMC) meeting will be on the market radar. Investors will be looking for clues on how close the Fed is to another rate cut in December.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our forecasts. Despite Powell’s cautious messages in his last speech, the Fed’s continuation of the interest rate cut cycle, and the volume in BTC ETFs, indicating an increase in institutional investor interest (in addition to MicroStrategy’s BTC purchases, Microsoft starting to evaluate the purchase, BlackRock’s BTC ETF options started trading…), support our upside forecast for the big picture for now.

For the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional respite or pullbacks in digital assets. We also evaluate yesterday’s movement in this context. At this point, it would be useful to underline again that fundamental dynamics continue to be bullish. While the expansion of the largest digital currency Bitcoin’s record high may continue to whet the appetite of buyers to take new, upside positions, we will watch this group struggle with the masses who may want to take profit realizations and speculators who want to take advantage of potential declines after rapid rises.

TECHNICAL ANALYSIS

BTC/USDT

Bitcoin is currently trading at 94,800, up 4.25% in the last seven days. Its market capitalization reached $1.88 trillion, while 24-hour trading volume rose to $69.13 billion. Large investors’ interest in market movements suggests that Bitcoin continues to be positioned as an important asset for institutional treasuries. Most recently, Semler Scientific announced that it purchased 297 BTC between November 18 and 22 at a total cost of approximately $29.1 million.

When we look at the technical outlook in the light of all this data, we see that the price is in a correction trend after reaching the 99,655 ATH level. As of yesterday, the price broke the support level of 95,000 and fell to the minor support level of 92,500. BTC, which exhibits high volatility ahead of the 100,000 level, which is the critical threshold due to market dynamics, is trading at 94,800 again. In order to gain upward momentum, persistence above the 95,000 level may maintain the optimistic mood. Otherwise, as we mentioned earlier, our momentum indicator continues to show signs of weakening while technical oscillators remain on a sell signal. In case the retreat deepens, we will follow the 90,000 level again.

Supports 95,000 – 92,500 – 90,000

Resistances 99,655 – 100,000 – 105,000

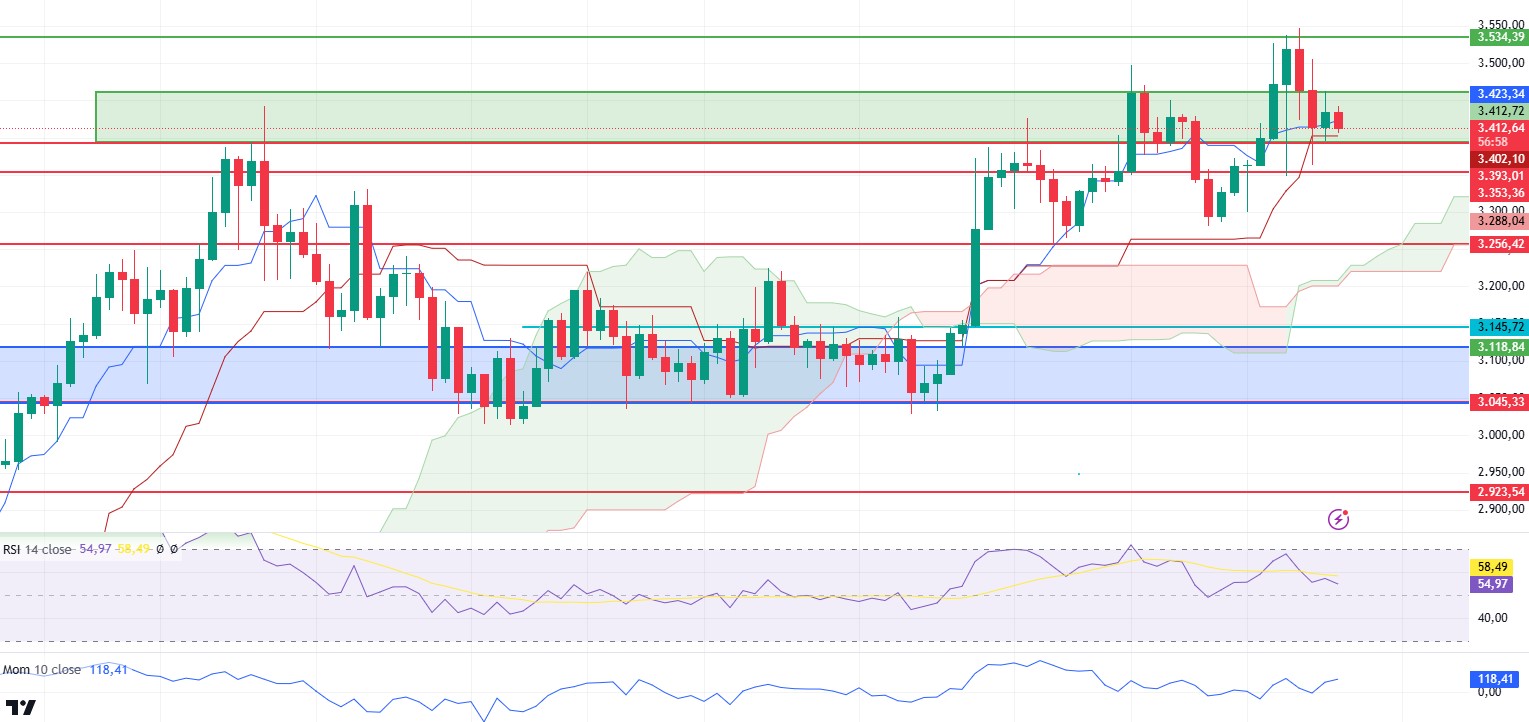

ETH/USDT

Although ETH retreated sharply with the decline in the crypto market yesterday, it managed to stay above the 3,400 level again by reacting from the 3,353 region. After the decline, while the positivity on the Relative Strength Index (RSI) is maintained, momentum continues to be positive. Chaikin Money Flow (CMF) also has a neutral outlook. In addition, Ichimoku for ETH, which managed to stay above the tenkan level with the decline, also offers a positive outlook with the rise of the kumo cloud level. Looking at the Cumulative Volume Delta (CVD), if the price recovers with the arrival of spot-weighted purchases after the decline and the price remains in the region marked in green on the chart with the decrease in the funding rate, an increase to 3,534 levels can be seen during the day. However, the violation of the region between 3,393 – 3,353 may cause the decline to deepen and fall to 3,256 levels.

Supports 3,393 – 3,353 – 3,256

Resistances 3,534 – 3,680 – 3,805

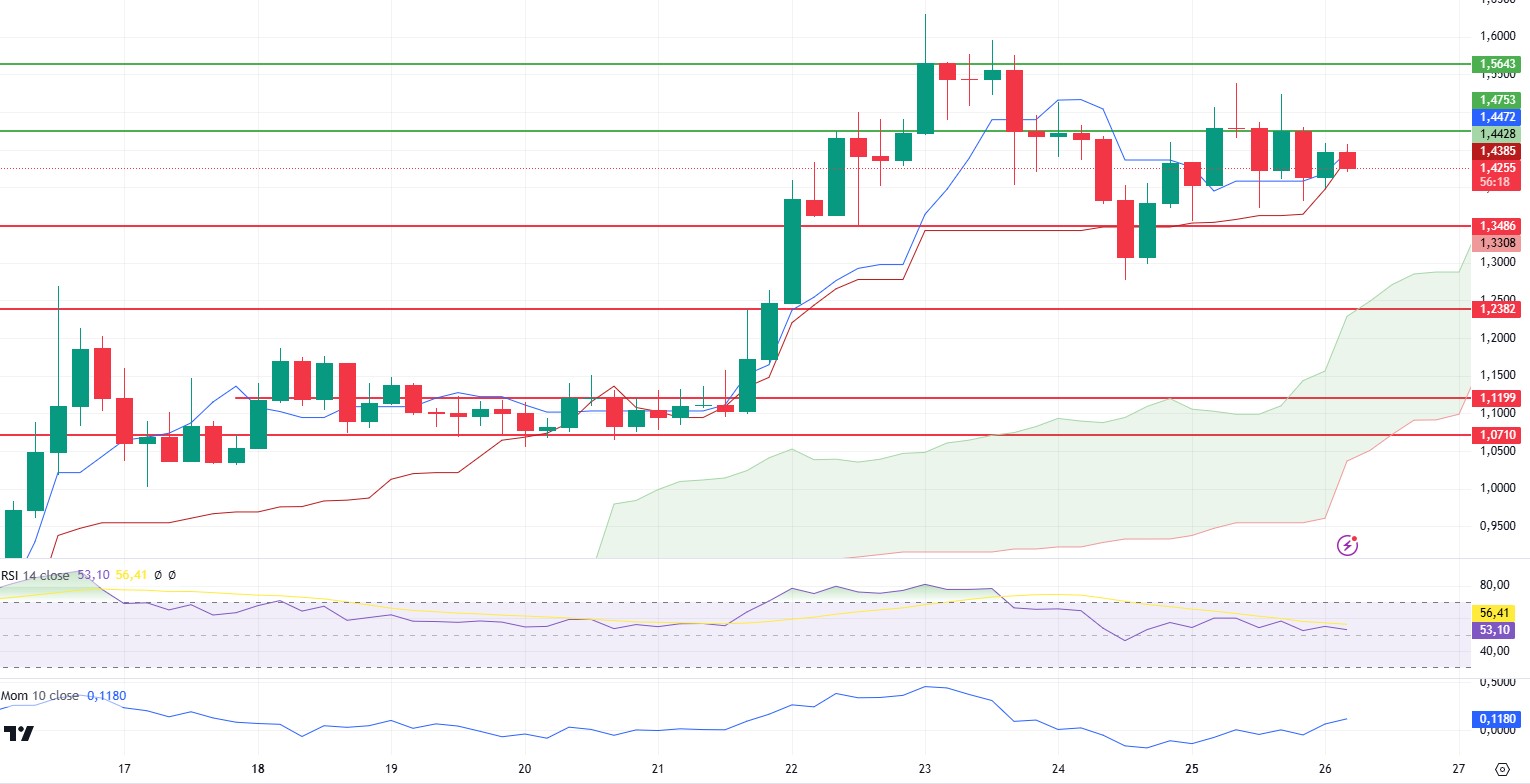

XRP/USDT

One of the first indicators that stands out for XRP is that the Relative Strength Index (RSI) has a very negative structure with descending highs. However, momentum also offers a positive outlook by moving upwards during the horizontal movement of the price. When the Ichimoku indicator is analyzed, for XRP, which we can state that it is in a decision-making zone with the convergence of tenkan and kijun levels, it can move according to the break after the horizontal movement in the region between 1.44 and 1.34. The break of the 1.34 level may start a negative trend and cause the decline to deepen. Above 1.44 the price may make new highs.

Supports 1.3486 – 1.2382 – 1.0710

Resistances 1.4753 – 1.5643 – 1.7043

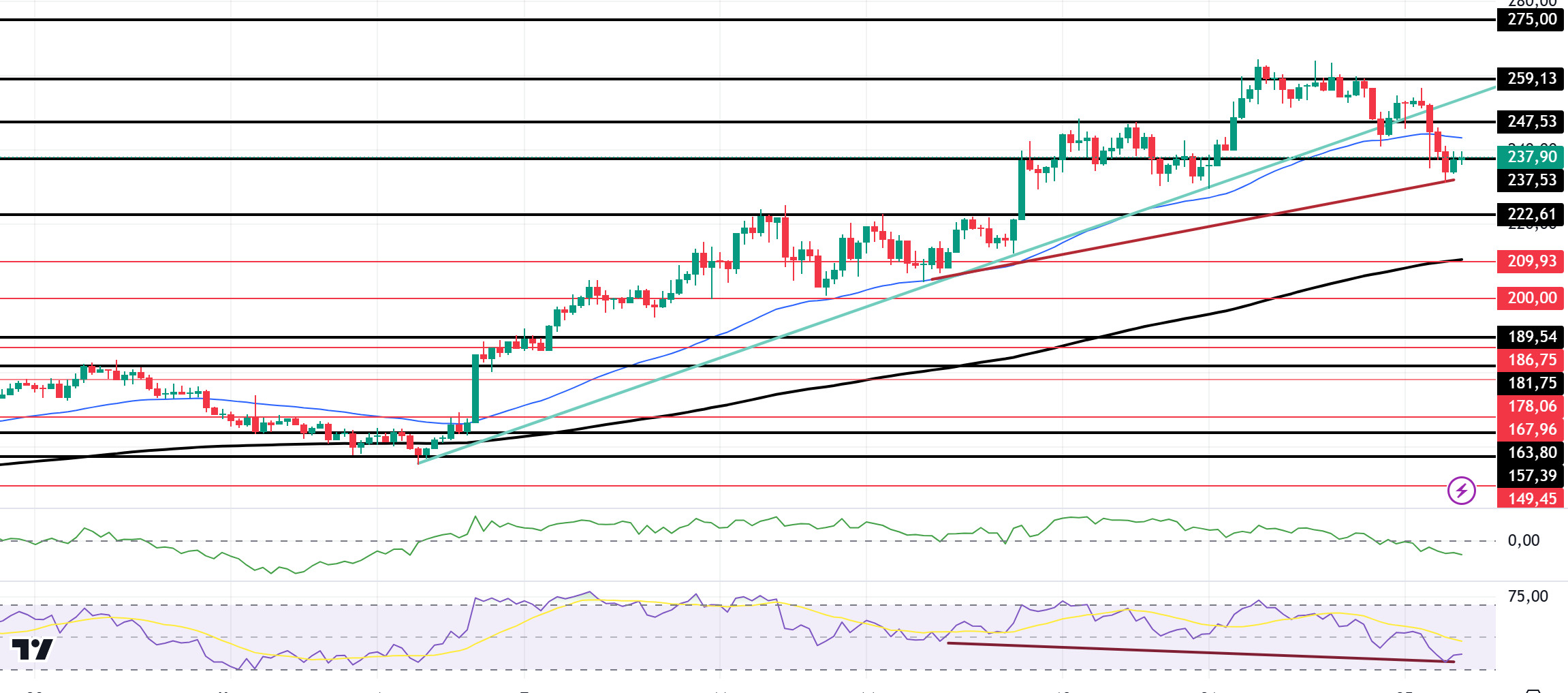

SOL/USDT

Pump.fun, a decentralized platform for creating memecoins in the Solana ecosystem, is under fire after users allegedly broadcast harmful and violent acts through its live streaming feature. The platform has faced criticism from members of the crypto community who have called for stricter oversight or the live streaming feature to be shut down. In response, Pump.fun administrator Alon supported the platform, emphasizing that the team was working on content moderation, but later in the night, the platform announced that the live streaming feature had been disabled. This could lead to a decline in meme token activity in the Solana ecosystem.

49.31% of Solana traders are long and 50.69% are short. Another metric, DEX volume, surpassed $100 billion for the first time. The network also dominates NFT user adoption with 43% weekly market share.

Solana (SOL) price is priced at 239.01, down 5.72% in the last 24 hours, starting to lose value after weakening buying. On the 4-hour timeframe, the 50 EMA (Blue Line) is above the 200 EMA (Black Line). Since November 4, SOL, which has been in an uptrend since November 4, has broken this trend to the downside. However, when we examine the Chaikin Money Flow (CMF)20 indicator, money inflows have turned negative after a long time, but there is a decline in inflows. At the same time, Relative Strength Index (RSI)14 approached the overbought zone. At the same time, there is a mismatch. The 259.13 level is a very strong resistance point in the uptrend driven by both macroeconomic conditions and innovations in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements due to possible macroeconomic reasons or profit sales, support levels 222.61 and 189.54 may be triggered again. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 237.53 -222.61 – 209.93

Resistances 247.53 – 259.13 – 275.00

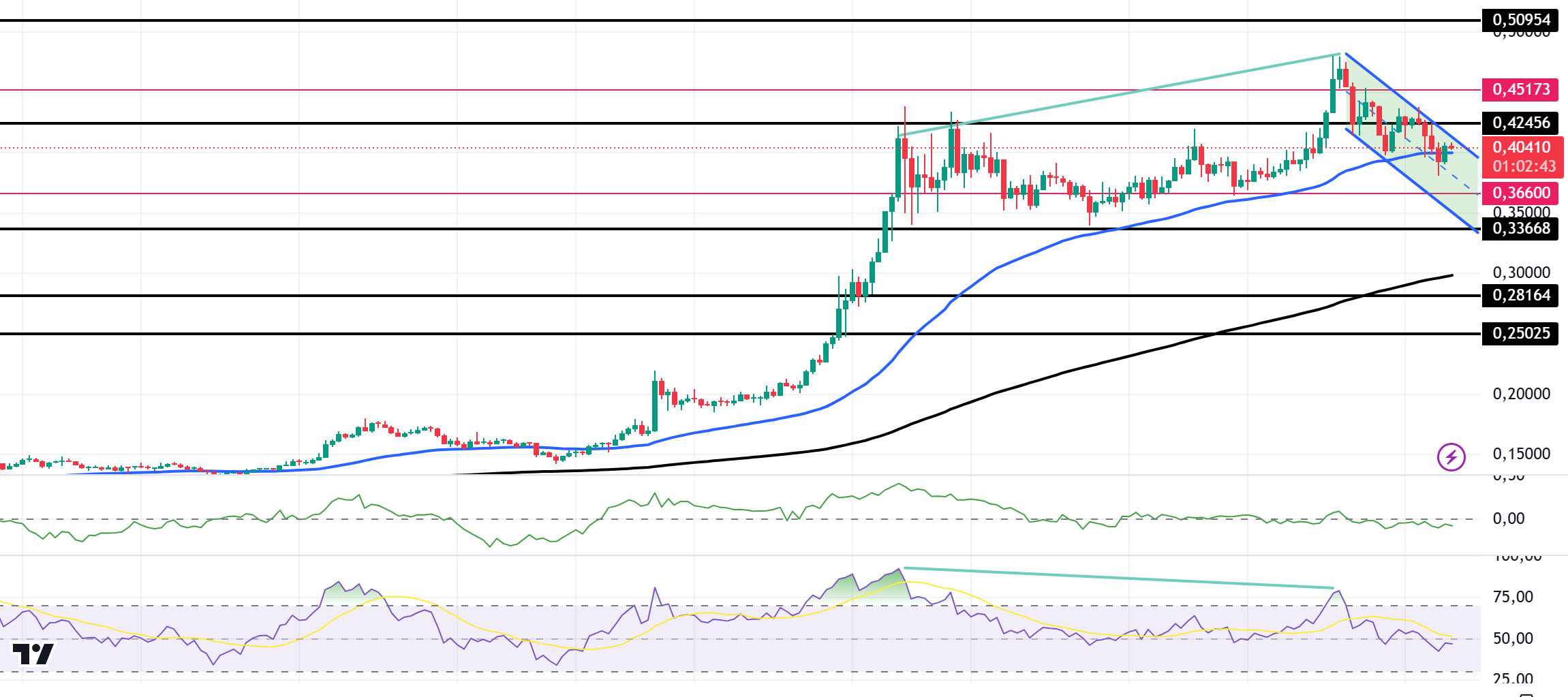

DOGE/USDT

Dogecoin Foundation plans to focus on open source in 2025. The organization is looking for sponsors for its planned projects. The foundation wants to make DOGE a commercial currency. To achieve this goal, it is doubling down on infrastructure development, scalability and decentralization. It is working to make Dogecoin a seamless part of everyday commerce. Since Dogecoin’s inception, the Foundation has focused on building tools and infrastructure to empower the community. On the other hand, the Dogecoin Foundation is intensifying its efforts to increase mass adoption with its new Dogebox initiative. This initiative aims to provide support to small and medium-sized businesses to accept Dogecoin as a payment method, thus further integrating cryptocurrency into everyday commerce.

Dogecoin broke another record as Open Interest approaches $4 billion. Investors continue to bet on Dogecoin, Elon Musk’s favorite coin. Open interest for the asset topped $4 billion on Saturday.

Keeping pace with the general decline of the market, DOGE has fallen by 4.60% in the last 24 hours and is priced at 0.4071. Technically, there seems to be a mismatch between the Relative Strength Index (RSI) 14 and the chart. If it works, the retracements may deepen. On the 4-hour timeframe, the 50 EMA (Blue Line) is above the 200 EMA (Black Line). But the gap between the two averages is still too wide. This may cause pullbacks. At the time of writing, the price is holding its value by finding support from the 50 EMA. But looking at some indicators, the RSI 14 has moved from overbought to neutral. However, when we examine the Chaikin Money Flow (CMF)20 indicator, it has turned negative. This shows us that there are money outflows, indicating that the pullbacks may deepen. The 0.50954 level appears to be a very strong resistance place in the rises driven by both macroeconomic conditions and innovations in Doge coin. If DOGE maintains its momentum and rises above this level, the rise may continue strongly. In case of retracements due to possible macroeconomic reasons or profit sales, the support levels of 0.36600 and 0.33668 can be triggered again. If the price hits these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.36600 – 0.33668 – 0.28164

Resistances 0.42456 – 0.45173 – 0.50954

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.