MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 91,982.81 | 1.69% | 58.77% | 1,82 T |

| ETH | 3,138.20 | 0.53% | 12.21% | 377,36 B |

| SOLANA | 240.98 | 1.54% | 3.70% | 114,37 B |

| DOGE | 0.3775 | 6.30% | 1.80% | 55,56 B |

| XRP | 1.154 | 6.76% | 2.11% | 65,41 B |

| CARDANO | 0.7596 | 4.73% | 0.86% | 26,59 B |

| TRX | 0.2055 | 4.15% | 0.57% | 17,74 B |

| SHIB | 0.00002552 | 5.01% | 0.49% | 15,04 B |

| AVAX | 35.91 | -1.28% | 0.48% | 14,69 B |

| LINK | 14.69 | 2.13% | 0.30% | 9,21 B |

| DOT | 5.912 | 3.70% | 0.29% | 8,96 B |

*Prepared on 11.18.2024 at 06:00 (UTC)

WHAT’S LEFT BEHIND

Metaplanet

On November 18, Metaplanet Inc. announced on its official X platform that the company will issue a total of 1.75 billion yen in bonds with an interest rate of 0.36% per annum and a maturity of one year. All funds raised will be used to buy Bitcoin.

Bill in the US

Republican Senator Cynthia Lummis of Wyoming has unveiled a bill that proposes to create a strategic reserve of 1 million Bitcoin by selling some of the Federal Reserve’s gold holdings. According to Bloomberg, Lummis’ initiative aims to create the strategic Bitcoin stockpile planned under the leadership of President-elect Donald Trump. The bill calls for the US to purchase 1 million Bitcoins, which would account for about 5% of the total supply of Bitcoin in circulation.

XRP Open Interest

Driven by regulatory clarity and technology updates, XRP futures market activity hit a new high, with open interest (OI) hitting a record high of more than $2 billion on Saturday, CoinDesk reported. At the same time, XRP prices have surged above $1.20 in recent days, hitting a three-year high and gaining more than 87% on the week.

Poland’s presidential candidate pledges to adopt strategic bitcoin reserves

Polish presidential candidate Sławomir Menzen has pledged to adopt strategic bitcoin reserves if elected, according to Bitcoin Magazine.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| Ronin (RON) Community Collection Vote: RON owners vote in Discord | |||

| PAAL AI (PAAL) Token Merger Vote: $PAAL tokens migrate to $FET with a 6.24:1 ratio and vesting period | |||

| Seedify.Found (SFUND) MicroGPT IDO | |||

| Madeira Blockchain Conference 3.0: Fostering Web3 innovation | |||

| 12:00 | Avalanche (AVAX) 1.67MM Token Unlock | ||

| 15:00 | FOMC Member Goolsbee Speaks | ||

| 16:00 | Oasis (ROSE) 176MM Token Unlock |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

Following the US presidential elections and the US Federal Reserve’s decision to cut interest rates, global markets are watching how the new US government will take shape, while closely monitoring geopolitical risks and news that may affect the crypto asset ecosystem.

This morning, we saw losses in the Yen as Bank of Japan (BoJ) Governor Ueda refrained from giving an interest rate hike message. The dollar index did not change much around 106.70. On the stock market front, Asian indices are generally positive except for Japan, while European indices are expected to start the day slightly higher. Digital assets, on the other hand, started the new week on a generally bullish note.

From the short term to the big picture.

The victory of former President Trump, one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our forecasts. The continuation of the Fed’s rate-cutting cycle (albeit with cautious messages from Powell…) and the inflows into BTC ETFs, indicating increased institutional investor interest (in addition to MicroStrategy’s BTC purchases, Microsoft starting to consider buying…), support our upside forecast for the big picture for now.

In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional respite or pullbacks in digital assets. At this point, it is worth reiterating that fundamental dynamics remain bullish. While the fact that Bitcoin, the largest digital currency, has extended its record highs several times may continue to whet the appetite of buyers to take new, upside positions, we will watch this group struggle with the masses who may want to take profit realizations and speculators who want to take advantage of the declines after rapid rises. During this struggle, volatility is likely to increase, as it has so far.

TECHNICAL ANALYSIS

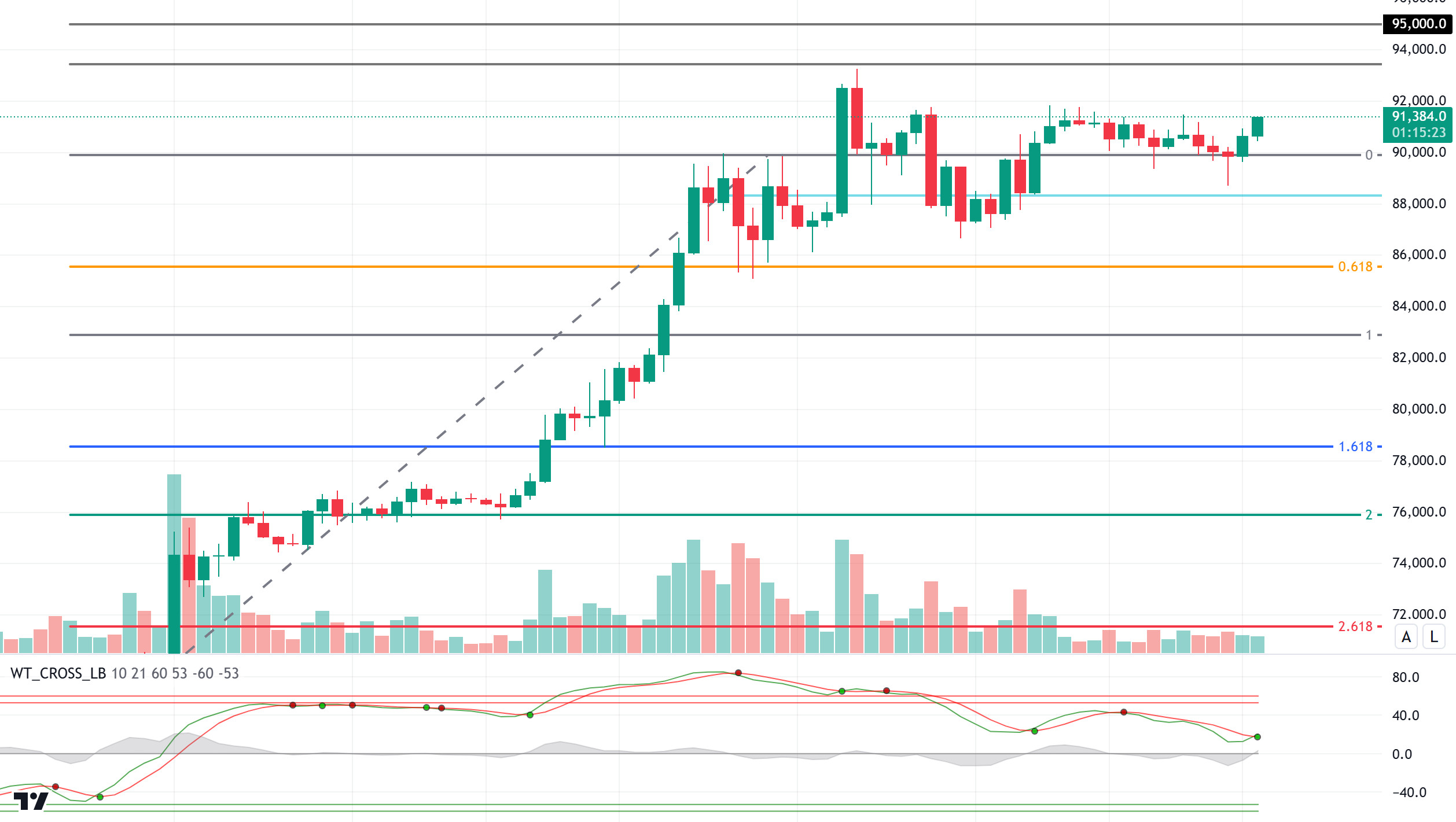

BTC/USDT

While institutional investors’ interest in Bitcoin Spot ETFs continues to grow in the US, Metaplanet, a Japanese company in Asia, continues to draw new roadmaps to expand Bitcoin purchases. According to the latest information shared, the company announced that it will issue a total of 1.75-billion-yen bonds with a maturity of one year and that all of these funds will be purchased Bitcoin.

When we look at the BTC technical outlook, the price, which spent the weekend relatively calm and above the 90,000 level for a long time, fell to 88,700 on Sunday evening. With the latest development, BTC has again risen above the 90,000 level and is currently priced at 91,200. BTC has been fluctuating between the 87,000 and 91,000 levels for some time, with its bullish momentum weakening. With the buy signal given by our technical oscillator, crossing the 91,350 level, which works as a minor resistance level, may trigger a rise towards the ATH level. In case of a pullback, the 90,000 point continues to serve as support again.

Supports 90,000 – 87,000 – 85,500

Resistances 91,350 – 93,000 – 95,000

ETH/USDT

ETH formed a double bottom over the weekend, testing the 3.045 level twice, before rebounding back above 3.118. Relative Strength Index (RSI) has formed a buy signal. Chaikin Money Flow (CMF) also moved back above the zero line, indicating a continued positive outlook. When we look at the Ichimoku indicator, we see that the price broke the tenkan and kijun levels upwards again. The fact that the price is in the cloud also stands out as another positive factor. Looking at the Cumulative Volume Delta (CVD), it is seen that the rise is spot-weighted. In the light of all this data, it can be said that ETH can rise up to 3,246 levels during the day. However, closures below the 3.118 level may cause 3.045 levels to be tested again. The break of this level may cause a negative trend to start on ETH.

Supports 3,118 – 3,045 – 2,925

Resistances 3,256 – 3,353 – 3,534

XRP/USDT

XRP strengthened its uptrend with Gary Gensler’s statements and caught a big breakout. Rising very fast up to 1.23 levels, XRP continues where it left off after correcting to 1.03 with the rejection from this level. The fact that Chaikin Money Flow (CMF) remains in the positive area by testing the zero level and the positive structure on the Commodity Channel Index (CCI) may indicate that the price is looking for new highs. A break of the 1.23 level may lead to rises up to 1.34 levels. However, it should be noted that 1.033 support is the key support level and its breakout could start a downtrend.

Supports 1.0709 – 1.0333 – 0.9382

Resistances 1.2386 – 1.3487 – 1.4463

SOL/USDT

As BTC hovered around $90,000 again, SOL broke the strong resistance of 222.61. In the Solana ecosystem, VanEck Crypto Assets President Matthew Sigel made striking statements about the Solana ETF. Sigel said, “I think a Solana ETF will start trading by the end of 2024.” Sigel’s words resonated widely in the cryptocurrency market. This outburst has once again turned investors’ attention to Solana. According to Coinglass, Solana’s futures open interest reached $5.64 billion, setting a new record. This significant increase shows that traders are not only opening new positions, but also hedging existing ones. On the chart, the ascending triangle pattern worked and pushed SOL to its highest level in the last 3 years. The long/short ratio was 1.0247 for the last 12 hours. Although this slight trend towards long positions suggests that more traders are looking for a price increase, investors seem to be cautious. As a result, while traders expect SOL’s price to rise, they are also ready for possible resistance. On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). This could mean that the uptrend will continue. However, when we examine the Chaikin Money Flow (CMF)20 indicator, inflows are positive and inflows are increasing. At the same time, Relative Strength Index (RSI)14 remained in the overbought zone. This could mean that there could be a sell-off. The price was supported by the 50 ascending triangle pattern, rising by about 14.02%. The 247.53 level is a very strong resistance point in the uptrend driven by both macroeconomic conditions and innovations in the Solana ecosystem. If it breaks here, the rise may continue. In case of possible retracements due to macroeconomic reasons or profit sales, the support levels of 222.61 and 193.78 may be triggered again. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 237.53 – 233.06 – 222.61

Resistances 247.63 – 259.13 – 237.53

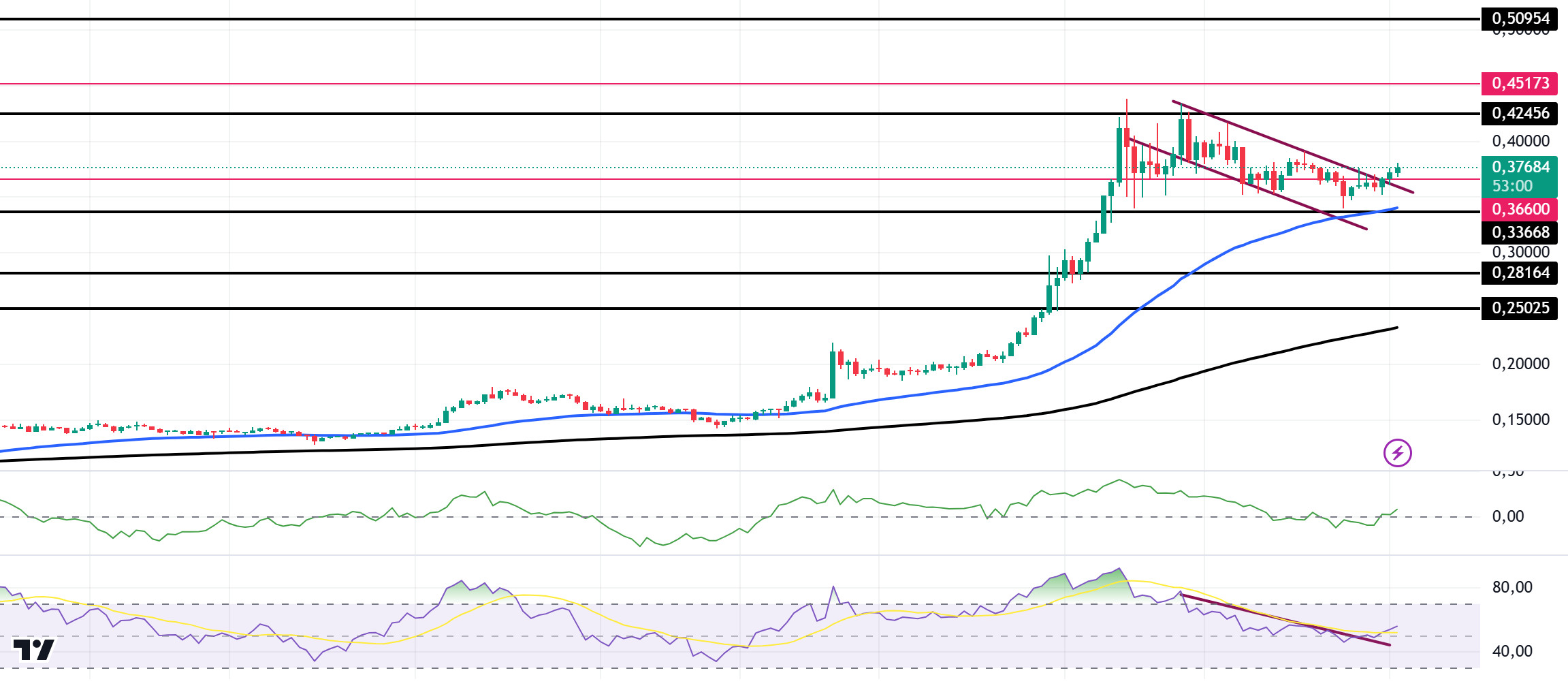

DOGE/USDT

US President-elect Donald Trump recently announced the creation of a new initiative known as the Department of Government Efficiency (DOGE), to be led by Elon Musk and Vivek Ramaswamy. Its ultimate goal, he said, would be to streamline federal operations and reduce government spending by at least $2 trillion, a goal that various budget experts have deemed unrealistic. In a statement, Vivek Ramaswamy promised to revamp the American bureaucracy under the Department of Government Efficiency (DOGE), which he and Elon Musk had just established. Musk did not bring a chisel; he brought a chainsaw, Ramaswamy said. “We’re going to take this to the bureaucracy,” the biotech CEO added. “It’s going to be a lot of fun.” He said. On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). This could mean that the uptrend will continue. However, the gap between the two averages has widened too much, creating a difference of 45.61%. This could cause pullbacks. At the same time, Relative Strength Index (RSI)14 has moved from overbought to neutral territory. However, when we examine the Chaikin Money Flow (CMF)20 indicator, money inflows seem to have turned positive. On the other hand, the downtrend is currently broken. This is supported by the RSI indicator, which has turned positive. The 0.42456 level appears to be a very strong resistance point in the rises driven by both macroeconomic conditions and innovations in the Doge coin. If DOGE, which tested here, maintains its momentum and rises above this level, the rise may continue strongly. In case of retracements due to possible macroeconomic reasons or profit sales, the support levels of 0.33668 and 0.28164 can be triggered again. If the price hits these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.36600 – 0.33668 – 0.28164

Resistances 0.42456 – 0.45173 – 0.50954

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.