MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | Change (%) | |||

|---|---|---|---|---|---|

| Weekly | Monthly | Since the beginning of the year | Market Cap. | ||

| BTC | 97,164.39$ | -0.16% | 0.34% | 2.86% | 1,93 T |

| ETH | 2,715.18$ | -0.93% | -15.27% | -19.10% | 327,06 B |

| XRP | 2.746$ | 15.82% | -2.61% | 17.91% | 158,32 B |

| SOLANA | 200.70$ | 1.98% | 7.30% | 3.50% | 97,98 B |

| DOGE | 0.2743$ | 8.54% | -22.56% | -15.56% | 40,54B |

| CARDANO | 0.8191$ | 12.29% | -19.51% | -10.67% | 28,86B |

| TRX | 0.2334$ | 2.46% | 4.49% | -8.53% | 20,11B |

| LINK | 19.31$ | 0.65% | -5.27% | -10.86% | 12,33B |

| AVAX | 26.32$ | 3.82% | -28.12% | -30.09% | 10,85B |

| SHIB | 0.000001676$ | 10.40% | -21.05% | -22.48% | 9,89B |

| DOT | 5.284$ | 12.56% | -20.77% | -24.76% | 8,19B |

*Table was prepared on 2.14.2025 at 11:30 (UTC). Weekly values are calculated for 7 days based on Friday.

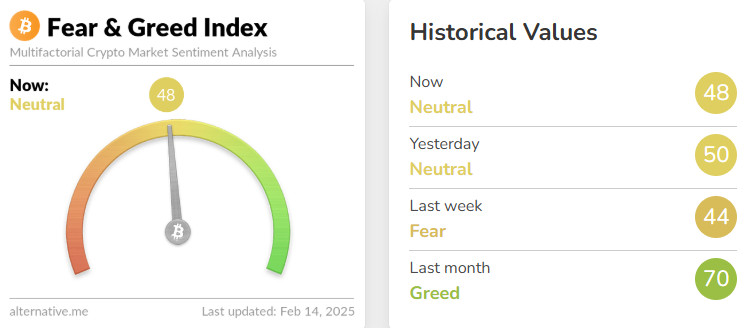

Fear & Greed Index

Change in Fear and Greed Value: +4

Last Week Level: 44

This Week’s Level: 48

This week, Fear & Greed Index increased by 4 points to 48. The lower-than-expected US jobless claims and Fed Chair Powell’s emphasis on the strength of the economy created cautious optimism in the markets. However, this optimism remained limited as inflation data exceeded expectations. In addition, Trump’s predictions of job growth and lower interest rates also gave positive signals to the market.

GameStop’s investment evaluation in cryptocurrencies and 21Shares’ staking offer for Ethereum ETFs supported the risk appetite in the crypto market. However, CPI and PPI data exceeded expectations, indicating that a cautious process continued due to uncertainty about inflation. These balanced developments had a positive, albeit limited, impact on the index.

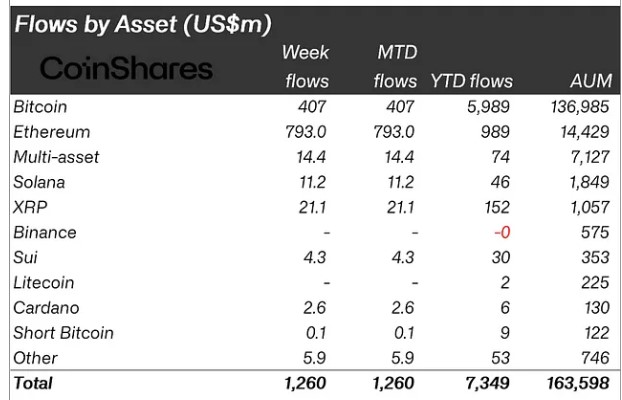

Fund Flow

Overview

Digital asset investment products saw a total inflow of $1.3 billion this week

Fund Inputs ,

- Bitcoin (BTC): Totalled $407 million this week, $79 million less than last week, after Trump’s announcement on tariffs.

- Ethereum (ETH): 21shares is offering staking for Ethereum ETFs. With this news, it saw an inflow of $793 million this week

- Multi-asset: BlackRock ETHA ETF saw net inflows of $24.6 million. The ETF saw inflows of $14.4 million, driven by BlackRock’s positive assessment of Ethereum

- Ripple (XRP): The XRP ETF received the first approval from the SEC. With this news, it saw an inflow of 21.1 million dollars

- Solana (SOL): Solana ETF applications supported inflows into the altcoin. There was an inflow of 11.2 million dollars this week.

- SUI: Market capitalization rose to $11 billion, ranking 12th in altcoins. It saw $4.3 million in inflows.

- Litecoin (LTC): The SEC gave initial approval to the Litecoin Trust, but the regulator is still far away. For this reason, there was no entry into Litecoin.

- Cardano (ADA): Grayscale filed for a Cardano ETF, with this news boosting fund inflows to 2.6 million this week.

- Other: Other altcoins saw inflows remain unchanged from last week at $5.9 million.

Fund Outflows; Short Bitcoin positions reached $0.1 million.

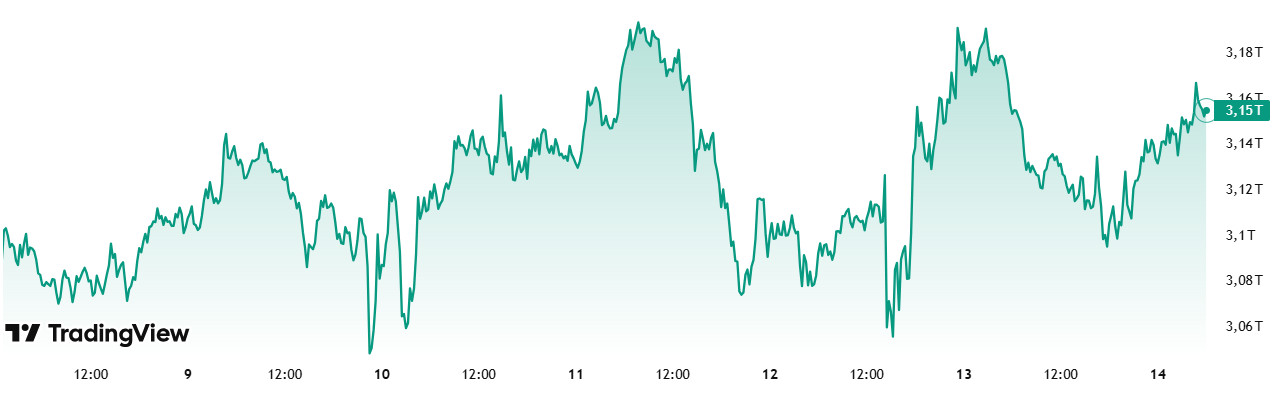

Total MarketCap

Source: Tradingview

Last Week Market Capitalization: 3.10 trillion Dollars

Market Capitalization This Week: 3.15 trillion Dollars

The crypto market, which fell to $3.10 trillion at the close of last week, has gained $54.82 billion in value this week with an increase of 1.58% and is hovering around $3.15 trillion. The total market cap, which moved between $3.21 – $3.03 trillion during the week, was last in this range on November 18, 2024. If this week closes positively, the two-week negative streak will end.

Total 2

Total 2, which fell as low as $1 trillion last week, is showing a positive movement of 3.76% with an increase of $44.24 billion this week. A close of $1.19 trillion and above on Total 2 at the close of the week could end the two-week negative streak.

Altcoins, which make up about 40% of the crypto market, seem to have collected about 80% of the net amount entering the market this week. In the altcoin market, the post-decline recovery seems to have started faster than Bitcoin.

Total 3

When Total 3 is analyzed, it is seen that the loss of approximately 32.86 billion dollars last week closed with an increase of 33.78 billion dollars this week. Total 3, which accounts for about 28% of the total market, collected about 61.61% of the net amount entering the market.

It can be said that the performance of altcoins this week has been much better compared to what happened in last week’s downturn. Of the current total of $54.82 billion in the market, about 19.30% is Bitcoin, 19.09% is Ethereum, and the main part, 61.61%, is seen to have entered altcoins other than Ethereum.

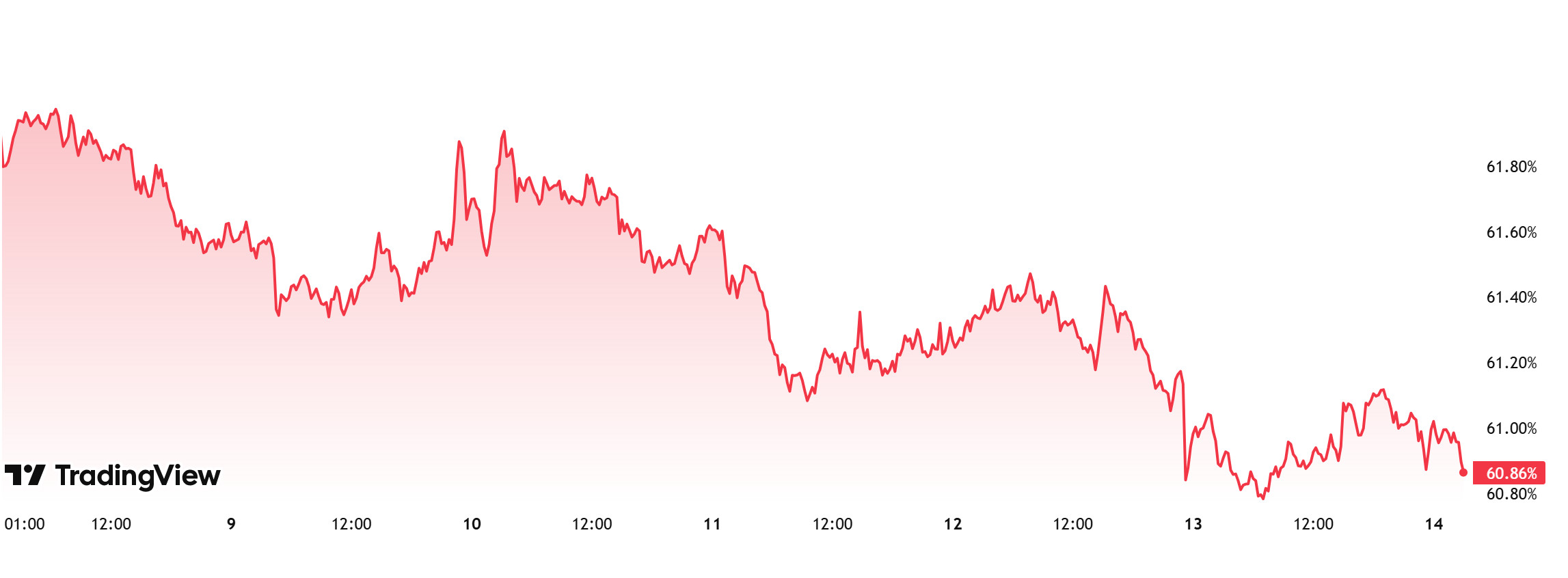

Bitcoin Dominance

Source: Tradingview

BTC dominance, which started the week at 61.66%, continued to decline throughout the week and is currently at 60.86%.

There will be little data flow in the coming week, with the US jobless claims data and FOMC meeting minutes to be released. In particular, higher than expected jobless claims data may be priced positively by the market as it will ease the FED’s hand in interest rate cuts. At the same time, the US President Trump’s positive negotiations on tariffs and the cancellation or easing of these tariffs are positive for the markets and may greatly increase the interest of institutional and ETF investors.

If all these positive scenarios materialize, we can expect BTC dominance to rise to 62% – 63% in the new week.

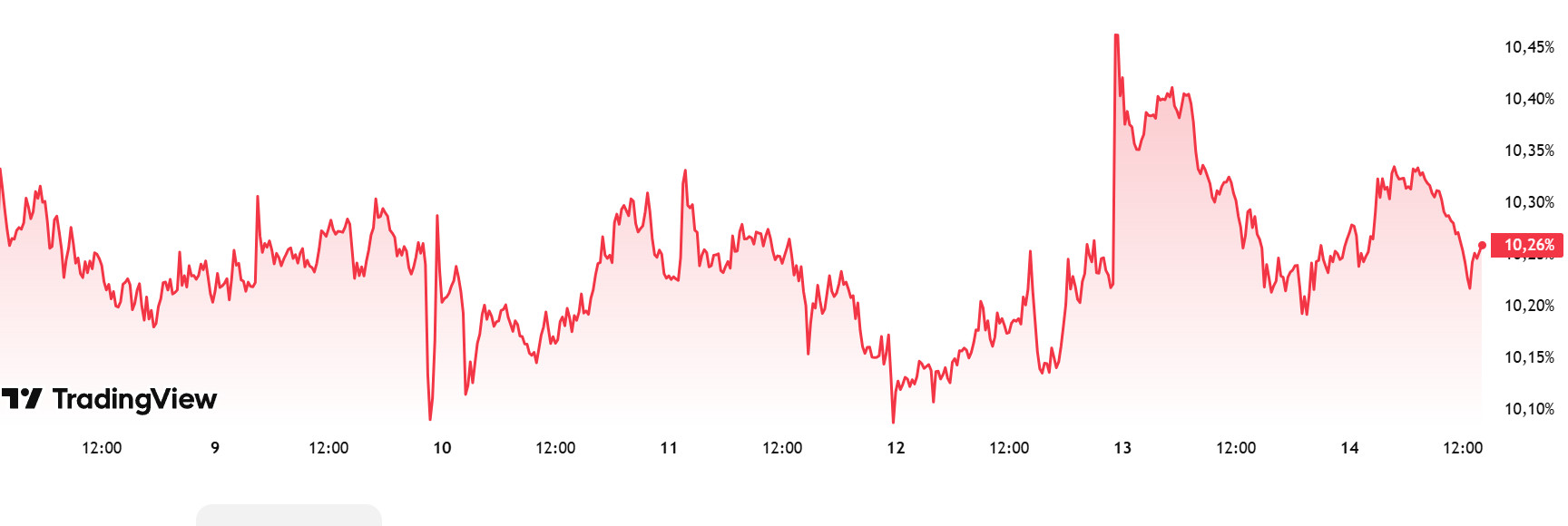

Ethereum Dominance

Source: Tradingview

Weekly Change

Last Week’s Level: 10.21%

This Week’s Level: 10.26%

Ethereum dominance continued its retreat from 12.90% in January until last week. The negative trend that remained in effect during this period caused the dominance to decline to 9.23%, a level last seen in May 2020. However, from this point on, it has made a remarkable recovery and has managed to rise above 10.00. As a matter of fact, Ethereum dominance has gained positive momentum as of the current week, reaching 10.33%.

On the other hand, there has been a reversal in Bitcoin dominance over the last six weeks, with positive trends on a weekly basis and a negative trend in the last week.

Accordingly, Ethereum dominance ended last week at 10.21% and is hovering at 10.26% as of the current week.

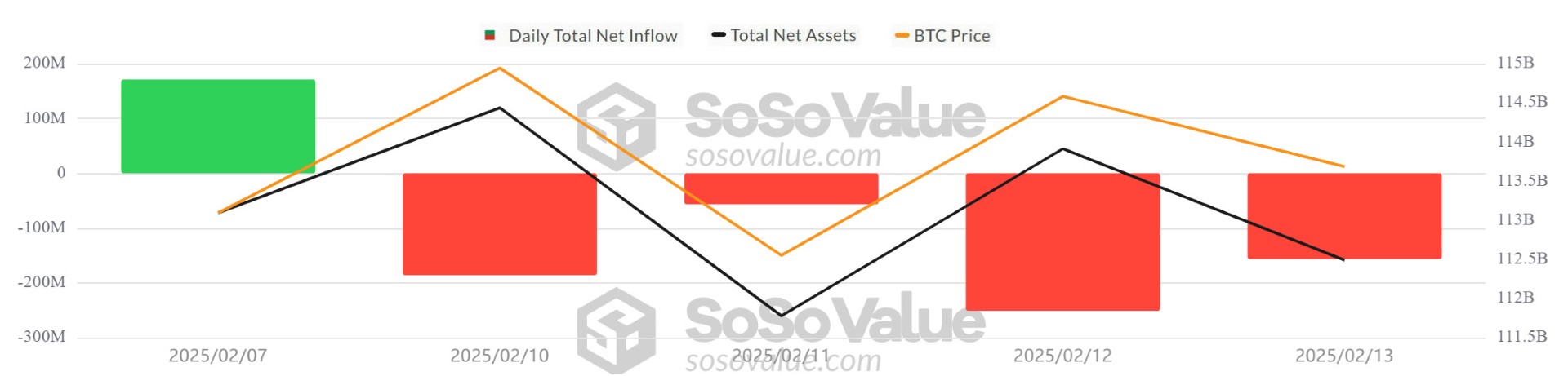

Bitcoin Spot ETF

Source: SosoValue

Featured Developments

- Negative NetFlow Series: While the negative series increased to 4 days between February 07-13, 2025, Spot Bitcoin ETFs recorded a total net outflow of $479.5 million. In this period, Fidelity FBTC ETF attracted attention with a net outflow of 323.7 million dollars. BlackRock IBIT ETF realized a net inflow of $105.2 million.

- Bitcoin Price: Bitcoin opened at $96,515 on February 07, 2025, and closed at $96,560 on February 13, with a small weekly increase of 0.05%. On February 12, it rose 2.18% to $97,816 but fell 1.28% to $96,560 on February 13. On a weekly basis, price movements were volatile.

- Cumulative Net Inflows: Spot Bitcoin ETFs saw a total net outflow of -$479.5 million between February 07-13, 2025, while the cumulative net inflow at the end of the 274th trading day was $40.05 billion.

| DATE | COIN | PRİCE | |||

|---|---|---|---|---|---|

| Open | Close | Change % | ETF Flow (mil$) | ||

| 07-Feb-25 | BTC | 96,515 | 96,454 | -0.06% | 171.3 |

| 10-Feb-25 | BTC | 96,423 | 97,379 | 0.99% | -186.3 |

| 11-Feb-25 | BTC | 97,379 | 95,731 | -1.69% | -56.7 |

| 12-Feb-25 | BTC | 95,731 | 97,816 | 2.18% | -251 |

| 13-Feb-25 | BTC | 97,816 | 96,560 | -1.28% | -156.8 |

| Total for 07 – 13 Feb 25 | 0.05% | -479.5 | |||

General Evaluation

Between February 07-13, 2025, Bitcoin price was volatile, while Bitcoin ETFs saw net outflows. BlackRock IBIT ETF remained positive with small inflows, while Fidelity FBTC and Grayscale GBTC ETFs saw significant outflows.

Economic decisions taken by the US have led to uncertainty in the crypto market and reduced investors’ risk appetite. In particular, US President Donald Trump’s comments on tariffs have increased uncertainty in the market and weakened investor interest in Bitcoin and ETFs. While price fluctuations are expected to continue in the short term, in the long term, increased interest in ETFs is expected to have a positive impact on the Bitcoin price.

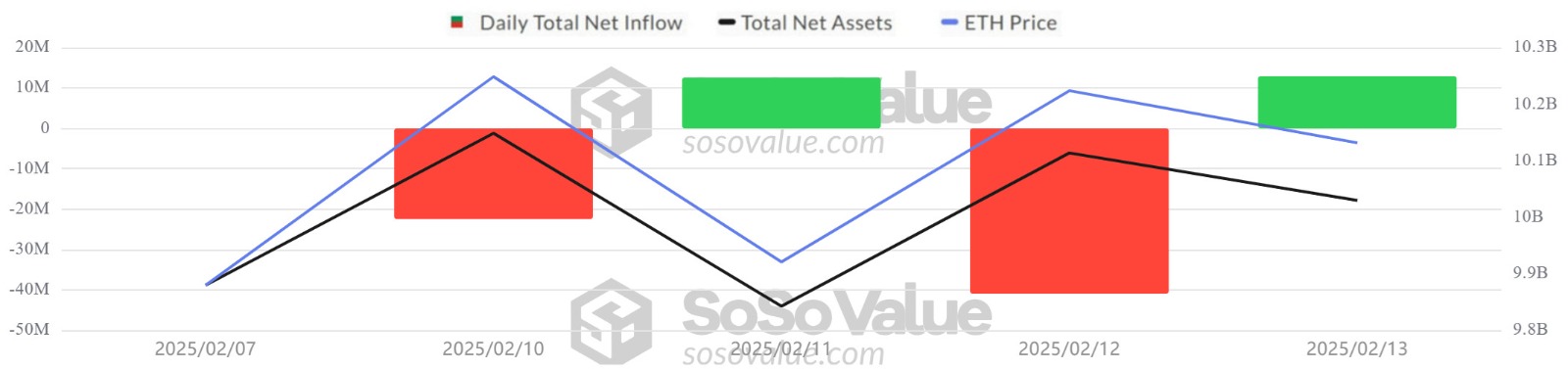

Ethereum spot ETF

Source: SosoValue

Between February 07-13, 2025, Spot Ethereum ETFs saw a total net outflow of -$38.0 million. Grayscale ETHE ETF had a total outflow of -$56.5 million, while BlackRock ETHA ETF had a net inflow of $24.6 million. The positive net inflow streak ended in this period. At the end of 142 trading days, total net inflows reached $3.14 billion. During this period, Ethereum had a daily opening of $2,685 on February 07, 2025 and a daily close of $2,674 on February 13. On a weekly basis, the Ethereum price fell by 0.41%.

| DATE | COIN | PRİCE | |||

|---|---|---|---|---|---|

| Open | Close | Change % | ETF Flow (mil$) | ||

| 07-Feb-25 | ETH | 2,685 | 2,620 | -2.42% | 0 |

| 10-Feb-25 | ETH | 2,626 | 2,659 | 1.26% | -22.5 |

| 11-Feb-25 | ETH | 2,659 | 2,601 | -2.18% | 12.6 |

| 12-Feb-25 | ETH | 2,601 | 2,737 | 5.23% | -40.9 |

| 13-Feb-25 | ETH | 2,737 | 2,674 | -2.30% | 12.8 |

| Total for 07 – 13 Feb 25 | -0.41% | -38.0 | |||

BlackRock said Ethereum is a risky asset but has more upside potential than Bitcoin. This statement suggests that Ethereum may become more attractive to institutional investors in the long run. The Ethereum ETF market continues to maintain investor interest despite its volatility. The Pectra update and BlackRock’s positive assessment of Ethereum could create a positive expectation in the market despite short-term volatility.

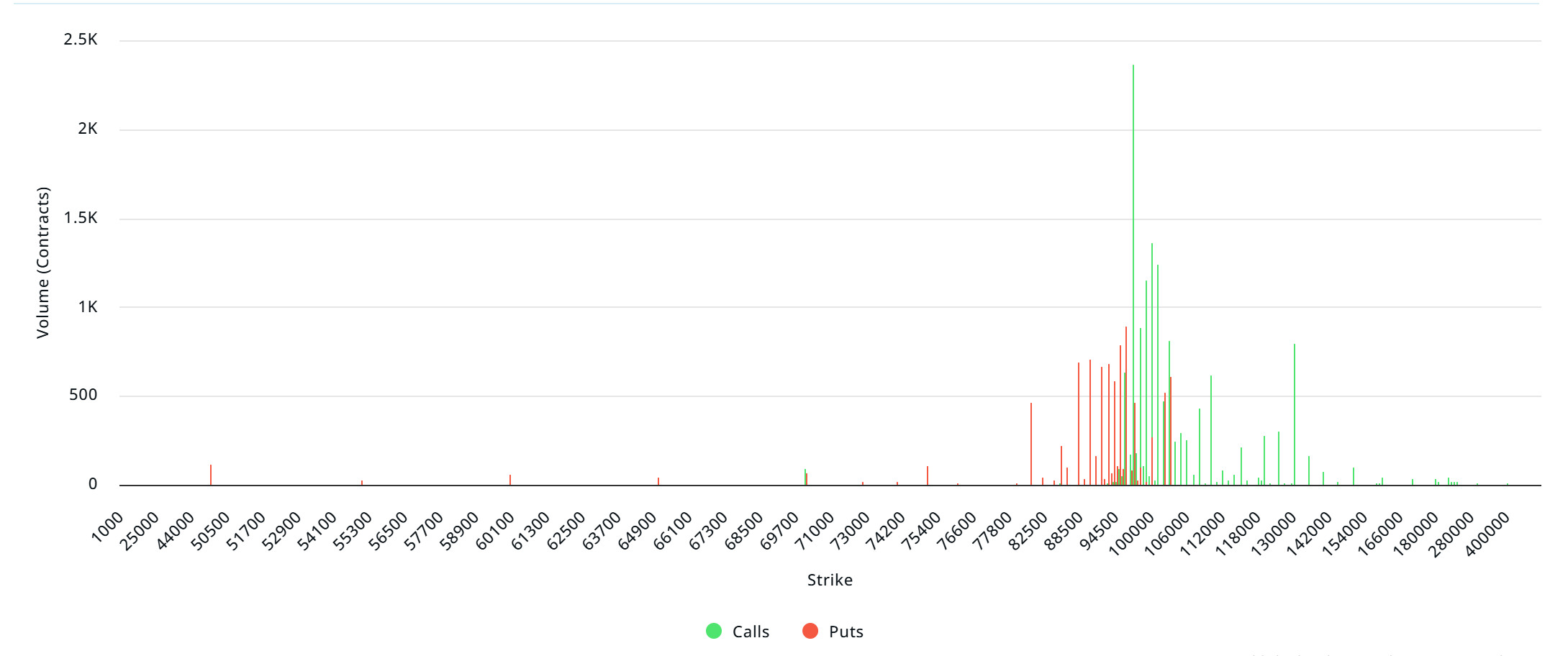

Bitcoin Options Breakdown

Source: Laevitas

Deribit Data: Deribit data shows that approximately 21,500 BTC options contracts with a notional value of approximately $2.07 billion expire today. The implied volatility of BTC options fell to its lowest level this year, mainly due to the continuous weakening of bullish momentum recently. Greeks.live noted in a statement that “CPI data on Wednesday slightly exceeded expectations and pushed BTC down to $94,000. However, mainstream coins will increase their high positions this week as factors such as Powell’s positive speech on encryption boost the market. Currently, the implied volatility of major futures options has been at a relatively low level for nearly a year. The volatility index (Dvol) has been lower than it is now by only 14% over the past year. This suggests that the options market has relatively low expectations for future volatility. The main reason for this is the continuous weakening of the buyers’ power recently. Now is the time for the market to digest TrumpTrade’s garbage period; following the whale sales seems to be a better choice.

Laevitas Data: When we analyze the chart, we see that put options are concentrated between 88,000 – 96,500 levels. Call options are concentrated between 98,000 – 110,000 levels and the concentration decreases towards the upper levels. At the same time, resistance has formed in the band of approximately 95,000 – 97,000 dollars. On the other hand, there are 2.36K call options at the $ 97,000 level, where there is a peak and there is a decrease in volume after this level.

Option Expiration

Put/Call Ratio and Maximum Pain Point: In the last 7 days data from Laevitas, the number of call options decreased by 48% to 61.57K compared to last week. In contrast, the number of put options decreased by 47% to 36.78K compared to last week. The put/call ratio for options was set at 0.57. A put/call ratio of 0.57 indicates that there is a strong preference for call options over puts among investors and a possible uptrend in the markets. Bitcoin’s maximum pain point is set at 98,000 dollars. In the next 7 days, there are 3.73K call and 1.58K put options at the time of writing.

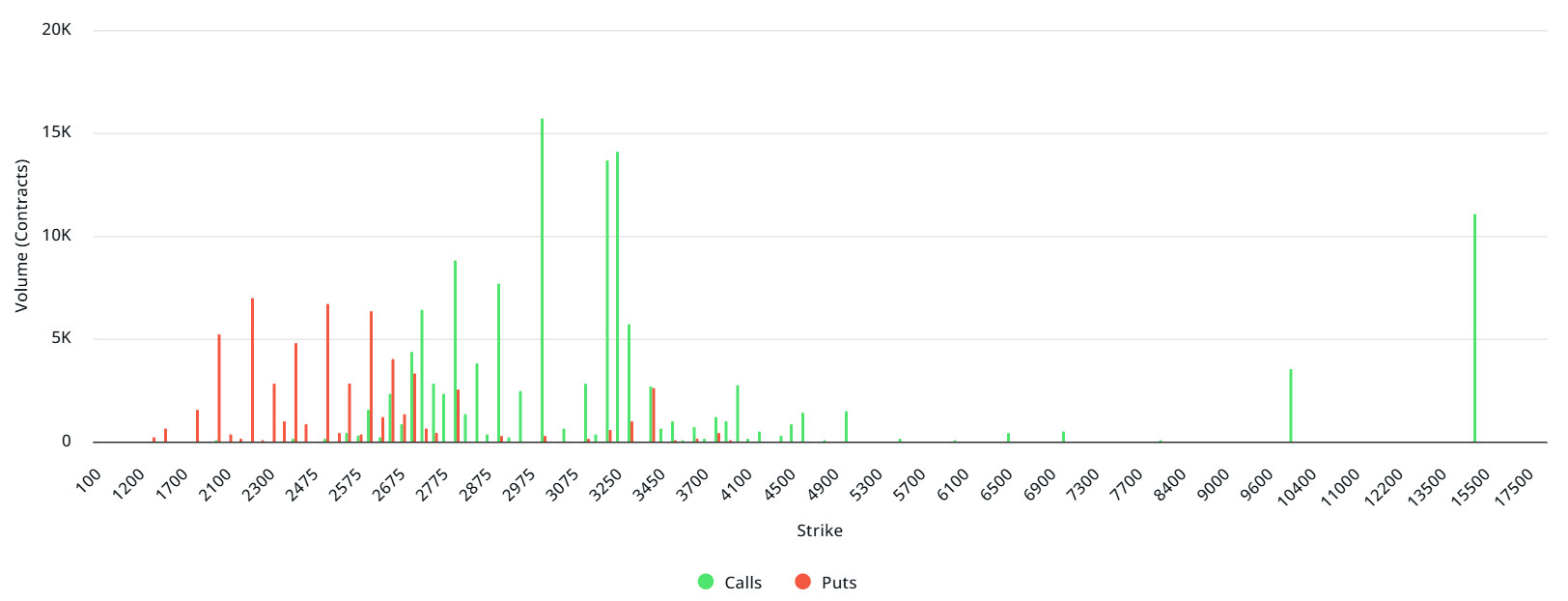

Ethereum Options Distribution

Source: Laevitas

Laevitas Data: Looking at the chart, it is clear that Call options are more concentrated than Put options. There is a significant volume of Call options, especially at the $3,000-3,250 levels, suggesting that these levels could be an important resistance point for the market. The $2,400-2,600 range, where Put options are concentrated, may stand out as support levels in the market. At higher strike prices, especially at $15,500, there is a noticeable concentration of Call options, but it should be noted that this volume may be speculative.

Deribit Data: Ethereum options with a notional value of $40.41 million expire on February 15.

Maximum Pain Point: $2,650.

Put/Call Ratio: 0.71. This shows that investors in the market are in a strong position to expect the price to rise.

WHAT’S LEFT BEHIND

US Non-Farm Payrolls data was announced as 143K, the expectation was 169K. Previous data was at 256K.

US Unemployment Rate was realized as 4.0%, below the expectations of 4.1%.

US PPI was announced as 3.5% (expectation 3.2%).

US CPI was announced as 3% (expected 2.9%).

SEC Accelerates Crypto ETF Reviews: Following the departure of Gary Gensler, the SEC has begun to review crypto ETF applications more quickly.

SOL Spot ETF Applications: Grayscale, Bitwise, VanEck, 21Shares and Canary Capital, Grayscale’s application was accepted by the SEC.

XRP Spot ETF Filings: Grayscale, Bitwise, Canary Capital, 21Shares and Wisdomtree filed XRP spot ETF applications with the SEC.

LTC Spot ETF Applications: Grayscale and Canary Capital’s Litecoin (LTC) ETF applications have entered the public comment period.

NYSE Arca filed a 19b-4 application for spot Dogecoin (DOGE) ETF.

SEC Reviewing Proposal to Allow Physical Redemptions in BlackRock’s Spot Bitcoin ETF.

BlackRock Increases Stake in Strategy to 5% and STRK shares rise 5% pre-market.

Michael Saylor said that Bitcoin has become a global reserve capital network.

Transaction Fees on Bitcoin and Ethereum Networks on the Decline: BTC transaction fees fell to $0.14 and Ethereum gas fees fell to $0.05.

Circle minted $250 million worth of new USDC at Solana.

Strategy bought 7,633 Bitcoin, spending $742.4 million.

Bitcoin Futures and Options Volumes at CME Break Records: $220 billion in futures and $6 billion in options volume.

There was a net inflow of USD 1.3 billion into Digital Asset Investment Products.

Nasdaq Submits CoinShares’ Litecoin and XRP ETF Applications.

Metaplanet expects a profit of $36 million from its Bitcoin investment.

US to Impose 25% Tariff on Steel and Aluminum Imports.

The SEC accepted the physical redemption application for 21Shares Bitcoin and Ethereum ETFs.

NYSE Arca filed for a Cardano (ADA) spot ETF on behalf of Grayscale.

The Governor of the Bank of England has called for high regulatory standards for stablecoins.

FTX will start repaying $6.5 – 7 billion in the first phase.

Jerome Powell stated that there should be no rush to cut interest rates.

Trump’s Crypto Project WLFI partners with Ondo Finance.

The US and the UK refused to sign the ethical AI agreement.

Tether has selected Arbitrum as its infrastructure provider for USDT0.

Trump called for interest rates to be lowered and aligned with tariffs.

USDC Treasury minted 106 million USDC on the Ethereum network.

SUI Network’s stablecoin market capitalization reached $500 million.

Pump.fun daily trading volume fell 82% to $560 million.

Robinhood’s crypto trading volume increased 400% to $70 billion.

BNB overtook Solana to 5th place in market capitalization.

Metaplanet is included in the MSCI Japan Index.

Trump: Big news on reciprocal tariffs coming.

Tether may be forced to sell Bitcoin to comply with US regulations.

Taurus has expanded its digital asset custody services to Solana.

The Ethereum Foundation distributed 45,000 ETH to Spark and other protocols.

Trump announced that he would launch the reciprocal tariff scheme in April.

Bukele and Michael Saylor met to discuss Bitcoin.

Bloomberg launches Bitcoin and gold hybrid index.

SEC accepted Grayscale’s XRP and DOGE ETF applications.

SEC approves DOGE ETF application.

CZ: “I’m not issuing meme coins; it depends on the community.”

MARKET COMPASS

US President Trump’s actions on tariffs and expectations over the Federal Reserve’s interest rate cut path continue to drive asset prices in global markets. The growing belief that Trump is using the threat of “tariffs” as a negotiating tool has strengthened the view that the President is taking steps to strengthen his hand before coming to the table, rather than intending to ignite a new trade war. We think it is not yet right to say anything clear on this issue due to the unpredictable nature of the President. On the other hand, we argue that Trump’s meeting with Russian leader Putin and a possible peace on Ukraine is an important parameter for the markets. In addition to these developments, the FED’s interest rate cut steps, which will be decisive in the dose of global financial tightness and therefore in financial markets, will continue to be under the scrutiny of investors. Next week’s data calendar is not very busy, except for Friday’s Purchasing Managers’ Indices (PMI), as US markets will be closed on Monday due to a holiday. However, the minutes of the last Federal Open Market Committee (FOMC) meeting to be released on Wednesday will be closely watched and will be important for the markets.

When is the Next FED Rate Cut?

FED Chairman Powell, who made presentations in Congress last week, gave a message that there was no need to rush for interest rate cuts. This assessment implies that tight financial conditions in the US economy will continue for now. After the latest macro indicators on the tariffs agenda, markets do not expect another rate cut from the Fed before September, according to CME FedWatch. If the clues between the lines of the FOMC meeting minutes cause a change in these expectations, the markets may move again.

If the Bank maintains its hawkish stance, we think that some of the recent losses in the dollar may be recovered and this may put pressure on digital assets. The surprise scenario would be a more dovish tone, and although we think it is unlikely, in such a case, the rise in digital assets may gain ground even for the short term.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Onchain Weekly Report – February 12

Blackrock’s Of Rwa-Specific Fund And Performances Of Ondo, Maple, Pendle

Winds of Change at the Ethereum Foundation: Is Decentralization in Danger?

The Performance Decline of Meme Coins in January and the Reasons

Trump’s Alleged America First Strategic Crypto Reserve Plan

Click here for all our other Market Pulse reports.

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.