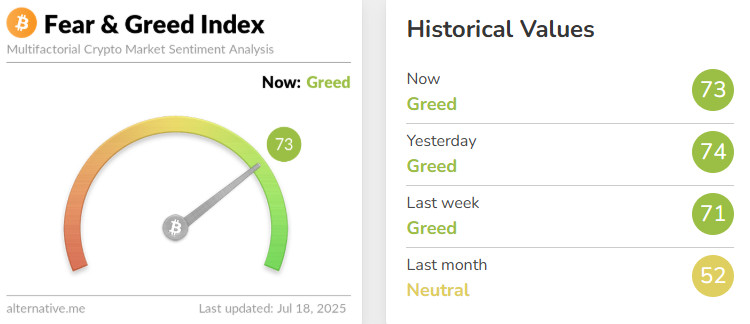

Fear & Greed Index

Source: Alternative

Change in Fear and Greed Value: +2

Last Week’s Level: 71

This Week’s Level: 73

Fear and Greed Index rose from 71 to 73 this week, indicating a limited increase in investor sentiment. Inflation data released in the US created cautious optimism in the markets. Annual CPI inflation came in at 2.7%, above the expectations (2.6%), indicating that price pressures persisted, while monthly inflation came in line with expectations at 0.3%, suggesting that this pressure may remain limited. The announcement that inflation in the Eurozone was close to the target level at 2% also supported the global confidence. Fed Governor Waller’s call for a rate cut in July was welcomed positively in the markets, but the upward trend in inflation again limited this expectation. On the other hand, MicroStrategy’s announcement that it purchased 4,225 Bitcoin between July 7-13 and that these transactions were made at an average of $111,827 reinforced institutional confidence in the crypto market. Another factor that strengthened investor interest in crypto assets was the US House’s approval of the Clarity Act and the Genius Stablecoin Act. With the impact of all these developments, Bitcoin rose to $ 123,153, hitting a new all-time high. Overall, investor sentiment improved marginally this week on the back of regulatory clarity and institutional buying, while mixed signals on the inflation outlook maintained caution.

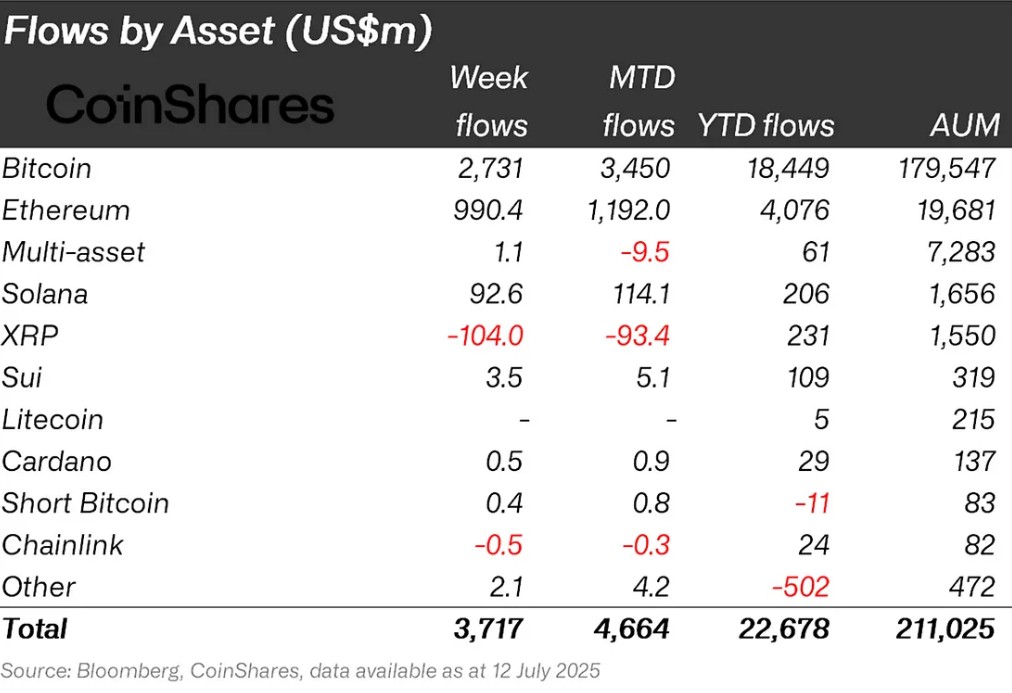

Fund Flows

Source: Coin Shares

Overview The crypto market has rebounded strongly on the back of reduced macroeconomic uncertainty and positive news on interest rate cut expectations. In particular, US President Donald Trump’s increasing pressure for an interest rate cut was an important factor supporting the markets’ appetite for a rise. In addition, the US House of Representatives’ adoption of a bill on crypto assets strengthened expectations that regulatory uncertainties would decrease. With the impact of all these developments, Bitcoin gained approximately 9%.

Fund Inflows:

Bitcoin (BTC): The US President’s rhetoric on interest rate cuts and statements that pension funds could be adapted to cryptocurrencies created a positive atmosphere in the market. These developments boosted investor confidence, leading to a significant increase in fund inflows and accelerating the upward movement of prices. This optimistic mood in the market also contributed to maintaining interest not only in Bitcoin but also in the altcoin market in general. This week, inflows into Bitcoin-focused funds reached $2.731 billion.

Ethereum (ETH): Spot ETH continued to perform strongly on the back of institutional interest and fund inflows. This week, Ethereum saw inflows of $990.4 million.

Multi-asset: Despite the ETF data, the multi-asset group also saw inflows.

Solana (SOL): The Solana ecosystem launched Onchain Holiday, an online shopping event where users can spend their stablecoins and memecoins to buy products from various brands. Solana saw $92.6 million in inflows.

Cardano (ADA): The Cardano Foundation launched Reeve, a tool designed for enterprise-grade auditable financial reporting. This week Cardano saw inflows of $0.4 million.

SUI: Sui is also focused on the gaming sector. SuiPlay0X1, a Web3 game console developed exclusively for Sui, was announced. Sui saw inflows of $3.5 million this week.

Short Bitcoin: Inflows into short bitcoin positions totaled $0.4 million.

Other: Altcoins saw sectoral and project-based rallies. These attacks brought inflows of $2.1 million in fund flow data.

Fund Outflows:

Ripple (XRP): The approval and launch of the ProShares Ultra XRP ETF (UXRP) opened up access to XRP for institutional investors. Fund outflows in Xrp this week totaled $104.0 million.

Chainlink (LINK): Chainlink has made significant strides in its goal to gain market share by partnering with major financial institutions such as UBS Asset Management and Swift for tokenized funding deals. Link saw outflows of $0.5 million this week following the announcement of this collaboration.

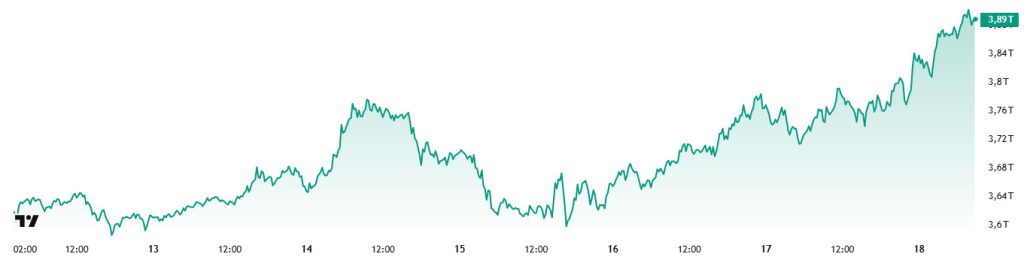

Total MarketCap

Source: Tradingview

- Last Week Market Capitalization: 67 trillion Dollars

- Market Capitalization This Week: 89 trillion Dollars

The cryptocurrency market recorded an increase of around 6% in total market capitalization with a capital inflow of approximately 220.6 billion dollars this week. Thus, the total value reached 3.89 trillion dollars. This is the fourth consecutive positive trend after last week’s close, giving a clear signal that the uptrend is continuing. At current levels, surpassing the all-time high market capitalization of $3.73 trillion marks a new high for the total market and the footsteps of the bull market are becoming more evident.

Total 2

Total 2 entered the new week with a market capitalization of 1.3 trillion dollars and recorded a value increase of 200 billion dollars, with an increase of approximately 15.38% during the week. With this rise, the market capitalization exceeded the level of 1.5 trillion dollars. However, the Total 2 index, just like the total market, needs an additional rise of about 10% from where it stands in order to reach its all-time high. This chart clearly shows that until last week, the rise was largely led by Bitcoin, while altcoins are just starting to gain momentum.

Total 3

The Total 3 index started the week at $939.2 billion. With a capital inflow of approximately $ 113 billion during the week, the total market capitalization increased by around 12% to $ 1.05 trillion. Breaching the $1 trillion threshold stands out as a very positive signal for altcoins within Total 3.

This rise shows that investor interest has been largely focused on Bitcoin until now, but now it is gradually shifting to altcoins. At the same time, it is safe to say that the upward movement across the market has turned into a broad-based spread and risk appetite is increasingly shifting towards minor assets.

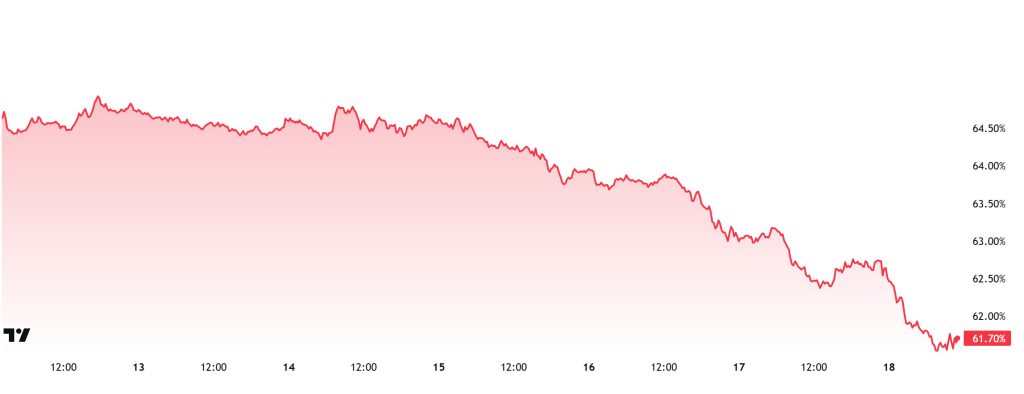

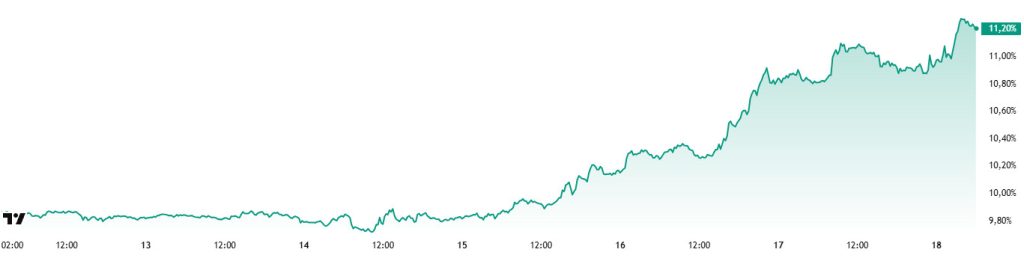

Bitcoin Dominance

Bitcoin Dominance

Bitcoin dominance, which started the week at 64.61%, declined throughout the week and is currently at 61.70%.

This week, Strategy bought 4,225 Bitcoin and Metaplanet bought 797 Bitcoin.

Data on Bitcoin spot ETFs shows a total net inflow of $2.02 billion to date.

Especially after the Clarity, Genus and Anti-CBDC laws approved in the US yesterday and the news that Trump is preparing to open the US pension market to crypto investments, the risk appetite in the markets has increased significantly. This development led to an increase in investor confidence and accelerated capital inflows. Steady institutional investor demand, continued strong net capital inflows into spot Bitcoin ETFs, and reduced global uncertainty have all contributed to an improvement in risk perception across the market and accelerated capital flows into digital assets.

Increased risk appetite is leading to capital being allocated not only to Bitcoin, but also to Ethereum and other altcoins. If Ethereum and other altcoins continue to outperform Bitcoin, Bitcoin’s market dominance may continue to decline. Depending on these developments, Bitcoin dominance can be expected to consolidate in the 59% – 62% band next week.

Ethereum Dominance

Source: Tradingview

Weekly Change:

Last Week’s Level: 9.78%

- This Week’s Level: 11.20%

Ethereum dominance, which rose as high as 10% as of the second week of June, failed to cross this critical threshold and retreated to 8.60%. However, the dominance, which found support at these levels, regained a positive momentum and exhibited a steady upward trend in the last four weeks. With this rise, Ethereum dominance has managed to exceed the critical level of 10%.

In the current week, it was observed that the upward movements in Ethereum dominance continued. Accordingly, while Ethereum dominance completed last week at 9.78%, it is trading at around 11.20% as of current data.

In the same period, Bitcoin dominance, unlike Ethereum, followed a negative course and showed a downward accelerated trend.

In a key development supporting this recovery in Ethereum dominance, Paidun data shows that the Ethereum Foundation team transferred 1,000 ETH (approximately USD 3.15 million) to EF2 via internal transfer. Such transfers are often associated with ecosystem support activities.

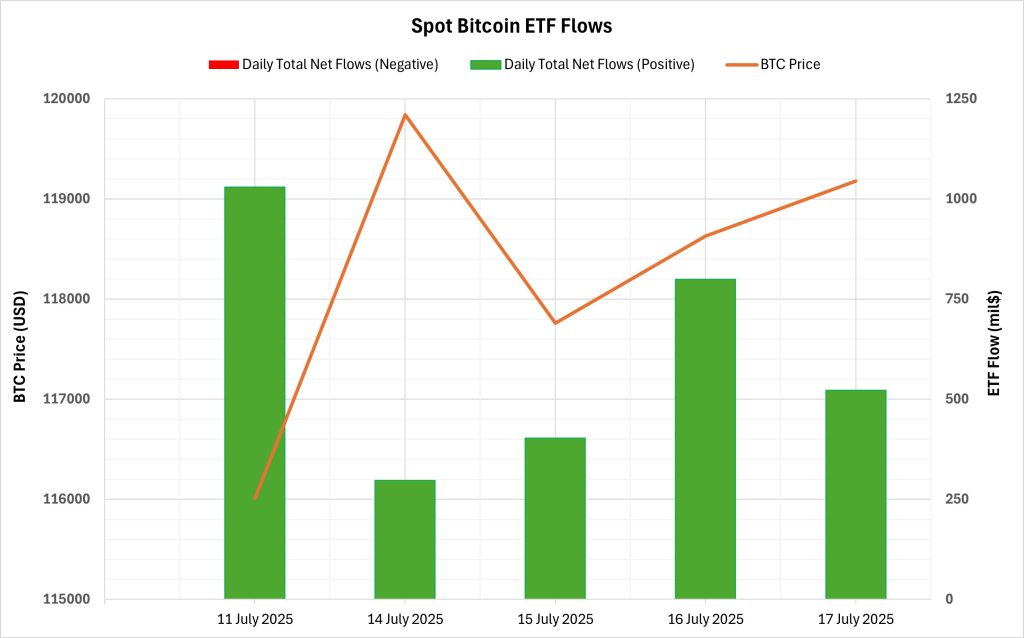

Bitcoin Spot ETF

NetFlow Status: Spot Bitcoin ETFs saw a total net inflow of $3.052 billion between July 11-17, 2025. The highest daily inflow was $1.029 billion on July 11. During this period, BlackRock’s IBIT ETF stood out with a net inflow of $3.025 billion. Spot Bitcoin ETFs have seen positive net flows in the last 11 trading days, reinforcing the stability in institutional interest.

Bitcoin Price: Opening at $116,010 on July 11, 2025, Bitcoin closed at $119,177 on July 17, 2025. In this process, BTC gained 2.73%. In addition, Bitcoin, which rose above the $ 123,000 level during this period, renewed its all-time high value (ATH) level.

Cumulative Net Inflows: The total cumulative net inflows of spot Bitcoin ETFs reached $54.36 billion at the end of the 379th trading day.

| Date | Coin | Open Price | Close Price | Change % | ETF Flow (mil$) |

|---|---|---|---|---|---|

| 11‑Jul‑25 | BTC | 116,010 | 117,527 | +1.31% | 1,029.6 |

| 14‑Jul‑25 | BTC | 119,086 | 119,841 | +0.63% | 297.4 |

| 15‑Jul‑25 | BTC | 119,841 | 117,758 | –1.74% | 403.1 |

| 16‑Jul‑25 | BTC | 117,758 | 118,630 | +0.74% | 799.4 |

| 17‑Jul‑25 | BTC | 118,630 | 119,177 | +0.46% | 522.6 |

| Total (11‑17 Jul 25) | — | +2.73% | 3,052.1 | ||

Strong and steady institutional buying was seen in the ETF market between July 11-17. In particular, heavy inflows into BlackRock’s IBIT fund were noteworthy, while total net flows remained positive despite ongoing outflows on the Grayscale side. ETF flows, which were in line with the upward trend of the price, showed that institutional confidence and demand continued. The new ATH level above $123,000 confirms that the ETF channel continues to create a direct leverage effect on the price.

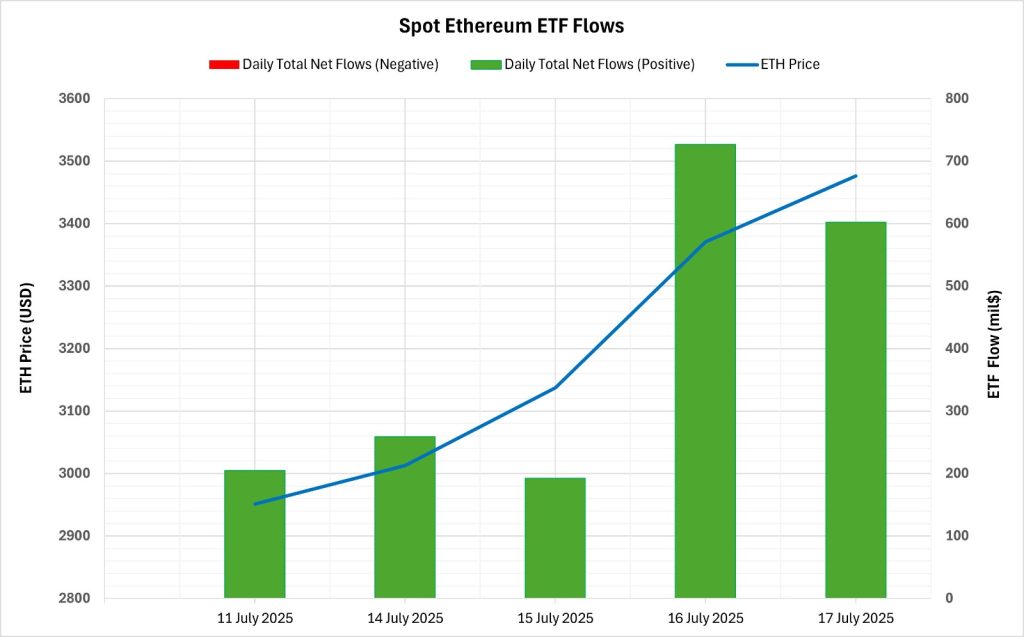

Ethereum spot ETF

Between July 11-17, 2025, Spot Ethereum ETFs saw a total net inflow of $1.98 billion. The strongest daily inflows were $726.6 million on July 16, followed by $602 million on July 17. These two days were recorded as the largest positive net inflows in Spot Ethereum ETFs since launch. During this period, BlackRock’s ETHA ETF attracted $1.5 billion in net inflows. Spot Ethereum ETFs’ total cumulative net inflows at the end of the 247th trading day reached $7.1 billion.

| Date | Coin | Open Price | Close Price | Change % | ETF Flow (mil$) |

|---|---|---|---|---|---|

| 11‑Jul‑25 | ETH | 2,951 | 2,958 | +0.24% | 204.9 |

| 14‑Jul‑25 | ETH | 2,972 | 3,013 | +1.38% | 259.0 |

| 15‑Jul‑25 | ETH | 3,013 | 3,137 | +4.12% | 192.3 |

| 16‑Jul‑25 | ETH | 3,137 | 3,371 | +7.46% | 726.6 |

| 17‑Jul‑25 | ETH | 3,371 | 3,476 | +3.11% | 602.0 |

| Total (11‑17 Jul 25) | — | +17.79% | 1,984.8 | ||

During this period, the Ethereum price rose from $2,951 to $3,476, a gain of 17.79%. The positive net inflows and 7.46% daily rise, especially on July 16, and the continuation of the series of positive net flows in the last 10 trading days showed the strong institutional interest and its clear impact on the price. The alignment between ETF flows and price action supports investors’ bullish expectations. The continued strengthening of institutional positions could increase upward pressure on the Ethereum price in the coming days.

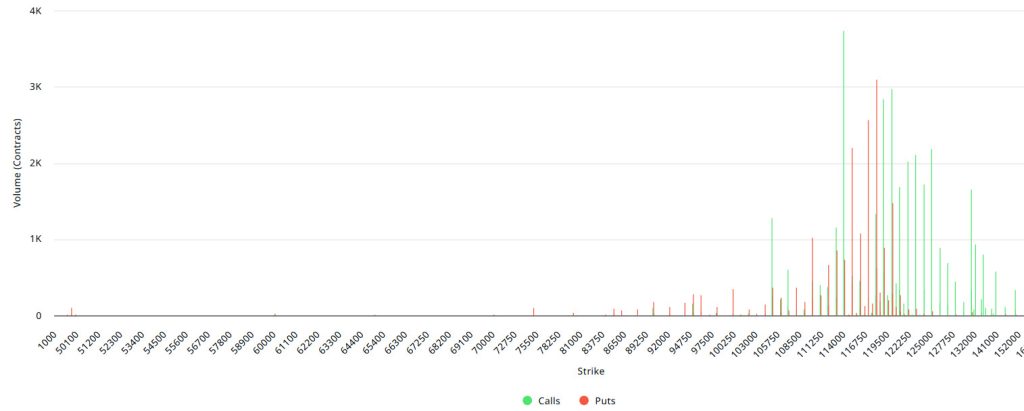

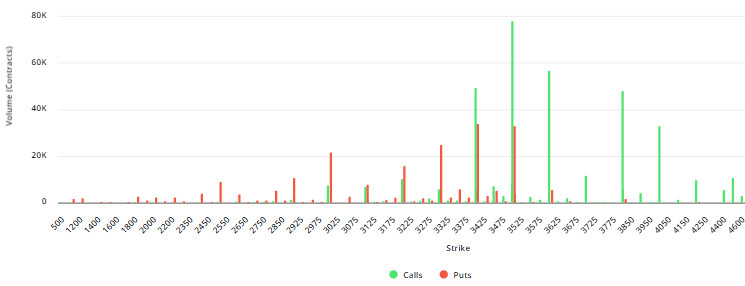

Bitcoin Options Distribution

Source: Laevitas

BTC: Notional: 4.935B | Put/Call: 0.78 | Max Pain: 114K

Deribit Data: Deribit data shows that BTC options contracts with a nominal value of approximately $4.935 billion expired today. At the same time, according to the data in the last 24 hours, if we look at the risk conversion in the next 1-week period, call options are the dominant side in hedging more than put options. This indicates that the expectation that the rises will continue is increasing. When we look at the expected volatility, it is above the realized volatility. This shows that put option fees are cheap. On the other hand, the positive spread value indicates that investors are acting appetite. Skew values have a slightly bullish value today, while this pressure will increase further next week.

Laevitas Data: When we examine the chart, it is seen that put options are concentrated in the band of 108,000 – 120,000 dollars. Call options are concentrated between $ 114,000 – 140,000 and the concentration decreases towards the upper levels. At the same time, the level of approximately $ 114,000 is seen as support and the level of $ 120,000 as resistance. On the other hand, there are 2.79K put options at the $ 118,000 level, where there is a peak and there is a decrease in put volume after this level. However, it is seen that 2.04K call option contracts peaked at the level of 120,000 dollars. When we look at the options market, we see that call contracts are dominant on a daily and weekly basis.

Option Maturity:

Put/Call Ratio and Maximum Pain Point: In the last 7 days of data from Laevitas, the number of call options increased by 27% compared to last week to 139.77K. In contrast, the number of put options was 108.52K, up 51% from last week. The put/call ratio for options was set at 0.78. This indicates that call options are much more in demand among traders than put options. Bitcoin’s maximum pain point is seen at $114,000. It can be predicted that BTC is priced at $119,200 and if it does not break the pain point of $114,000 downwards, the rises will continue. Looking ahead, there are 4.12K call and 3.74K put options at the time of writing.

Ethereum Options Distribution

Source: Laevitas

ETH: 852.5M notional | Put/Call: 1.01 | Max Pain: $2,950

Laevitas Data: Looking at the data in the chart, we see that put options are particularly concentrated at the price levels between $3,000 and $3,400. The highest put volume is at $3,400 with around 33.7K contracts and this level can be considered as a possible support zone. On the other hand, there is a noticeable concentration in call options at the $3,500 and $4,000 levels. The $3,500 level in particular stands out with a high call volume of about 77.7K contracts.

Deribit Data: 25 Delta Risk Reversal (RR) data rose to 22.39, up more than 20% on a daily basis. This shows that the market continues to expect upward movement. However, it is also felt that this expectation is a bit weaker compared to the previous days. On another note, the 25 Delta Butterfly (BF) metric also rose by nearly 11% to 13.73. This suggests that the number of investors taking positions against extreme scenarios has increased, meaning that the market has become more sensitive to sudden and sharp price movements.

However, the most remarkable data of the day is on the Open Interest side. Total Open Interest exceeded $852 million, with approximately $145 million worth of new positions opened in just one day. This corresponds to an increase of more than 20%. Such a strong rise suggests that there is a significant inflow of new money into the market and a marked increase in interest in ETH options.

Option Maturity:

Ethereum options with a notional value of $852.5 million expire on July 18. The Max Pain level is calculated at $2,950, while the put/call ratio is at 1.01.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.