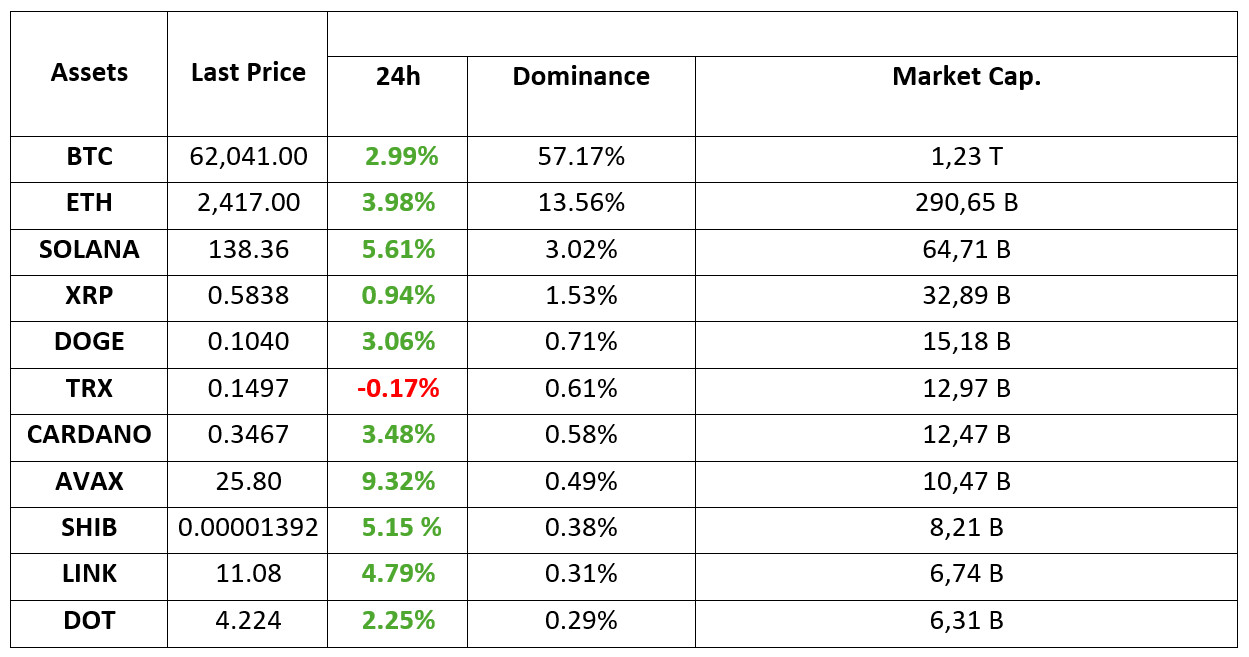

MARKET SUMMARY

Latest Situation in Crypto Assets

*Prepared on 19.09.2024 at 07:00 (UTC)

WHAT’S LEFT BEHIND

Critical FED Rate Cut Decision Announced

The FED cut interest rates by 50 basis points to 5.00%.

Actual: 5.00%,

Expectation 5,25%

Previous: 5,50%

After the Fed’s Big Rate Cut

The US Federal Reserve (FED) recently cut interest rates by 50 basis points; the first rate cut in four years. This decision pushed the markets to guess until the last moment and the leading cryptocurrency Bitcoin reached the level of $ 62,500, although it displayed a volatile image after the decision.

Powell’s Important Statements After Historic Interest Rate Cut

Fed Chairman Jerome Powell emphasized that monetary policy is still tightening, and that this policy is appropriate. Powell stated that inflation could return to 2% by the end of next year or the following year. However, he noted that wage increases are still above the level where they will reach equilibrium. According to Powell, there is a cooling process in the labor market, and he pointed out that wage increases have started to retreat towards more sustainable levels.

Former US President Donald Trump

Former US President and current presidential candidate Donald Trump paid the bill at a bar in New York using Bitcoin (BTC). Trump, who received help from the staff next to him, paid with a QR code and sent BTC to the other party.

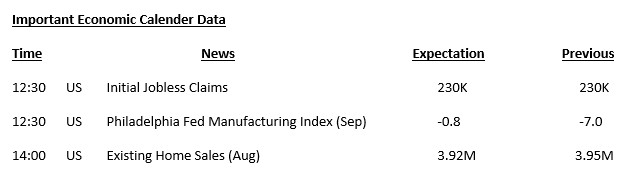

HIGHLIGHTS OF THE DAY

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

The highly anticipated US Federal Reserve’s (FED) critical Federal Open Market Committee (FOMC) meeting was completed yesterday. The FED cut interest rates by 50 basis points. Speaking at the press conference, Chairman Powell emphasized that this was not a new series of 50 basis point rate cuts. In other published forecasts, FOMC officials revised their expectations for employment data negatively and projected lower inflation figures for the future. According to the “dot plot” table, FED officials predicted a total of 50 basis points in the remaining two meetings in 2024.

Although the dollar depreciated immediately after the announcement of the interest rate decision, it first gained value in the US and Asian sessions with the effect of Powell’s emphasis on the dose of interest rate cuts. It then gave back most of its gains. Stock market indices and digital assets were on the rise.

According to European and US futures contracts, stock markets are expected to start the new day with a bullish start. On the crypto front, we can say that an article published by Wall Street giant BlackRock for Bitcoin also had an impact. In this article, BlackRock evaluated BTC as a “unique diversifier”.

Data from the US will be monitored in the rest of the day. After the FED and Powell underlined that they will continue to make decisions by focusing on data, the country’s macro indicators may continue to be influential in the markets. In order for the recent rise in digital assets to continue, data indicating that the US is far from recession, but the FED may continue to cut interest rates, may be supportive.

TECHNICAL ANALYSIS

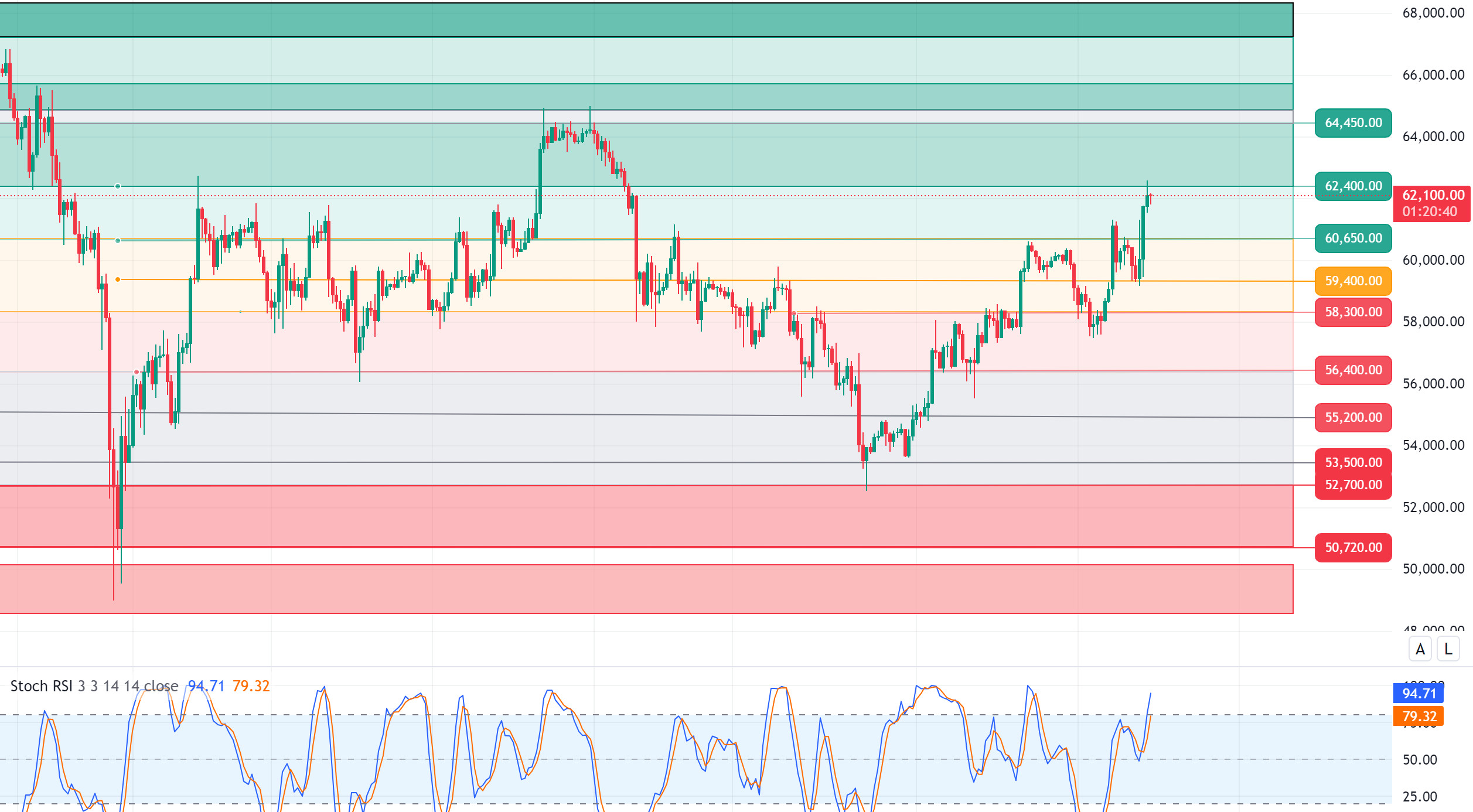

BTC/USDT

Bitcoin After The Historic Decision! As of yesterday, the US central bank FED announced its critical interest rate decision. The FED, which entered the interest rate cut cycle, made a decision that can be called a surprise for the market by making a cut in line with the 50 basis point interest rate cut expectations that have been on the agenda for only a few days. FED chair Powell stated that the rate cuts will continue, citing solid growth, cooling inflation and a strong labor market. Powell emphasized that the last 50 basis point rate cut should not be seen as the norm and that the FED should adopt a flexible, meeting-by-meeting approach. It was observed that volatility increased considerably in the markets after the critical decision. In the BTC 4-hour technical analysis, we observed that the upward reaction of the price after the decision was limited to the 61,200 level. BTC, which fell to the 60,000 level after moving here for a while, turned its direction upwards again after Powell’s statements and rose to the level of 62,400 with the break of the 60,650 resistance zone. We can say that volatility may continue on the price, which is currently trading at 62,000. We can expect BTC, which is in an upward trend, to record an increase in the long term with its flexible monetary policy. In the short term, we may need to pay attention to technical breakouts, the upward momentum may continue with the break of the resistance level of 62,400. The retreat, especially in the US markets after interest rate cuts, may have a negative impact on the BTC price. In this direction, our closest support range may create selling pressure again with the down break of the 60,650 and 60,850 band.

Supports 60,650 – 59,400 – 58,300

Resistances 62,400 – 64,450 – 65,725

ETH/USDT

Ethereum managed to surpass the 2,400 resistance in the market, which rose after the interest rate decision. On the 4-hour timeframe, a W pattern has started to form. The break of the 2,451 level can start a very positive trend with this pattern structure. There is also a buy signal on the Ichimoku indicator. Positive structures have formed on CMF, OBV and RSI and there is no discrepancy. We may see a continuation of the upward pricing during the day. However, the loss of 2,400 – 2,395 levels may cause a re-test to 2,350 levels.

Supports 2,400 – 2,346 – 2,276

Resistances 2,451 – 2,490 – 2,558

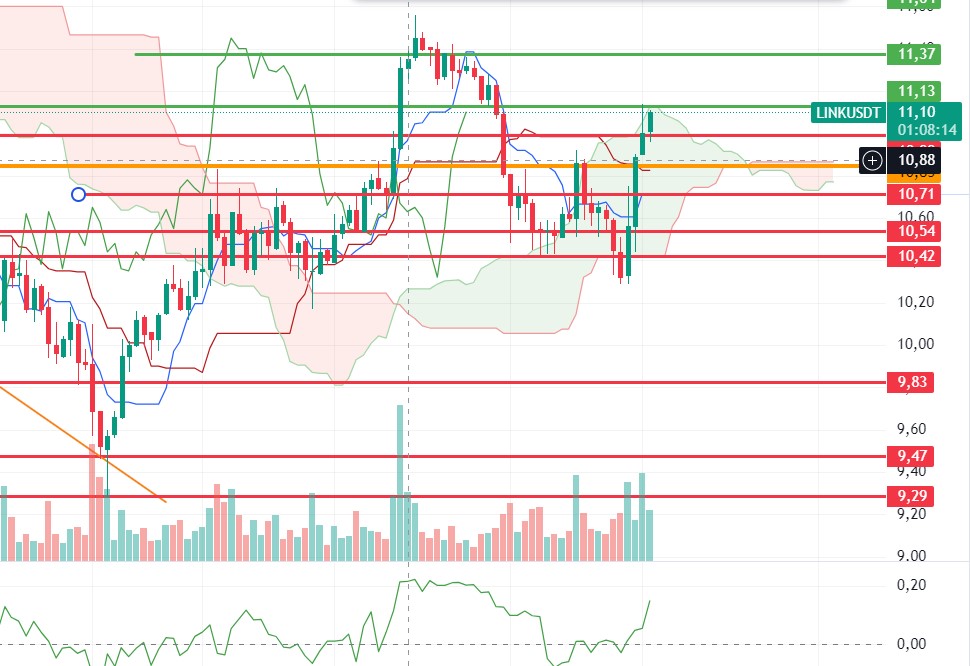

LINK/USDT

LINK, which started a positive trend with the gain of the 10.85 level, has reached the 11.13 kumo cloud resistance, which is the most important resistance. For LINK, which also looks positive when looking at OBV and momentum, the break of this level may bring the continuation of the rise. In a possible pullback, it may react at 10.85. The voluminous break of this level may bring a decline to 10.54 levels again.

Supports 10.99 – 10.85 – 10.54

Resistances 11.13 – 11.37 – 11.64

SOL/USDT

Fed cut interest rates for the first time in 4 years. It realized the market’s expectation with a 50 basis point rate cut. The interest rate was 5%. After this news, the cryptocurrency market rose and realized an increase of 3.19%. This brought the total market capitalization to $2.10 trillion. The main reason for the rise was the Fed chairman Powell’s hints that there was a very high probability that the rate cut would continue. According to data from the CME, the probability of a 25 basis point rate cut in November is 66.3%. In the Solana ecosystem, Solana SOL Mobile, a subsidiary of blockchain developer Solana Labs, unveiled its second crypto smartphone called “Solana Seeker” at TOKEN2049 in Singapore on Thursday. With it, Solana surpassed 75 million monthly active addresses. Solana was trading in a narrowing triangle pattern for a long time. It is currently priced slightly above the 200 EMA on the 4-hour chart, breaking the triangle pattern. Solana, which has increased by 9% since yesterday, is among the best coins to react to the interest rate cut. Both macroeconomic conditions and innovations in the Solana ecosystem, 143.64 – 147.40 levels appear as resistance levels. If it rises above these levels, the rise may continue. 137.77 – 135.18 can be followed as support levels in the retracements that will occur if investors make profit sales. If it comes to these support levels, a potential rise should be followed.

Supports 137.77 – 135.18 – 129.28

Resistances 143.64 – 147.40 – 151.12

ADA/USDT

Fed cut interest rates for the first time in 4 years. It realized the market’s expectation with a 50 basis point rate cut. The interest rate was 5%. After this news, the cryptocurrency market rose and realized an increase of 3.19%. This brought the total market capitalization to $2.10 trillion. The main reason for the rise was the Fed chairman Powell’s hints that there was a very high probability of continuing the rate cut. According to data from CME, the probability of a 25 basis point rate cut in November is 66.3%. Technically, when we look at the RSI indicator, the mismatch on the 4-hour chart seems to have worked with the incoming macroeconomic data. We see exactly 6.19% price rise. On the other hand, ADA is pricing at the level of the EMA200 moving average on the 4-hour chart. This may be a situation that indicates that the uptrend will continue with the momentum it receives. In possible pullbacks, 0.3460 – 0.3320 levels appear as support. In the rises that will take place with macroeconomic data raising BTC or good news in the ecosystem, 0.3596 – 0.3651 levels can be followed as resistance levels.

Supports 0.3460 – 0.3320 – 0.3288

Resistances 0.3596 – 0.3651 – 0.3724

AVAX/USDT

AVAX, which opened yesterday at 23.78, closed the day at 24.68, rising by about 4% after the FED rate cut decision. Today, applications for unemployment benefits and second-hand home sales data from the US will be important for the markets.

AVAX, which is currently trading at 25.81, has moved above the Bollinger upper band on the 4-hour chart. AVAX, which has approached the overbought zone with RSI 67, may face a selling reaction from these levels. It is trying to break the 25.86 resistance and if it fails to break it, it may test the supports of 25.35 and 24.65 by moving towards the Bollinger middle band with the selling pressure. With the candle closing above 25.86 resistance, it may want to test 26.20 and 26.81 resistances. As long as it stays above 22.79 support during the day, the desire to rise may continue. With the break of 22.79 support, selling pressure may increase.

Supports 25.35 – 24.65 – 24.09

Resistances 25.86 – 26.20 – 26.81

TRX/USDT

TRX, which started yesterday at 0.1500, continued its horizontal movement during the day and closed the day at 0.1496. After the FED interest rate decision, there was not much change in its price and it diverged from the market. Applications for unemployment benefits to be announced today and second-hand housing sales data may determine the direction after the data.

TRX, currently trading at 0.1497, TRX, which continues its movement in the falling channel on the 4-hour chart, is in the upper band of the falling channel and a sales reaction can be expected from here. In such a case, it may move to the lower band of the channel and test the support of 0.1482. If it breaks the channel upwards with volume purchases from the upper band of the channel, it may want to test the 0.1532 resistance. As long as TRX stays above 0.1482 support, the desire to rise may continue. If this support is broken downwards, sales can be expected to increase.

Supports 0.1482 – 0.1429 – 0.1399

Resistances 0.1532 – 0.1575 – 0.1603

XRP/USDT

XRP, which tested the 0.5628 support level in the 4-hour analysis with the decline it experienced yesterday before the FED interest rate decision, continued to rise with the FED’s interest rate cut by 50 basis points and yesterday’s daily close was at 0.5850. In the 4-hour analysis, XRP, which tested the resistance level of 0.5909 with its rise in the opening candle today and fell by failing to break it, fell to the support level of 0.5807 with its decline and rose again with the purchases coming here. In the 4-hour analysis, XRP, which returned to the starting level of the day with a recovery after the decline in the opening candle, is currently trading at 0.5838 with the decline in the last candle. If the decline continues, XRP may test the 0.5807 support level again and if it breaks, it may test the 0.5723-0.5628 support levels in the continuation of the decline. In the event that it starts to rise, it may test the 0.5909 level again and if it breaks it, it may test the 0.6003-0.6096 resistance levels in the continuation of the rise.

In the XRP decline, it may rise with purchases at 0.5807 and EMA20 and may give a long trading opportunity. If these levels are broken down, the decline may deepen and offer a short trading opportunity.

EMA20 (Blue Line) – EMA50 (Green Line) – EMA200 (Purple Line)

Supports 0. 5807 – 0.5 723 – 0.5628

Resistances 0.5909 – 0.6003 – 0.6096

DOGE/USDT

DOGE, which moved in a horizontal band by failing to break the level of 0.1013 in its rise and 0.0995 in its fall in the 4-hour analysis before the FED interest rate decision yesterday, rose with the crypto market after the FED cut the interest rate by 50 basis points to 5.00%. Yesterday, with the DOGE rise, the daily closing was realized at 0.1038 with a 2.75% increase in value. In today’s 4-hour analysis, DOGE, which started with a rise in the opening candle in the opening candle, fell with reaction sales in the 0.1054 resistance level zone and fell to 0.1040. With the decline in the last candle, it could not break the 0.1035 support level after testing it and is currently trading at 0.1037. DOGE continues to trade on the falling channel with the rise that occurred yesterday, and if it tests and breaks the 0.1054 level by rising again, it can test the 0.1080-0.1109 levels by continuing its rise. In the event of a decline, it may test the 0.1013-0.0995 support levels in the continuation of the decline with the retest and subsequent break of the 0.1035 support level.

With the FED interest rate decision, US presidential candidate Trump’s payment at a venue with BTC and similar positive news, the crypto market is in a positive mood. If DOGE declines in this process, the 0.1035 and EMA200 levels come to the fore and may rise with the purchases that may come from these levels and may offer a long trading opportunity.

EMA20 (Blue Line) – EMA50 (Green Line) – EMA200 (Purple Line)

Supports 0.1035 – 0.1013 – 0.0995

Resistances 0.1054 – 0.1 080 – 0.1109

DOT/USDT

The FED cut the interest rate by 50 basis points. FED Chairman Powell stated that inflation is moving towards the 2 percent target but is still high. Emphasizing that the economy is growing strongly, Powell said that decisions will be made in the light of data at each meeting. The higher-than-expected interest rate cut had a positive impact on the cryptocurrency market.

As for the Polkadot chart, the price reacted from the 4.072 support band and made a sharp rise to the 4.210 resistance band. When we examine the MACD oscillator, we show that the buyer pressure is slowing down. As a correction of this rise, we may see a correction towards EMA50 levels. On the other hand, if the price advances with buyers, it may want to make the correction after rising to the 4,350 band.

(Blue line: EMA50, Red line: EMA200)

Supports 4,133 – 4,072 – 3,925

Resistances 4.210 – 4.350 – 4.455

SHIB/USDT

Shiba Inu’s (SHIB) burn rate increased by 3348% to 7.8 million SHIBs. SHIB, which was positively affected by the FED’s interest rate cut process, broke the selling pressure in the 0.00001358 resistance band. When we analyze the chart, we see that the EMA50 broke the EMA200 upwards (Golden Cross). When we examine the CMF oscillator, we see that the buying pressure continues. After the price breaks the 0.00001358 resistance, we can expect a rise to 0.00001412 levels and then a correction. On the other hand, according to the MACD oscillator, we can say that the buyer pressure is slowing down. As a correction of this rise, the price may test the previous resistance level of 0.00001358 as support.

(Blue line: EMA50, Red line: EMA200)

Supports 0.00001358 – 0.00001300 – 0.00001271

Resistances 0.00001412 – 0.00001443 – 0.00001475

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.