MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | Weekly | Monthly | Since the Beginning of the Year | Market Cap. |

|---|---|---|---|---|---|

| BTC | 105,719.14$ | 3.15% | 7.82% | 11.90% | 2,09 T |

| ETH | 3,407.94$ | -0.02% | -2.35% | 1.67% | 410,87 B |

| XRP | 3.184$ | -1.59% | 38.64% | 37.18% | 183,38 B |

| SOLANA | 263.60$ | 22.44% | 32.95% | 36.17% | 128,45 B |

| DOGE | 0.3597$ | -13.52% | 8.29% | 10.93% | 53,15 B |

| CARDANO | 1.0031$ | -9.86% | 8.98% | 9.32% | 35,28 B |

| TRX | 0.2590$ | 5.43% | 0.86% | 1.52% | 22,33 B |

| AVAX | 36.23$ | -12.14% | -11.73% | -3.74% | 14,93 B |

| LINK | 26.22$ | 9.26% | 5.40% | 21.15% | 16,76 B |

| SHIB | 0.00002027$ | -16.05% | -12.10% | -6.29% | 11,95 B |

| DOT | 6.461$ | -12.30% | -13.73% | -7.93% | 9,98 B |

*Table was prepared on 1.24.2025 at 11:30 (UTC). Weekly values are calculated for 7 days based on Friday.

“Weekly Image to be added”

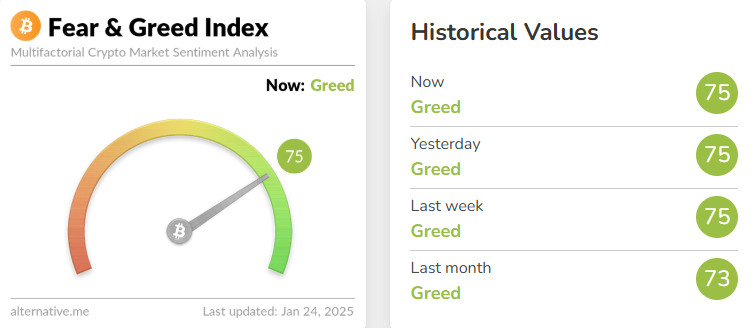

Fear & Greed Index

Source: Alternative

Change in Fear and Greed Value: 0

Last Week’s Level: 75

This Week’s Level: 75

This week, the Fear and Greed Index remained stable at 75. Donald Trump’s executive order prohibiting agencies from establishing Central Bank Digital Currencies (CBDCs) in the US or abroad has been effective in maintaining the current level in the index while creating positive expectations regarding the regulatory framework.

On the other hand, the official revocation of SAB 121 by the US Securities and Exchange Commission (SEC) eased the regulatory pressure on the sector by eliminating the requirement to count crypto assets as bank liabilities. This has led to greater confidence among investors in digital assets.

The US weekly jobless claims (223 thousand) came in close to expectations and did not significantly change the market dynamics. In general, the market displayed a balanced outlook this week, while the index maintained its position at the “greed” level.

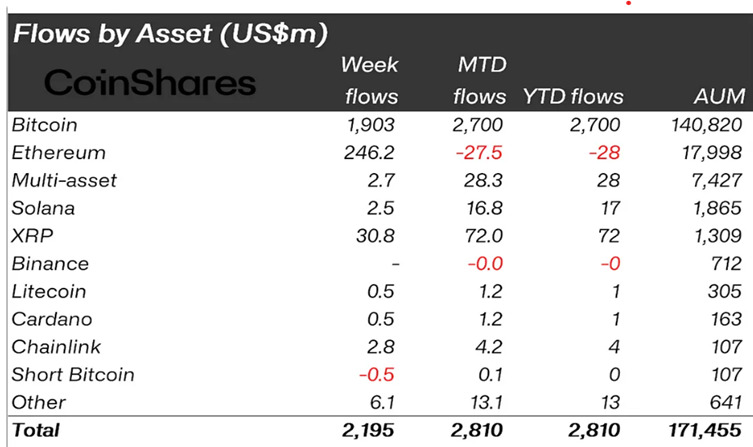

Fund Flow

Source: CoinShares

Digital asset investment products saw inflows of $1.98 billion this week in the aftermath of the US elections. Ethereum saw its largest inflow since July ($157 million).

Fund Inputs;

- Bitcoin (BTC): Saw inflows of $1.9 billion.

- Ethereum (ETH): $246 million in inflows

- Ripple (XRP): $30 million in inflows.

- Solana (SOL): $5 million was received.

- Litecoin (LTC): $0.5 million in inflows

- Cardano (ADA): $0.5 million saw an entry.

- Other: $8.8 million in inflows.

Fund Outflows;

Short Bitcoin outflows have increased compared to last week. Bitcoin’s new ATH levels show that traders are opening Short Bitcoin positions and expecting the rise to result in some profit-taking.

Since the beginning of the month, Ethereum has lost -27.5 million dollars since Trump took office. This indicates that investors’ interest in Ethereum has shifted to Bitcoin. Compared to last week, digital assets have seen more money inflows. Especially the higher demand for altcoins compared to last week may be a sign that investors are investing by distributing their assets.

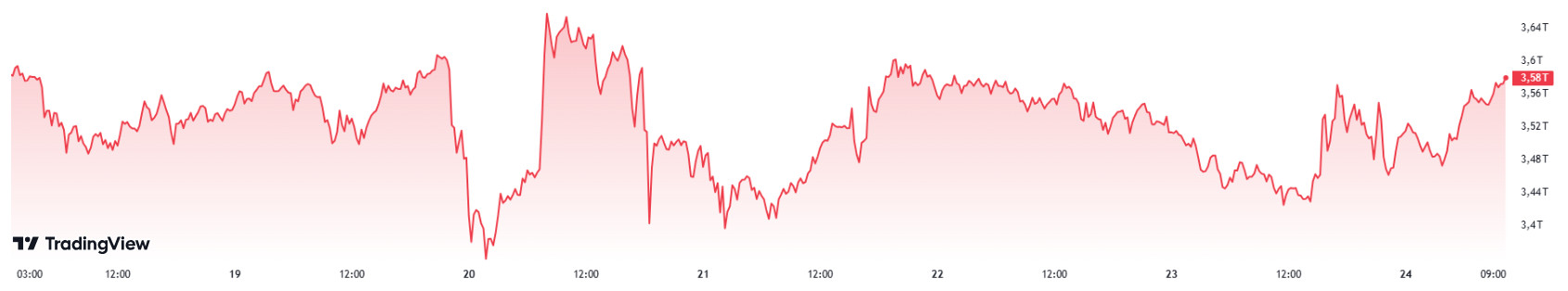

Total MarketCap

Source: Tradingview

Last Week Market Capitalization : $3.42 Trillion

Market Capitalization This Week: $3.58 Trillion

Following last week’s 5.93% rise on the total market with net inflows of $191.51 billion, this week saw net inflows of $152.21 billion and the market is trending positive with a 4.45% rise.

Total 2

This week, an increase of $67.19 billion was recorded on Total 2, an increase of 4.75%. When compared to the percentage increases compared to Total, it shows that altcoins continue to be dominated by Bitcoin and most of the money entering the market continues to flow to Bitcoin.

Total 3

When Total 3 is analyzed, it shows a positive outlook, similar to Total and Total 2, with an increase of $43.44 billion this week, up 4.35%. The underperformance of Total 3 compared to Total 2 reveals that altcoins in general had a less profitable week than Ethereum.

Of the $152.21 billion that entered the market this week, $67.19 billion flowed into altcoins, while $85.02 billion was collected on Bitcoin.

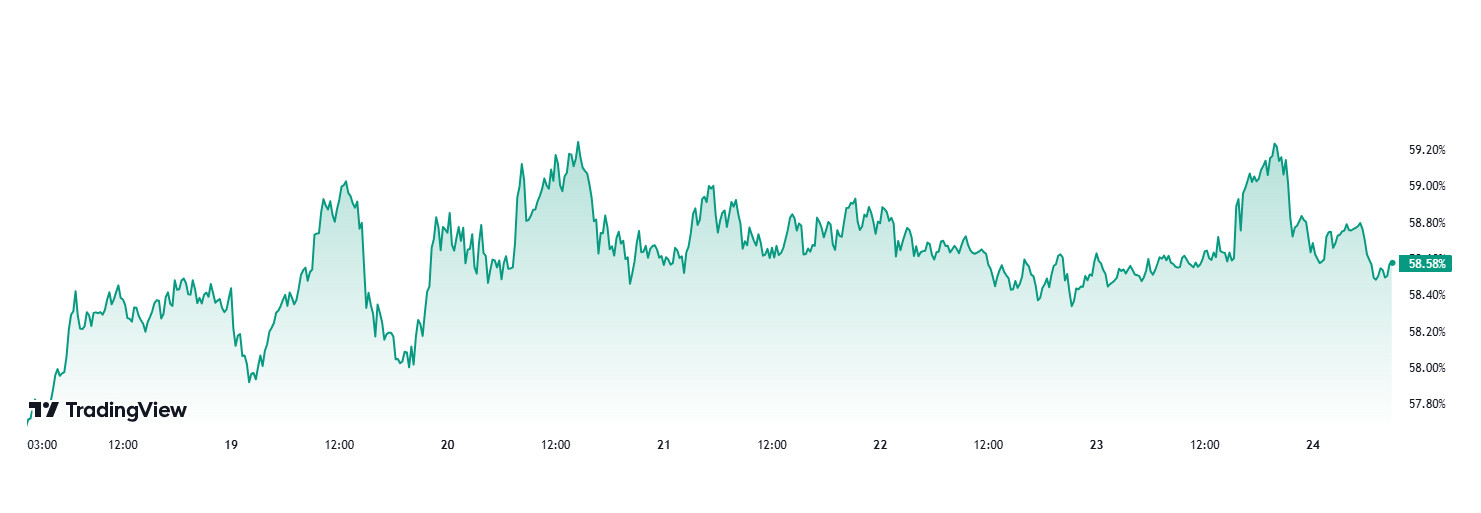

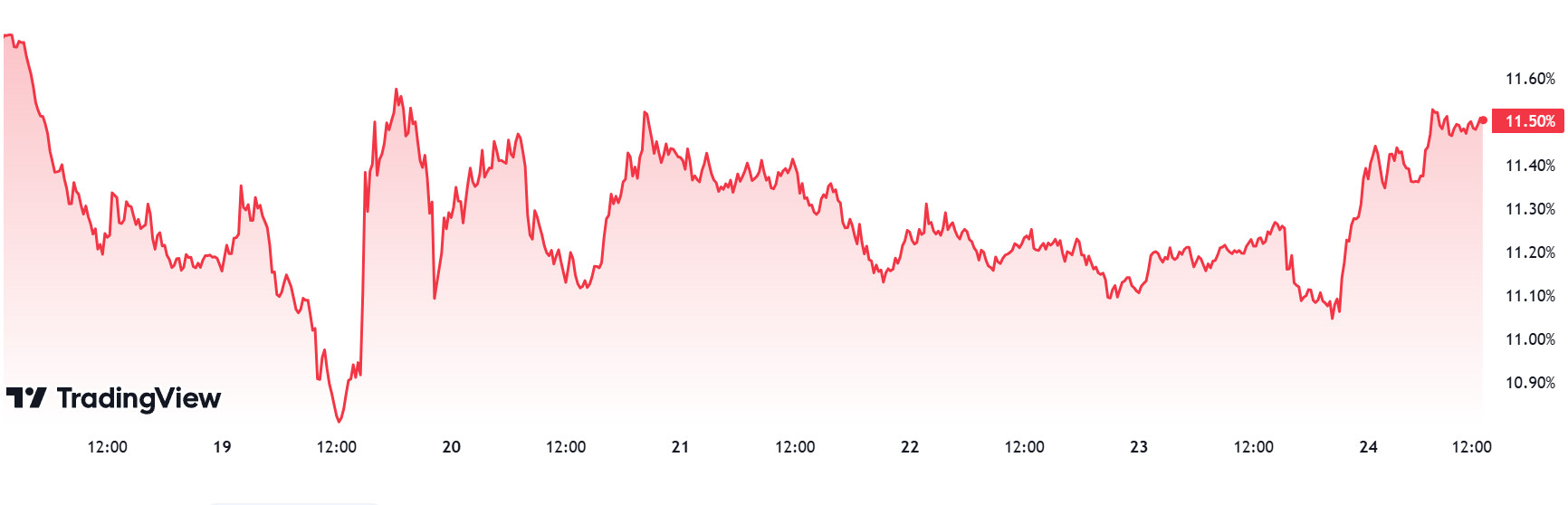

Bitcoin Dominance

Source: Tradingview

BTC dominance, which started the week at 58.63%, moved sideways throughout the week and is currently at 58.58%.

Conference Board consumer confidence, FED interest rate decision, FED chairman Powell’s speech, gross domestic product, unemployment claims data will be announced in the US next week. In particular, the FED interest rate decision was left unchanged in line with expectations and a possible reduction in the number of interest rate cuts in Powell’s speech may be negatively received by the market. At the same time, the executive order signed by US President Trump to create a digital asset reserve may increase the buying appetite of institutional investors and ETF investors.

Considering all these developments, we can expect BTC dominance to rise to 59.5% – 60% in the new week.

Ethereum Dominance

Source: Tradingview

Weekly Change:

Last Week’s Level: 11.32%

This Week’s Level: 11.50%

Ethereum dominance recorded a positive momentum in the last two weeks of December 2024, rising towards 12.90%. However, from the beginning of January 2025, it started to retreat under pressure below the 12.90% level and this situation has continued as of the current week. In this context, the negative trend led to a retracement down to 11.13% during the current week. However, the dominance, supported by the 11.13% level, recorded positive accelerations again and rose to the 11.50% level. In this process, the Bitcoin dominance had the opposite effect and experienced a positive appreciation.

Accordingly, Ethereum dominance ended last week at 11.32%, while it is moving at 11.50% as of this week.

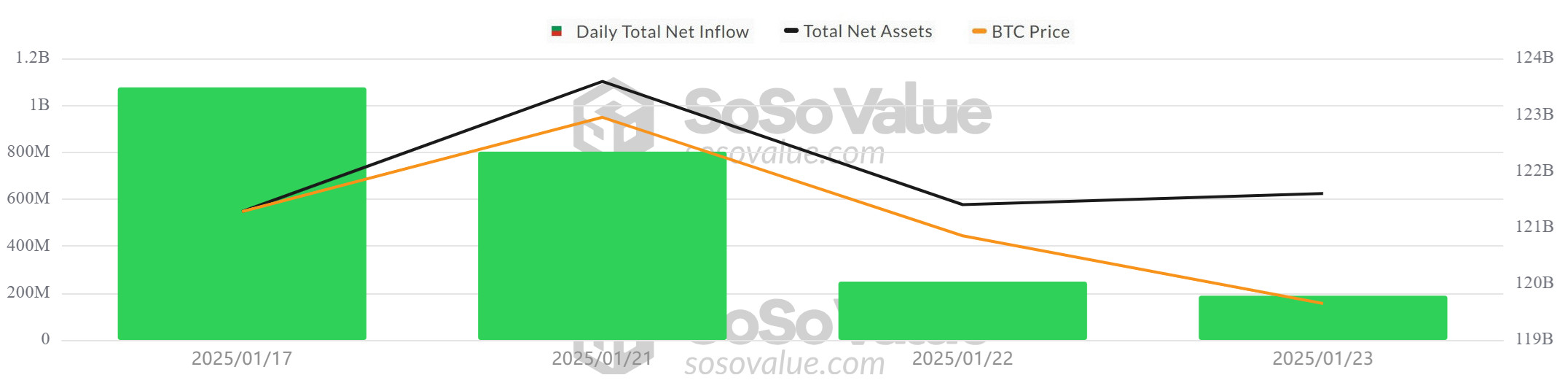

Bitcoin Spot ETF

Source: SosoValue

Featured Developments:

Positive Net Inflow Streak: The positive net inflow streak in spot Bitcoin ETFs has reached 6 days. Between January 17 and 23, 2025, net inflows totaled $2,312.8 million. During this period, the BlackRock IBIT ETF led the positive net inflow streak. The net inflows recorded on January 17 ($1,072.8 million) and January 21 ($802.6 million) were particularly noteworthy.

Bitcoin Renews ATH: Bitcoin price hit a new all-time high (ATH) of $109,588 on January 20, 2025. Between January 17-23, 2025, it started at $99,937 and closed the day at $103,864 on January 23, 2025, up 3.93%.

Cumulative Net Inflows: Spot Bitcoin ETFs saw a total net inflow of $2,312.8 million between January 17 and 23, 2025. Cumulative net inflows into Spot Bitcoin ETFs reached $39.42 billion by the end of the 259th trading day.

| DATE | COIN | Price | ETF Flow (mil$) | ||

|---|---|---|---|---|---|

| Open | Close | Change % | |||

| 17-Jan-25 | BTC | 99,937 | 104,042 | 4.11% | 1072.8 |

| 20-Jan-25 | 101,311 | 102,247 | 0.92% | 0 | |

| 21-Jan-25 | 102,247 | 106,114 | 3.78% | 802.6 | |

| 22-Jan-25 | 106,114 | 103,664 | -2.31% | 248.7 | |

| 23-Jan-25 | 103,664 | 103,864 | 0.19% | 188.7 | |

| Total for 17 – 23 Jan 25 | 3.93% | 2312.8 | |||

Between January 17 and 23, 2025, the price of Bitcoin increased by 3.93%, while there was a strong correlation between price movements and ETF flows. BlackRock IBIT ETFs continued to lead this week, reaching a total net inflow of $1,536.7 million. Grayscale GBTC ETFs, on the other hand, showed a negative performance with a net outflow of $77 million on a weekly basis.

The official inauguration of US President Donald Trump on January 20, 2025 and the renewal of Bitcoin’s ATH on this date marked a significant momentum in the markets. The spot Bitcoin ETF market continues to support price action and reinforces Bitcoin’s strategic position in the financial markets.

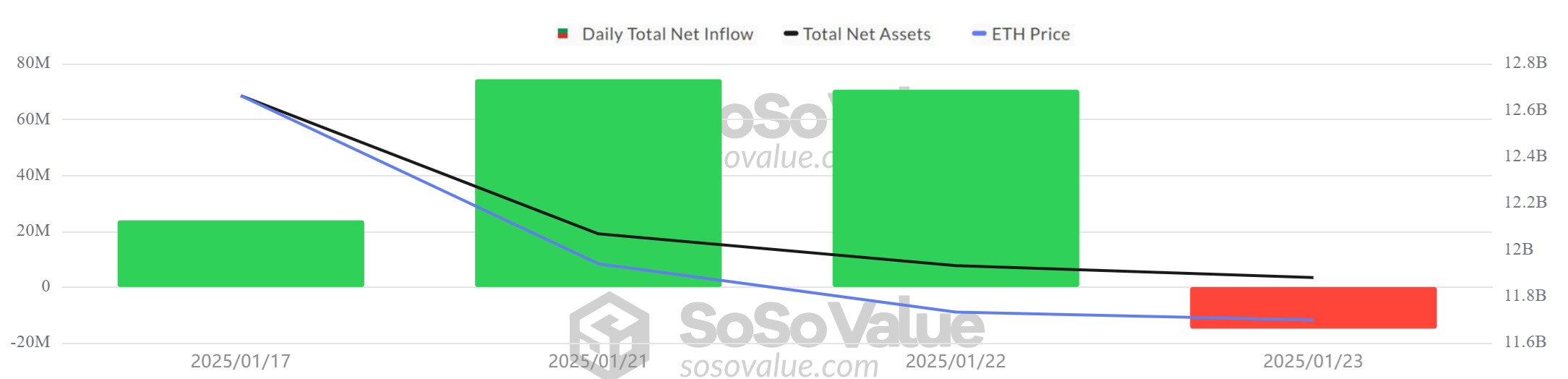

Ethereum spot ETF

Source: SosoValue

Between January 17 and 23, 2025, Spot Ethereum ETFs saw a total net inflow of $154.1 million. On January 21, there were net inflows of $56.3 million into the BlackRock ETHA ETF and $79.1 million on January 22. However, a net outflow of $22.3 million from the Grayscale ETHE ETF on January 23 was noteworthy. Ethereum had a daily open of $3,306 on January 17, 2025, and a daily close of $3,337 on January 23, up 0.94%. During this period, Ethereum rose by 2.15% on January 20, strengthened by the price increase, but fell by 2.53% to $3,242 on January 22. On January 23, it rose by 2.93% to close the day at $3,337. Cumulative net inflows since the launch of the US Spot Ethereum ETFs reached $2.8 billion at the end of the 127th trading day.

| DATE | COIN | Price | ETF Flow (mil$) | ||

|---|---|---|---|---|---|

| Open | Close | Change % | |||

| 17-Jan-25 | ETH | 3,306 | 3,472 | 5.02% | 23.9 |

| 20-Jan-25 | 3,214 | 3,283 | 2.15% | 0 | |

| 21-Jan-25 | 3,283 | 3,326 | 1.31% | 74.4 | |

| 22-Jan-25 | 3,326 | 3,242 | -2.53% | 70.7 | |

| 23-Jan-25 | 3,242 | 3,337 | 2.93% | -14.9 | |

| Total for 17 – 23 Jan 25 | 0.94% | 154.1 | |||

The official inauguration of Donald Trump as the US president on January 20, 2025 has created a positive sentiment in the markets for cryptocurrencies, including Ethereum. The spot Ethereum ETF market has exhibited a structure that both supports price movements and shows continued institutional interest. However, short-term price volatility and fluctuations in ETF flows stood out as the main factors affecting market dynamics.

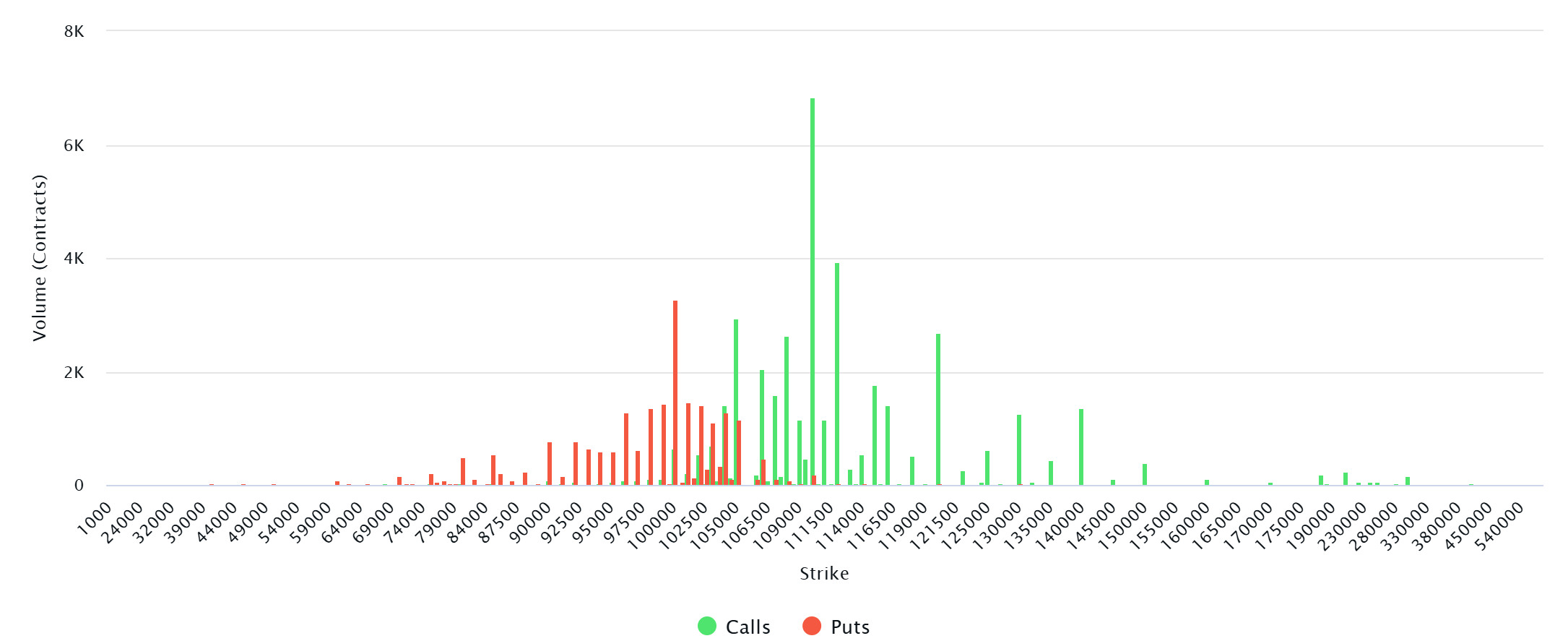

Bitcoin Options Breakdown

Source: Laevitas

Laevitas Data: When we examine the chart, we see that put options are concentrated in the 93,000 – 105,000 level band. Call options are concentrated between 105,000 – 120,500 levels and the concentration decreases towards the upper levels. At the same time, resistance has formed at around 104,000 dollars. On the other hand, it is seen that call options peaked at $ 110,000 and there is a general decline in volume after this level.

Deribit Data: 31,000 BTC options contracts with a notional value of approximately USD 3.19 billion will expire today. On the other hand, on January 22, CoinDesk reported that the CME Bitcoin options market showed the strongest uptrend since the US presidential election and Bitcoin ETF capital inflows increased, according to CoinDesk. However, on January 21, options listed on Deribit continued to have a bullish outlook for Bitcoin compared to Ethereum after Trump did not mention crypto or Bitcoin in his inauguration speech on Monday.

Option Expiration

Put/Call Ratio and Maximum Pain Point: If we look at the options in the last 7 days data from Deribit, the number of call options increased by about 96% compared to last week to 155.09K. In contrast, the number of put options increased by 28% to 76K compared to last week. The put/call ratio for options was set at 0.41. A put/call ratio of 0.41 indicates a strong preference for call options over puts among investors and a possible upturn in the markets. Bitcoin’s maximum pain point is set at $100,000.

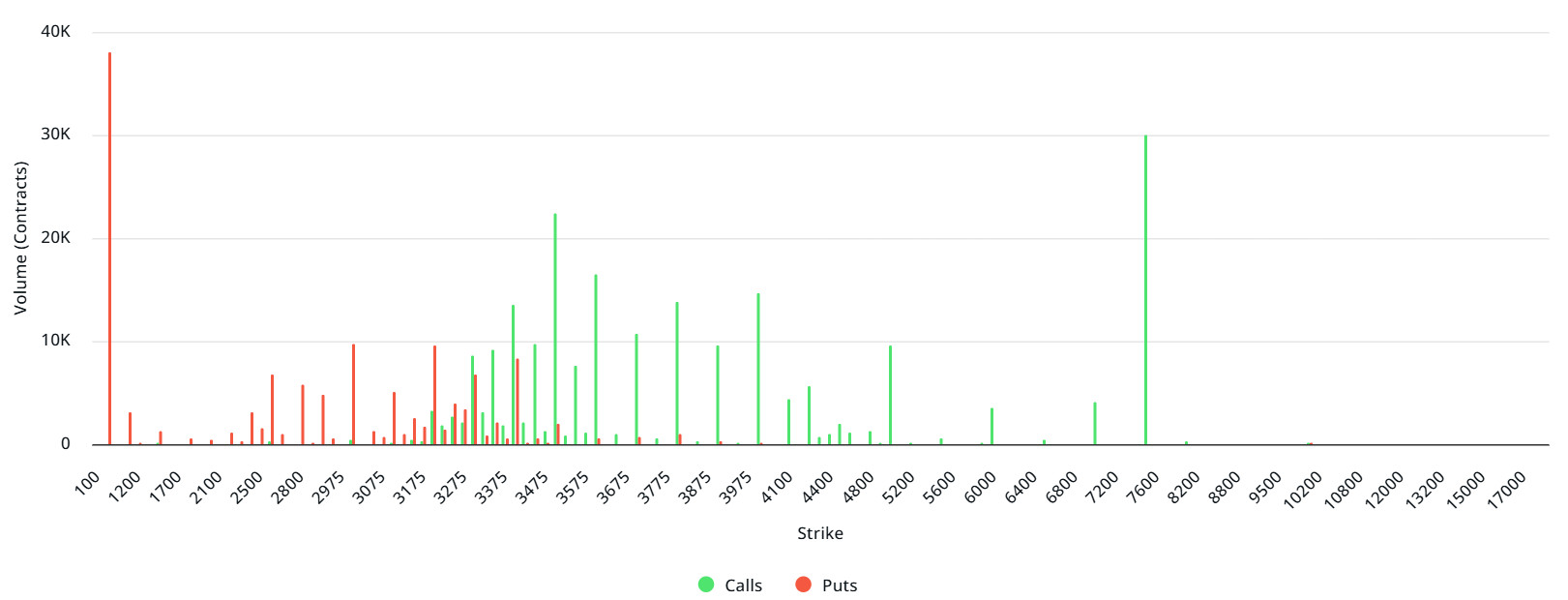

Ethereum Options Distribution

Source: Laevitas

Laevitas Data: When we examine the chart, the transactions concentrated in the range of $ 3575-3975 in Call contracts reveal an expectation of a rise in the Ethereum price towards these levels. The high call volumes at the $7200 and $7600 strike levels are more likely to be speculative bullish trades. These call contracts, which are concentrated at more distant strike levels, generally reflect the strategies of investors seeking high risk and high reward

Deribit Data: Ethereum options with a notional value of $142.9 million expire on January 25.

Maximum Pain Point: $3,300.

Put/Call Ratio: 0.30. This shows that investors in the market are in a strong position to expect the price to rise.

WHAT’S LEFT BEHIND

US President Donald Trump Makes Remarks at Inauguration Ceremony

Donald Trump announced after his inauguration that he would declare a national emergency and strengthen the economy with new trade policies.

Trump Signs Cryptocurrency Executive Order

President Trump signed an executive order evaluating the creation of a national digital asset reserve and banning CBDC.

US SEC Cancels SAB 121 Policy

The SEC announced that it has withdrawn guidance on the SAB 121 policy on accounting for crypto assets.

Senator Lummis Named Chairman of the Digital Assets Subcommittee

Senator Cynthia Lummis stated that a comprehensive legal framework for digital assets should be established and that she would support the US strategy to strengthen its Bitcoin reserves.

DeFi and Crypto Lending Report from EBA and ESMA

The European Banking Authority and the European Securities and Markets Authority published a report stating that DeFi accounts for 4% of the global crypto market.

Bhutan Transfers Another 377.78 BTC

The Royal Government of Bhutan transferred 377.78 BTC worth a total of $38.57 million, bringing its total BTC holdings to 11,055.

North Korea Suspected in Phemex Hack Attack

It has been suggested that North Korean hackers may be behind the $70 million in funds stolen from Phemex. After the attack, Phemex suspended withdrawals.

MELANIA: Market Capitalization $6.4 Billion

MELANIA, the meme coin introduced by Melania Trump, made a rapid entry into the market, reaching a market capitalization of $6.4 billion.

Bitcoin Tracker Data from Michael Saylor

Michael Saylor shared Bitcoin Tracker data for the 11th time and drew attention with the statement “Tomorrow everything will be different”. MicroStrategy bought another 11,000 BTC, bringing its total holdings to 461,000 BTC.

World Liberty Financial Raises $250 Million in IPO

WLFI, backed by the Trump family, raised $248.7 million during the IPO process, bringing its total ETH holdings to 32,852.

TikTok Resumes Service in the US

TikTok restarted its services in the US in agreement with internet service providers.

El Salvador Increases Bitcoin Holdings

El Salvador bought another 11 BTC, bringing its total holdings to 6,043.18 BTC.

Solana Sets Record for DEX Trading Volume

In January, Solana set a record with DEX trading volume exceeding $158 billion, the highest trading volume on record.

TRON DAO Invests Another $45 Million in WLFI

Justin Sun announced that TRON DAO has invested a total of $75 million in the Trump-backed WLFI project.

Elon Musk and the DOGE Corporation

The Elon Musk-led DOGE organization could be sued for violating federal transparency laws.

Vitalik Buterin and the Ethereum Foundation

Vitalik Buterin announced that the Ethereum Foundation will consider staking options in the future.

Italy and Bitcoin Investments

An Italian parliamentarian urged banking foundations to invest in Bitcoin, while noting that creating a national Bitcoin reserve is not expected in the near term.

5 Altcoins Purchased by World Liberty Financial

WLFI bought ETH, LINK, ENA, AAVE and TRX for a total of $23.5 million.

Cryptocurrency Searches at the Top on Google

Searches for “how to buy cryptocurrency” reached the highest level in the last 5 years.

Rumble Makes First Bitcoin Purchase

Rumble took the first step in his $20 million Bitcoin strategy and bought BTC.

2.2 billion Dollar Inflows to Crypto Funds

With Trump’s inauguration, crypto funds saw a net inflow of 2.2 billion dollars in one week.

Bitcoin Spot ETFs Net Inflows of $1.96 Billion

Bitcoin Spot ETFs saw a net inflow of $ 1.96 billion in one week.

MARKET COMPASS

Global markets are preparing to leave behind a challenging week but perhaps starting a busier one. On January 20th, Donald Trump took over the White House, and his failure to address the issue of cryptocurrencies led to a painful trading period for digital assets. But then, as previously promised, the President signed an executive order this week to create a cryptocurrency task force. While we think this is a turning point for digital assets, we do not rule out that the impact on prices may not be immediate. As we are going through a critical period where different dynamics are driving asset prices, investors will continue to carefully monitor every step Trump takes. In addition, next week, US macro indicators and the Federal Reserve’s monetary policy announcements may be decisive in determining the dose of financial tightening. Therefore, attention may turn back to the Federal Open Market Committee (FOMC) and macro dynamics.

FED Expected to Pause Interest Rate Cuts

The first FOMC meeting of the year will be held on January 28-29. The Bank is expected to take a break from the rate cut cycle, which started strongly in September, after the latest employment and inflation data. In fact, it would not be wrong to say that this break is expected to be a long period of silence.

The statements and guidance following the 25-basis point rate cut in December indicated that Powell and his team wanted to watch the upcoming economic data for a while before deciding on a new rate cut. President-elect Trump’s policies, rising bond yields and the appreciating dollar may have had at least as much impact on FOMC members’ thinking as macro indicators. As a result, according to CME Fedwatch, the likelihood of another Fed rate cut in the first two meetings of the year looks slim. For now, the prediction is that officials will cut the policy rate from 4.50% to 4.25% at one of the FOMC meetings in May or June.

Markets do not expect a change in interest rates on January 29, but clues on how many times the FED will cut rates by 25 basis points each this year and when the first-rate cut will take place after the break will be important. At this FOMC meeting, officials’ expectations regarding interest rates and macro indicators will not be published. Therefore, we will have the monetary policy text and the statements of FED Chairman Powell, who will speak at the press conference afterwards. With these inputs, we will try to get information about the Bank’s interest rate cut course. Messages indicating a rate cut of more than 50 basis points during the year or a rate cut at the next meeting may create a supportive backdrop for rises in digital assets . In the opposite scenario, there will be no new rate cuts in the first half of the year, or a total of less than 50 basis points in the first half of the year. In this case, we may see pressure on the value of cryptocurrencies.

Macro Indicators from the US

In addition to the FOMC meeting, which will have an impact on pricing behavior, the markets will also monitor the macro indicators coming from the US. These data will also be evaluated in order to predict the FED’s steps during the year. Some of these data will be released before the FOMC decision on Wednesday, while others will be released afterwards and their impact on prices may be different. It would be useful to follow our weekly data calendar for this sequence and our daily bulletins for updates.

Many US indicators will be closely watched this week, such as figures on the subject market, durable goods orders, consumer confidence indices, economic growth (GDP) and inflation (PCE Price Index) data. Among them, we can filter out the most important US data as GDP and PCE, excluding the FOMC statement and possible Trump’s statements.

Starting with GDP, we see that economic growth in the US is expected to slow down in the last quarter of the year. The change in GDP is estimated to have been around 2.6%, down from 3.1% in the third quarter. Relatively fast growth, especially before Trump’s policies take effect, may cause the FED to further narrow its interest rate path, as it may be considered as faster inflation. This would not reflect positively on digital assets. On the other hand, a lower-than-expected growth data may have the effect of easing the FED’s hand for a rate cut.

After Thursday’s growth on Thursday, the last working day of the week will see the release of the PCE Price Index, which is used by the FED to monitor inflation. On a monthly basis, core PCE is expected to be announced as 0.2%. This data should be read as negative for digital assets if it comes above expectations and positive if it comes below expectations. After the course to be drawn with the FOMC meeting, we find it useful to state that we care about the PCE data set that will test the market’s belief in new expectations and that it is one of the variables in our equation that causes us to create positive expectations for digital assets in the long term.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Onchain Weekly Report – January 22

The Digital Asset Funds Revolution: Crypto ETFs

Inflation and Cryptocurrency: Observations and Forecasts in 2025

The Most Important Airdrop Projects Expected in 2025

Transparency And Reliability Review For USDC

World Liberty Financial and Crypto Investments

Meme Coin Craze in 2024: Market Share, Featured Projects and Why

Analysis of Exchanges’ Bitcoin Reserves and Bitcoin Price Change

USDT’s Struggles and Compliance Challenges in the European Market under MiCA Regulation

Click here for all our other Market Pulse reports.

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.