MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | Change (%) | |||

|---|---|---|---|---|---|

| Weekly | Monthly | Since the beginning of the year | Market Cap. | ||

| BTC | 104,131.60$ | -0.97% | 12.11% | 10.32% | 2,06 T |

| ETH | 3,261.51$ | -3.93% | -1.79% | -2.69% | 393,29 B |

| XRP | 3.075$ | -3.24% | 46.93% | 32.52% | 177,59 B |

| SOLANA | 234.91$ | -10.88% | 24.88% | 21.34% | 114,53 B |

| DOGE | 0.3277$ | -8.52% | 5.08% | 1.12% | 48,49 B |

| CARDANO | 0.9543$ | -4.28% | 13.29% | 4.06% | 33,60 B |

| TRX | 0.2550$ | -1.34% | 0.94% | -0.15% | 21,96 B |

| LINK | 24.96$ | -4.29% | 26.71% | 15.27% | 15,94 B |

| AVAX | 34.54$ | -4.19% | -1.53% | -8.30% | 14,23 B |

| SHIB | 0.00001864$ | -7.68% | -10.28% | -13.88% | 10,98 B |

| DOT | 6.202$ | -3.60% | -5.17% | -11.75% | 9,58 B |

*Table was prepared on 1.31.2025 at 11:30 (UTC). Weekly values are calculated for 7 days based on Friday.

“Weekly Image to be added”

Fear & Greed Index

Source: Alternative

Change in Fear and Greed Value: +1

Last Week’s Level: 75

This Week’s Level: 76

This week, the Fear and Greed Index rose to 76. DeepSeek’s challenge to US-based projects with its low-cost R1 artificial intelligence model increased volatility in the technology market, leading to selling pressure on cryptocurrencies. In addition, the Fed’s decision to keep interest rates unchanged and to keep inflation still high created a cautious mood in the markets. However, Powell’s statement that there is no rush to cut interest rates and that banks can serve crypto customers as long as they can manage risks caused investors to think more positively about the crypto sector. As a result, the index remained at high levels this week, reflecting investors’ increased appetite for risk and an optimistic approach despite the uncertainties in the markets.

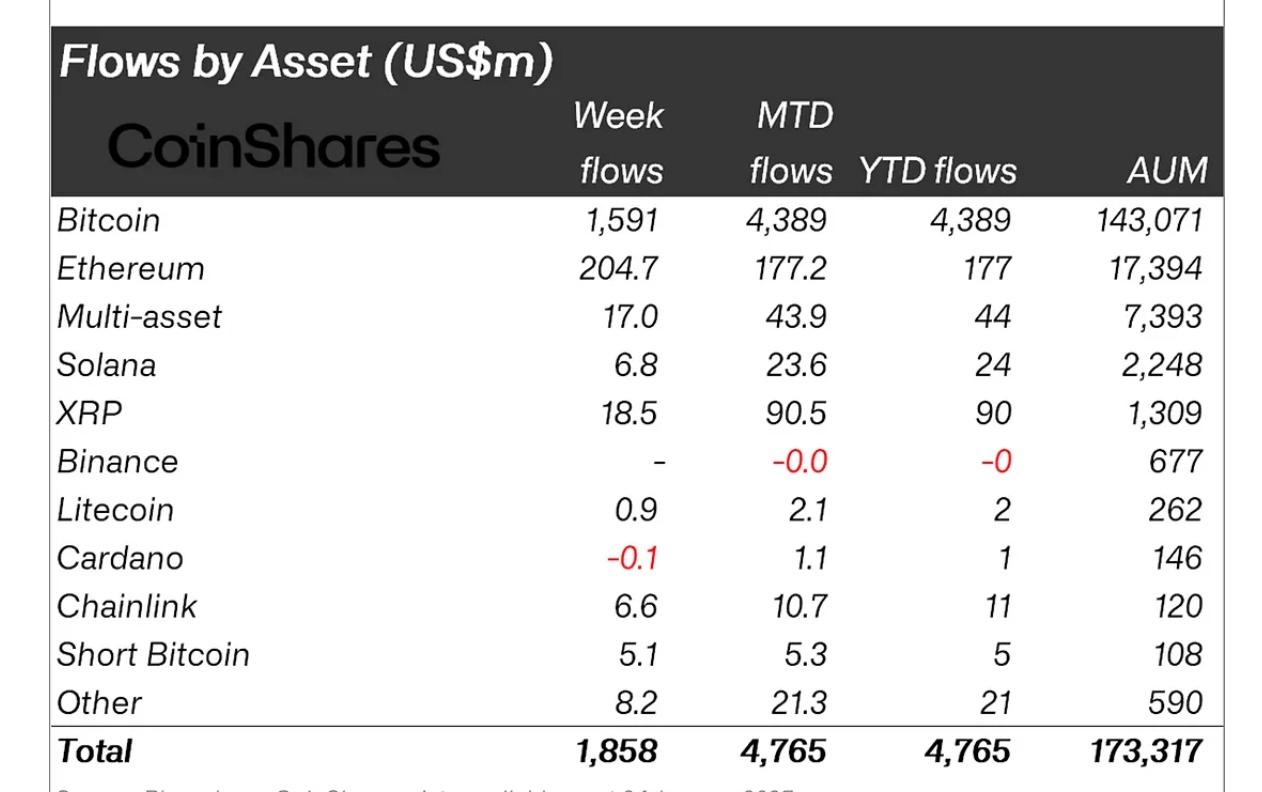

Fund Flow

Source: CoinShares

Overview: Digital asset investment products saw inflows of $1.9 billion this week, driven by the launch of a strategic reserve asset in Bitcoin.

Fund Inputs;

- Bitcoin (BTC): $1.9 billion saw inflows.

- Ethereum (ETH): $205 million in inflows

- Ripple (XRP): $18.5 million logins.

- Solana (SOL): $6.8 million was login.

- Litecoin (LTC): saw an inflow of $0.9 million.

- Other: $8.2 million in inflows.

Fund Outflows; Short Bitcoin outflows decreased compared to last week (5.1)

- Cardano (ADA): -$0.1 million saw an exit.

Regulatory decisions on digital assets and Trump’s statements on cryptocurrencies marked a $25 billion increase in trading volume compared to last week. The volume of digital asset dominance of cryptocurrency exchanges increased by 35%. This prompted investors to turn to altcoins and short Bitcoin ETFs. The trend towards digital assets continues to gain positive momentum.

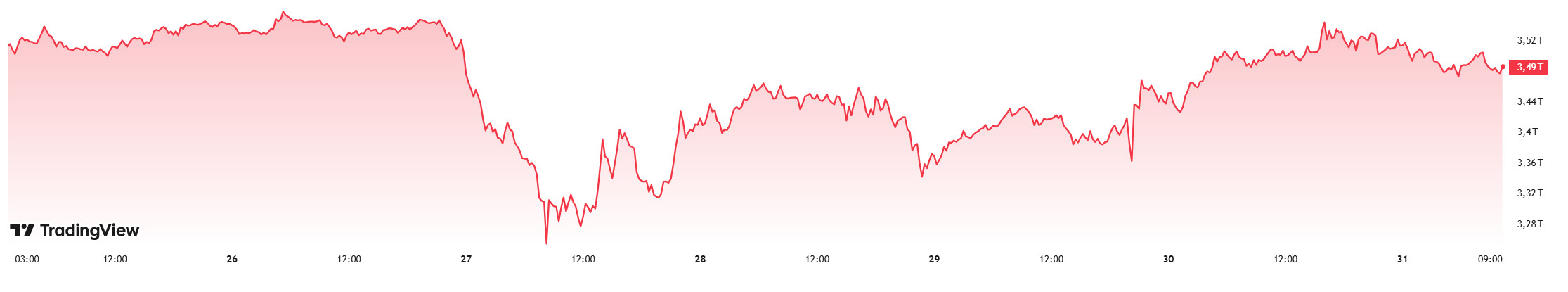

Total MarketCap

Source: Tradingview

Last Week Market Capitalization : 3.45 Trillion Dollars

Market Capitalization This Week: 3.49 Trillion Dollars

During the week on the crypto market, there was a 1.13% increase with a net inflow of $ 37.76 billion. With this rise, the market, which was worth 3.45 trillion dollars at the beginning of the week, reached 3.49 trillion dollars and continues the week positively. Totalmarket, which is in a 2-week positive closing series, will complete the 3rd positive week series if the week closes in this way.

Total 2

This week, a net inflow of $11.56 billion was recorded on Total 2, up 0.82%. Compared to Total, altcoins continue to be dominated by Bitcoin, with most of the money entering the market continuing to flow into Bitcoin.

Total 3

When Total 3 is analyzed, similar to Total and Total 2, it shows a positive outlook with an increase of $6.85 billion this week, up 0.67%. Of the $ 37.76 billion entering the market this week, $ 11.56 billion flowed into altcoins, while $ 26.20 billion was collected on Bitcoin.

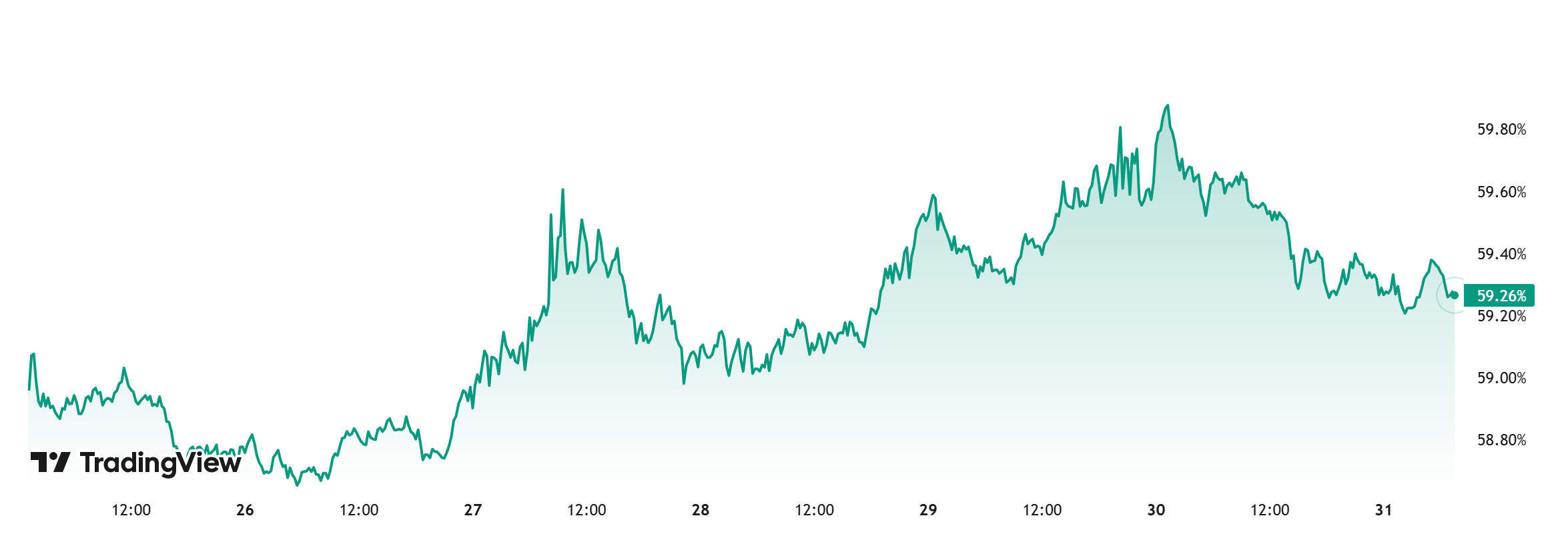

Bitcoin Dominance

Source: Tradingview

Bitcoin Dominance

BTC dominance, which started the week at 58.98%, moved up until the middle of the week and saw the level of 59.89%, but then declined slightly and is currently at 59.26%.

In the coming week, job openings and staff turnover rate, applications for unemployment benefits, unemployment rate and non-farm payrolls data will be announced in the US. In particular, the announcement of non-farm payrolls below expectations may be welcomed positively by the markets. At the same time, US President Trump’s possible statements on the creation of a digital asset reserve or the bills prepared to create Bitcoin reserves on a state-by-state basis may increase the interest of institutional and ETF investors.

If all these positive scenarios materialize, we can expect BTC dominance to rise to 60% – 61% levels in the new week.

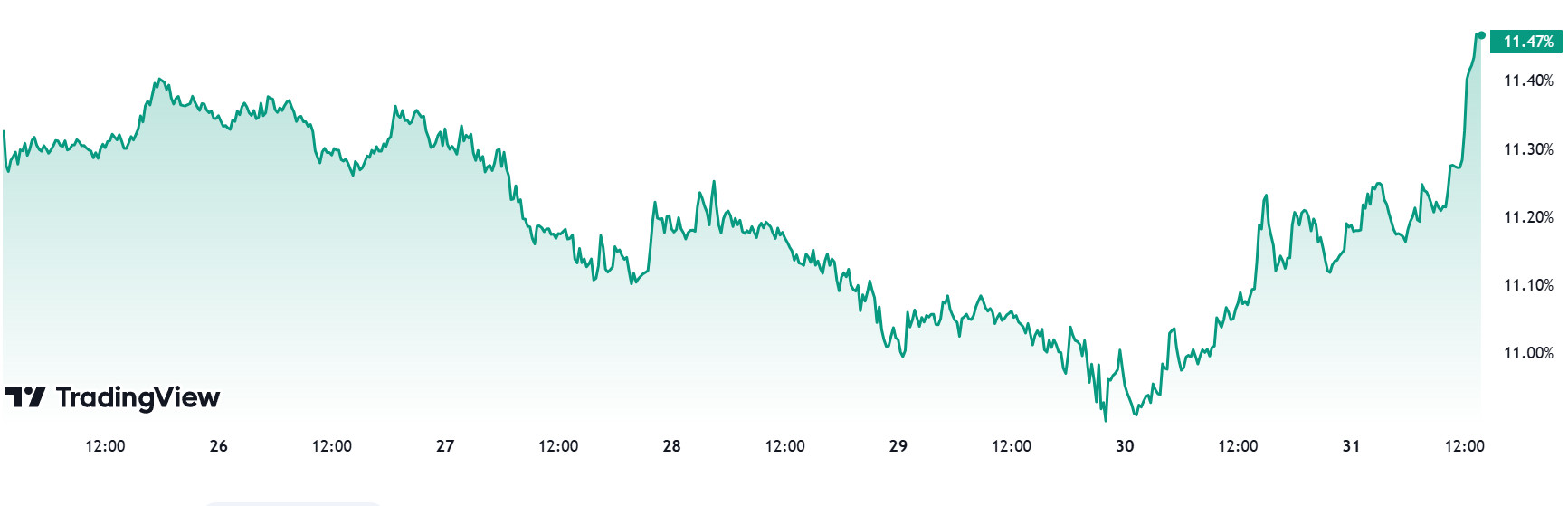

Ethereum Dominance

Source: Tradingview

Weekly Change:

Last Week’s Level: 11.30%

This Week’s Level: 11.47%

Ethereum dominance continued its retracement process until last week, starting at 12.90% at the beginning of January 2025, after a positive movement in the last two weeks of 2024. The negative trend that continued in this process led to a decline to 10.90% last week, but from this point on, especially with the statements of Ethereum’s founder Vitalik Buterin, it recovered and exhibited a significant rise to 11.47%. On the other hand, during the same period, a reverse movement in Bitcoin dominance was observed and negative trends started to emerge on a weekly basis.

In this regard, Ethereum dominance is hovering at 11.47% as of the current week, compared to 11.30% last week.

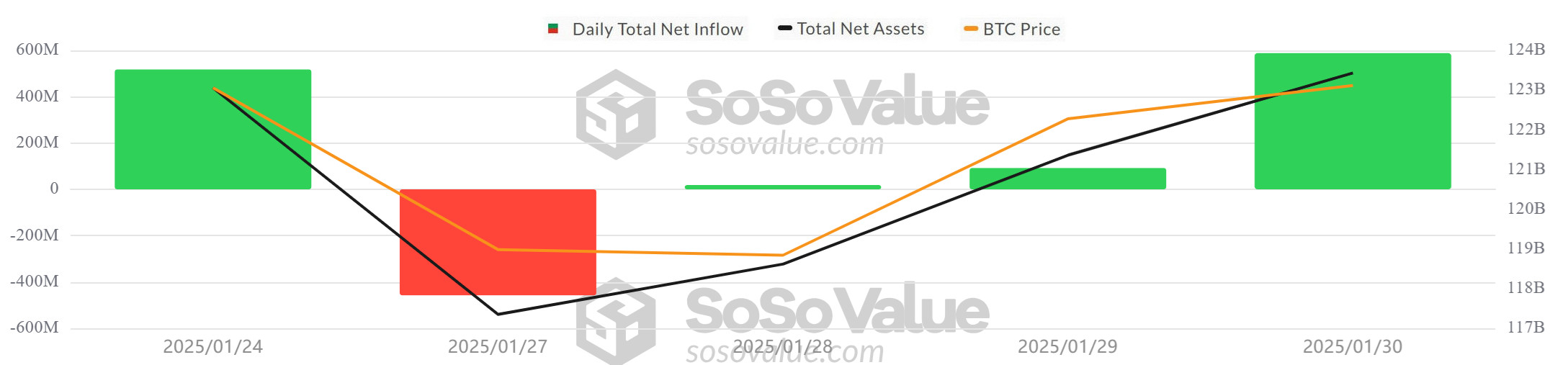

Bitcoin Spot ETF

Source: SosoValue

Featured Developments:

Net Inflows: Between January 24-30, 2025, Spot Bitcoin ETFs saw a total net inflow of $758.6 million. During this period, the BlackRock IBIT ETF stood out with net inflows of $542.8 million. Grayscale GBTC ETF attracted attention with a net outflow of $108.5 million.

Bitcoin Price: Opening at $103,864 on January 24, 2025, Bitcoin closed the week at $104,676, up 0.78%. It hit its lowest level of $101,279 on January 29, but recovered in the next two trading days.

FED Chairman Powell’s Statements Supported the Crypto Market: On January 29, 2025, FED Chairman Jerome Powell’s statements, in which he used a supportive tone for the markets and emphasized that a balanced path would be followed in the fight against inflation, had a positive impact on risky assets. Following these statements, Bitcoin recovered rapidly to close at $103,698 and ETF inflows increased.

Cumulative Net Inflows: Spot Bitcoin ETFs saw a total net inflow of $758.6 million between January 24-30, 2025, with cumulative net inflows reaching $40.18 billion by the end of the 264th trading day.

| DATE | COIN | Price | ETF Flow (mil$) | ||

|---|---|---|---|---|---|

| Open | Close | Change % | |||

| 24-Jan-25 | BTC | 103,864 | 104,808 | 0.91% | 517.7 |

| 27-Jan-25 | 102,560 | 102,021 | -0.53% | -457.6 | |

| 28-Jan-25 | 102,021 | 101,279 | -0.73% | 18.4 | |

| 29-Jan-25 | 101,279 | 103,698 | 2.39% | 92 | |

| 30-Jan-25 | 103,698 | 104,676 | 0.94% | 588.1 | |

| Total for 24 – 30 Jan 25 | 0.78% | 758.6 | |||

Although there were strong inflows between January 24-30, 2025, significant outflows were observed on certain days. In particular, BlackRock and ARK ETFs supported the market, while Grayscale and Fidelity created negative pressure on some days. During this period, there was a strong correlation between Bitcoin price and ETF inflows. In particular, on January 27, the price dropped as low as $101,279 after large outflows, but recovered again with high inflows on January 30. This once again showed that investor confidence in ETFs has a direct impact on Bitcoin price movements.

Moreover, FED Chairman Powell’s market-friendly statements on January 29th offered strong support to the crypto markets. This boosted investor confidence and gave Bitcoin’s price an upward momentum. The FED’s policies and messages to the markets once again proved their impact on risky assets and contributed to increased inflows into Bitcoin ETFs.

This data shows that Bitcoin is strengthening its position in the financial markets and the impact of ETF inflows on price movements is evident.

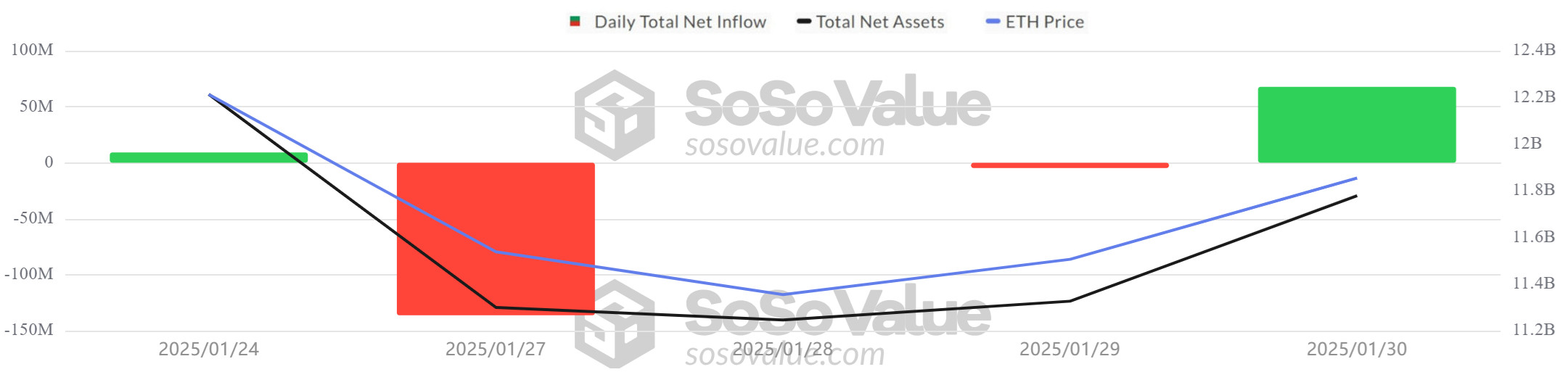

Ethereum spot ETF

Source: SosoValue

Between January 24-30, 2025, Spot Ethereum ETFs saw a total net outflow of $63.9 million. Notably, $84.2 million outflow from Grayscale ETHE ETF and $68.5 million outflow from Fidelity FETH ETF on January 27. In contrast, on January 30, inflows of $79.9 million into the BlackRock ETHA ETF and $15.4 million into the Fidelity FETH ETF contributed to the market’s recovery. Ethereum opened the day at $3,337 on January 24, 2025, and closed at $3,308, down 0.87%. It fell 1.55% on January 27 and 3.30% on January 28 to $3,075. However, it rose by 1.20% on January 29 and 4.27% on January 30, closing at $3,245. On a weekly basis, the Ethereum price fell by 2.76%.

| DATE | COIN | Price | ETF Flow (mil$) | ||

|---|---|---|---|---|---|

| Open | Close | Change % | |||

| 24-Jan-25 | ETH | 3,337 | 3,308 | -0.87% | 9.2 |

| 27-Jan-25 | 3,230 | 3,180 | -1.55% | -136.2 | |

| 28-Jan-25 | 3,180 | 3,075 | -3.30% | 0 | |

| 29-Jan-25 | 3,075 | 3,112 | 1.20% | -4.7 | |

| 30-Jan-25 | 3,112 | 3,245 | 4.27% | 67.8 | |

| Total for 24 – 30 Jan 25 | -2.76% | -63.9 | |||

On January 29, 2025, the US Federal Reserve (FED) announced its interest rate decision and kept the interest rate unchanged. On the same day, FED Chairman Jerome Powell’s speech created a positive atmosphere in the markets and an upward movement was observed in the Ethereum price. In particular, the recovery in ETF flows and price increase after the rate decision showed that the market reacted positively to the FED statements. Since the launch of the US Spot Ethereum ETFs, cumulative net inflows have reached $2.75 billion after 132 trading days. The ETF market reveals continued institutional investor interest and spot Ethereum ETFs have made a strong impact on the market. However, short-term price volatility and shifts in ETF flows continue to dictate market dynamics.

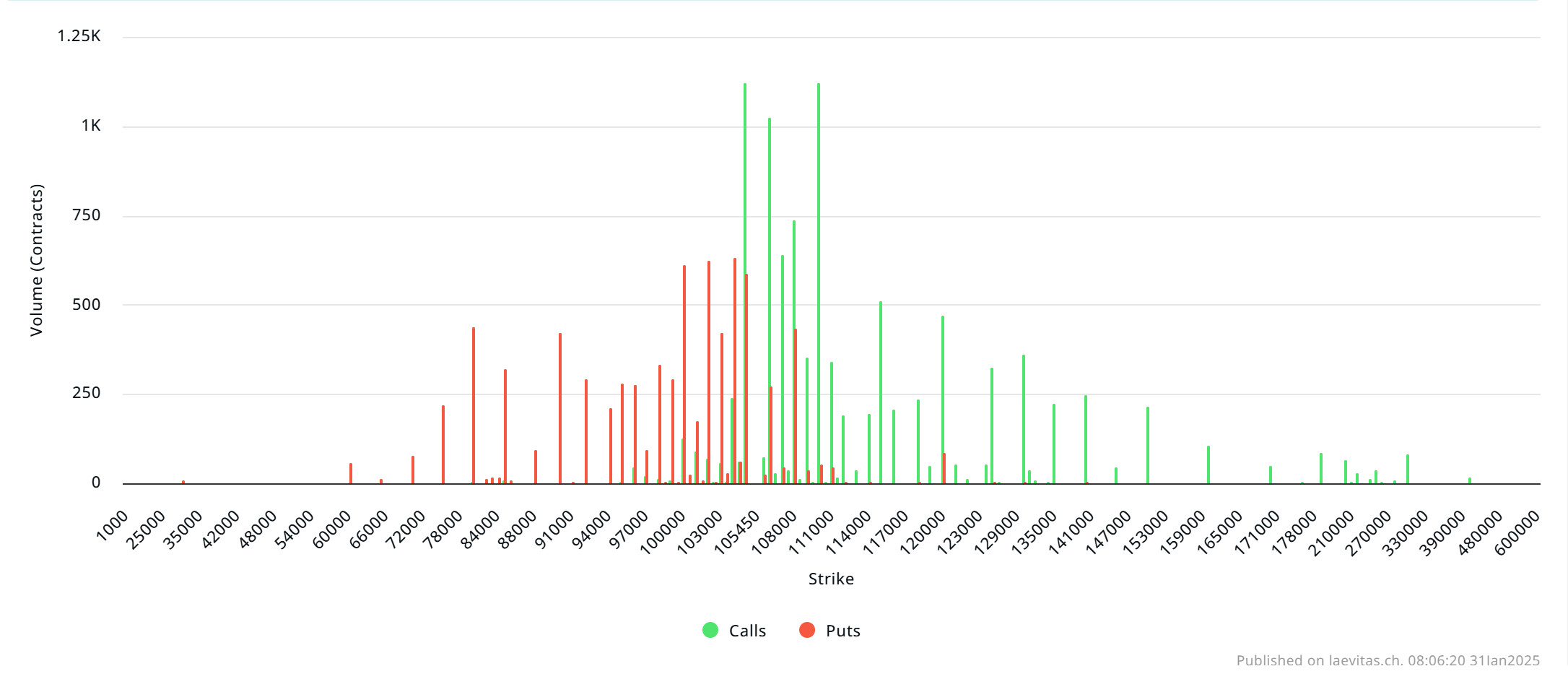

Bitcoin Options Breakdown

Source: Laevitas

Deribit Data: Approximately $8.1 billion worth of BTC options contracts expire today. Meanwhile, CME Group, the world’s leading derivatives market, launched Bitcoin Friday futures options on February 24, pending regulatory review. These new contracts will be the first financially settled CME Group cryptocurrency options to expire every day of the week, Monday through Friday. “We are pleased to offer these new options, which provide investors with even greater precision to manage short-term Bitcoin price risk,” said Giovanni Vicioso, Global Head of Cryptocurrency Products at CME Group. “Building on the success of our Bitcoin Friday futures, the smaller size and daily expirations of these contracts offer market participants a capital-efficient toolkit to effectively adjust their Bitcoin risk.”

Laevitas Data: When we examine the chart, it is seen that put options are concentrated in the 100,000 – 108,000 level band. Call options are concentrated between 105,000 – 115,000 levels and the concentration decreases towards the upper levels. At the same time, resistance has formed in the band of approximately 105,000 – 107,000 dollars. On the other hand, it is seen that call options peaked at $ 110,000 and there is a general decline in volume after this level.

Option Expiration

Put/Call Ratio and Maximum Pain Point: In the last 7 days data from Laevitas, the number of call options decreased by 47% to 82.45K compared to last week. In contrast, the number of put options decreased by 24% to 57.84K compared to last week. The put/call ratio for options was set at 0.68. A put/call ratio of 0.68 indicates that there is a strong preference for call options over puts among investors and a possible uptrend in the markets. Bitcoin’s maximum pain point is set at $102,000. In the next 7 days, there are 13.89K call and 9K put options at the time of writing.

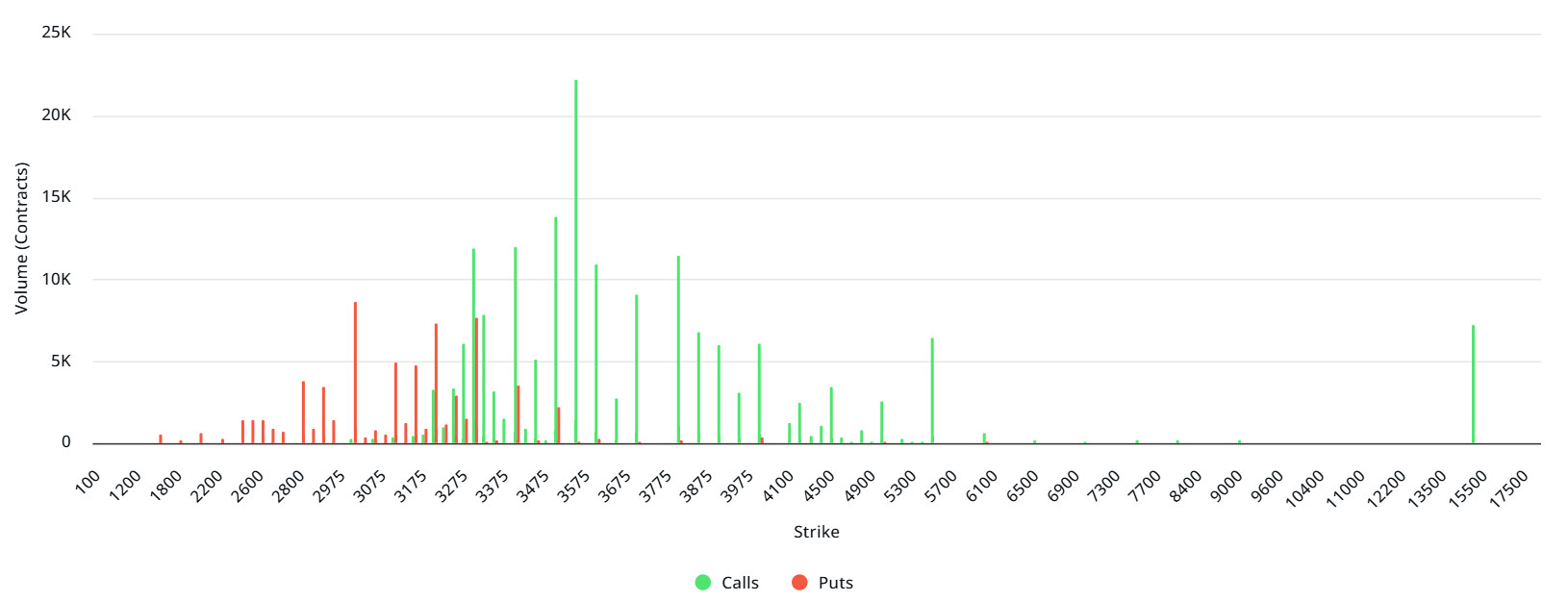

Ethereum Options Distribution

Source: Laevitas

Laevitas Data: When we analyze the chart, we observe that Call options are more concentrated than Put options. There is a high volume of Call options, especially at the $3,575 and $3,600 levels, indicating that these levels may be important resistance points for the market. In the $3,300-3,400 range, the concentration of Put options is noteworthy. At higher strike prices ($4,000 and above), Call options dominate, but volumes are relatively low, suggesting that investors are more focused on current price levels.

Deribit Data: Ethereum options with a notional value of $86.19 million expire on February 1.

Maximum Pain Point: $3,250.

Put/Call Ratio: 0.33. This shows that investors in the market are in a strong position to expect the price to rise.

WHAT’S LEFT BEHIND

- MicroStrategy will pay $1.05 billion in bonds with stock.

- Phemex hacked by North Korean hackers, $69.1 million in crypto assets stolen.

- ECB member Piero Cipollone stated that the digital euro could be a response to the US dollar.

- Vitalik Buterin said that it is possible to burn 713 thousand ETH per year on the Ethereum network.

- The SEC will consider Solana spot ETF applications from Grayscale and other companies.

- Circle minted 250 million USDC on the Solana blockchain.

- China-based DeepSeek overtook ChatGPT to become the most popular app in the US.

- The US Senate confirmed Scott Bessant as Secretary of the Treasury with 68 votes.

- Donald Trump supported investors by emphasizing that Bitcoin will leave countries like China behind.

- Trump’s stablecoin regulations have encouraged the European Central Bank to accelerate its digital euro work.

- Trump said DeepSeek should be a “wake-up call” for the US.

- Trump announced that he expects a big tender for the sale of TikTok.

- Trump announced 25% tariffs on imports from Canada and Mexico.

- Hong Kong granted virtual asset licenses to PantherTrade and YAX, bringing the total number of licenses to 9.

- Nvidia said DeepSeek’s AI models will drive GPU demand.

- The Arizona Senate is debating Bitcoin reserve legislation.

- Japanese investment company Metaplanet aims to reach 10,000 BTC by the end of 2025.

- The Fed kept interest rates unchanged at 4.25% – 4.50%.

- Trump’s media company “TruthFi” will create a $250 million fund for Bitcoin and crypto ETFs.

- SEC considers Canary Capital’s Litecoin ETF application.

- CME Group announced on February 24 that it will launch options on Bitcoin futures.

- Tesla announced a $600 million gain in the value of its Bitcoin holdings.

- JPMorgan pointed out the correlation between crypto markets and small tech stocks.

- Grayscale listed its Bitcoin mining ETF MNRS on NYSE Arca.

- Illinois advances Bitcoin strategic reserve bill.

- Ethena’s USDe stablecoin supply reaches $5.7 billion.

- Jupiter Exchange acquires Sonar Watch and launches a new asset management platform.

- Avalanche reduced transaction fees by 75% with the December update.

- The Ethereum community supports Danny Ryan as the leader of the Ethereum Foundation.

- Norway‘s Central Bank announced a $500 million stake in MicroStrategy.

- Tether responds to EU’s MiCA regulations, Coinbase and Crypto.com delist USDT.

- SEC gives partial approval to Bitwise Bitcoin and Ethereum ETF.

MARKET COMPASS

Last week, global markets started the week with the turmoil caused by the rise of China’s DeepSeek. DeepSeek’s rise, which triggered concerns that it could undermine US dominance in the field of artificial intelligence, led to a decline in risk appetite and a global sell-off. Major digital assets were also affected. While the markets were trying to digest this situation, the Federal Open Market Committee (FOMC) came to the rescue. Although the US Federal Reserve (FED) interrupted the interest rate cut cycle and left the policy rate unchanged, Chairman Powell’s speech, which started in a hawkish tone, brought some relief to the markets. New rate cut expectations, which had been postponed until June in the past weeks, were pushed back to May according to CME FedWatch. Powell also took a moderate stance on cryptocurrencies.

Markets will continue to monitor US macro indicators to better understand the Fed’s course. Next week will contain important data in this respect. Among these, the January Non-Farm Payrolls Change (NFP) will stand out. We will open a separate thread for this data, but from the beginning of the week, ISM Manufacturing PMI, JOLTS, ADP private sector non-farm payrolls change, ISM Services PMI, weekly jobless claims and the unemployment rate and average hourly earnings data, which will be released simultaneously with the NFP on Friday, will be closely monitored.

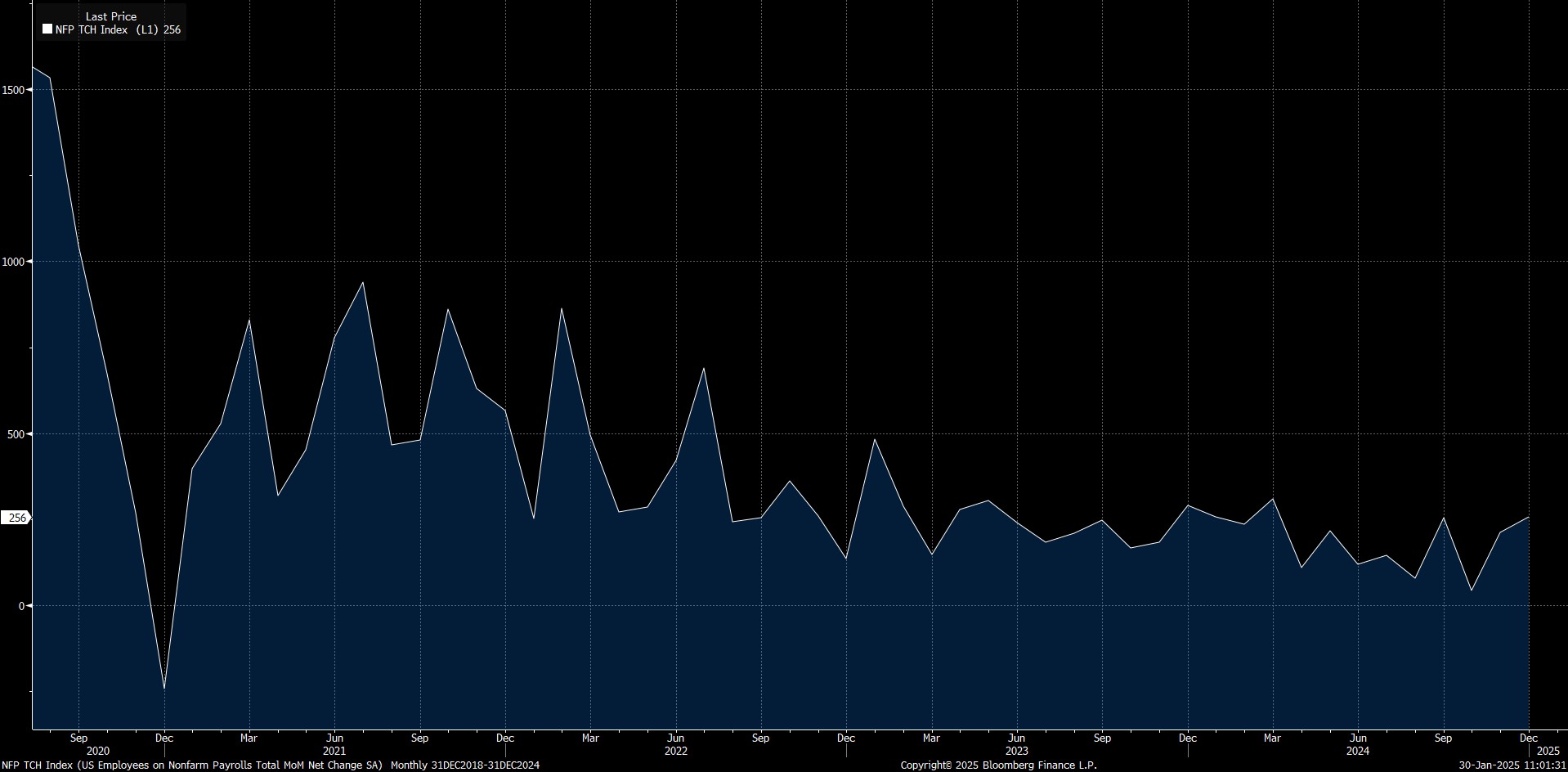

NFP Could Be Decisive

In the last month of last year, the US economy added 256,000 jobs in the non-farm sector. This change was well above the expectations of 164 thousand and supported the expectations that the pace of interest rate cuts by the FED would slow down.

Source: Bloomberg

*Note: The results of labor market data such as NFP and unemployment rate should be evaluated together. You can follow the expectation figures formed by the surveys and the changes in these figures in our daily analysis reports.

Recently we have seen a fluctuation in the NFP due to a number of external factors, strikes and natural disasters being the main ones. In the first months of the year, in order to understand whether things are on track in the world’s largest economy, we need data that is free from such effects. We think that the first of these could be the January data.

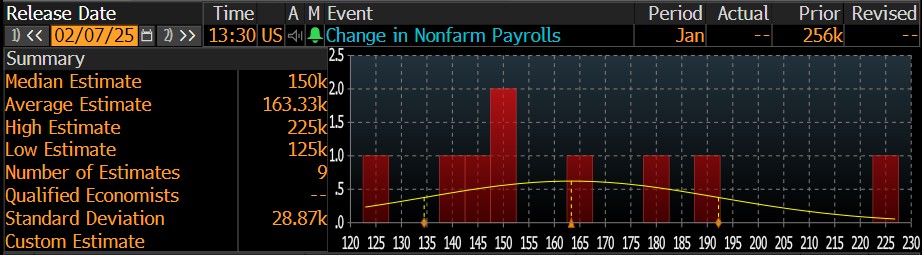

Considering the Bloomberg survey last analyzed on January 31, the median NFP forecast of economists for the first month of the year is seen at 150 thousand. The average of the forecasts is around 161 thousand. The forecast range varies between 225 thousand and 125 thousand.

Source: Bloomberg

“nfp2 will be added”

Let us underline once again that not only the NFP data, but also indicators such as average hourly earnings and the unemployment rate, which will be released with this report, should be closely monitored, but this time, we think that the revisions to the NFP for the previous months should also be looked at. Potential large downward revisions could call into question the strength of the labor market.

Let’s turn to the NFP data for January. A lower-than-expected data may increase risk appetite as it may strengthen the FED’s hand for interest rate cuts, which may have a positive impact on digital assets. In the opposite case, we may see pressure on cryptocurrencies.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Onchain Weekly Report – January 29

Market and Digital Economy Impacts of Tether’s Relocation to El Salvador

Regulations and the Future of Privacy Coins

The Digital Asset Funds Revolution: Crypto ETFs

Inflation and Cryptocurrency: Observations and Forecasts in 2025

The Most Important Airdrop Projects Expected in 2025

Transparency And Reliability Review For USDC

World Liberty Financial and Crypto Investments

Click here for all our other Market Pulse reports.

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.